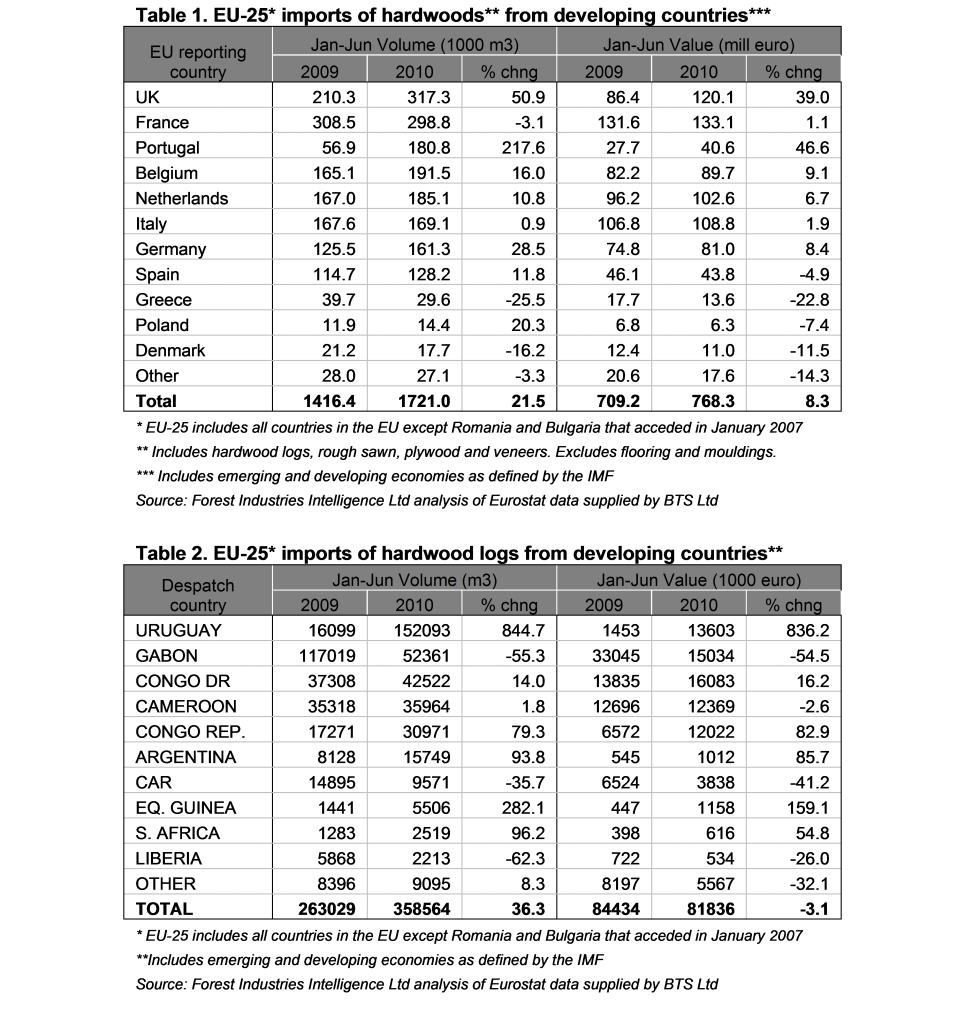

The latest EU-wide trade data indicates that imports of hardwoods from less developed countries (LDCs), while still at historically very low levels, were showing early signs of recovery in the first half of 2010 (see Table 1). During this period, European imports of hardwood logs, sawn, plywood and veneers from LDCs totalled 1,721,000 m3, a 21% gain on the volume achieved in the first half of 2009. Most of the gains were made in the second quarter of the year after a very slow start to 2010. Import performance also varied widely by European country. The overall result was strongly affected by big increases in imports of plywood by the UK and of eucalypt logs (destined for the paper rather than solid wood sector) by Portugal. Imports into several European countries including Spain, Greece and Denmark remained very weak.

