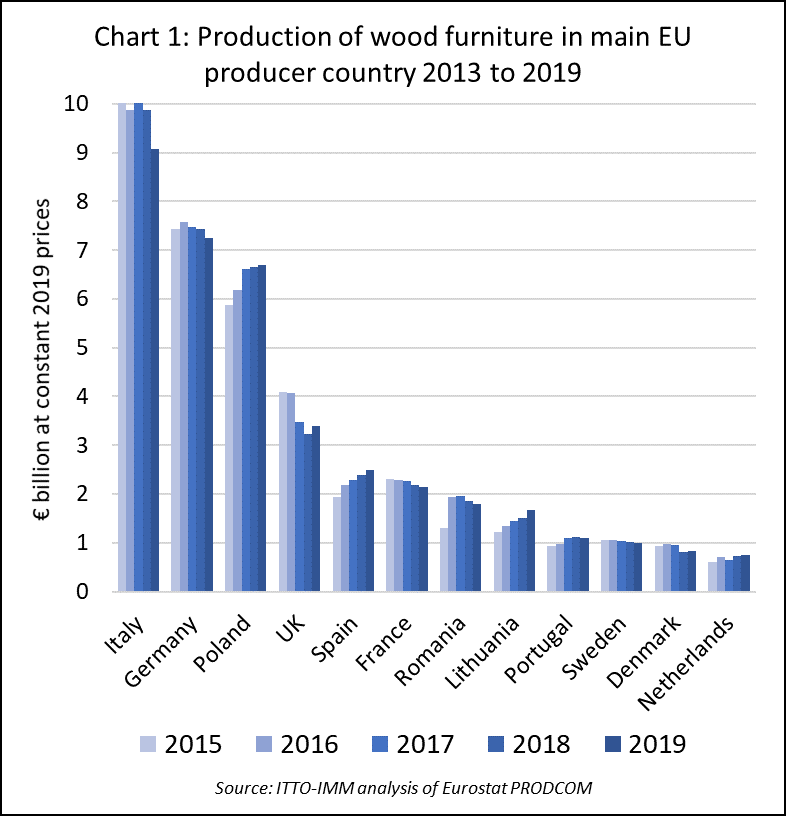

Newly released Eurostat data indicates that the value of EU27+UK wood furniture production was €42.5 billion in 2019, 1.4% less than the previous year. In retrospect, it looks as if the rebound in EU wood furniture production following the 2008 economic crises peaked as early as 2017, as 2019 was the second straight year of decline and the COVID-19 pandemic has damaged market prospects in 2020. Last year, EU wood furniture production was still 20% down, in real terms adjusted for inflation, compared to the years just prior to the 2008 crises.

Last year, there was a sharp downturn in wood furniture production in Italy (-8% to €9.1 billion), and a more moderate decline in Germany (-3% to €7.2 billion), France (-2% to €2.1 billion), Romania (-3% to €1.8 billion), and Sweden (-1% to €1.0 billion). These declines were only partly offset by rising production in Poland (+1% to €6.7 billion), UK (+5% to €3.4 billion), Spain (+4% to €2.5 billion), Lithuania (+10% to €1.7 billion), Denmark (+2% to €0.8 billion) and the Netherlands (+1% to €0.7 billion). Production was stable in Portugal during the year, at €1.1 billion. (Chart 1).

