Although the EU Timber Regulation (EUTR) has narrowed the supply base for tropical timber imported into the EU, traders in Belgium and the Netherlands strongly support the FLEGT regulatory approach – combining licensing with EUTR – as a platform to help rebuild confidence in tropical timber in the EU market.

FLEGT licensing is helping importers to comply with EUTR, while the forest sector reforms and new procedures implemented during the FLEGT VPA process form part of a positive narrative that now needs to be communicated more widely to buyers and procurement officials in the EU.

These were key messages of the latest European trade consultation, which targeted Belgian and Dutch traders, hosted by the FLEGT Independent Market Monitor (IMM), an ITTO project funded by the EU (more details of IMM and the trade consultation are available at www.flegtimm.eu).

The event held in the Belgian port of Antwerp formed part of a series of consultations to inform IMM work to assess market drivers and market impacts and perceptions of FLEGT. Similar consultations were held last year in France, Germany and the UK, and others are planned in Spain and Italy later in 2019.

An audience of 50 attended the event co-organised with Belgian and Dutch trade federations Fedustria and the VVNH. Delegates included timber importers and distributors, end-users, retailers and representatives from trade associations, EU Timber Regulation and FLEGT competent authorities (CAs) and government agencies.

Participants mainly came from Belgium and the Netherlands and operated in a wide variety of product areas including plywood, hardwood for interior fittings, such as mouldings, interior furniture and other manufactured goods, laminated components and exterior products, including decking, cladding, fencing and garden furniture.

Participating companies sourced from suppliers worldwide. Among those listed were Bolivia, Brazil, Cameroon, China, Congo, Gabon, Indonesia, Malaysia, Peru, Russia, Thailand, and Vietnam. Their customers included the construction sector, merchants and distributors, flooring, furniture, packaging and other manufacturers, and, in the case of retailer delegates, consumers.

Apart from the number and range of participants, the insights from the Antwerp consultation were made more relevant by recent tropical timber trade flow trends in the EU. The consultation was an opportunity to explore the views of traders playing an increasingly prominent role as gatekeepers for the wider European trade in tropical timbers.

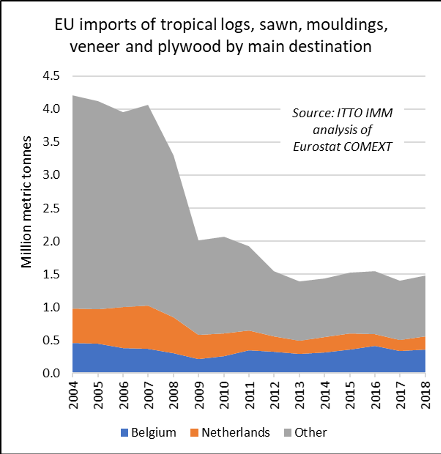

Imports of tropical wood products into Belgium and the Netherlands have held up more strongly than most other EU countries following the economic crises in 2008 and 2009. In 2018, 38% of total EU imports of tropical timber primary products (logs, sawn, veneer, mouldings and plywood) were landed in Belgium and the Netherlands compared to 23% in 2004 (Chart 1).

The agenda featured presentations on global trends in the tropical timber trade, and notably European trade with VPA countries, private and public sector timber procurement policy and the Dutch CA’s experience with FLEGT-licensed timber. Individual trade bodies and operators gave their perspectives on tropical timber trade developments, the FLEGT initiative and links to forest management certification.

Opening the consultation, IMM Lead Consultant Sarah Storck reported the results of the IMM 2018 trade survey which showed the EU timber sector has become quickly accustomed to the FLEGT licensing system. “In 2017 a significant minority of respondents had said it was more complex than undertaking due diligence under the EUTR. But in the 2018 survey only 1% of respondents still felt that, whereas the vast majority said it made importing easier”.

Commenting on the direct impacts of FLEGT-licensing and the EUTR on EU tropical timber imports, Ms. Storck said that the market introduction of FLEGT-licensed timber was felt to have had a small positive impact by EU trade respondents to the 2018 IMM survey. At the same time, around 35% maintained that the EUTR had negatively impacted tropical timber imports (compared to 63% indicating no impact and 2% indicating a slight increase).

Nonetheless, according to Ms. Storck, trade representatives interviewed by IMM for the 2018 survey emphasised that they were supportive of the EUTR and saw it as an opportunity for the tropical timber trade in the medium and long-term – as long as it was effectively implemented.

