The most recent data released by European countries continues to show very mixed economic conditions across the continent. While much of the data is still gloomy, some more positive trends are beginning to emerge. Notable amongst the latter are signs of robust recovery in Germany and the UK, together with a rise in the level of loans to European households which suggests improved consumer confidence and some loosening of the exceptionally tight credit conditions so prevalent over the last two years.

Strengthening global demand helped Europe’s economy to expand 1% in the second quarter of 2010, the fastest pace in four years. The German economy grew by 2.2% during the period, implying an annualised rate of 8.8% and outpacing even China. Growth was particularly boosted by an increase in the level of Germany’s exports manufactured goods, helped along by weakening of the euro on international currency markets. Economists are becoming more confident that output in Germany, Europe’s largest economy, will continue to rise at a healthy pace. This view is reinforced by surveys of business sentiment in Germany which increased to a three-year high in August 2010.

During the second quarter, the UK economy recorded its strongest growth in nine years with GDP growing by 1.2%. The UK statistical office reports that the improved growth was mainly due to strong performance in the building sector which is particularly encouraging for the wood sector.

Unfortunately, rising optimism does not extend to all areas of Europe. The latest GDP data provides little evidence of a revival in the countries of Southern Europe. GDP growth between April and June in France, Italy and Spain was only 0.6%, 0.4% and 0.2% respectively. Italian consumer confidence fell in August to the lowest in more than a year as government austerity measures made households more pessimistic about their ability to save.

Lack of credit to companies continues to slow trade

Lack of credit for both consumers and companies has been a major factor gumming up the European economy since the 2008 banking crises, limiting investment particularly in the housing market and impacting directly on the ability of firms to trade. The latest news on this issue is mixed.

In July this year, the overall level of loans to the private sector rose by 0.9% from a year earlier, which is the strongest increase since June 2009. Lending to households was up 2.8%, suggesting rising consumer confidence.

However the headline figure masks the fact that lending to corporations fell by 1.3%, suggesting both that long-term business investment remains weak and that many European trading companies continue to suffer from lack of available credit. This situation is not likely to change quickly. According the European Central Bank’s latest Bank Lending Survey published on July 28, euro-area banks “anticipate credit standards on loans to enterprises to tighten somewhat in the third quarter.”

Efforts to reduce budget deficits hamper domestic consumption

In the short term, future economic growth and domestic consumption across Europe is expected to be dampened as governments reduce spending to tackle bloated budget deficits. In contrast to the U.S. where the need for government spending to stimulate growth is still widely accepted, the political consensus in Europe is that the emphasis must now be on greater austerity. The head of the European Central Bank recently said that “reducing the debt overhang is the only option to bring the world economy back to a sustainable and strong path of growth”. Starting in June, indebted European countries including UK, Greece, Italy and Spain set off down a common path toward fiscal austerity, promising to slash spending and raise taxes.

With domestic consumption likely to remain low in the EU for the foreseeable future, prospects for growth are heavily dependent on the development of new export market demand. This in turn hinges heavily on continuing sustained economic growth in the United States, Asia and the Middle East.

