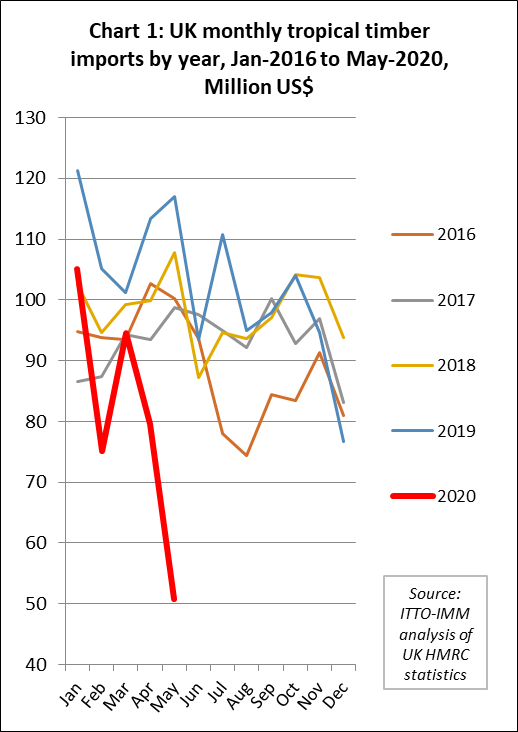

As expected, following the UK lockdown in response to COVID-19 introduced on 24th March and allowing for the long lead time in the tropical trade, there was a very sharp decline in UK imports of tropical timber products in May. The total value of UK imports of all tropical wood (HS 44) and wood furniture (HS 94) products during the month was just over US$50 million, only half the value typical in what is usually one the busiest months of the year for the UK trade (Chart 1).

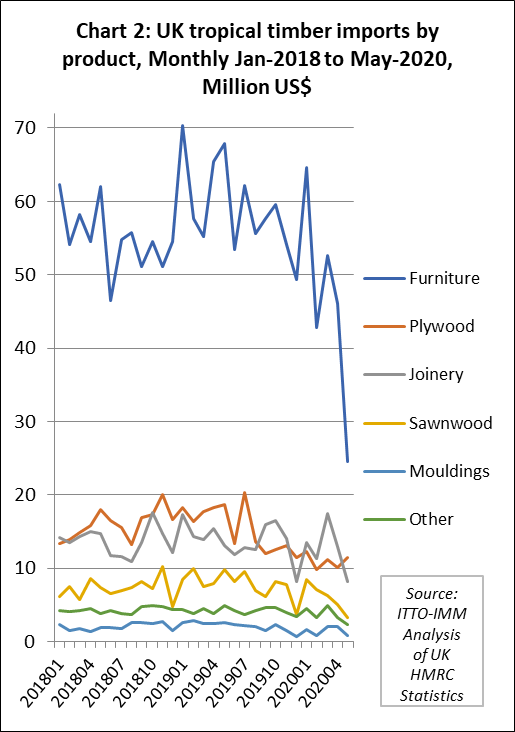

There was a large downturn in UK imports of all tropical timber products in May. Imports of tropical wood furniture were US$24.5 million during the month, compared to an average of US$61.6 million for the same month in the previous 5 years. The same comparison for tropical plywood is US$11.5 million in May this year against the 5-year average of US$14.3 million, for tropical joinery US$8.2 million in May this year against the 5-year average of US$13.0 million, for tropical sawnwood US$3.3 million in May this year against the 5-year average of US$8.3 million, and for tropical mouldings/decking US$0.9 million in May this year against the 5-year average of US$2.2 million (Chart 2).

The sharp downturn in May, a direct result of the COVID-19 lockdown measures, follows a period of more gradual decline in UK imports of tropical timber products. UK wood furniture imports from tropical countries have been weakening since the start of 2019 and were particularly slow in February this year. Imports of tropical plywood and sawnwood have also been sliding since the middle of 2019.