Rising Dutch imports of FLEGT licensed timber

These results were consistent with comments made at the consultation by Meriam Wortel, representing the NVWA, the Dutch CA for EUTR and FLEGT. A role of NVWA is to monitor volume trends in Indonesian forest product imports into the Netherlands since the start of FLEGT licensing.

Ms. Wortel said that “while, pulp and paper trade is more prone to fluctuation, the overall direction [of Indonesian timber imports into the Netherlands] has been upwards, with latest figures for timber and wood furniture showing further rises. However, while we can say licensing has had no negative effects, it is not yet clear to what degree or if FLEGT licensing is a factor in this positive trade trend.”

According to Ms. Wortel, the NVWA is processing more FLEGT licences than any other CA, a total last year of 8546. The Dutch CA is also one of the driving forces behind developing a fully electronic FLEGT-licensing system in cooperation with Indonesia and the EC.

Initial administrative teething problems dealing with licences had been overcome as the trade grew accustomed to the process, said Ms Wortel. However, an ongoing issue was mismatches between HS codes on licences and those applied in the Netherlands.

“We’ve raised this with the Indonesian authorities and liaised with other CAs, but, while the incidence of mismatches decreased last year, it has recently risen again,” said Ms. Wortel. “So, there’s continuing need to stress to exporters they must get licence details right.”

During the subsequent discussion, participants highlighted that perceived “mismatches” were sometimes not due to mistakes on the FLEGT-licenses or importers’ documentation but to limited product knowledge and mistranslations on the part of customs’ officials.

“Laminated” joinery products, for example, would sometimes be expected by customs officials to be “film-faced”. One or two participants complained that sorting out such issues and getting customs authorities to accept that the mistake was in fact their own would sometimes involve lengthy negotiations.

Ms Wortel added that the NVWA anticipated fewer mismatch issues with imports from Ghana when it starts licensing due to its less complex product mix and the different system of applying for and issuing FLEGT-licenses. She also said that the goal was that the process of FLEGT-licensing in Ghana should be fully electronic right from the start.

Potential of FLEGT licensing as platform to rebuild market share

Much discussion at the Antwerp consultation was directed towards exploring whether the long-term declining trend in EU tropical timber consumption can be changed and the potential for FLEGT licensing as a platform to rebuild market share.

A presentation by IMM Trade Analyst, Rupert Oliver, set the stage by highlighting that the share of tropical timber in total EU imports was only 19.7% in 2018, down from 20.3% in 2017 and the third consecutive year of decline (after a brief rebound in 2015). Longer term, the share of tropical countries in EU imports have fallen from well over 30% before the financial crises in 2007-2008.

Participants were invited to identify and rate the factors that may be restricting their sales of timber from VPA partner countries. “Environmental prejudices and uncoordinated marketing” was rated the most significant constraint by this audience, followed by “product substitution”. The factors of “competition from China” and “diversion of wood supply to other markets” were viewed as the next most significant, in line with previous IMM research.

In contrast to previous IMM research, participants in Antwerp rated the “economic downturn and slow economic recovery” as a less significant factor limiting EU imports from VPA partner countries. This may simply be a sign that as time passes, memories of the economic downturn are gradually receding and there is growing acceptance that slow economic growth is the “new normal”.

And in the Netherlands, where economic growth has been reasonably robust in the last 2 years, it’s unlikely now to be viewed as such a significant market factor.

In addition to these various factors, participants suggested that the EU Timber Regulation (EUTR) has shaken up EU importers’ supplier selection process. There was a widespread view amongst Belgian and Dutch traders at the consultation that they now put their supply chains through greater scrutiny than ever. Illegality risk assessment and the capacity of suppliers to provide adequate information to satisfy the due diligence requirements of the EUTR was a priority.

“If a supplier can’t meet our due diligence needs or supply the further proof of legality for risk mitigation, then we don’t pursue the relationship further,” said one plywood operator. As a result, said some traders, their tropical supply pool and consequently the variety of tropical products available to them, had narrowed.

While EUTR may be placing constraints on supply of tropical timber to EU importers, there was strong support for the regulatory approach adopted by the EU, combining FLEGT licensing with EUTR, when participants were asked, in another exercise, to rank overall strategies that might be adopted to improve the position of tropical wood products in the European market.

Of various strategies identified during the consultation, the FLEGT regulatory approach was by far the most popular amongst Antwerp participants. No single participant reckoned that the opposite strategy, of repealing the FLEGT licensing measures and EUTR (and thereby in theory reducing the regulatory burden of importing timber products) would help to improve tropical timber’s position in this market.

