Newly released Eurostat data provides official confirmation of anecdotal reports of a dramatic EU-wide fall in imports of tropical hardwood products during 2008. The downturn was felt in all corners of the EU and affected just about the entire range of wood products imported from tropical countries. In 2008, the volume of EU-25 imports of hardwood logs, sawn, veneer, and plywood from countries in the tropical forest zone was down 27%, 23%, 11% and 14% respectively.

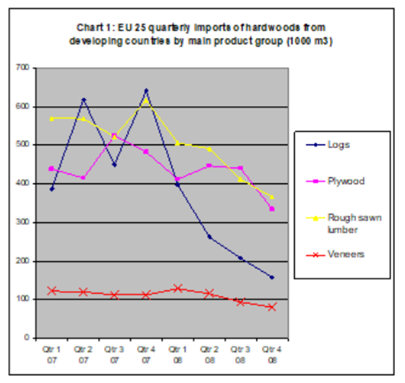

Closer analysis of quarterly data indicates that the timing of the downward trend varied by product group (Chart 1). The decline in EU-25 imports of hardwood logs and sawn from tropical countries set in at the start of 2008, falling dramatically between the last quarter of 2007 and the first quarter of 2008. The downturn in veneer imports began in the second quarter of 2008, following a gentler but nevertheless relentless slide. Hardwood plywood imports held up well until the end of the third quarter of 2008 but then tumbled dramatically in the last three months of the year. The late response of the European plywood sector to the changing demand situation seems now to be reflected in particularly dire market conditions for this commodity in the EU, with importers now desperate to offload excessive stocks in the face of very slow consumption.

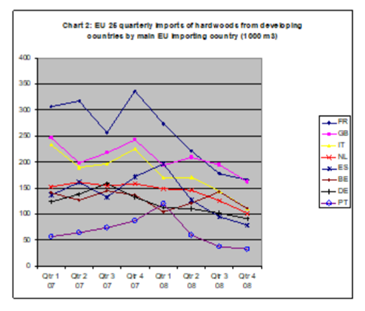

No European country has escaped the impact of the market downturn, although there is some variation in the depth of the recession in timber imports (Chart 2). The volume of hardwood imports from tropical countries into France, Italy, Spain, and Portugal fell particularly steeply during the course of 2008. Imports into the UK fell more slowly, although this may be due more to the delayed reaction of the UK plywood sector than to any strength in underlying consumption. Germany’s decline was more moderate, partly because this market is already now less dependent on tropical wood than other European countries and partly due to more stable (but still unexciting) demand in Germany’s joinery sector.

Imports of hardwoods from tropical countries into Belgium and to a lesser extent, the Netherlands, held up better than most other countries in 2008. Since both countries are very significant as staging posts in the supply of other European countries, the relative stability of their imports during 2008 is just as likely to reflect changes in purchasing practices in the wider European hardwood market in the face of the

recession as it is underlying domestic consumption in the Benelux region. One impact of the recession may have been to intensify the trend towards increased reliance on little-and-often purchases from the large concentration yards in the Benelux countries and to reduce the numbers of European companies engaged in direct imports of tropical wood.

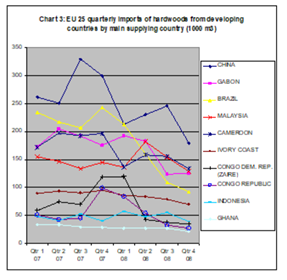

The fortunes of key tropical hardwood supplying countries to the EU have also varied widely, although none could claim to have had a particularly “good year” in Europe during 2008 (Chart 3). The volume of EU-25 imports of hardwood products from China (mainly plywood) fell from a peak of around 330,000 m3 in the third quarter of 2007 to less than 180,000 m3 in the last quarter of 2008. Rising costs of labour and raw material combined with quality and environmental concerns were undermining the competitiveness of Chinese plywood products in the EU market from the middle of 2007 onwards. The economic downturn only added to these problems – although it’s worth noting that in pure volume terms, China remains a very significant supplier of hardwood-based products to the EU.

The decline in EU-25 imports of hardwood products from Brazil (mainly plywood and sawn lumber) also fell very dramatically from close to 250,000 m3 in the fourth quarter of 2007 to less than 100,000 m3 in the last quarter of 2008. During the whole of 2008, the volume of EU-25 imports of hardwood plywood and sawn lumber from Brazil were down respectively 44% and 15%. This reflects both difficult supply conditions in the Brazilian hardwood sector as well as slowing European consumption.

