The relationship between hardwood demand and overall construction activity in the EU is not a simple one. Hardwoods tend to be used in the finishing trades rather than for structural elements and demand is often driven more by refurbishment than new build. That said, there is no doubt that indices of overall construction sector activity are a useful guide to likely levels of hardwood consumption. And since hardwoods tend to arrive on-site at the end rather than the beginning of construction projects, a recent upturn in construction activity can usually be interpreted as a sign that hardwood demand is about to pick up.

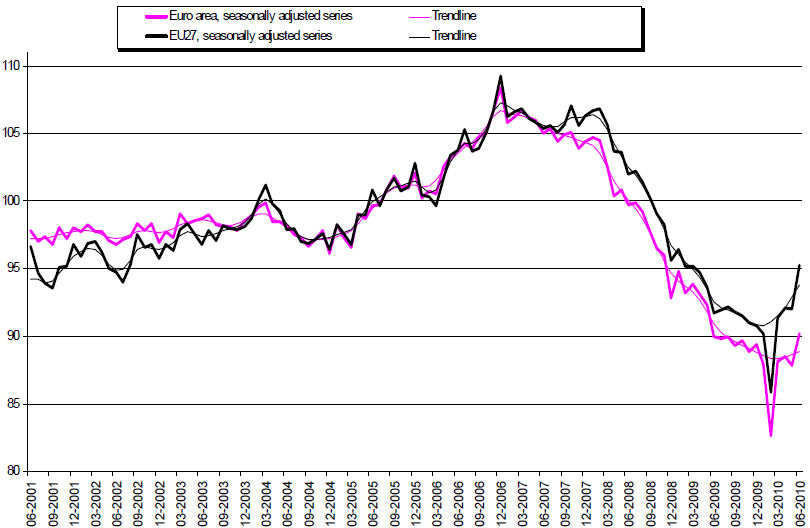

Against this background, recent trends in the European construction index contain both good and bad news for the hardwood sector (see chart). On the downside, the chart shows that the decline in European construction sector activity which set in sharply and deeply in mid 2008 continued until only very recently. In fact, overall European construction sector activity experienced a very dramatic downturn as late as March 2010. This adds weight to the conclusion that the bottoming out and general uptick in European hardwood imports recorded in the second half of 2009 was simply a response to short-term stock shortages and not due to any increase in underlying consumption.

Chart: Production index in the European construction sector (2005 = 100)

The deep and lengthy decline in European construction activity helps explain why this year, the recovery in European hardwood imports has generally slowed. In fact the continent’s hardwood trade now seems to have entered a new more stable phase characterised by very low levels of mainly top-up orders balanced by relatively low levels of supply. Only the largest companies distributing over a wide area, particularly in north-western Europe, have taken steps to build landed stocks and these companies are now satisfying requirements from smaller distributors for small but regular orders.

The more positive news from the European construction sector data is, of course, the sharp upturn in activity that began in April 2010. The upturn slackened again in May but then resumed in June in the run up to the summer vacation. It is not possible to say with any degree of certainty that this upturn will be sustained, particularly with continuing talk of a possible “double dip” recession in the EU largely stimulated by concern over levels of debt and the introduction of deep government spending cuts. But the upturn in overall European construction activity in the April to June period at least bodes reasonably well for the finishing trades in the second half of 2010. With overall European hardwood lumber stocks still at very low levels, importers should keep buying, although business will remain very price driven and volumes are likely to remain much lower than in the past.

Meanwhile other factors are playing a critical role to influence the direction of the hardwood trade. For example, the general weakening of the euro in relation to the US$ combined with low levels of availability of products and associated firm prices from Southeast Asia and Amazonia, are now significantly boosting prospects for African hardwoods in the European market.

Reports from European forest products companies turn positive

Another useful indicator of overall performance in the European wood sector is provided by corporate financial results. The financial consultancy company PricewaterhouseCoopers has just published its annual survey of the Top 100 global forest sector companies (by value of sales), a list which, perhaps surprisingly, continues to be led by European companies (see www.pwc.com/ca/fpp). The survey shows that sales by the 31 European-based companies included in the PwC Top 100 amounted to $103 billion in 2009, down 20% from the $129 billion reported for 2008.

While sales fell dramatically in 2009, the PwC survey highlights that large European forest products’ companies were already adjusting in 2009 with major rationalisation and cost-cutting efforts. As a result, net losses of $0.6 billion recorded by European PwC 100 companies were much less than losses of $1.4 billion reported in 2008.