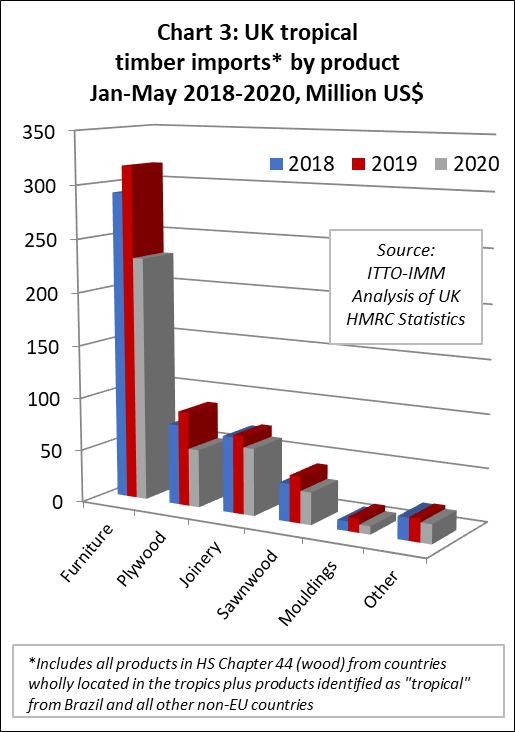

Comparing the first five months of 2020 with the same period in 2019, total UK import value of tropical timber products fell 27% to US$405 million. Import value of wood furniture from tropical countries fell 27% to US$230.6 million, while imports of tropical plywood were down 39% at US$54.9 million, tropical joinery products were down 14% at US$63.4 million, tropical sawnwood fell 31% to US$30.3 million, and mouldings/decking declined 41% to US$7.7 million (Chart 3).

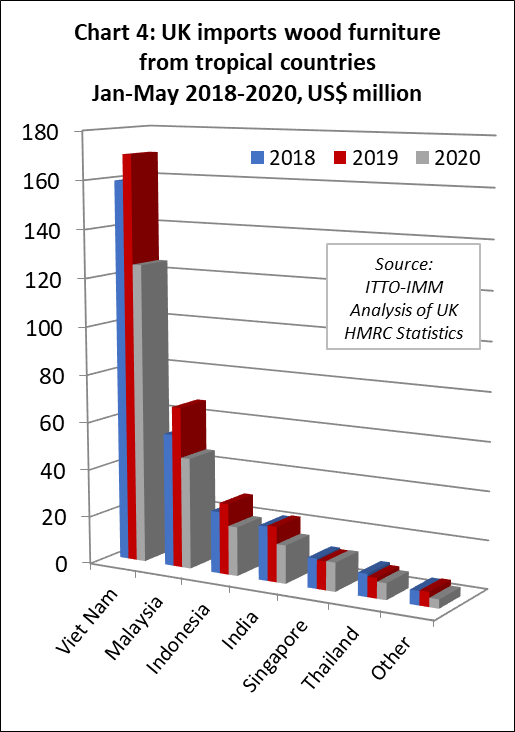

UK imports of wood furniture declined sharply from all the leading tropical supply countries in the first five months of this year (Chart 4). Imports from Vietnam were down 26% at US$125.1 million, imports from Malaysia fell 31% to US$46.5 million, imports from Indonesia declined 31% to US$20.5 million, and imports from India fell 31% to US$15.9 million.

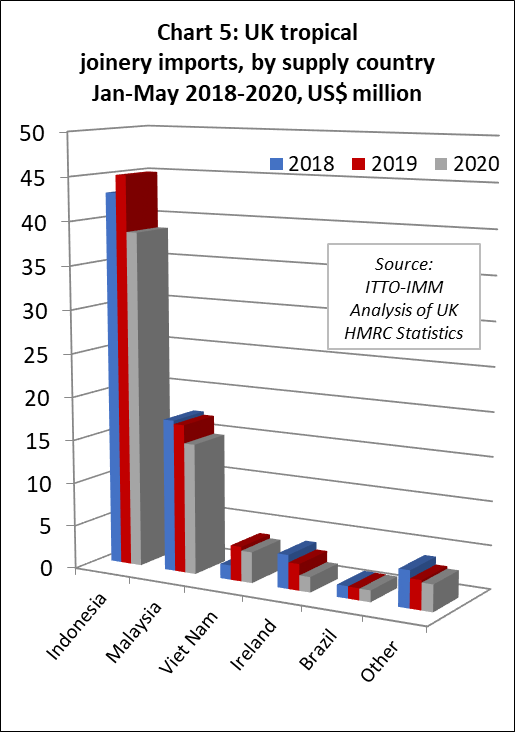

Indonesia loses ground in UK joinery market

After making gains in 2019, UK imports of tropical joinery products from Indonesia, mainly consisting of doors, fell 14% to US$38.6 million in the first five months of this year. After a strong start to the year, UK imports of joinery products from Malaysia and Vietnam (mainly laminated products for kitchen and window applications) stalled almost completely in May. Total joinery imports in the first five months were down 12% to US$15.1 from Malaysia and down 11% to US$3.5 million from Vietnam. UK trade in joinery products manufactured from tropical hardwoods in neighbouring Ireland have also fallen dramatically this year, down 42% to US$1.8 million in the first five months. (Chart 5).