Changing fortunes of hardwood plywood suppliers in the EU

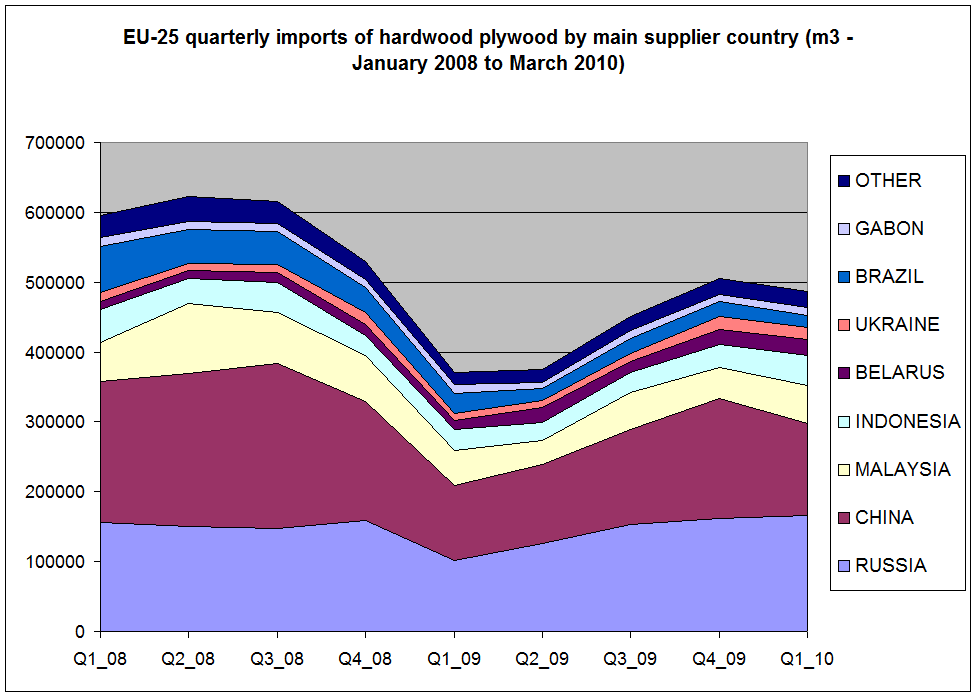

Recent import statistics (see chart) highlight the shifting fortunes of hardwood plywood suppliers to the EU. After the dramatic fall in European hardwood imports between September 2008 and March 2009, imports recovered some ground during the second half of last year. However the recovery was short lived and imports fell away again during 2010.

A particularly notable trend in recent months has been a significant rise in the share of European hardwood plywood imports derived from Russia, increasing from 26% to 34% of all imports between the first quarter of 2008 and first quarter of 2010. This is in line with anecdotal reports that Russian birch plywood has been increasingly favoured as a substitute for hardwood plywood from China and tropical sources. This trend may not be maintained into the second half of 2010 with emerging signs that lead times and prices for Russian birch plywood are on the rise.

Over the last two years, the share of China in European imports of hardwood plywood has decreased from 34% to 26%. A number of factors have contributed including continuing quality concerns, rising costs in China, and high and volatile freight rates combined with fears of delivery delays.

Recent market reports from the German trade journal EUWID suggest that these problems with Chinese plywood continued throughout the second quarter of 2010. Chinese hardwood plywood exporters have been trying to force through price rises for products shipped to Europe to better reflect rising costs but continue to face resistance from a largely unreceptive market. Freight rates from China to Europe are anticipated to rise from a level of around US$3700-US$3,800/40ft in July to US$3,900-US$4,100 in August. This is encouraging more European buyers to consider break bulk imports of Chinese plywood.

Malaysia and Indonesia accounted respectively for around 11% and 9% of European hardwood plywood imports in early 2010, both having marginally improved their market position relative to Chinese product over the last 2 years. Some recent signs of improvement in supply suggest this trend might be maintained into the second half of 2010. South East Asian plywood suppliers are also beginning to benefit from increased focus on higher quality more specialised and certified products for the European market.

Nevertheless, according to EUWID, European consumption of South East Asian plywood remains low and there continues to significant market resistance to exporters’ efforts to increase prices. As with Chinese plywood, a significant proportion of shipments of Malaysian and Indonesian plywood are now arriving break bulk due to high container rates.

Brazil has lost significant ground in the European hardwood plywood market over the last 2 years with its share of European imports falling from 11% to only 3%. This reflects lack of available hardwood supply for export in Brazil and the relative strength of the Brazilian currency which has reduced competitiveness.

EU market for Sout East Asian hardwood still very slow

The German trade journal EUWID reports that the European market for meranti lumber and bangkirai decking has not seen any major changes in demand or prices in the last few weeks. EUWID notes that “hardly any orders continue to be placed for Malaysian meranti lumber”. EUWID also reports that following another slow season for decking, many European importers have now suspended orders for bangkirai decking profiles as new product cannot be expected to arrive in Europe before November, well past the end of the current summer season. `

Downturn in European panels production

According to data compiled by the European Panels Federation (EPF), production of wood-based panels in Europe reached 49.5 million in 2009, down 12% on the figure of 56.0 million in 2008. Output during 2009 was down 19.1% on the peak level of 61.1 million recorded in 2007.

