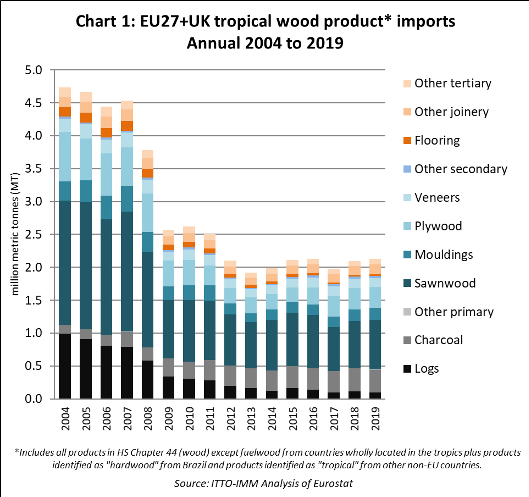

Despite a downturn in the last six months of 2019, EU imports of tropical wood products last year were greater than in 2018. In 2019, the EU28 imported 2.13 million tonnes of tropical wood products (including all those in HS Chapter 44 except fuelwood, wood waste and chips) with a total value of €2.32 billion, respectively 1.5% and 3.2% greater than the previous year. This was the second consecutive year of import growth after a dip in 2017.

The marginal growth in imports in 2019 was driven mainly by a recovery in imports of sawnwood from Cameroon and of sawnwood and mouldings/decking from Brazil, particularly into Belgium, together with rising imports of a variety of joinery products (doors and laminates) from Indonesia and Malaysia. These gains offset falling imports of tropical logs, charcoal, plywood, and veneers last year.

When considering the longer-term trend, imports in 2019 are very much in line with the overall stasis in EU tropical wood trade after hitting an all-time low in 2013 following the financial crises. Since then EU imports have fluctuated within a narrow band around 2 million tonnes (Chart 1).

Over the last seven years, total EU imports of tropical sawnwood have fluctuated in the region of 750,000 tonnes without showing any strong upward or downward trend. During this period, there has been a continuing decline in imports of tropical logs and flooring products.

However, these losses have been offset by rising EU imports of charcoal and a variety of laminated and other joinery products from tropical countries and a recovery in imports of tropical mouldings/decking and tropical hardwood faced plywood (although the latter is increasingly sourced from China and destined for the UK, which ceased to be an EU country on 31st January 2019).

(Note that since the UK was still an EU country throughout 2019, all references to the EU in the following report on import trends last year refers to the EU28 inclusive of the UK).

EU imports of tropical sawnwood rise 5% in 2019

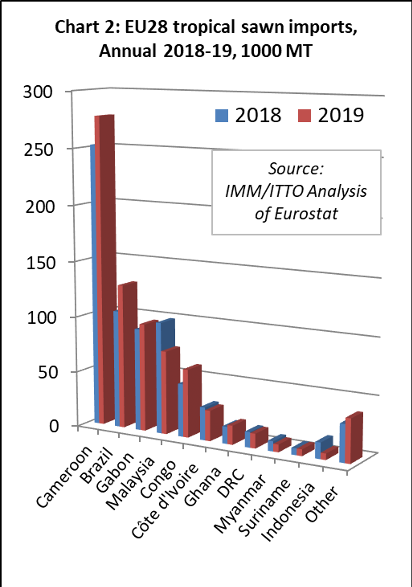

EU imports of tropical sawnwood increased 5% to 753,000 tonnes in 2019 while import value declined slightly, by 0.1% to €728.1 million. EU traders reported generally steady, in some cases strong, trading conditions for tropical timber in the first half of 2019 followed by a distinct slowdown in the second half as uncertainty mounted over the wider economic picture.

Imports from Cameroon, particularly slow in 2018, increased 10% to 277,600 tonnes during 2019. Imports also increased from several other countries including Brazil (up 23% to 129,100 tonnes), Gabon (up 5% to 96,300 tonnes), Congo (up 28% to 60,900 tonnes), and Ghana (up 12% to 17,000 tonnes). After a strong start to 2019, imports from DRC were 13,100 tonnes over the entire year, down 5% on 2018. These gains offset a 25% decline in imports from Malaysia, to 74,500 tonnes, an 8% decline from Côte d’Ivoire to 27,200 tonnes, and a 24% decline in imports from Myanmar, to 6,800 tonnes (Chart 2).