More recently, PwC’s quarterly Net Earnings Summary for the Top 100 during the April to June 2010 period indicates recovery in the overall European forest products market. Nine of the largest European-based forest companies reported overall earnings of $550 million in the second quarter of 2010, up over $1.1 billion from losses of $598 million reported in the second quarter of 2009. All but three of the companies experienced an improvement in performance compared to the same period in 2009 citing improved sales volumes and favourable prices.

Since hardwood companies are generally too small to register in the PwC Top 100, the index is heavily dependant on events in the paper and softwood sectors. However, a notable feature of the 2009 PwC Top 100 from the perspective of hardwoods is that the DLH-Group of Denmark, Europe’s largest hardwood trading company, was listed for the first time. DLH squeezed on to the list in 94th place despite the report showing that company sales fell from $988 million in 2008 to $682 million in 2009. This implies that for all DLH’s woes last year, some large companies in the softwood and paper sectors performed considerably worse.

A recent report in the German trade journal EUWID also indicates that DLH’s performance has improved significantly this year. Overall company turnover during the first 6 months of 2010 was up 7% on the same period in 2009. The positive results are attributed to overall market recovery and a successful internal cost-cutting programme. As part of this process, DLH is selling its forestry and production activities, including its African subsidiaries CIB in the Congo Republic and GIB in Gabon. EUWID reports that preliminary offers have already been made on both these companies

These reports of improvements in turnover and profits of European companies in the second quarter of 2010 are mirrored in other sectors of the European economy relevant to the hardwood trade. For example, EUWID recently reported significant improvements in turnover during this period at Junkers (Denmark’s largest joinery manufacturing company), VBH (German window, door and fittings retailer), and Inwido (Swedish window and door manufacturer). Meanwhile, the German furniture industry association VDM recorded a 7% improvement in sales of non-upholstered home furniture (primarily cabinets) during the January to June period of 2010 compared to the same period the previous year.

Slightly less encouraging, the financial results of the Paris-based construction materials giant Saint Gobain suggest diverging market performance in various parts of the continent. During the second quarter, the company’s building material revenues returned to growth in Germany, the UK and Scandinavia, but suffered further declines in Netherlands, France and southern Europe.

Rougier report suggests recovery in European tropical hardwood consumption

The recent financial performance of the Paris-based tropical timber group Rougier provides another insight into trends in the European tropical hardwood market. According to an interim financial statement issued in August 2010, Rougier recorded €67.8 million in revenues for the first half of 2010, up 11.0% in relation to the first half of 2009. With revenues climbing 22.1% compared with the second quarter of 2009 to €37.4 million, the second quarter of 2010 saw a clear improvement in business, benefiting from improved end-user consumption rising sales prices, and improved business efficiency. There was particularly strong growth in sales to the European continent.

The improvement in Rougier’s performance came despite the company having to adjust to the end of log exports from Gabon. The interim report highlights that Rougier revenues are coming increasingly from further processed products and less from logs which accounted for only 26% of sales in the first half of 2010 compared to 36% during the same period in 2009. However Rougier also report that the contraction in the company’s log trade was limited in the second quarter of 2010 due to improved level of business on export sales in Cameroon and Congo, in addition to the ramping up of log sales to local industrial operators in Gabon. Meanwhile in the first half of 2010, sawn wood has accounted for 46% of Rougier’s revenue and plywood for 28%.

The report notes that Rougier is now developing “a commercial differentiation strategy built around the widest possible range of quality products, focused in priority on certified products”.