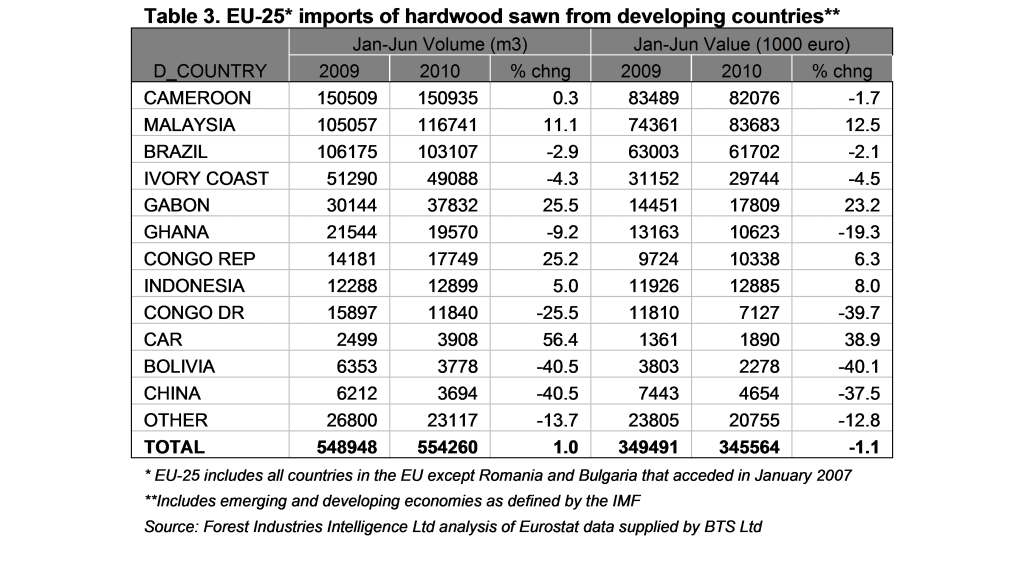

Table 2 shows trends in EU-25 imports of hardwood logs from LDCs during the first half of 2010. It shows the big increase in eucalypt imports from Uruguay during the period, mostly destined for the paper sector in Portugal. The most significant trend from the perspective of tropical hardwoods is the 55% decline in log imports from Gabon. This trade is expected to decline to zero in subsequent quarters following imposition of the Gabon log export ban from May 2010 onwards. To some extent European traders are compensating for the Gabonese ban by increasing log imports from the Congo Republic, Congo DR and Equatorial Guinea.

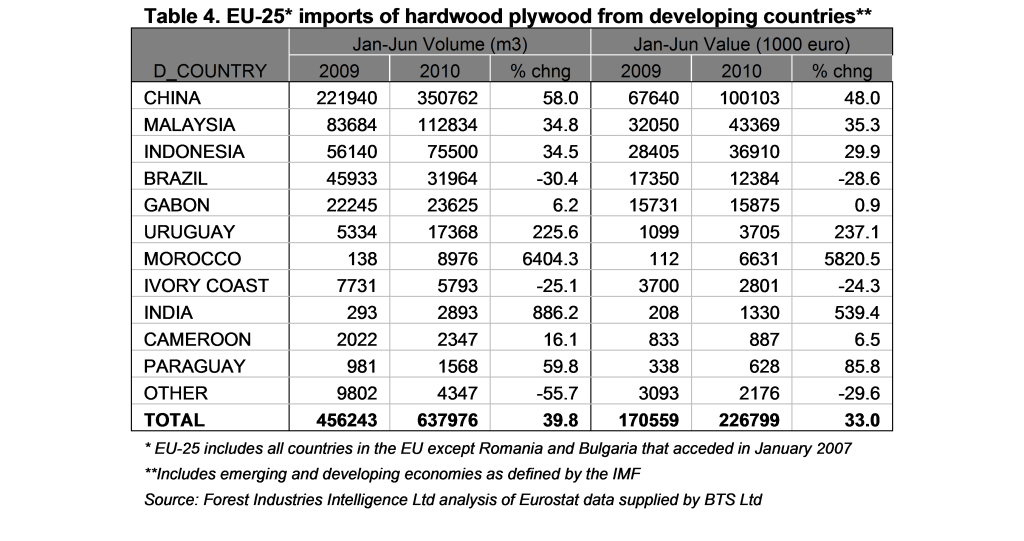

The trade data confirms anecdotal reports that the anticipated recovery in European tropical sawn lumber market was very slow and patchy during the first half of 2010. Table 3 shows that EU-25 imports of hardwood sawn from LDCs during the first half of 2010 were almost exactly equivalent to imports during the same period in 2009. Gains in EU imports of hardwood sawn lumber from Malaysia, Gabon and the Congo Republic were offset by continuing declines in imports from Brazil, Ivory Coast, Ghana and the Democratic Republic of Congo.