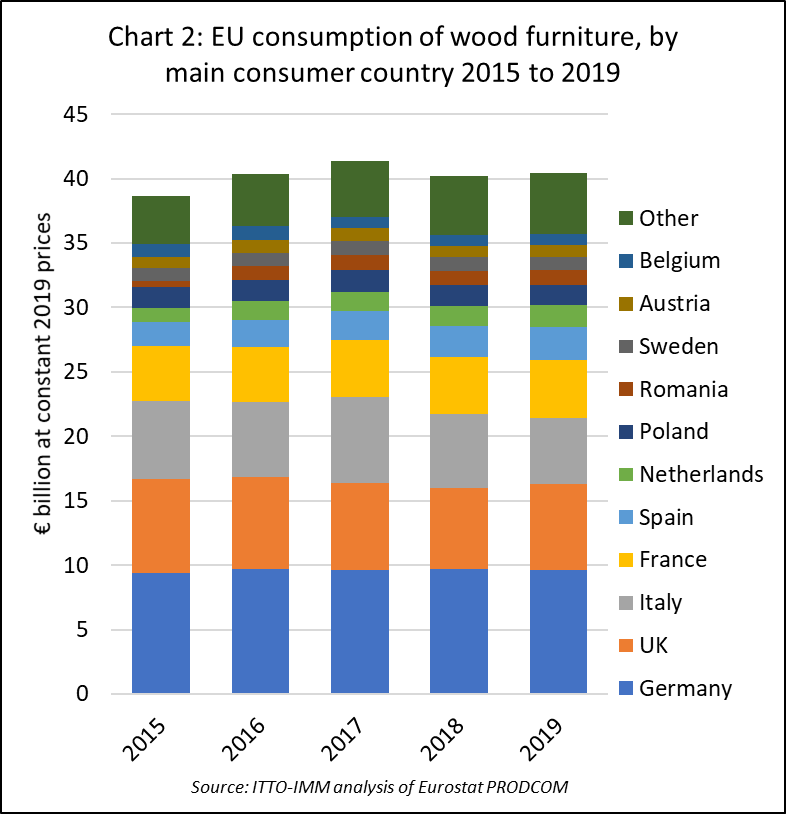

European wood furniture manufacturers lost internal EU market share to overseas producers in 2019, although they remained very dominant overall. In 2019, 86.4% of all wood furniture sales in the EU27+UK market comprised products manufactured within the EU27+UK, a marginally lower percentage than the previous year (87.6%).

EU27+UK wood furniture consumption was €40.4 billion in 2019, a gain of 0.6% compared to 2018. In 2019, consumption increased in the UK (+6% to €6.7 billion), France (+2% to €4.5 billion), Spain (+8% to €2.6 billion), Netherlands (+8% to €1.7 billion), Romania (+3% to €1.2 billion), Austria (+7% to €0.9 billion), and Belgium (+2% to €0.9 billion). However, consumption fell 11% to €5.2 billion in Sweden, 3% to €1.5 billion in Poland, and 7% to €1.0 billion in Sweden. (Chart 2).