European hardwood veneer market trends

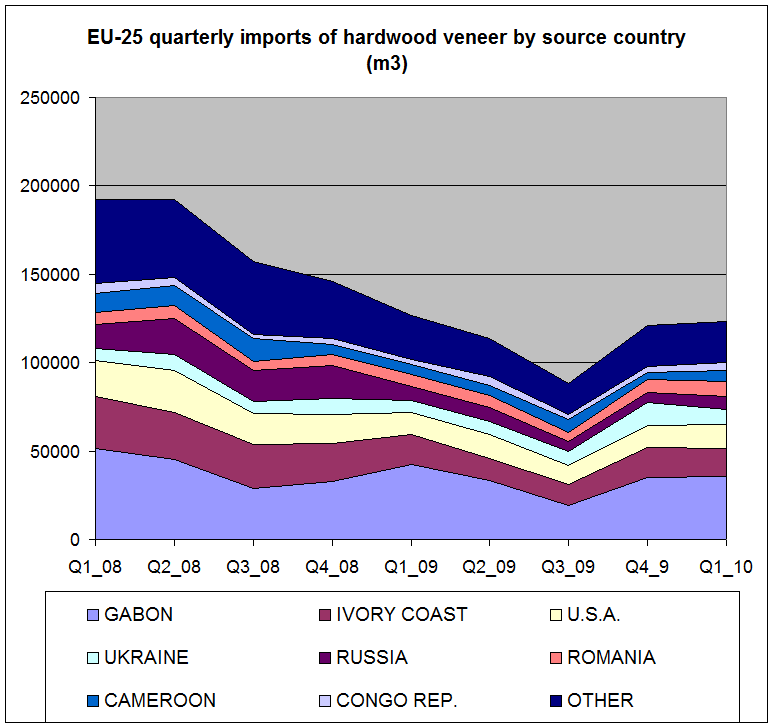

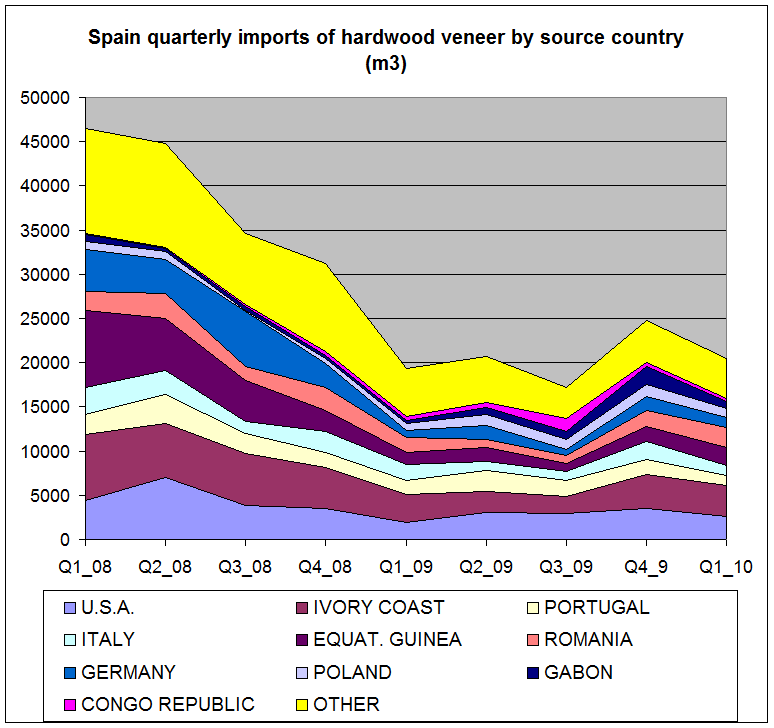

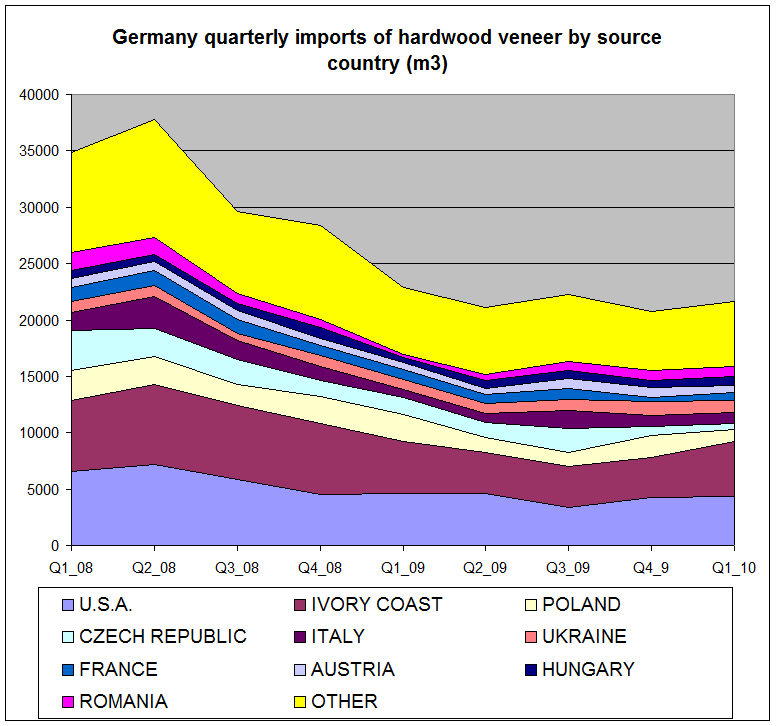

Recent trade trends relevant to the European hardwood veneer sector are illustrated in the charts below. The picture is complicated by the diversity of market sectors involved.

