The value of EU wood furniture production was €41.4 billion in 2018, only 0.8% more than the previous year. This continues the trend of slow, but consistent, annual growth of around 1% in the last 5 years. Despite this growth, the total value of wood furniture production in the EU in 2018 was still 20% down, in real terms adjusted for inflation, compared to the years just prior to the financial crises in 2008.

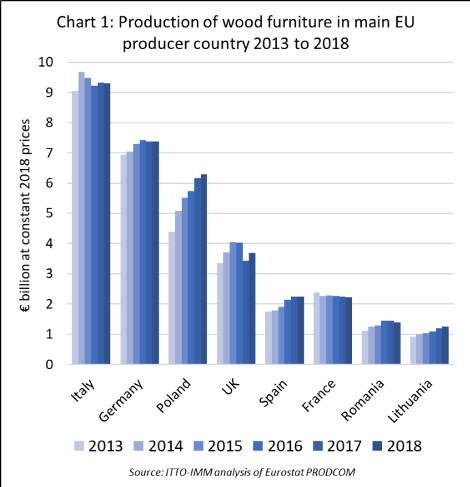

Last year, slowing wood furniture production in France, Romania, and Sweden offset gains made in Poland, the UK, Lithuania and the Netherlands. Production in Italy and Germany, the two largest wood furniture manufacturing countries in the EU, was flat in 2018 (Chart 1).

Despite only slow production growth, EU manufacturers are maintaining their hugely dominant position in the EU wood furniture market. In 2018, 87.0% of all wood furniture sales in the EU market comprised products manufactured within the EU, a marginally higher percentage than in the previous year (86.8%).

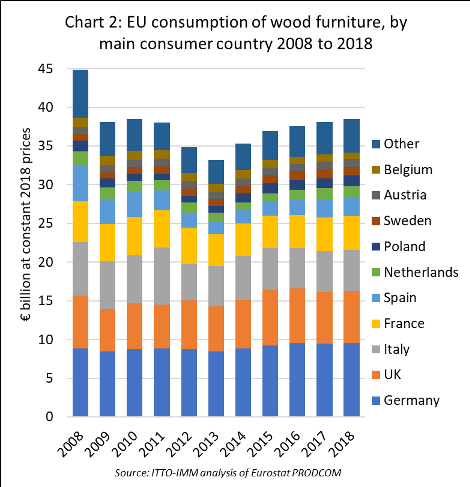

EU wood furniture consumption was €38.5 billion in 2018, a gain of 1.2% compared to 2017. During 2018, consumption increased by around 1% each in Germany (to €9.6 billion), the UK (to €6.7 billion), and France (to €4.4 billion). Consumption growth was stronger in Spain (+2% to €2.3 billion), the Netherlands (+3% to €1.6 billion), and Poland (+4% to €1.4 billion). However, consumption fell 4% to €1.1 billion in Sweden and consumption in Italy was flat at €5.3 billion in 2018 (Chart 2).

Slowing pace of EU wood furniture imports

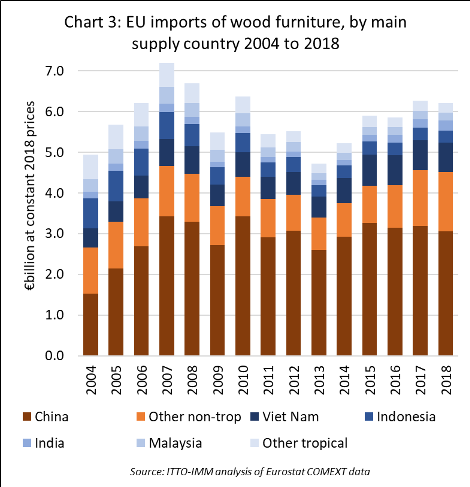

The generally slow development of the EU wood furniture market in 2018 is also apparent in the import data. After rising 7% in 2017, the value of EU imports of wood furniture from non-EU countries fell 1% to €6.21 billion in 2018. Imports from China, by far the largest external supplier, fell 4% to €3.1 billion in 2018 and imports from tropical countries fell 0.5% to €1.69 billion. However, there was a 7% rise in import value from non-EU temperate countries, to €1.46 billion, notably Ukraine, Belarus and Turkey (Chart 3).