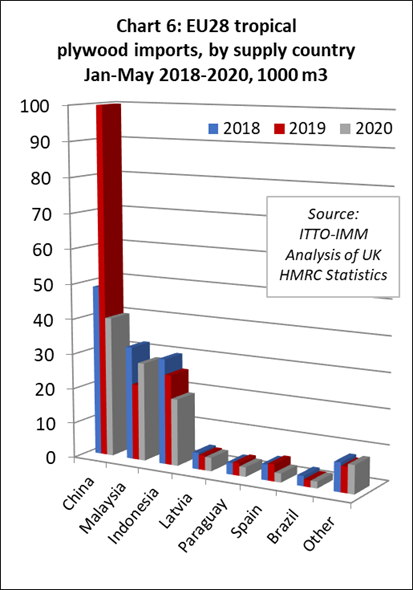

UK imports of tropical hardwood plywood from China fall 60%

The UK imported 40,000 m3 of tropical hardwood faced plywood from China in the first five months of this year, 60% less than the same period last year. UK imports of this commodity from China were at unusually high levels in the first half of 2019 after a period of slow buying in 2018 due to Brexit uncertainty. However, the market suffered from over-stocking in the second half of last year as consumption slowed. This year, UK imports have been further dampened by COVID related supply problems in China.

Likely due to supply problems elsewhere, UK imports of plywood from Malaysia, which have been in long term decline, were recovering ground in the opening months of 2020. Despite significant slowing in May, imports from Malaysia were still up 30% at 28,100 m3 for the first five months of the year. However, imports from Indonesia were down 26% to 19,000 m3 during this period, while imports from Paraguay were 24% less at 2,700 m3. In recent years, the UK has been importing small volumes of tropical hardwood faced plywood from Latvia and Spain. In the first five months of 2020, imports declined 8% to 3,800 m3 from Latvia and 47% to 2,600 m3 from Spain. (Chart 6).

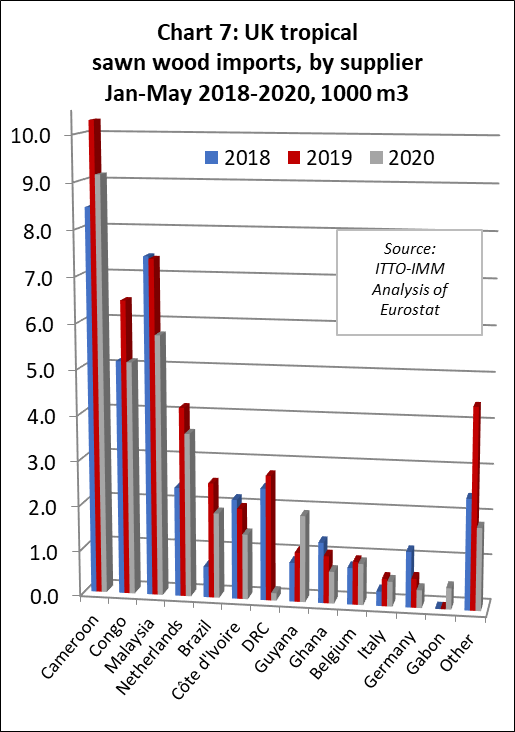

UK tropical sawn hardwood imports down 24% in year to May

The UK is now a relatively minor market for tropical sawn hardwood, importing less than 100,000 m3 in each of the last two years, making it only the fifth largest European importer for this commodity (after Belgium, Netherlands, France and Italy). With the UK trade stagnating in May this year, imports were well down from nearly all the major supply countries by the end of the first five months. Total imports of 34,000 m3 during this period were 24% less than the same period in 2019.