Can the EU market for tropical timber be turned around?

In addition to rating market constraints and opportunities for timber products from VPA partner countries, participants at the Antwerp consultation were asked to provide feedback on three questions: (1) can the market for VPA partner timber products in Belgium/Netherlands and wider EU be turned around; (2) if so, how; and (3) what role do you think the FLEGT process can play in turning the market around?

On the first question, quite a few participants felt there was little or no prospect of the market turning around, suggesting that share has now been irretrievably lost to other materials and demand for tropical wood has shifted elsewhere in the world. However, others responded with a cautious “yes, in some specific market sectors”.

On the second question, of “how to turn the market around”, it was noted that trying to encourage more demand just by focusing on traditional product groups for tropical timber products and business-to-business communication channels, and trade servicing activities, was unlikely to lead to any significant increase.

On the other hand, there was some optimism that new opportunities could arise through the introduction of better organised and targeted marketing campaigns, involving considered analysis to match specific VPA partner products to niche markets, and backed by widespread certification and/or licensing, and concerted efforts to explain the FLEGT narrative to customers.

Views were divided on the third question, just how important is FLEGT licensing likely to be as part of the process? Some participants seemed sceptical that licensing had an important role to play, others were more enthusiastic.

To some extent this split reflected the experience to date of marketing Indonesian FLEGT products. Feedback from the Antwerp consultation suggests that FLEGT licensing is helping those importers that have traditionally purchased Indonesian products as it greatly simplifies EUTR conformance for these products.

However, licensing has yet to encourage any broader interest in Indonesian products in the European market. There was a widespread view in the room that companies so far have not been switching to Indonesian products due to the availability of FLEGT licenses. As things stand, participants also suggested that price premiums could not be charged for FLEGT-licensed products in the EU market.

Longer term, FLEGT licensing was expected by some participants to play a larger role in expanding the EU market for timber products from VPA countries if the range of countries and products covered by licensing increased.

The forest sector reforms and new procedures implemented during the FLEGT VPA process were seen as part of a positive narrative that could help at least to maintain, if not necessarily grow, market share in the EU.

However, for this to happen, participants stressed there needs to be more concerted efforts to improve awareness and recognition of the role of the FLEGT process down the supply chain, amongst retailers, manufacturers, and other buyers.

A clear, consistent and widely agreed message on FLEGT’s sustainability credentials in terms of wider environmental, economic and social impacts, would also help, as would greater recognition of FLEGT licences in government timber procurement policy in all 28 EU member states.

Participants flagged up a lack of awareness of the wider benefits of FLEGT VPAs among decision makers shaping EU public procurement policies and decision makers specifying timber for public projects, especially at local level. It was noted that government recognition and procurement of FLEGT-licensed timber would help drive private sector consumption.

The topic of creating a logo for FLEGT was also raised once more, with some participants suggesting it needed to become a trademark. Participants also highlighted that lack of a chain-of-custody system for FLEGT licensed timber once it enters the EU supply chain is a barrier to FLEGT-licensed timber being accepted in EU public procurement.

Participants in Antwerp strongly favoured combining the FLEGT regulatory approach with further efforts to expand supply of third-party certified tropical timber. Perhaps unsurprising in this part of the EU where there has been particularly strong support for timber procurement policies favouring FSC and PEFC certified timber.

Participants emphasised that FSC and PEFC certification is still a greater purchasing preference amongst importers in the Netherlands and Belgium and their customers than a FLEGT licence.

Far reaching CSR commitments necessary to build EU market for tropical timber

Participants also strongly endorsed a view that NGOs need to be actively engaged in efforts to improve the market position of tropical timber in the EU. Specifically, participants noted that the three NGOs which, probably, have been most influential on forestry issues in the EU (WWF, FoE and Greenpeace) need to be convinced of the “use it or lose it” message and to be more visible in their support for the FLEGT process.

Taken together, the demand for a regulatory approach in combination with wide-ranging commitment to private sector certification, and direct liaison with NGOs, mirrors the high ranking accorded to “environmental prejudices” as a key driver of tropical wood’s decline in this part of the EU.

There was a strong feeling in this audience that the poor environmental reputation of tropical timber products, irrespective of just how well deserved, must be rectified by far-reaching corporate commitments to good practice, backed by regulation, as an essential pre-requisite to maintain or rebuild market share.

