The EU’s “Illegal Timber Law” (ITL) was formally introduced by the European Council on 11 October 2010 although with the proviso that there should be a 27 month preparatory period before the law becomes actionable (at the beginning of 2013) to firm up the regulations and to give time for development of the required procedures by the European Member States and trade.

The ITL, formerly referred to as the “due diligence” legislation, was passed with almost unanimous agreement by the European Member States. The only exceptions were Sweden and Portugal whose objections were largely on grounds of excess bureaucracy and cost and that the law may be disproportionate to the scale of the problem and may be ineffective as a means of preventing illegal logging. A number of other countries (Czech Republic, Finland, Italy, Lithuania, Luxembourg, Slovenia, Sweden and Romania), issued a joint statement which while indicating their support for the ITL, emphasised that special consideration should be given to the situation of small and medium sized enterprises/operators during implementation.

Key aspects of the finalised legislation include:

- There is a general “prohibition” against the “placing on the EU market of illegally harvested timber or timber products derived from such timber”.

- A “traceability obligation” is placed on “traders throughout the supply chain” to identify “the operators or the traders who have supplied the timber and timber products; and where applicable, the traders to whom they have supplied timber and timber products.”

- Operators that “place timber or timber products on the market” (taken to include importers and primary producers in the EU) are required to implement a so-called “due diligence system” in line with minimum requirements established in the legislation.

- Each operator is required to regularly evaluate the due diligence system which it uses, either through its own procedures or those of a “monitoring organisation”. The latter effectively amounts to a group “due diligence system” and is expected, most commonly, to be operated by a European importers’ association.

- The “due diligence system” must contain at minimum:

- procedures providing access to information on the operator’s supply of timber products such as: the trade name and type of product as well as the common name of tree species and, where applicable, its full scientific name; country of harvest; and “where applicable”, the “sub-national region where the timber was harvested” and “concession of harvest”; quantity traded; name and address of the immediate suppliers and buyers of timber products; and “documents or other information indicating compliance of those timber and timber products with the applicable legislation”;

- Risk assessment procedures enabling the operator to analyse and evaluate the risk of illegally harvested timber or timber products derived from such timber being placed on the market. Risk assessment procedures are required to take into account such things as third party certificates of compliance with legislation, information on the prevalence of illegal harvesting in the source region; any UN or European sanctions and the “complexity of the supply chain of timber and timber products”.

- Risk mitigation procedures (such as requiring extra information or third party verification) “except where the risk identified in course of the risk assessment procedures is negligible”.

- FLEGT VPA licensed timber and timber products covered by CITES certificates are effectively given a “free pass” under the legislation and are not required to be subject to any further scrutiny or “risk mitigation” by traders.

Analysis of the final legislative text reveals ambiguity and potential conflict between clauses that will need to be resolved before the full implications of the law for European importers and external suppliers are clear. One area of ambiguity relates to where the “burden of proof” will lie. Some European importers’ associations have stated confidently in publicity material lending their support to the legislation that European authorities will be obliged to prove illegality in order prosecute under the “prohibition” part of the law. This is in line with the widely held legal principle of “innocent until proven guilty”. While this may be true in theory, the legislative text also appears to place potentially far-reaching obligations on all suppliers to positively demonstrate legality as a pre-requisite to their timber being placed on the EU market.

Another area of ambiguity is the apparent conflict between the “traceability obligations” and the requirements for “due diligence systems”. The former gives the impression that all suppliers are under an obligation to establish full traceability of the supply chain. On the other hand, the due diligence requirements imply that if the risk of illegal logging is “negligible” with regard to a particular species or country, then there should be no need to go further than establishing the country of harvest.

Given extreme complexity and fragmentation of timber product trade flows, and the inevitable challenges that these present for traceability and delivery of documents demonstrating legality, such points of interpretation are not minor considerations. How they are resolved has much potential to impact on the relative competitiveness of all timber and timber product suppliers to the EU market.

International trade considers new “illegal timber” requirements

The third International Timber Trade Federation (ITTF) meeting was held 5 to 8 October in Geneva, neatly timed to coincide with final deliberations by the European Council of Ministers over adoption of the new “Illegal Timber Law” (ITL). The meeting – hosted by The Forest Trust under the auspices of the EC-funded Timber Trade Action Plan (TTAP) – was attended by representatives of timber trade associations from both European importing countries and major timber (mainly hardwood) supplying countries.