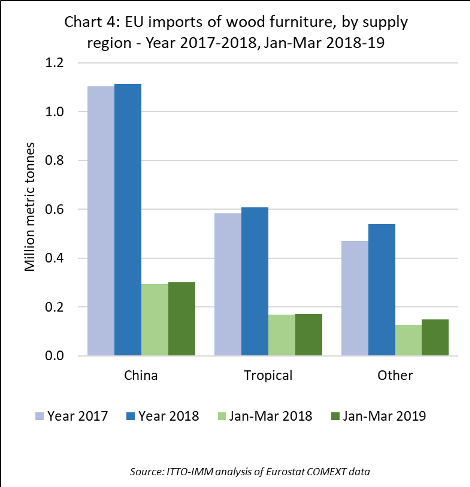

While the total value of EU wood furniture imports fell in 2018, import tonnage increased indicating a decline in the price and/or a change in the mix of products. Total import tonnage increased 5% in 2018, to 2.26 million metric tonnes (MT). Import tonnage increased by 1% from China to 1.12 million MT, and by 4% from tropical countries to 609,000 MT. However, continuing the trend of recent years, there was a sharper increase in imports from countries bordering the EU, including Ukraine (+30% to 97,000 MT), Belarus (+22% to 85,000 MT) and Turkey (+16% to 82,000 MT) (Chart 4).

These broad trends have continued in 2019. In the first quarter of this year compared to the same period in 2018, EU wood furniture imports from tropical countries increased by only 1% to 171,000 MT and imports from China were up 2% to 302,000 MT. Meanwhile imports from non-EU temperate countries increased 16% to 148,000 MT, with imports rising 35%, 23% and 16% respectively from Ukraine, Belarus and Turkey.

While China remains the largest external supplier of wood furniture to the EU, the overall decline in EU imports from China between 2015 and 2018 is notable. In recent years China’s competitiveness in the EU wood furniture market has been impeded as prices have risen on the back of growing domestic demand and new laws for pollution control pollution in China. EU furniture importers also continue to question the variable quality of product imported from China and some have struggled to obtain the legality assurances required for EUTR conformance when dealing with complex wood supply chains in China.

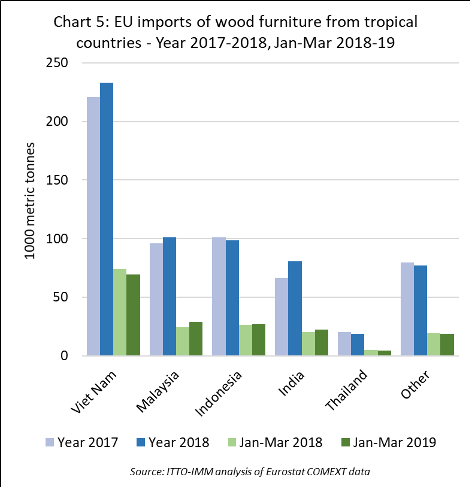

Of tropical countries, Vietnam is the leading supplier of wood furniture to the EU. EU imports from Vietnam increased 6% to 233,000 MT in 2018, but were slow in the first quarter of 2019, falling back 6% compared to the same period last year, to 70,000 MT. The trends are different in euro value terms. EU import value from Vietnam was flat in 2018, at €723 million, but increased 2% to €230 million in the first quarter of 2019.

In the EU, the Vietnamese furniture sector has gained a reputation for supply of large volume mid-range products, both for exteriors and, increasingly, for interior use. Market research by the FLEGT Independent Market Monitor, hosted by ITTO with EC funding, indicates that the Vietnamese furniture industry is regarded by EU importers as technically more evolved than most other Asian producer countries and increasingly able to supply products to high European quality standards.