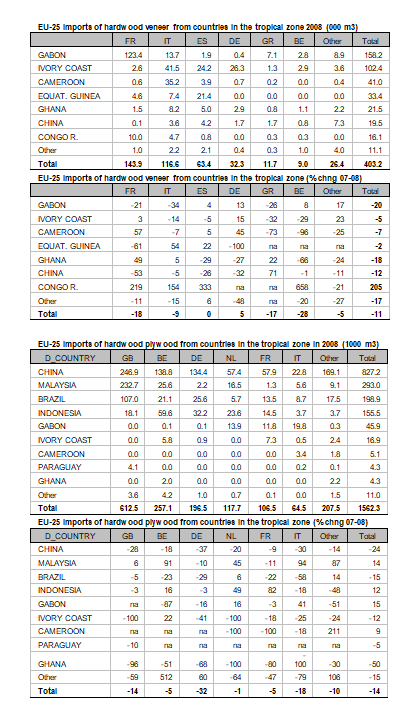

EU-25 imports from African countries during 2008 saw some significant declines, although less dramatic than those experienced from Brazil and China. European log and sawn imports from Gabon were down 19% and 11% respectively on the previous year, although these declines were partly off-set by a 15% rise in EU imports of plywood from Gabon, an effect of the new inward investment in processing capacity in the country in recent times. EU-25 imports from Cameroon followed a similar path, with significant declines in volumes of logs (-45%) and sawn (-19%), but a rise in volumes of plywood (+9%). EU-25 hardwood imports from the Congo Democratic Republic (logs and rough sawn), having risen dramatically at the end of 2007, fell to much lower levels from the end of March 2008 onwards. EU-25 imports of logs and rough sawn from the Congo Republic fell consistently throughout 2008, partly offset by a rise in imports of veneer from the country. EU-25 imports of hardwood (mainly sawn lumber) from Ivory Coast and Ghana fell consistently during the course of 2008, ending the year around 17% down on 2007.

Malaysian hardwood suppliers performed better than most of their competitors in the European market in 2008. EU-25 imports of Malaysian sawn lumber in 2008 were down only 5% on the previous year while imports of Malaysian plywood were actually up 14%, with large increases in sales to Belgium, Netherlands, and Italy. This reflects both the mounting problems in Chinese plywood supply and the development of new FSC-certified combi-plywood products in Malaysia combining tropical hardwood face with a New Zealand radiata pine core.

Meanwhile EU-25 hardwood imports from Indonesia (mainly plywood and mouldings) remained relatively stable throughout the course of 2008, although a shadow of their former self at well below 200,000 m3 for the whole year.

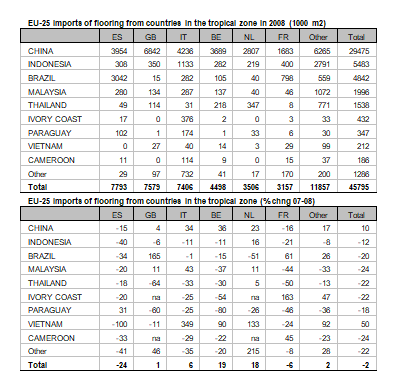

During 2008, EU-25 imports of hardwood flooring products from developing economies reached 45.8 million m2, a 2% decline on the previous year. China consolidated its position of dominance in the sector, contributing 29.5 million m3 of European imports, up 10% on the previous year. EU-25 imports of hardwood flooring from most other developing countries declined, including from Indonesia (-12%), Brazil (-20%), Malaysia (-24%), Thailand (-22%) and Ivory Coast (-22%).

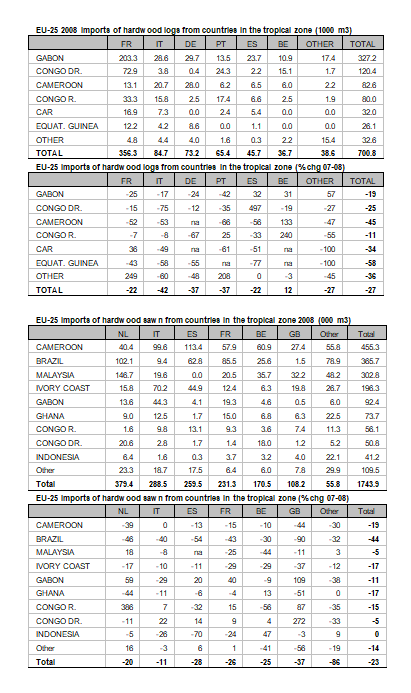

A comprehensive breakdown of EU-25 imports of hardwood products from countries in the tropical zone during 2008 by leading supply country and European Member State is shown in the following tables. European imports of all hardwood from countries that are fully or partially in the tropical zone are included. In some cases a significant proportion of these hardwoods may be of temperate origin, particularly in the case of China. The EU-25 group of countries includes all members of the EU with the exception of Romania and Bulgaria (which only joined the EU on 1 January 2007). Data is compiled from Eurostat data supplied by Business Trade and Statistics Ltd. Forest Industries Intelligence Limited analysed the data to remove inconsistencies.

PDF of this article:

Copyright ITTO 2009 – All rights reserved