The decline in EU imports from Malaysia in 2019 was attributed by some importers to a decline in the availability of PEFC certified product following the suspension of MTCS certification in Johor and Kedar states in May 2019 which led to the total certified area in Malaysia to fall by around 25%.

This may have been a factor in the Netherlands and UK where there is a stronger preference for certified wood. However, rising EU imports from other tropical countries with even less access to certified wood, such as Cameroon and Brazil, implies that other factors were also important for the decline in imports from Malaysia.

For example, Malaysian mills have been held back by raw material shortages and Malaysian products have come under growing competitive price pressure from Brazilian products. This is partly due to exchange rate movements. The value of the Brazilian real is currently at historically very low levels on international currency exchange markets and has lost nearly 50% against the euro in the last decade which has meant that Brazilian producers are more inclined to export. In contrast the Malaysian currency has lost less than 10% against the euro over the same period.

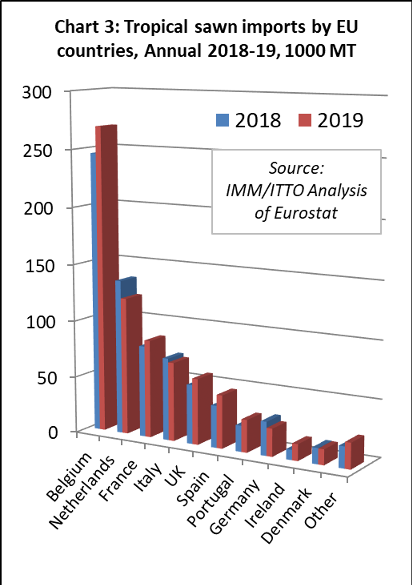

The trend towards increased concentration of tropical sawnwood imports into the EU by way of Belgium continued in 2019 (Chart 3). Belgian imports increased 10% to 269,100 tonnes last year, with the country accounting for much of the gain in EU imports from Brazil, Gabon and the Congo Republic. In contrast Belgian imports of sawnwood from Malaysia and DRC declined last year. Belgian imports from Cameroon, by far the largest supplier of tropical sawnwood, to Belgium accounting for around 45% of the total, remained stable at 120,000 tonnes last year.

Imports of tropical sawnwood into the Netherlands declined by 11% to 120,600 tonnes in 2019. There was a significant increase in Dutch imports from Brazil and Cameroon offset by a large decline in imports from Malaysia and Indonesia.

Imports of tropical sawnwood into France increased 7% last year, to 85,800 tonnes, the second consecutive year of gains after a 25% downturn in 2017. Imports increased from all four of the leading supply countries to France – Cameroon, Brazil, the Republic of Congo, and Gabon – but declined from Malaysia. There was also a slight increase in French imports from Madagascar last year – France being the only EU country importing anything other than negligible volumes (4450 tonnes in 2019) from the country.

Italy’s imports of tropical sawnwood fell 4% to 69,100 tonnes in 2019, with imports down from both Cameroon and Gabon, the two leading suppliers. Italian sawnwood imports from Côte d’Ivoire recovered a little ground in 2019 after several years of continual decline but, at less than 7,000 tonnes, were still only around half the level of three years before. Italian imports from Myanmar last year were 4,400 tonnes, a slight gain on 4,300 tonnes in 2018 and double the volume of 2017.

The UK imported 57,900 tonnes of tropical sawnwood in 2019, 12% more than the previous year with significant gains in imports from Cameroon, Republic of Congo, DRC and Brazil offsetting a decline in imports from Malaysian and Côte d’Ivoire. Imports of tropical sawnwood into Ireland made even larger gains, but from a smaller base, rising 64% to 14,500 tonnes, sourced almost exclusively from Cameroon.

Tropical sawnwood imports into Spain and Portugal also made significant gains last year, respectively rising 26% to 46,600 tonnes and 25% to 28,500 tonnes. Imports into Spain and Portugal derive mainly from Cameroon and Brazil, and imports from both countries increased in both Spain and Portugal last year. Spain also recorded gains in imports from the Republic of Congo and Gabon. However, Portugal’s imports from these two latter countries declined, losses only offset by a recovery in Portugal’s imports from Angola.