UK tropical sawn imports are sourced from a large range of countries, both directly in the tropics and indirectly from other European countries (Chart 7). UK imports from Cameroon, the leading supplier, fell 11% to 9,100 m3 in the five-month period, while imports from the Republic of Congo declined 21% to 5,100 m3. Of other African suppliers, imports were down 28% to 1,400 m3 from Côte d’Ivoire, 94% to only 166 m3 from DRC and 33% to 704 m3 from Ghana.

UK imports from Malaysia were 5,700 m3 in the first five months of 2020, 22% less than the same period in 2019. Indirect imports into the UK via the Netherlands were down 14%, at 3,600 m3, after significant growth last year. Imports from Brazil fell 26% to 1,900 m3. Of all countries supplying tropical sawnwood to the UK, only Guyana recorded any growth in this market in the first five months of 2020, rising 75% to 1,900 m3.

‘Four years’ to recover from record recession in the UK

The key question now for the UK trade in tropical wood products is what “shape” will the recovery take following the sharp fall in May (likely maintained in June given the lead times involved): will it be a “V-shaped rebound”; or a “tick mark” with the sharp fall followed by a longer tail of recovery; or, worst case, an “L-shape” where trade barely recovers and bounces along at the lower level for many months?

This is difficult to forecast with any confidence given continuing uncertainty over prospects for a second wave of the virus in the UK and the long-term effects of the lockdown and of the government’s policy response on jobs, consumer confidence, and business investment. That is before factoring in other key sources of uncertainty, such as on-going negotiations towards a post-Brexit trade agreement with the EU, and the profound effects of the virus on wood production in tropical countries and competing supply regions.

The latest forecasts of growth in the UK economy are not optimistic and imply that hopes of a V-shaped recovery are fading. On the other hand, there are some more positive signals from the construction sector, a more direct driver of timber demand, and new government support measures have potential to boost consumption.

In their latest report, the EY Item Club, a leading UK economic forecasting body, warns that the economy may not get back to pre-pandemic levels before 2024. The organisation expects a record recession as the UK economy contracts by 11.5% this year followed by a slow rebound. Unemployment will more than double, it says, from 3.9% to 9%, leaving roughly three million people out of work as the furlough scheme ends. Job losses and poor real wage growth will lead to a collapse in consumer confidence and hold growth back.

According to the EY Item Club report, “even though lockdown restrictions are easing, consumer caution has been much more pronounced than expected. Consumer confidence is one of three key factors likely to weigh on the UK economy over the rest of the year, alongside the impact of rising unemployment and low levels of business investment.”

Recent economic data in the UK has been inconsistent. Retail sales jumped in June by 13.9%, more than expected by most forecasters. The flash purchasing managers’ index for business activity in the UK also registered solid growth for July. However, these improvements come from a very low base. Deloitte’s consumer confidence tracker for the UK found that households were emerging from the second quarter in a slightly improved but still highly cautious mood.

Recovery in the UK manufacturing sector is also proving to be elusive. According to the Confederation of British Industry industrial trends survey, the manufacturing sector remained in a deep downturn in June. Output volumes fell at a record pace in the three months to June, exceeding the previous record in May.

More positive, particularly for having a more direct bearing on timber demand, is that June data pointed to a sharp turnaround in the performance of the UK construction sector. The phased restart of building work on site in the UK helped to lift output volumes and boost business confidence in this sector. At the same time, new orders stabilised after three months of sharp declines and purchasing activity expanded at the fastest rate since December 2015.

The headline seasonally adjusted IHS Markit/CIPS UK Construction Total Activity Index jumped to 55.3 in June, from 28.9 in May, to signal a strong increase in total construction output. Moreover, the latest reading signalled the steepest pace of expansion since July 2018.

Residential building was the best-performing area of UK construction activity in June. Around 46% of respondents to the IHS Markit/CIPS survey noted an increase in housing activity, while only 27% experienced a reduction. Commercial work and civil engineering activity also returned to growth in June, although the rates of expansion were softer than seen for house building.

The index measuring business expectations in the construction sector for the year ahead remained historically subdued but climbed to its highest since February amid a boost from the reopening of work on site. 46% of the survey panel anticipate a rise in business activity, while 31% forecast a reduction. The latter mostly commented on concerns about the wider UK economic outlook.

