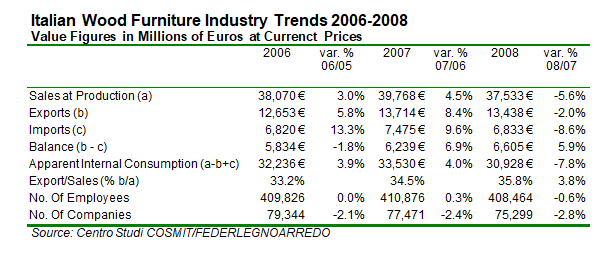

The Italian furniture sector held up reasonably well to the end of 2008 considering the scale of the economic downturn. Preliminary 2008 end-year figures suggest that Italian sales of wood furniture fell by 5.6% in 2008 compared to the previous year. Much of the decline in sales was due to a fall in the overall level of Italian domestic furniture consumption. The value of Italian wood furniture exports fell by only 2%. The likelihood is that the Italian furniture sector extended its share of the global wood furniture sector in 2008. The latest available international data indicates that the share of Italian furniture on the global market in 2007 reached 9.1%, rising from 8.9% in 2006.

After the sharp upturn in overseas sales during 2006 and 2007, a 2% drop in exports is by no means a positive result. However it is an indication that Italian furniture products remain highly competitive on international markets. During 2008, there was a severe downturn in Italian furniture exports to two markets worst hit by the credit crunch, the United Kingdom (-13%) and the United States (-22%), together with Germany (-5%) and Spain (-14%). However these losses were offset by strong gains in exports to Russia (+17%), the United Arab Emirates (+37%), and Greece (+4%). Exports to France and Austria remained stable.

Two factors had a bearing on the drop in Italy’s domestic furniture consumption in 2008. On the one hand, there was a severe loss of consumer confidence during 2008 and, on the other, there was a significant slump in the real estate and rental markets even before the construction industry was hit by a sharp fall in demand.

But overall, Rosario Messina, President of the Italian wood furniture association FederlegnoArredo, believes the figures are a reason for optimism. “This is a crisis that is being imported, quite unlike those in the past which were all linked largely to a gap in our country’s competitiveness and in part to our business system. We are stronger now: we have had time to absorb the competitive shock generated by embracing the Euro and spot exchange rates that were far from favourable to Italian exports. We have taken stock of an increasingly global market and of the difficulties inherent in true internationalisation. Much still remains to be done, but businesses have responded well….the fact that Italian companies suffered to a lesser extent than others on the international markets is largely attributable to the quality of our products”.

Italian furniture companies have certainly been hit by the crises and small artisan businesses in particular have registered an overall decline of 2.6% in numbers. However the employment figures have been holding up. According to Rosario Messina there are very definite reasons for this: ” at times like these family-run businesses [which dominate the Italian furniture industry] are in a position to tighten their belts and focus on medium-term objectives. There are many cases in which families have fallen back on their own reserves during a credit crunch or a lack of liquidity and, equally, family-run businesses offer greater flexibility in terms of choice when times are hard. When entrepreneurs identify with their own businesses, they are less likely to make staff cuts, tending to view these as a last resort. This in turn avoids setting a vicious circle of consumer uncertainty and cutbacks in motion, which then rebounds on the businesses themselves”.

Italian wood sector not yet feeling the benefits

These comments might provide some crumbs of comfort to timber importers in Italy, but it is also clear that the benefits of the furniture sector’s apparent resilience have yet to filter through to the wood trade. Trade data suggests that the Italian wood sector suffered more severely than the furniture sector during the latter months of 2008. This was due in part to widespread destocking by furniture and joinery manufacturers in response to the uncertain economic conditions and also to a sharp downturn in construction sector activity. According to Federlegno Arredo, Italian wood industry sales fell by 7.5% (an overall total of approximately 15 billion Euros) in 2008 compared to the previous year, mainly due to a decline in Italy’s internal wood consumption which plummeted by 9.1%.

Growth in Milan show highlights Italian determination to stay on top

The Salone del Mobile in Milan is perhaps the most significant furniture show in the world where a huge number of exhibitors jostle for attention, many employing the services of some of the world’s top designers. In terms of sheer volume of production, Italy was recently overtaken by China as the world’s largest furniture manufacturing country. However the Italian furniture sector generally, and the Salone show in particular, continues to have a huge impact on furniture fashion trends in all areas of the world.

A key part of the Italian furniture sector resilience during the global downturn has been a heavy emphasis on design and marketing. Underlining the determination of the Italian furniture sector to stay on top, or perhaps a reflection of greater desperation to generate demand during the economic downturn, this year’s Salone show boasted a huge increase in the numbers of exhibitors compared to last year. The show, which ended on 27 April, hosted 2,723 exhibitors (of whom 911 were non Italians) and covered an exhibition area of 202,350 square metres. In 2008, there were 1,068 Italian and 230 foreign exhitors and the overall exhibition area stood at 152,207 square meters.