There were, however, much clearer signs of recovery in the European market for hardwood plywood during the first half of 2010(Table 4). Overall imports of hardwood plywood from LDCs increased almost 40% during the six month period compared to the same period in 2009. There was particularly strong growth in European imports of hardwood plywood from China, confirming anecdotal reports that China has been gaining market share in this sector during the recession, largely owing to its continuing ability to offer product at highly competitive prices. However sales of Malaysian and Indonesian plywood also made significant gains. Chinese and tropical hardwood plywood have benefited during 2010 from rising prices for Russian birch plywood as a result of the forest fires that raged through Russia this summer. Another notable trend this year is the emergence of Uruguay as a more significant supplier of hardwood plywood to the EU following intense marketing of products derived from plantation-grown eucalypt as an environmentally-friendly alternative to tropical hardwood plywood.

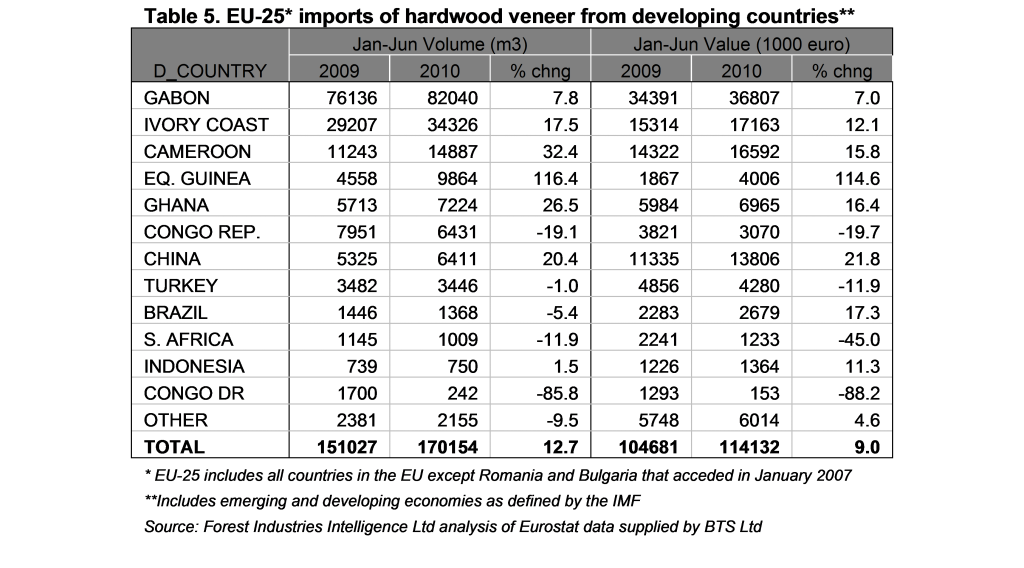

The ban on log exports from Gabon is just beginning to reveal itself in the form of increased European imports of rotary veneers for plywood manufacture (Table 5). Overall EU veneer imports during the first half of 2010 were up nearly 13% on the same period the previous year. An increase in European veneer imports from several countries more engaged in the sliced veneer business, as opposed to the rotary veneer business, also suggests some improved buying by the European decorative panel and furniture sectors. During the first half of 2010, EU veneer imports increased from Gabon, Ivory Coast, Cameroon, Equatorial Guinea, and Ghana. There were also small increases in European imports from China which – despite a huge veneer manufacturing sector – has yet to emerge as a large exporter of this commodity.

Only minor gains in EU sawn hardwood and veneer trade during second quarter

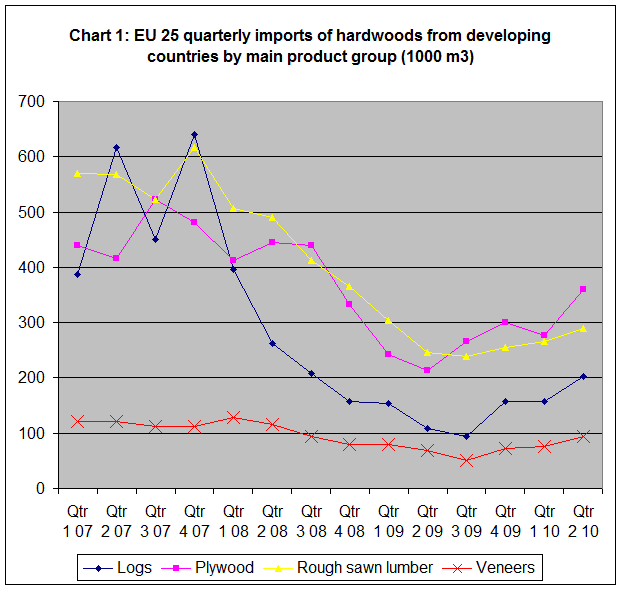

Quarterly trends in the volume of EU-25 hardwood imports from LDCs are shown in Charts 1, 2 and 3. Chart 1 highlights very strong growth in EU-25 imports of hardwood plywood from developing countries during the second quarter of 2010 after a disappointing performance in the first quarter of the year. However imports of hardwood sawn lumber and veneers made only minor gains during the second quarter.