Uptick in EU27+UK wood furniture imports in 2019

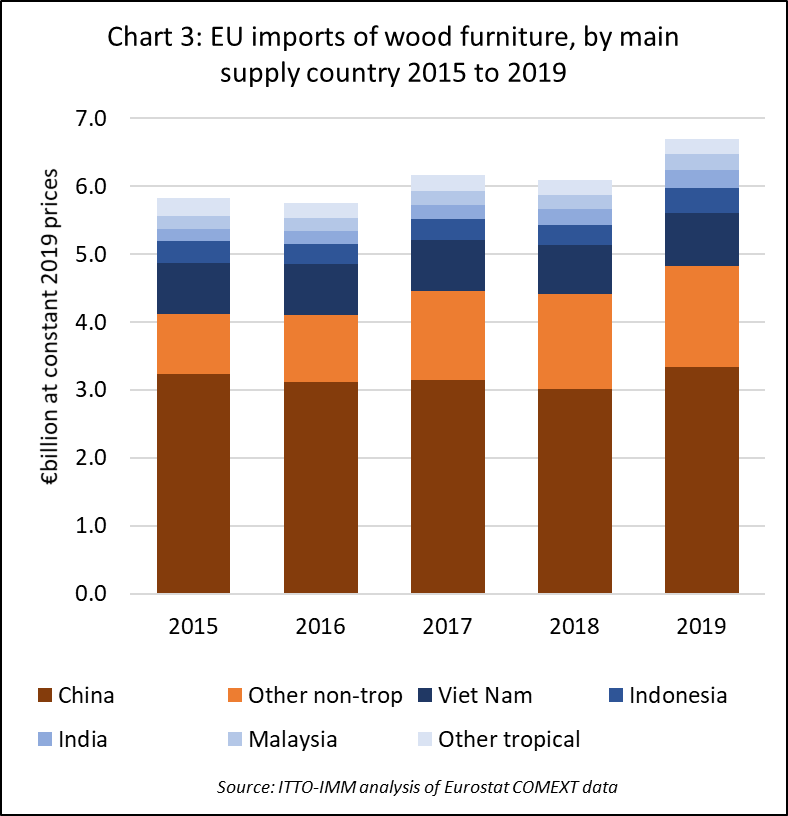

EU27+UK imports of wood furniture from non-EU countries increased nearly 10% to €6.7 billion in 2019 after falling 1% in 2018. Imports from China, by far the largest external supplier, increased 11% to €3.34 billion in 2019, while imports from other non-tropical countries increased 7% to €1.50 billion. Imports from tropical countries increased 11% overall to €1.87 billion. (Chart 3).

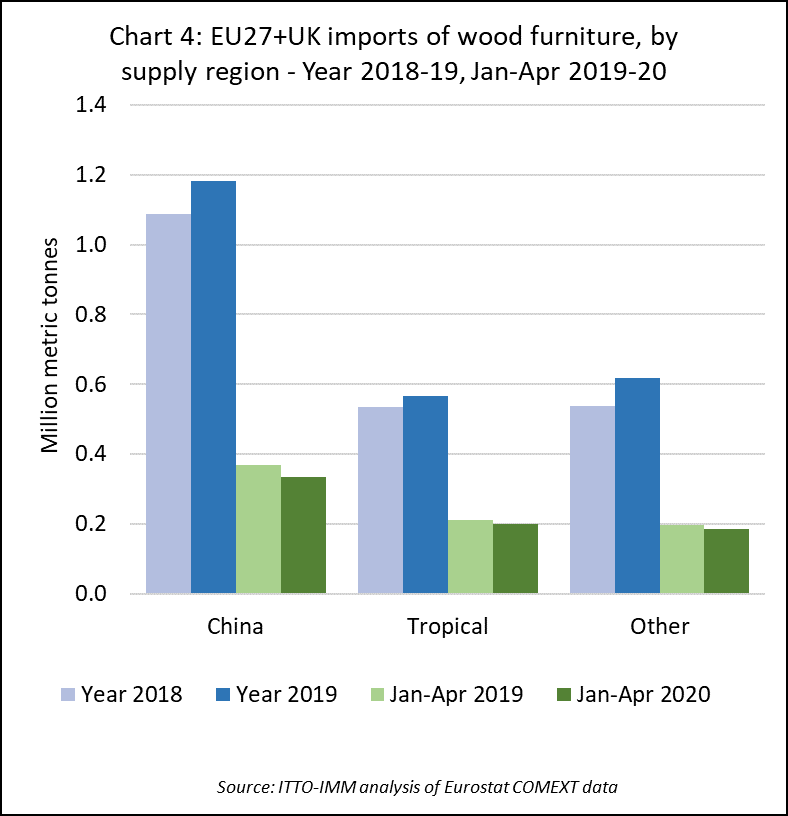

Total EU27+UK import tonnage increased 10% in 2019, to 2.37 million metric tonnes (MT). Import tonnage increased by 9% from China to 1.18 million MT, by 15% from other non-tropical countries to 620,000 tonnes, and by 6% from tropical countries to 570,000 MT (Chart 4). Continuing the trend of recent years, in 2019 there was a particularly large increase in import tonnage of wood furniture from several countries bordering the EU, including Ukraine (+32% to 104,000 MT), Belarus (+32% to 95,000 MT), Turkey (+20% to 95,000 MT), and Serbia (+13% to 60,000 MT).