Germany’s direct imports of tropical sawnwood suffered another downturn last year, falling 18% to only 24,300 tonnes. Imports fell from both Cameroon and Brazil, partly offset by a rise in imports from Ghana. Germany is now by far the largest direct EU importer of Ghanaian sawn timber, taking 6,300 tonnes last year, nearly twice the volume of Belgium, the next largest importer. However, for imports from other tropical countries, Germany is increasingly dependent on indirect trade via Belgium and the Netherlands.

After a continuous rise between 2014 and 2018, Denmark’s imports of tropical sawnwood fell 2% to 13,600 tonnes in 2019. Nearly all the gains in recent year have been from Brazil and, to a lesser extent Peru, and Danish imports from the two South American countries continued to rise in 2019. Imports from Ecuador (likely of balsa wood, possibly to supply the wind turbine industry) also increased sharply from only 336 tonnes to 1100 tonnes last year. However, these gains were offset by a fall in Danish imports from Republic of Congo and Cameroon.

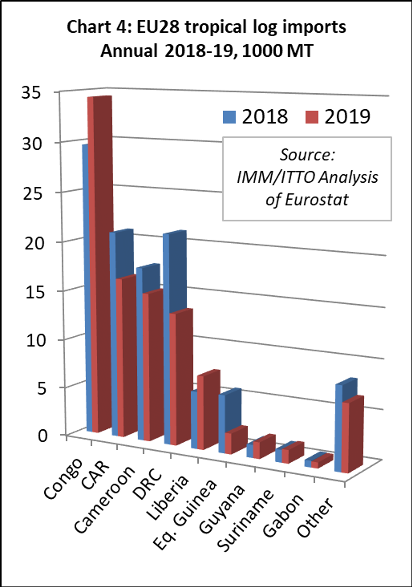

EU imports of tropical logs slow in second half of 2019

After recovering ground in 2018 and stabilising in the first half of 2019, EU imports of tropical logs slowed in the second half of 2019. Imports of 98,600 tonnes in 2019 were 13% less than in 2018 while import value fell 14% to €48.4 million during the year.

In 2019, EU imports of tropical logs increased by 16% to 34,400 tonnes from the Republic of Congo, the leading supplier, by 29% from Liberia to 7,500 tonnes, by 7% from Suriname to 1,400 tonnes, and by 27% from Guyana to 1,700 tonnes. However, these gains were offset by falling imports from the Central African Republic (-22% to 16,300 tonnes), DRC (-37% to 13,400 tonnes), Cameroon (-14% to 15,100 tonnes), and Equatorial Guinea (-64% to 2,100 tonnes) (Chart 4).

After a more buoyant second quarter, imports of tropical logs slowed into France and Belgium in the second half of 2019. By the end of the year, France had imported 36,400 tonnes of tropical logs, 8% less than in 2018, while imports into Belgium were down 23%, at 23,600 tonnes. Imports were also down 22% to 15,200 tonnes in Portugal during the year.

Rising log imports in some smaller markets, including Italy (+3% to 10,800 MT), the Netherlands (+18% to 2,500 tonnes), Spain (+12% to 2,600 tonnes) and Greece (+23% to 2,300 tonnes) were insufficient to offset falling imports in France, Belgium and Portugal.

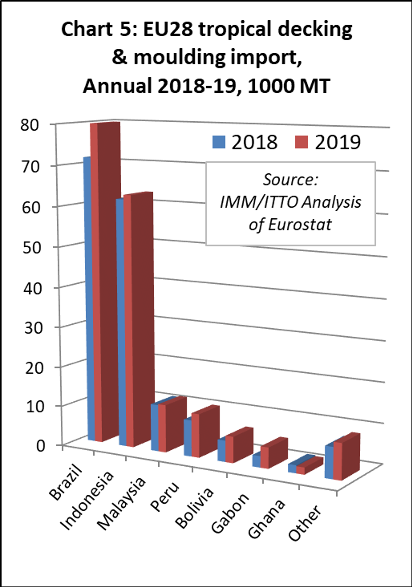

EU imports of tropical mouldings/decking up 9% last year

Bouyant trade in the first three quarters of 2019 drove a 9% gain in EU imports of tropical mouldings (which includes both interior mouldings and exterior decking products) to 188,100 tonnes for the year as a whole despite of a sharp slowdown in the last quarter. The value of EU imports of tropical mouldings/decking in 2019 was €294.6 million, 14% more than the previous year.