EU imports of wood furniture from Indonesia declined 3% in tonnage terms to 99,000 MT in 2018 but increased 2% to 27,000 MT in the first quarter of 2019 compared to the same period last year. In value terms, imports from Indonesia declined 2% to €301 million in 2018 and increased 7% to €89 million in the first quarter of 2019.

The relative lack of growth in EU furniture imports from Indonesia since the start of FLEGT licensing in November 2016 may seem disappointing, but the trend is influenced by wider stagnation in EU furniture market growth and by intense competition in the sectors targeted by Indonesian manufacturers.

Indonesia’s furniture exports to the EU are dominated by outdoor products, particularly due to relatively abundant plantation teak supplies. However, there is now intense competition in this sector from a wide range of modified temperate wood and non-wood products which are taking share from tropical hardwoods. Indonesia’s long woodworking tradition has also meant it has gained a reputation for supply of good quality specialist hand-made furniture, a niche market in the EU where it competes most directly with India.

In 2018, EU imports of wood furniture from India increased 21% to 81,000 MT, and the rising trend continued in the first quarter of 2019 with a further increase of 10% to 23,000 MT. In value terms, EU imports from India increased 18% to €238 million in 2018, and by 15% to €66 million in the first quarter of 2019.

Imports of wood furniture from Malaysia increased 5% to 101,000 MT in 2018 and by a further 20% to 29,000 MT in the first quarter of 2019. In value terms the trend was slightly different, with imports from Malaysia falling 1% to €197 million in 2018 but recovering 19% to €57 million in the first quarter of this year. Malaysia is supplying the EU market with high quality furniture products but a much smaller range than Vietnam with a heavy focus on rubberwood and other plantation species.

Changing direction of investment flows in global furniture industry

Insights into the current furniture market in the EU, set within wider global market trends, were provided at the CSIL World Furniture Outlook seminar which took place on April 10th 2019 at the Salone del Mobile show in Milan.

According to CSIL, drawing on data presented at the seminar (www.worldfurnitureonline.com), the overall trend in global furniture consumption is positive with growth expected to continue at an annual rate of 3% (in real terms) in the coming years. As in previous years, the fastest growth rate is expected to be in Asia but positive trends are also expected in all the other main consuming regions.

While growth is being maintained overall, discussions at the seminar also highlighted that the recent globalisation trend, which has been so much a feature of the industry and contributed to the rapid expansion of furniture production in parts of Asia in recent years, may be slowing.

According to CSIL’s report of the seminar “this was due to several concurrent factors….including the continuous reduction in the gap between Chinese and US/European production costs, the reduction of labor intensity due to the progressive advent of technology, the development of regional value chains and productive systems integration and finally the increasing demand for product customization and shorter time to market, which are favoring proximity of the industry to its clients”.

CSIL also mention the present “chaotic status of international trade regulations” as another factor creating uncertainties in the international investment environment for furniture and which may be encouraging a greater focus on intra-regional rather than globalised trade.

According to CSIL data presented to the seminar, despite relatively slow production growth, Europe is still a leading player in the global furniture industry, being the second largest producing region in the world and accounting for around one quarter of the total sector output.

The seminar highlighted some of the steps being taken by European furniture manufacturers to maintain their existing dominance in the European regional market and to expand their influence in export markets.

A presentation by Giulia Taveggia, CSIL partner, drawing on a new CSIL report on the market position of the world’s top 200 furniture manufacturers, highlighted the extent to which overseas investment has become of strategic importance in the sector. Around half of these large manufacturers now operate manufacturing plants outside their headquarter country.

For European companies, the history of foreign investment is a long one. The early focus of outside investment was in neighbouring European countries, particularly those acceded to the EU from 2004 onwards, most notably Poland, but extending into a wide range of countries including Romania, Lithuania, and the Czech Republic. More recent investments have been directed towards non-EU countries, mainly in the European region (such as Ukraine and Belarus) but also further afield, notably in China.