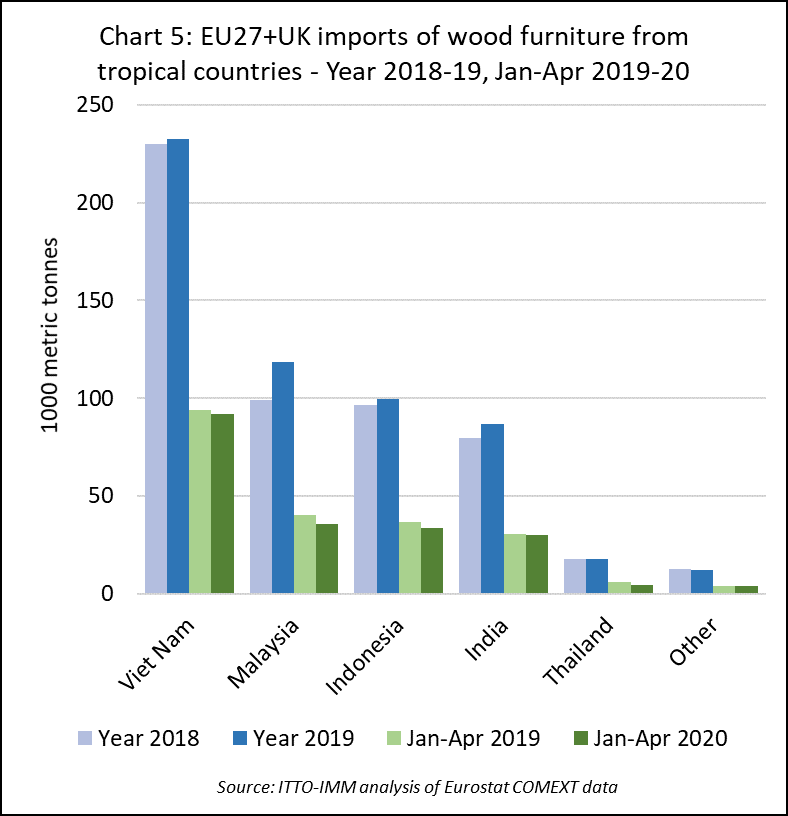

Vietnam was by far the largest tropical supplier of wood furniture to the EU27+UK in 2019, with imports from the country rising 1% to 232,000 MT. However, the largest gain by a tropical country in the EU wood furniture import tonnage in 2020, was by Malaysia with a rise of 20% to 119,000 MT. There was also a 9% rise in import tonnage from India, to 30,000 tonnes. Import tonnage from Indonesia increased 3% to 100,000 MT in 2019. Import tonnage from Thailand was stable at 18,000 MT in 2019. (Chart 5).

First indications of post-lockdown rebound in EU wood furniture imports

The development of the EU27+UK wood furniture market this year will be strongly dependent on the effects of the COVID-19 pandemic, as it is having a profound impact on both supply and demand. Data indicating the likely scale and duration of these impacts is only just becoming available and is still fragmentary.

Import data for the whole of the EU27+UK region is currently available to the end of April 2020 and captures only the earliest stages of the lockdown which began in mid-March in most European countries. Given lead times typically of five weeks or longer to deliver Asian furniture to the European market, this data provides only limited insight into the effects of the pandemic.

In total, the EU27+UK imported 720,000 tonnes of wood furniture in the first four months of this year, 8% less than the same period in 2019. Imports fell by 10% from China, to 330,000 MT, by 7% from other non-tropical countries, to 180,000 MT, and by 6% from tropical countries, to 200,000 MT (Chart 4).

The biggest decline in EU27+UK imports of wood furniture from tropical countries in the first 4 months of 2020 was from Malaysia, down 12% to 35,000 MT. Imports also declined sharply from Indonesia, by 9% to 34,000 MT, and Thailand, by 25% to 4,400 MT. Imports were down only 2% to 92,000 tonnes from Vietnam.