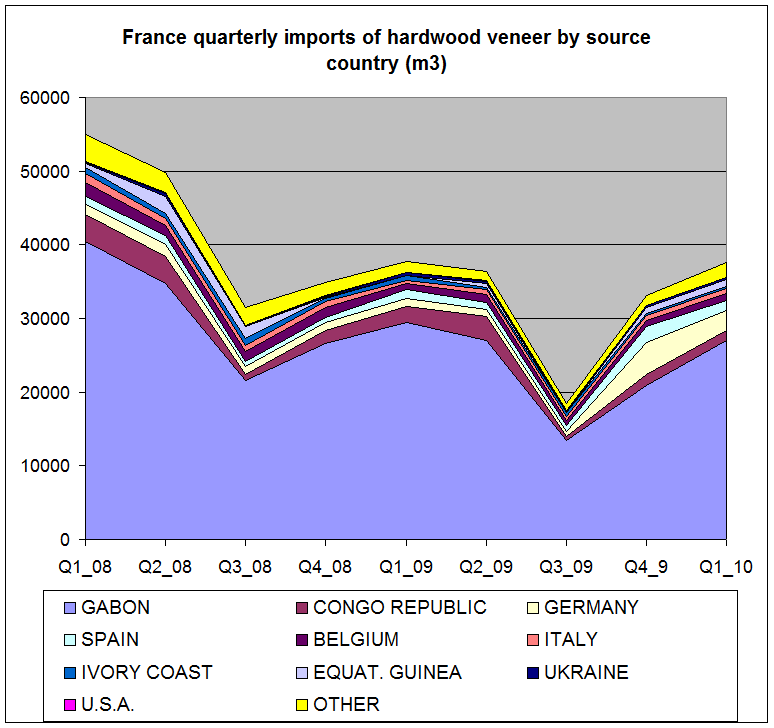

There is the market for rotary veneers for okoume plywood which was traditionally produced in France from Gabonese logs but which, since the Gabon log export ban, is now based on imported veneers. France lies at the heart of Europe’s rotary veneer market.

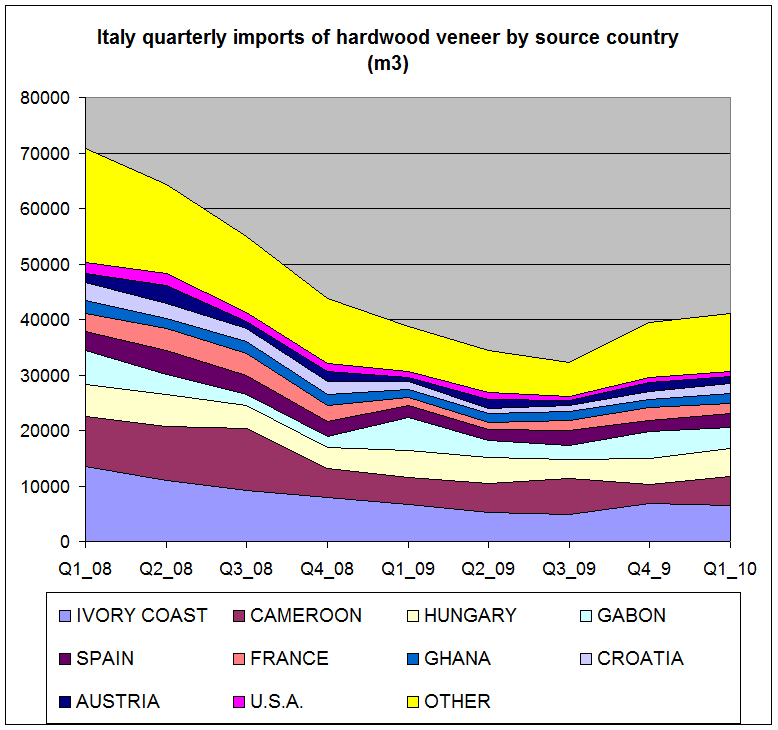

There is also the market for decorative sliced veneers which may be supplied by European mills based on imported logs or, increasingly, by imports of finished veneers. Italy, with its large and globally significant furniture sector remains the largest European market for sliced veneers. Spain’s door sector was traditionally a major importer of cheaper decorative veneers, although this market has been severely damaged in recent times by the collapse in Spanish construction sector. And then there is Germany which has for long been at the very heart of Europe’s market for all decorative surfaces. Although much of Germany’s own domestic veneer manufacturing capacity has recently shifted to Eastern Europe and further afield into Asia, German-owned veneer companies remain dominant on the world stage.