The CSIL report also highlighted growing investment flows in the opposite direction as Chinese companies are increasingly engaged in “branding/know-how” acquisitions and other agreements or mergers with leading European furniture manufacturers. This reflects a strategic decision by some Chinese companies to invest closer to major western consumer markets and to add high-end and mid-high-end brands to their product portfolio.

Examples of Chinese acquisitions in Europe mentioned by CSIL include the 2018 acquisition by the Chinese furniture giant Kuka of the German upholstered furniture manufacturer Rolf Benz and the acquisition by Qumei Home Furnishings of the Norwegian furniture company Ekornes. In 2017 Ekornes itself invested more than EUR 10 million in a new manufacturing plant in Lithuania which started production in the first half of 2019.

A presentation by Piotr Beer and Sylwia Oleriska of the Polish Chamber of Commerce of Furniture Manufacturers (OIGPM) focused on the efforts of Polish manufacturers to enhance their competitiveness in the global furniture market. To achieve this, Polish manufacturers are building on their long experience of trading furniture in the highly competitive Western European market, on their relatively lower production costs and the high quality of furniture supplied.

Beer and Oleriska suggested that the main challenges to Polish manufacturers competitiveness relate to the implementation of new technology for furniture manufacturing, the need to reinforce brands, and for greater cooperation with designers to increase the added value of production. To overcome these challenges, the Polish furniture sector is focusing very heavily on development of human resources, through training and with specific initiatives to reduce entry barriers and increase sector attractiveness for younger workers.

Furniture market potential in Africa

Several African countries have good potential to develop their furniture industry, both for expanding internal consumption and for export markets. Total furniture consumption in Africa is expected to rise 2.4% in real terms during 2020 and significant consumption growth is expected longer term.

These are key conclusions of the latest edition of the Africa Furniture Outlook report by CSIL, the furniture research organisation based in Milan, Italy (available for online purchase and download at: www.worldfumitureonline.com)

According to CSIL, Africa has a total household consumption of US$1,400 billion with 1.13 billion inhabitants and per capita GNP of about US$ 1,700. Consumer demand has grown rapidly in the last decade thanks to an increase of the real income. With 16% of the world’s total population, Africa accounts for only 3% of world GDP but, according to IMF projections, per capita GDP between 2019 and 2023 will grow faster in Africa than in all other world regions except Asia.

CSIL estimated that apparent furniture consumption in Africa (at production or import prices, excluding retail mark-up) was US$9.8 billion in 2017, which is $8 per capita and represents just 2% of total global furniture consumption. The main furniture consumer markets in Africa, all with consumption exceeding US$500 million in 2017, are South Africa, Nigeria, Algeria, Egypt, Morocco and Sudan. North Africa, West Africa and South Africa are the main consuming regions, showing the highest per capita furniture consumption.

CSIL note that Africa has 59 metropolitan areas with population in excess of 1 million. Despite political instability and relatively poor infra-structure, these urban centres are expanding, with diversifying economies, and have significant potential as growth markets for furniture. In some areas, large investments are being made in real estate and tourism while the hospitality, cultural and entertainment sectors are all boosting demand for furniture.

CSIL report that total furniture imports in Africa (including both internal African trade and imports from outside the region) were worth about US$3 billion in 2017. About 32% of furniture consumed in Africa is imported from outside the region and 68% is manufactured internally. About 45% of imports from outside the region come from China, followed at a distance by Italy and Turkey.

Most imports from outside the region are destined for Southern and Northern Africa. South Africa is the largest furniture importer in the Southern region, importing mainly from China, Germany, and Italy. In North Africa the largest furniture importer is Morocco (which imports mostly from China, Spain, France and Italy), followed by Algeria, Egypt and Libya. In 2017, total Africa furniture production was US$ 7.5 billion in 2017, and only 10% of furniture manufactured in Africa was exported, the main exporting countries being Egypt, South Africa, Morocco and Tunisia.

PDF of this article:

Copyright ITTO 2020 – All rights reserved