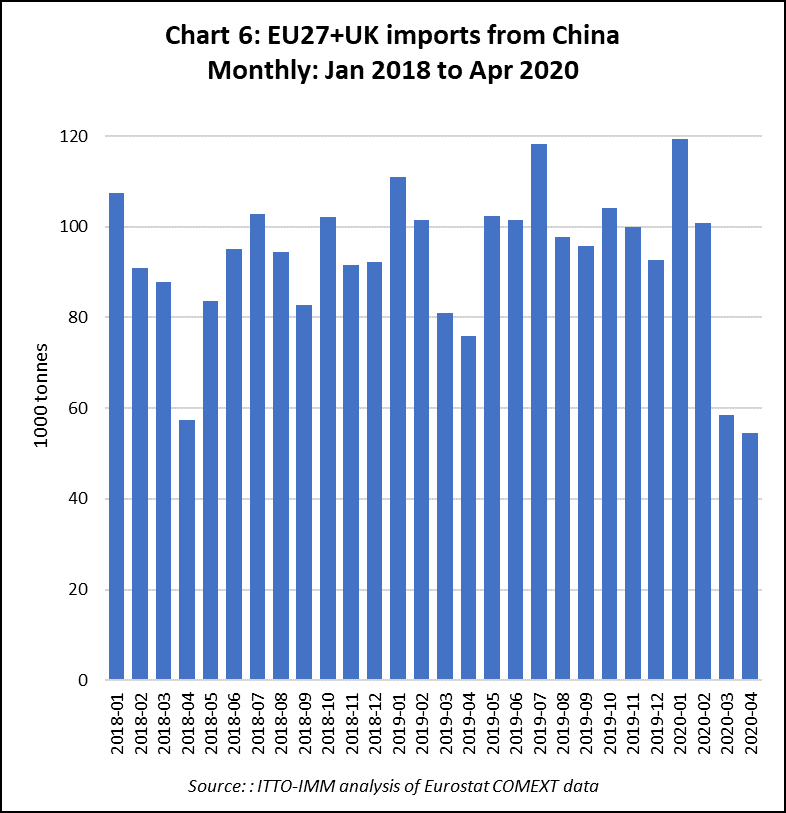

Closer analysis of monthly import and export data gives more insight into the effects of the pandemic and the pace of the rebound. The available data on EU27+UK imports of wood furniture from China shows a very sharp dip in March and April this year (Chart 6).

This is partly cyclical since EU27+UK imports from China tend to decline in the spring months after a rush at the turn of the year to despatch products before the Chinese New Year holiday season. However, the dip in EU arrivals this year started early in March, due to supply side problems in China, and deepened into April.

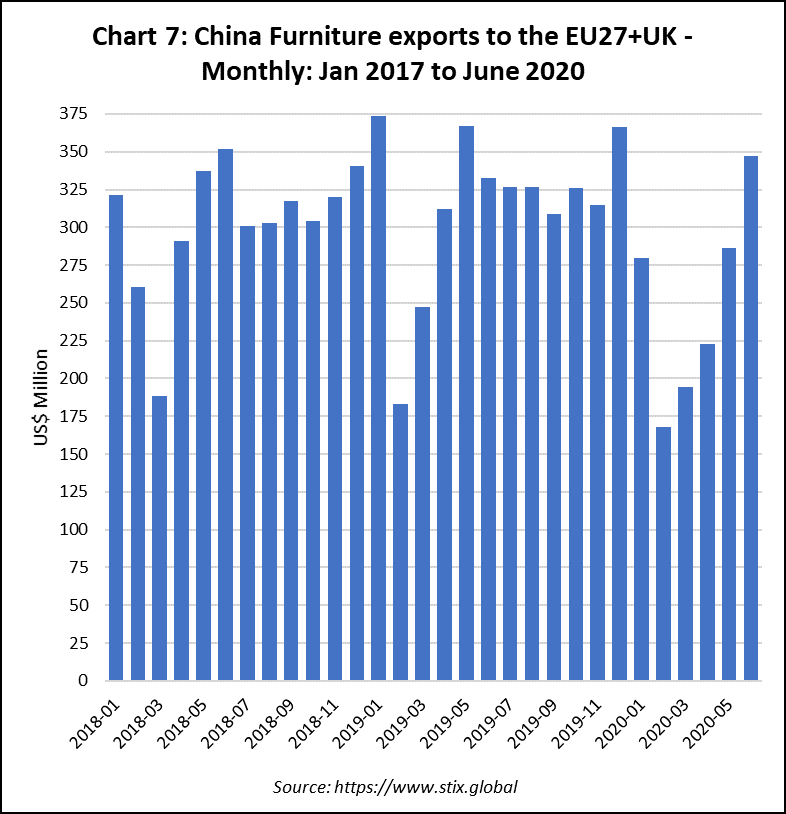

The supply side problems in China early in 2020 are more obvious from export data (Chart 7). China’s exports of wood furniture to the EU27+UK fell more steeply than usual in February this year and remained at unusually low levels in March and April. However, there was a strong recovery in China’s exports to the EU27+UK in May and June, strongly suggesting that the direct effects of the COVID-19 lockdown on EU27+UK imports of wood furniture from China will be short lived.