Chart 1 shows that Europe’s imports of finished veneers declined progressively from the second quarter of 2008 and then staged a recovery from the third quarter of 2009. However it also shows that the overall pattern of trade was strongly influenced by events in Gabon which mainly supplies rotary rather than sliced veneers. If Gabon is excluded, the indications are that while European imports of sliced veneers fell rapidly during 2008, they have remained remarkably stable at a low level since then. It also suggests very little change in the market share of countries supplying sliced veneer to Europe over the last 2 years.

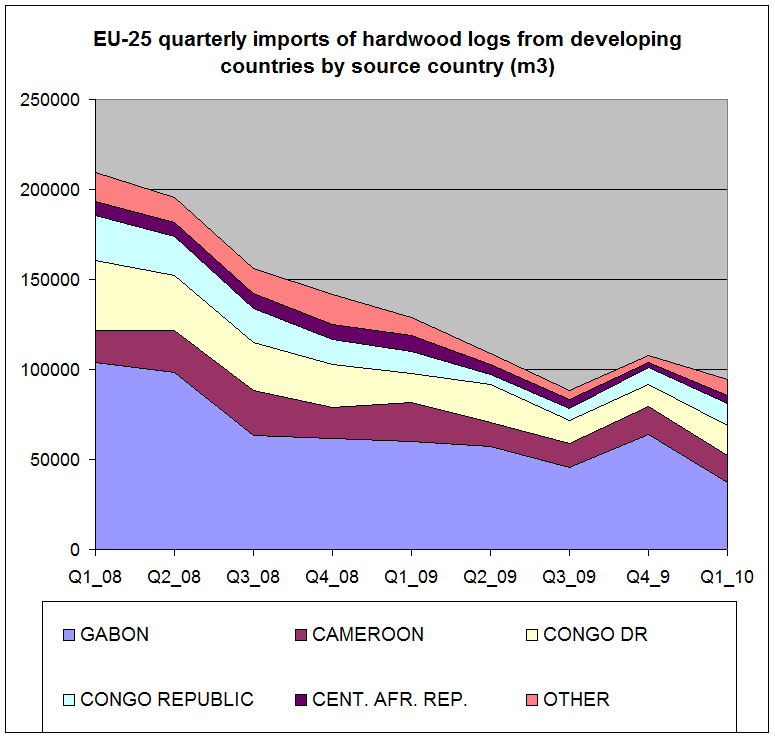

Chart 2 shows the trend in EU imports of tropical hardwood logs over the last two years, thereby providing an indication of how much of the veneer market is supplied by tropical hardwoods converted within the EU itself. As recently as 2007, the EU was still importing in the region of 1 million m3 of tropical hardwood logs, around half believed to be destined for the rotary veneer sector and the other half for the sliced veneer sector. However following Gabon’s log export ban and a recent decline in tropical hardwood veneer manufacturing within Europe, the indications are that European imports of tropical hardwood logs in the future may be limited to no more than around 200,000 m3 per annum.

Chart 3 showing hardwood veneer imports into Italy (mostly sliced veneers), suggests that this market segment has been recovering slowly since the third quarter of 2009.

Chart 4 highlights the extent to which French hardwood veneer imports are influenced by cyclical events in the Gabon export trade. The general trend in French imports of rotary veneer from Gabon was downward until mid-2009 but there was a good recovery to the end of March 2010. Future French imports of rotary veneer should be boosted following the recent ban on Gabon log exports. On the other hand, demand for okoume plywood remains slow across Europe and there is intensifying competitive pressure from alternative products, particularly poplar plywood and combi products.

Chart 5 reveals the very deep decline in Spanish imports of hardwood veneers from the second quarter of 2008 onwards as construction activity collapsed. A brief revival in imports towards the end of 2009 proved to be short-lived. Recent reports from the Spanish door industry suggest little prospect of any significant upturn in demand in the immediate future.

Chart 6 shows that German imports of hardwood veneer fell consistently and steeply in the 12 months to end June 2009 and have remained stable at a low level since then. However, one positive recent trend for tropical hardwoods is the significant increase in the share of Ivory Coast in overall German hardwood veneer imports since the third quarter of 2009.

Note – full charts and data numbered appropriately are contained in the attached excel file

PDF of this article:

Copyright ITTO 2020 – All rights reserved