Inevitably, the ITL was a major focus for discussion with European Commission officials on hand to try to explain the intricacies to trade delegates. EC officials also stated that “consultation starts now” and that they would welcome inputs from all interested parties as they work to develop the implementation measures. EC officials identified key implications for external suppliers of wood to the EU as: “increased demands for traceability”; “third country timber suppliers will have to provide evidence of legality”; and that “third party certified wood will be regarded by EU operators as being at a low risk of being derived from illegal sources”.

Representatives of tropical wood exporting associations at the meeting reported on their on-going efforts to improve transparency and demonstrate legality of wood supplies. There was, for example, a comprehensive report on the current status of Indonesia’s SVLK system.

Tropical wood exporters also commented on some of the challenges arising from the new ITL and on potential solutions. For example, one exporter emphasised that “demonstrating legality with confidence can be a very expensive process” and warned that European importers should expect to pay more for tropical wood following introduction of the legislation. Concern was also expressed at the apparent lack of a co-ordinated approach to due diligence in the EU as each national importing associations appears to be developing a different system. As a result exporters to different European markets face the prospect of being bombarded with a huge number of complex and varying requests for information. There was a call for unified approach, at least with respect to the process of supplier risk assessment.

Eric Boilley of Le Commerce du Bois (LCB) the French timber trade federation, presented on the organisation’s responsible procurement policy as an illustration of how a due diligence system and monitoring organisation is likely to work. The policy requires members of LCB to ensure that all wood supplied is at minimum legal (using guidance developed by the WWF) and to demonstrate that the proportion of certified wood purchased rises from year to year. It was also noted that LCB is working with WWF to develop a database of supplier risk ratings.

UNECE forecasts very slow recovery from recession in Europe

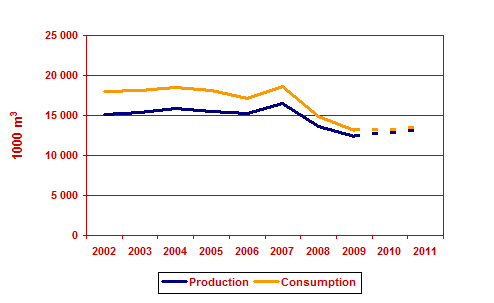

Between 11 and 14 October, the United Nations Economic Commission for Europe (UNECE) Timber Committee met to discuss timber markets throughout Europe, North America and the CIS. The committee’s conclusions and forecasts relating to sawn hardwood production and consumption across the region are shown in the chart below. The committee reckon that total sawn hardwood consumption across the European region fell from a peak of 18.7 million m3 in 2007 to only 13.7 million m3 in 2009. Consumption during 2010 and 2011 is forecast to remain largely unchanged at this low level.

Underlying the forecast is the UNECE’s analysis of broader economic conditions in Europe which are forecast to improve only very slowly over the next two years. For example, in a detailed analysis of construction sector growth throughout the UNECE region presented to the meeting, Delton Alderman of the US Department of Agriculture commented that “it will be several years before we see robust growth. A key problem is that an excess inventory of housing and building stock in several countries such as the US, Spain, Ireland and the UK must first be absorbed”.

Specifically on Europe, Alderman noted the continuing existence of significant downside risks to economic recovery, notably the scale of national debt. On the other hand, he also showed that while the scale of new construction in Europe has declined dramatically over the last three years, spending on remodelling activity has remained remarkably stable. This suggests continuing opportunities for hardwoods in the refurbishment sector.

Production and consumption of sawn hardwood in the UNECE Europe Sub-region 2002 to 2009 and Timber Committee forecasts for 2010 and 2011

African log imports into Nordenham hit record lows

The trade journal EUWID reports that timber handling at the port of Nordenham, the most important German port for imports of African hardwood logs, fell to record lows in 2009. Total timber imports through the port during 2009 stood at only 37,915 tonnes, a decline of 58% compared to the previous year. Timber import volumes through the port in 2009 were less than a third of the volume recorded in 2006. EUWID notes that imports of African wood through the port in 2010 have remained at very low levels being particularly affected by the Gabon log export ban imposed at the start of the year.

PDF of this article:

Copyright ITTO 2020 – All rights reserved