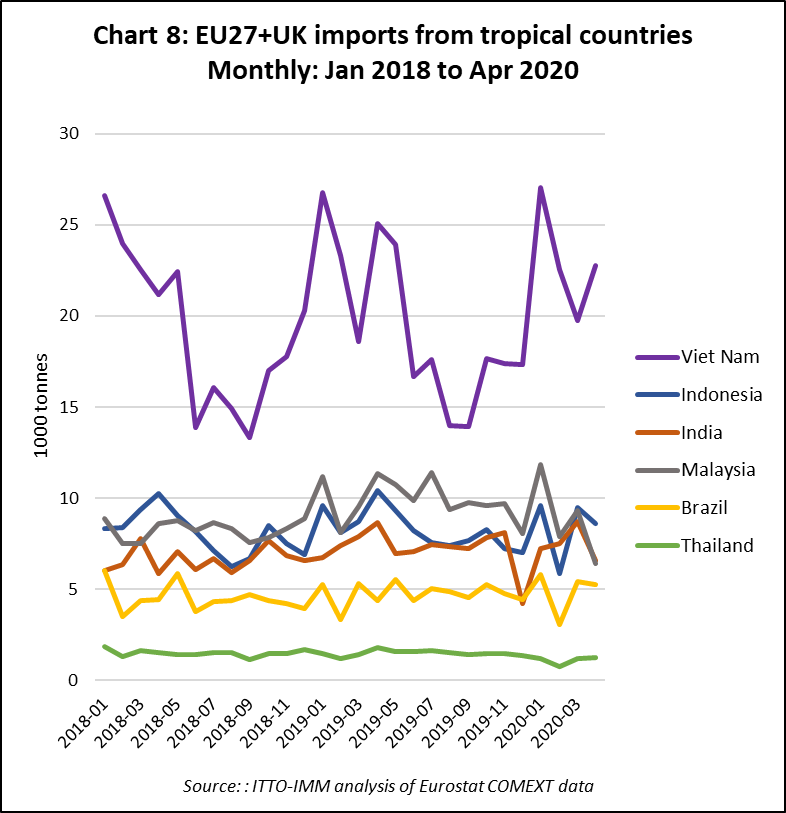

Signs of the market impact of COVID-19 are also becoming clearer for tropical suppliers. EU27+UK imports of wood furniture from Vietnam were strengthening in April (Chart 8). However, this is certain to be followed by a significant decline in May through to July. Again, this is indicated both by cyclical changes – EU27+UK imports of wood furniture from Vietnam typically fall in the second quarter of the year – and by Vietnamese export data. Latest data from www.goviet.org.vn shows that the total value of all Vietnamese wood and wood products exports to the EU27+UK – which is dominated by wood furniture – fell 41% from US$213.7 billion in the first quarter to US$125.6 million in the second quarter.