Considering the main products, European output of particleboard declined 13.9% during 2009 to reach only 29.7 million m3. MDF/HDF reached 11.2 million m3 last year, down 8.2% on the previous year. In contrast, European OSB output actually increased 9.1% to reach 3.6 million m3.

EPF’s 350 page annual report for 2009/2010 can be ordered by contacting the EPF (Tel. +3225562589, email info@europanels.org)

EU Timber Trade Action Plan extended

The European Commission recently announced an 18 month extension to the so-called “Timber Trade Action Plan (TTAP) 2” that will take project activities to June 2013. Managed by The Forest Trust (TFT) in partnership with a number of European Timber Trade Federations, TTAP aims to reduce the trade in illegal wood products and contribute to sustainable forest management.

The “TTAP 2” project assists members of EU trade associations to demonstrate that timber originating from the focus countries (China, Brazil, Guyana, Bolivia and Suriname) is legal through third-party verification. It is distinct from “TTAP 1” which prepares producers in Africa (Cameroon, Congo-Brazzaville and Gabon) and South East Asia (Indonesia and Malaysia) for legality verification. “TTAP 1”, which is unaffected by the announcement, is due to end in December 2011.

According to TFT, the extension of the “TTAP 2” period reflects delays in project activities which have been hampered by the world financial crisis. In a situation of uncertainty where many companies in China and Brazil were going out of business, European importers were not willing to invest in their supply chains.

In addition, the prolonged negotiations of the EU Due Diligence Regulation held back the project as a single clear message to the market was lacking from regulators. However, the context has now changed with the European Parliament voting overwhelmingly in favour of the new timber regulation in June. TFT views this as a significant change in the illegal logging debate in Europe as buyers are now obliged to implement due diligence systems in preparation of the entry into force of the legislation in two years’ time.

In related news, The Forest Trust has announced that it is hosting a third annual International Timber Trade Federation Day (ITTFD) on 6-8 October 2010 in Geneva to provide a forum for discussion and to present ideas and initiatives on improving market demand for legal and sustainable timber.

Further details of the TTAP project and the ITTFD are available from The Forest Trust, Chemin des Brumes 4 1263 Crassier, Tel +41223679440, email info@tft-forests.org

Vietnam and EU in discussions on illegal logging agreement

Vietnam and the EU are to hold the first round of formal negotiations on a bilateral Voluntary Partnership Agreement (VPA) for Forest Law Enforcement, Governance and Trade (FLEGT) in Hanoi by late November. At the first VPA preparatory meeting on August 16, both sides raised hopes that the negotiations will conclude with the signing of a voluntary partnership agreement by the end of 2012.

The agreement is expected to create conditions for Vietnam’s timber producers to improve their position on the EU market and increase their ability to adapt to EU market requirements with respect to the legality of timber. The agreement aims to establish control and licensing procedures in timber producing and processing countries to ensure that only timber products derived from legally harvested timber enter the EU.

At the VPA preparatory meeting, the Charge d’Affaires of the EU delegation Hans Farnhammer emphasised the importance of the agreement. He said, “We do hope that the signing of the FLEGT Voluntary Partnership Agreement will help to further strengthen the position of Vietnam ’s timber and timber products in the EU market. The forthcoming negotiations are witness to Vietnam’s commitment to meeting EU consumer demands as well as fighting climate change”.

Vice Minister of Agriculture and Rural Development Hua Duc Nhi said, “This is the first step to ensure the exports of timber and timber products from Vietnam to the EU continue smoothly in years to come. In the long run, the VPA will give legal certainty and bankable guarantees to exporters, importers and investors in the timber sector willing to trade with the EU”.

The EU has so far signed FLEGT VPAs with Ghana, Cameroon and the Republic of Congo and is also conducting negotiations with Malaysia, Indonesia, Central African Republic, and Liberia.

PDF of this article:

Copyright ITTO 2020 – All rights reserved