EU imports of tropical mouldings/decking increased from all the leading suppliers of this commodity in 2019 including Brazil (+12% to 79,900 tonnes), Indonesia (+2% to 62,900 tonnes), Peru (+20% to 10,900 tonnes), Malaysia (+2% to 11,900 tonnes), Gabon (+85% to 5,200 tonnes) and Bolivia (+24% to 6,500 tonnes) (Chart 5).

In 2019, imports of tropical mouldings/decking increased in France (+25% to 60,100 tonnes), Netherlands (+27% to 32,500 tonnes), the UK (+8% to 11,300 tonnes), Italy (+11% to 7,900 tonnes) and Denmark (+0.4% to 4,900 tonnes). However, imports weakened in Germany, down 10% to 33,000 tonnes, and Belgium, down 12% to 25,700 tonnes.

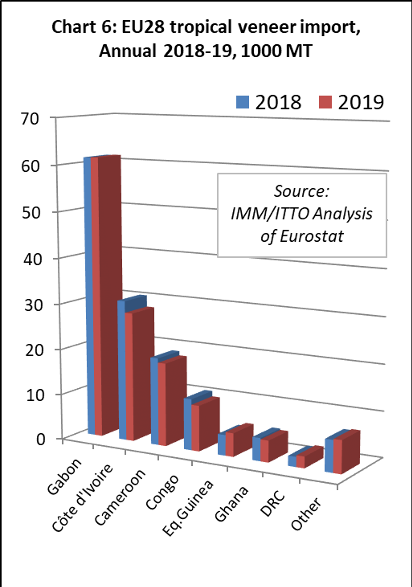

EU imports of tropical veneer fall 3% in 2019

Following a similar trajectory to sawn hardwood imports, EU imports of tropical veneer slowed in the second half of 2019 after a strong performance in the first six months of the year. Imports, which were up 10% on the previous year in the first half of 2019, ended the year at 137,200 tonnes, 3% down on 2018. Import value decreased 4% to €175.6 million during the year.

The EU imported 61,400 tonnes of veneer from Gabon in 2019, just 0.1% more than in 2018. Imports declined from Cote d’Ivoire (-8% to 28,300 MT), Cameroon (-5% to 18,200 tonnes), Republic of Congo (-11% to 10,000 tonnes), and Ghana (-6% to 4,700 tonnes). However, there were some gains from Equatorial Guinea (+15% to 5,100 tonnes) and DRC (+16% to 2,500 tonnes) (Chart 6).

In 2019, tropical veneer imports increased by 1% in France to 49,600 tonnes, by 7% in Italy to 35,500 tonnes, by 12% in Greece to 12,400 tonnes, and by 4% in Romania to 6,100 tonnes. However, imports fell by 18% in Spain, to 20,700 tonnes, and by 21% in Germany, to 4,000 tonnes. Imports by Belgium were stable, at 4,700 tonnes.

The downturn in tropical veneer imports in the second half of 2019 is partly allied to weakness in the European plywood and door manufacturing sectors during this period. There are also signs that tropical wood veneer is coming under pressure from temperate wood substitutes and a wide range of artificial surface materials.

It is notable that EU imports of American hardwood veneers in 2019 (21,200 tonnes) were also down by over 10%, registering significant declines in white oak and walnut in several markets including Spain, Portugal, UK and Belgium. Imports from Ukraine, which have risen dramatically in recent years, stabilised at a high level (63,000 tonnes) in 2019, while imports from Russia (41,000 tonnes) and Serbia (25,300 tonnes) continued to rise.

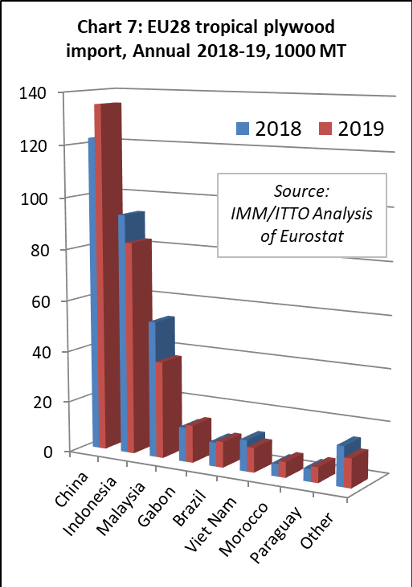

Large Chinese suppliers dominate UK tropical plywood imports

EU imports of tropical plywood products, which were 5% up on the previous year after the first three quarters of 2019, ended the year 5% down compared to 2018 at 313,000 tonnes. Import value was also down 5% at €278.4 million. The pace of imports fell dramatically in the face of a tightening market and highly competitive conditions, with particularly low prices for Russian birch plywood and Chinese mixed hardwood products that have been taking market share from tropical products.