The key question doing the rounds of insiders in the run-up to the Salone show was this: “How will manufacturers and designers respond to the crisis that has the world economy in its grip?” The show’s publicists, based on their own survey of products on display, felt that the economic downturn had contributed to two contrasting trends in Italian furniture design. They note that “some designers and firms have striven for greater pragmatism, a more balanced relationship between object and cost and a greater focus on consumer demand. Others have sought refuge in escapism. An important element of this trend has been to link furniture design to the world of nature”.

The first approach is believed to have led to an “unexpected return to minimal”, scaling down the decorative explosion of the last few years. There is greater emphasis on timeless objects that are built to last rather than paying lip service to passing fashions. There is an emphasis on “gracious”, non-aggressive designs that can “stray” from one room of the house to the next.

Many of the wood furniture items on show adhered to the minimalist ideal. The Dutch furniture company Arco was displaying a table manufactured 100% in wood with no metal or other elements. The simplicity of the design combined with use of real wood veneers and avoidance of other potentially expensive materials meant the product was extremely cost efficient. Another example is the Eno chair in black oak designed by Mikko Lakkonen for Covo. Other exemplars of the minimalist look in wood were the Italian FEG company, the Swiss Mobimex, and the Italian Mathias company.

There was a strong preference in these modern minimalist designs either for very dark brown, often black woods, or for whitened woods. Walnut was used most extensively to achieve the darker colours. Wenge was occasionally seen, although much more typically oak was stained to achieve the black look. Ash was often painted for the white look.

Another common theme was to combine a minimalist design with a more exotic finish. A simple chair or table may be manufactured in a heavily grained even stripey wood, or in plywood cross-cut to produce an interesting look. A particularly good example was the Gem 743 table designed by Gianni Astolfi and Sergio Mian for the Mathias company in ziricote (Cordia dodecandra), a tropical hardwood from Central America.

The second trend towards “escapism” and “naturalism” had even clearer implications for the use of wood, particularly tropical. According to the show publicists, this trend has contributed to the strong emergence of outdoor furniture (often with a dual “outdoor/indoor” function). They note that “outdoor collections are multiplying; costlier materials and finer designs are being employed”.

It was evident from the show that while tropical wood is benefiting to some extent from this trend, it now has to share the outdoor furniture sector with a huge range of other materials. Gone are the days when teak was dominant, a reflection both of a fashion for mixed materials and the increasing difficulties of obtaining high quality large dimension teak. Much of the outdoor furniture on display at the Salone show was manufactured from plastic, steel, aluminium and fabric.

Alternative woods were also being used for exterior furniture. The Belgian company Tribu was promoting a new line of garden furniture made of painted acacia wood. Schonhuber Franchi now combines teak with aluminium and is also promoting a line of aluminium/palissandro products. Fornasarig was displaying outdoor furniture by Japanese designers Shinibu and Setsu in treated oak chosen primarily for its ability to produce curvatious designs. Gloster, while maintaining their strong loyality to teak, were introducing a new design which combines the tropical wood with copious quantities of soft material for a more comfortable look.

The concepts of “escapism” and “nature” were also major influences in the indoor furniture sector. While designers were interpreting these themes in a huge variety of ways, certain threads tended to be repeated, such as the widespread use of natural fibres and reclaimed materials, and of non-geometric “rough”, “ethnic” and “rural” designs.

The Italian Riva company were particularly firm adherents to the “natural” concept. Their stand was dominated by a huge timber board 12 meters in length and 2 meters wide carved from a New Zealand kauri tree (agathis australis). The theme of the stand was “eco-design”, Riva having brought together around 20 of the world’s top furniture designers to create unique furniture, all in real wood. The company claims to use only sustainably managed woods – although interestingly there was no reference to any specific sustainable forestry standard or labelling system such as FSC or PEFC (in fact no-one seemed to be visibly promoting either of these labels at the show). Instead, Riva emphasises its heavy reliance on American hardwoods. All the products on display were manufactured in American black walnut.

Generally, tropical timbers were not strongly featured in the visual elements of indoor furniture displayed at the show. The only exception was Indian rosewood (Dalbergia latifolia) used widely in veneer form to produce a highly exotic and glossy striped finish on more classic furniture lines. There was a little teak favoured for the darker brown grainy look which is currently in fashion. In line with the “natural” and “rustic” themes, there were also a few companies displaying furniture in reclaimed teak. Tropical redwoods appear to be very much out of fashion in the European furniture sector. But closer examination of some furniture items revealed a bit of tropical wood under the skin. For example, mahogany was occasionally being used for frames in high quality classic furniture lines where it is valued for its strength and stability.

PDF of this article:

Copyright ITTO 2009 – All rights reserved