Another clear message from the Antwerp consultation was that while FLEGT licenses and other environmental assurance mechanisms provide essential platforms to help build market share, there are broader competitiveness issues that also need to be addressed. Suppliers of FLEGT licensed products must still compete on price, availability, quality and consistent delivery.

A plywood importer illustrated this point by noting that “cheaper Russian plywood, which due to greater investment in technology has also become a better quality, more consistent product, has been taking Indonesian market share”.

Improved tropical wood marketing in Europe, with strong focus on certification

Europe’s timber and wood products sector has stepped up the level of its marketing and advertising activity and the clarity, cohesion and effectiveness of its communications in recent years. This includes marketing initiatives related to tropical timber which currently focus more on third party forest management certification programs than on FLEGT-related activities.

The focus on certification is partly due to the more limited range of FLEGT licensed products currently available on the EU market and partly to continuing lack of clarity in EU procurement policies and practices on the status of FLEGT licencing relative to systems like FSC and PEFC.

These are key conclusions of a new study on EU wood promotion programs issued by the Independent Market Monitor (IMM), the project hosted by ITTO with EU funding, to assess the market impact of FLEGT Licensing.

The study draws on a series of interviews and a literature survey conducted in the spring of 2019. In total twenty-five interviews were conducted across a range of EU member states and from a variety of perspectives – including wood promotional campaigns, timber trade federations, civil society organisations, companies and other industry commentators.

The IMM study shows that Europe’s timber and wood products sector has developed a wide range of national and international marketing programs and campaigns. The sector has focused particularly on promotion and communications of timber’s environmental performance, in recognition that its key markets, notably construction, but also government decision makers are increasingly environmentally aware and informed and addressing climate change issues ever more urgently.

Campaigns incorporate latest findings on wood’s carbon and climate mitigation benefits, its life cycle analysis performance in relation to competing man-made materials and its potential role in developing a circular, bio-economy.

There is also a stress on timber’s renewability and sustainability and the role sustainable forest management can play in maintaining the forest resource, with the carbon and biodiversity gains that entails. The stress here is very much on third-party forest and chain of custody certification as assurance that timber is from a sustainably managed forest.

Europe’s timber trade federations are involved both in these wider promotion campaigns and also conduct their own campaigns to highlight the industry’s efforts to assure legality of timber placed on the European market and combat illegal logging, with the main focus in this area on the EU Timber Regulation and associated due diligence.

On promotion of FLEGT and FLEGT licensing, there is a central communications hub in the EFI FLEGT Facility, which continues to develop its content, strategy and outreach. The UK Timber Trade Federation ran an exhibition exclusively focused on FLEGT, a UK initiative supporting development of Indonesian FLEGT marketing strategies is underway and other trade federations do communicate the facts on FLEGT.

But otherwise the profile of FLEGT licenses in industry promotion and marketing is low relative to third party forest certification. Europe’s two main tropical timber promotion campaigns – the Sustainable Tropical Timber Coalition (STTC) and the ATIBT “Fair and Precious” branding exercise – commend only forest certification as a procurement criterion, although FLEGT licenses are seen to have potential to make the market more tropical timber-friendly generally and do not rule out more communication on FLEGT in the future.

The emphasis of European NGOs in their forestry and timber sector campaigning is also on sustainable forest management linked to third party certification. There is, however, communication of FLEGT and some active NGO advocacy for the FLEGT VPA process in the sector.

Some in the European timber industry believe there is potential for raising FLEGT’s profile in communications and promotion further, given a more holistic approach. That includes greater emphasis on its wider social, environmental and economic impacts, but also a still greater trade focus, with more information on the actual products available with licences.

Another influence on the direction of wood promotion generally must be that rival materials sectors’ increasing communication of their environmental credentials, as the IMM report shows, is focused very much on issues of sustainability, carbon and climate.

The report recommends provision of targeted information on FLEGT to the managers of existing timber promotion campaigns, linked to a strong focus on continuing efforts to increase availability of FLEGT licenced products in the EU market, and further research and consultation to clarify the status of FLEGT Licencing compared to third party certification.

It also recommends measures to facilitate VPA signatory countries to themselves lead the process of communicating the role and positive impacts of the timber legality assurance systems being developed under the terms of FLEGT VPAs.

The report can be downloaded at https://www.flegtimm.eu/index.php/newsletter/imm-project-news/141-flegt-s-profile-in-promotion-and-marketing-is-low-relative-to-certification

PDF of this article:

Copyright ITTO 2020 – All rights reserved