A large and growing proportion of the plywood faced with tropical hardwood imported into the EU is manufactured in China. The EU imported 135,100 tonnes of this product from China in 2019, 11% more than in 2018.

When linked with news that numerous smaller mills in China have closed in recent years due to new emissions controls, and anecdotal reports from European buyers of a greater focus on quality and species content due to EUTR and CE Marking requirements, the strong implication is that the trade is becoming more concentrated amongst a few large consolidated suppliers in China.

Although direct imports of plywood increased from a few smaller tropical suppliers in 2019, the total volume was down 14% at 166,800 tonnes. Imports increased from Gabon by 9% to 14,500 tonnes, from Brazil by 8% to 10,000 tonnes, from Morocco by 26% to 6,100 MT, and from Paraguay by 23% to 6,000 tonnes.

However, these gains were not enough offset to declining plywood imports from the two largest tropical suppliers, Indonesia and Malaysia. Imports from Indonesia declined 11% to 82,800 tonnes and fell 29% from Malaysia to 37,700 tonnes. A brief surge in imports from Viet Nam earlier in the year also faltered in the second half so that total imports were down 21% at 9,500 tonnes by the end of 2019. (Chart 7).

In 2019, UK imports of tropical plywood products increased 6% to 174,700 tonnes, despite widespread reports of overstocking and declining plywood consumption in the country. UK imports of tropical hardwood plywood from China increased by 36% to 95,300 tonnes in 2019, while UK imports from Indonesia fell 12%, to 34,200 tonnes, and were down 27% from Malaysia to 33,000 tonnes.

In contrast to the UK, tropical plywood imports declined into all other major EU markets in 2019, including Belgium (-35% to 31,700 tonnes), Netherlands (-4% to 32,100 tonnes), Germany (-8% to 24,200 tonnes), France (-4% to 18,500 tonnes), Italy (-12% to 15,800 tonnes), and Greece (-12% to 2,800 tonnes).

For advocates of FLEGT licensing, there was some consolation in that direct imports of plywood from Indonesia increased in 2019 into the Netherlands (+6% to 13,000 tonnes) and Germany (+5% to 17,700 tonnes) despite the overall weakness of the market. Imports of Indonesian plywood by the Netherlands last year were double those of 2016 just before licensing started. However, the gains made in these markets in 2019 were not enough offset declining imports last year into the UK and Belgium.

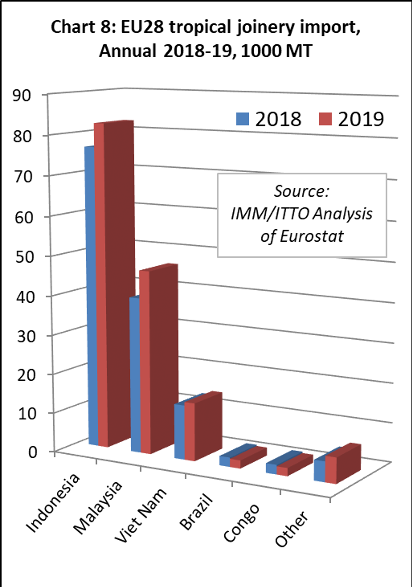

Rising EU imports of joinery from Indonesia and Malaysia

EU imports of tropical joinery products, mainly doors (from Indonesia), and laminated window scantlings and kitchen tops (from Indonesia, Malaysia and Viet Nam), increased 11% to 154,500 tonnes in 2019. Import value increased 16% to €315.8 million.

EU imports in 2019 increased from all three of the countries that dominate international trade in tropical joinery products including Indonesia (+8% to 82,500 tonnes), Malaysia (+18% to 46,600 tonnes), and Viet Nam (+6% to 14,700 MT) (Chart 8).

In 2019, imports of tropical joinery products increased by 4% to 63,200 tonnes in the UK and by 42% to 48,200 tonnes in the Netherlands. There were also significant gains in two smaller markets for tropical joinery products, Ireland increasing 54% to 3,000 tonnes and Poland up 17% to 1,700 tonnes. These gains offset a 5% fall in Belgium to 16,900 tonnes, an 18% fall in France to 10,500 tonnes, and a 6% fall in Germany to 7,700 tonnes.