The apparent improvement in European hardwood log imports from LDCs during the second quarter of 2010 is strongly influenced by increased eucalypt imports from Uruguay by Portugal and does not imply any improvement in the market for tropical hardwood logs. EU imports of the latter only reached 95,000 m3 in the first quarter of 2010 and then fell to 93,000 m3 in the second quarter of 2010.

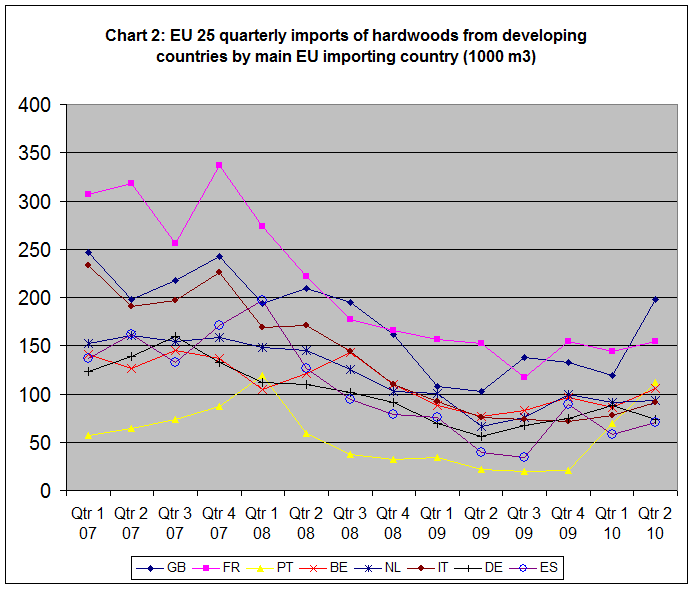

Chart 2 shows that imports of LDC hardwood products by the UK and Portugal made significant gains in the second quarter of 2010, due respectively to spikes in imports of plywood and eucalypt logs. Imports into Belgium and Italy continued to improve slowly during the second quarter of 2010, while imports into Spain were a slight improvement on the desperately low levels recorded in the first quarter of 2010. However, the recovery in German imports stalled during the second quarter of 2010, particularly disappointing after three consecutive quarters of growth between June 2009 and March 2010.

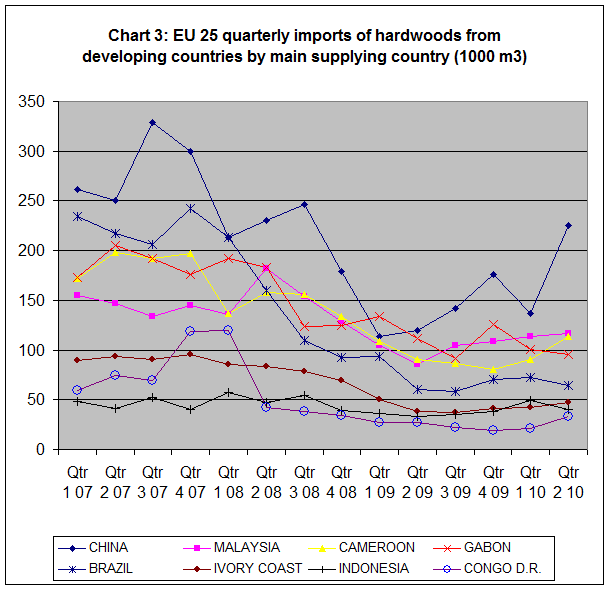

Chart 3 shows that China was the major beneficiary of the tentative market recovery in Europe during the second quarter of 2010, mainly a result of rising demand for hardwood plywood in the UK. European imports of hardwood products from Cameroon and the Democratic Republic of the Congo have also shown fairly consistent growth this year. European imports from Brazil and Indonesia slowed again in the second quarter after showing signs of improvement in the opening months of the year. Imports from Malaysia and Ivory Coast remained stable at historically low levels between the first and second quarters of 2010.

No significant upturn in the European market for tropical hardwood products is now expected until at least the first quarter of 2011. This is against a background of government austerity measures, sluggish construction activity, the onset of winter weather conditions, a continuing tendency to maintain low stocks, and relatively low forward availability.

PDF of this article:

Copyright ITTO 2020 – All rights reserved