To help improve that outlook, on 8th July, the UK government announced GBP30 billion in additional spending measures to boost demand, retain jobs, and get young people into employment. This was the second major fiscal response to the COVID-19 crisis and represents a new phase of response from the Government.

From the perspective of wood demand, probably the most significant measure is a temporary holiday on stamp duty for all property transactions up to a threshold of GBP500,000. The last time such a holiday was introduced was 2009, following the Global Financial Crisis, it did turn out to be an effective measure for boosting transactions in the housing market. The benefit of transactions in this market is that they tend to be paired with other forms of activity, including in sectors, like furniture, particularly relevant to wood product suppliers in tropical countries.

According to UK government figures, there were 48,450 UK residential property transactions in May 2020, which, while 16.0% higher than April 2020, was still 49.6% lower than May 2019, and 6.2% lower than at the lowest point in the financial crisis, which was January 2009. It is hoped the stamp duty holiday will lead to a more significant increase in transactions in August and September.

Also included in the government’s announcement was GBP1 billion in funding to improve public buildings and GBP2 billion of Green Home Grants, with grants of up to GBP10,000 for each household towards retrofitting properties to be energy efficient. This should help boost demand and activity in the UK joinery sector.

The UK and EU “still some way off reaching agreement” on Brexit deal

Following negotiations in London in the week ending 24th July, the UK and EU have said they still remain some way off reaching a post-Brexit trade agreement. This was the second official negotiation round to be held in person since the coronavirus crisis, after both sides agreed to “intensify” talks in June.

EU chief negotiator Michel Barnier said a deal looked “at this point unlikely” given the UK position on fishing rights and post-Brexit competition rules. The EU is demanding that the UK tie itself closely to the bloc’s state aid, labour and environmental standards to ensure it does not undercut the EU’s single market with poor-quality goods.

Mr Barnier said there was a risk of no deal being reached unless the UK changed course on these topics, which were “at the heart” of the EU’s trade interests. He added that an agreement would be needed by October “at the latest” so it could be ratified before the current post-Brexit transition period ends in December.

His UK counterpart David Frost said “considerable gaps” remained in these areas, but a deal was still possible. The UK has ruled out extending the December deadline to reach a deal. The two sides’ chief negotiators are meeting again informally in London in the last week of July, with another round of official talks scheduled for mid-August in Brussels.

In his regular weekly blog on 27th July, under the heading “Any deal is better than no deal”, the CEO of the UK Timber Trade Federation David Hopkins called on members to put more pressure on the Government to ensure a deal with the EU is secured.

Mr Hopkins highlighted the “increased bureaucracy, increased costs, and increased time to move goods across borders” seen in the UK government’s new publication for the Border Operating Model (https://www.gov.uk/government/publications/the-border-operating-model).

He was also critical of the new UK Global Tariff regime. “On the face of it, this is a positive document for trading with the rest of the world, with the stated intention to lower the tariffs currently in existence and simplify the framework”.

“However”, says Mr Hopkins, “in the event of a no deal exit it will have exactly the opposite effect on imports from Europe, our main trading partner, imposing duty on many products that have been duty free within the single market”.

Mr Hopkins identified the following “obvious problems for the wood sector” created by the new tariff regime:

“First, the UK Global Tariff introduces tariffs on imports of European plywood and laminated timber products of between 6 and 10%. This will reduce the competitiveness of these products in the market – possibly pushing buyers towards competing non-timber alternatives or products from outside Europe with lower transparency and worse track record on performance.

“Secondly, it seems to provide a disincentive to manufacturing certain products and adding value within UK borders. For example, manufacturing of certain joinery items such as door sets, windows or I-beams, can use laminated sections as components or feedstock. These components could now face tariffs of up to 10% adding costs to the manufacturing process.

“However, paradoxically, importing fully manufactured items of joinery or I-beams will attract considerably lower tariffs of zero to two per cent. Under this scenario, what would be the point of maintaining manufacturing in the UK – with the associated costs of machinery, trained skilled staff and so on – when one could simply import the products from abroad?”.

Mr Hopkins concludes, “Of course, it may not come to this. The scenario described above could easily be solved by negotiating and agreeing a comprehensive free trade deal with the EU, thus eliminating the need for tariffs”.

PDF of this article:

Copyright ITTO 2020 – All rights reserved