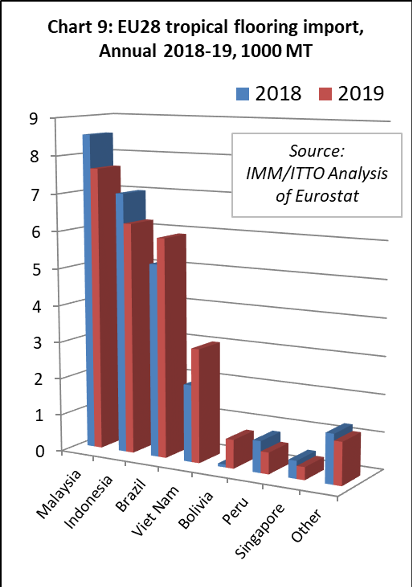

First rise in EU imports of tropical flooring since the financial crises

EU imports of flooring products from tropical countries increased 0.5% to 25,690 tonnes in 2019, while import value was up 1.2% at €59.4 million. These gains are small but are significant for being the first increase in EU imports of tropical flooring since 2007 before the financial crises.

Between 2007 and 2018, EU imports of tropical flooring products fell continuously from 150,000 tonnes to only 25,550 tonnes in response to intense competition from European and Chinese manufacturers and non-wood alternatives, fashion trends favouring temperate timbers, supply contraints, and challenges of EUTR conformance.

In 2019, a continuing decline in imports from the leading suppliers – Malaysia (-10% to 7,600 tonnes), Indonesia (-11% to 6,200 MT) – was offset by rising imports from Brazil (+14% to 5,900 tonnes), Viet Nam (+48% to 3,100 MT), and Bolivia (from near zero to over 800 tonnes) (Chart 9).

In 2019, tropical wood flooring imports recovered ground in France (+36% to 7,700 tonnes) and the UK (+27% to 2,500 tonnes). However, imports fell in most other significant European markets including Belgium (-0.5% to 3,300 tonnes), Italy (-9% to 2,100 tonnes), Denmark (-28% to 2,000 tonnes), Spain (-30% to 1,900 tonnes), the Netherlands (-5% to 1,900 tonnes), and Germany (-16% to 1,700 tonnes).

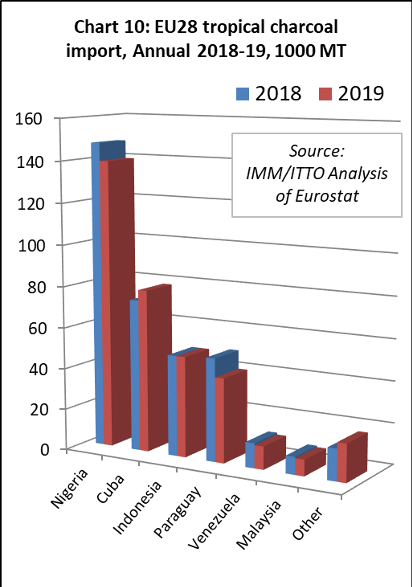

Slowing pace of EU imports of tropical charcoal

EU imports of charcoal from tropical countries, which were rising between 2016 and 2018, fell 3% to 345,300 tonnes in 2019. Import value was level at €141.4 million in both 2018 and 2019.

In 2019, EU imports of charcoal decreased from Nigeria (-6% to 139,400 tonnes), Paraguay (-18% to 40,900 tonnes), Venezuela (-7% to 11,200 tonnes), and Malaysia (-8% to 7,900 tonnes). However, imports from Cuba increased 7% to 78,800 tonnes. Imports from Indonesia were unchanged at 48,800 tonnes in 2019 (Chart 10).

A wide range of EU countries now import wood charcoal from tropical countries. The largest destinations (in descending order in 2019) were: Poland (-14% to 49,100 tonnes); Greece (-3% to 47,900 tonnes); Portugal (+9% to 41,400 tonnes); Spain (+21% to 37,900 tonnes); Italy (+6% to 34,000 tonnes); Germany (-38% to 30,200 tonnes); UK (+2% to 30,000 tonnes); Netherlands (+45% to 22,600 tonnes); Belgium (-39% to 17,100 tonnes), and Croatia (+137% to 6,600 tonnes).

PDF of this article:

Copyright ITTO 2020 – All rights reserved