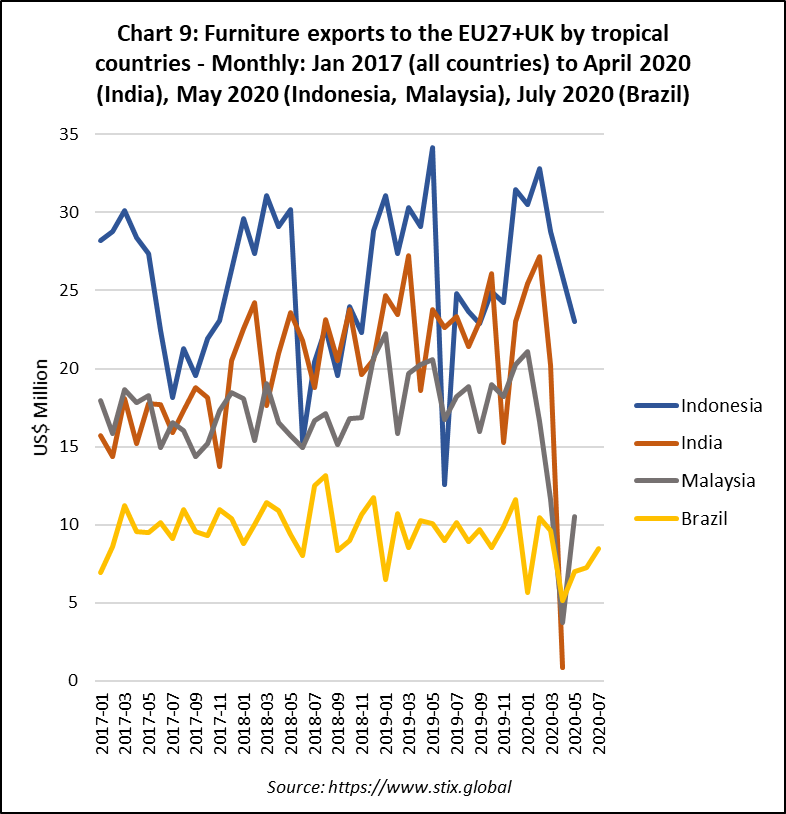

EU27+UK imports from Indonesia were quite strong in the first quarter of 2020 and weakened only slightly in April. Export data reveals a downturn in Indonesian despatches to the EU27+UK in April and May this year, but not out of line with trends in previous years (Chart 9).

Indonesia’s furniture exports to the EU are dominated by outdoor products, particularly due to relatively abundant plantation teak supplies. It maybe that Indonesia is benefitting from the continuing relative strength of European demand for outdoor furniture during lockdown. Social distancing measures meant more people meeting outside and restaurants and bars only serving to customers outside. A run of good weather has also encouraged people confined to their homes to install garden decking and sheds.

The impact of the COVID-19 pandemic on EU27+UK imports of wood furniture from India, which mainly supplies a niche market for handcrafted interior furniture, appears to have been much more severe. Export data indicates an extremely sharp (96%) fall in India’s exports of wood furniture to the EU27+UK in April this year – a trend confirmed by import data for those few European countries that have already published trade statistics to the end of May, including the UK, France and Spain.

Malaysian trade data shows a severe decline in wood furniture exports to the EU27+UK between January and April this year, but trade began to rebound and make up some ground in May.

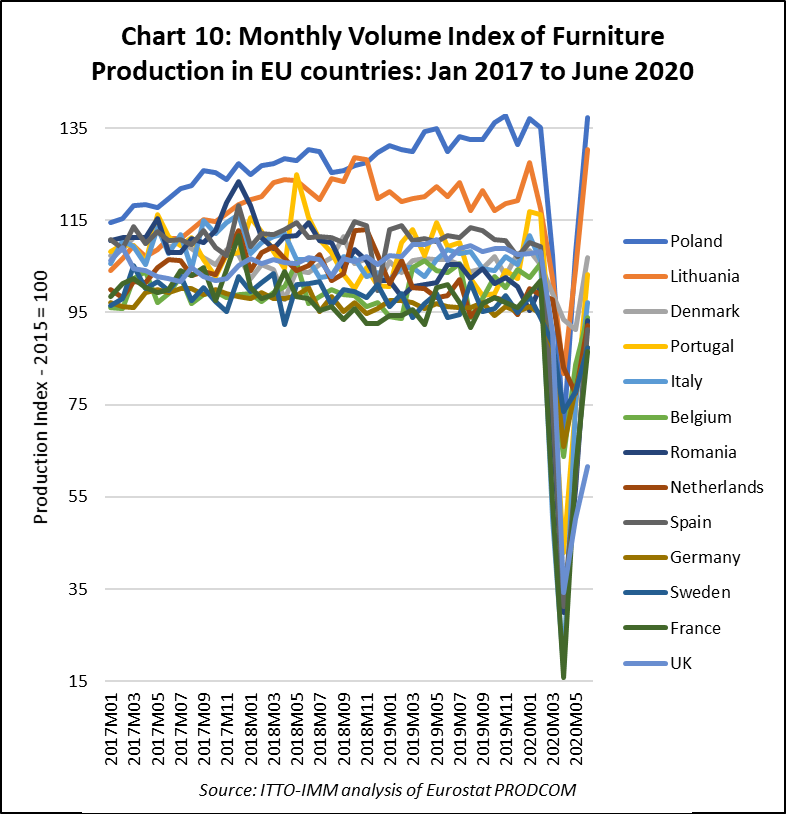

The Eurostat furniture production index for EU countries is another indicator of the scale of the downturn and rate of recovery in the European furniture sector during lockdown period (Chart 10). For most EU countries, the monthly index was broadly stable throughout the whole period from January 2015 through to February 2020 – the only exceptions being Poland and Lithuania, both of which outperformed all other EU countries by recording a significant rise in production.

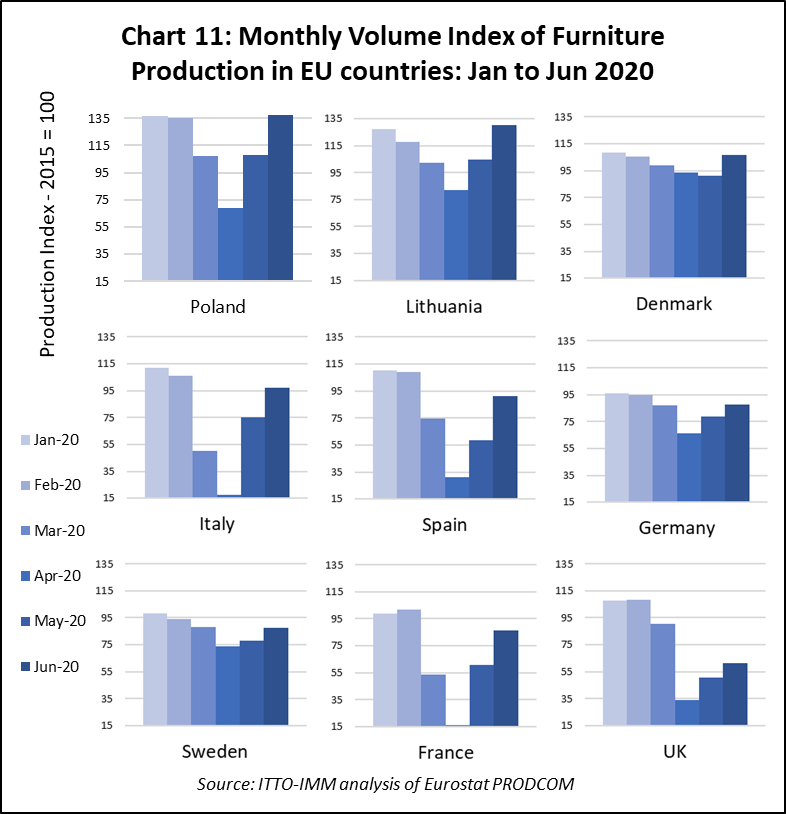

The picture changes dramatically in March, with nearly all leading EU furniture manufacturing countries recording a precipitous and unprecedented fall in production as the continent went into the lockdown. The downturn deepened in April but was followed by recovery in May and June for all countries. While the overall trend was the same, the depth of decline and rate of recovery varied widely between countries (Chart 11).

Compared to other EU countries, Germany, Sweden and Denmark all suffered less dramatic declines in production in April and March and production was close to normal levels by June. In Poland and Lithuania the furniture production index fell steeply in March and April, to around 50% of previous (quite buoyant) levels, and then recovered very strongly in May and June.

In Italy, Spain and France, there was a very large fall in production in March and April – down 85% on normal levels in the case of France and Italy. Although still down 20% on normal levels in June, the rebound In France, Italy and Spain was quite robust. In the UK, the decline in March and April was large, down 65% on usual production levels, and the recovery slower and weaker than elsewhere in Europe. In June UK production was still down by around 50%.

PDF of this article:

Copyright ITTO 2020 – All rights reserved