The European plywood market is undergoing a rapid period of change. Since the start of recession in 2008, the market has become less and less willing to pay premium prices for tropical hardwood plywood. Instead it has opted for plywood manufactured in alternative hardwood species. The emergence of China as a major supplier of large volumes of hardwood plywood at competitive prices played an important role to drive this change. Now the market looks set to alter again. This time the main driver is likely to be the EU Timber Regulation (EUTR), to be enforced from March 2013. EUTR will require that EU importers have access to documents demonstrating negligible risk of any wood product coming from an illegal source. This will present challenges for suppliers of wood products that rely on long and complex supply chains – such as many Chinese plywood manufacturers.

Switch from tropical to temperate plywood

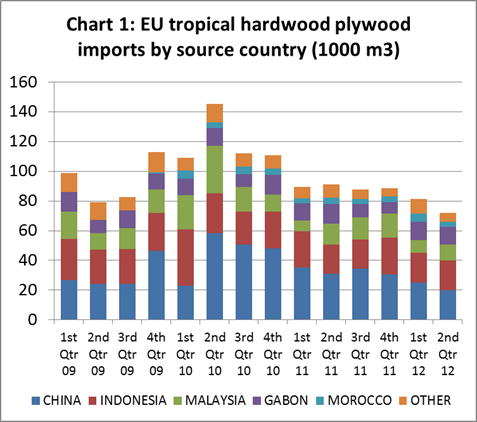

EU imports of tropical hardwood plywood have declined steadily since the second quarter of 2010 (Chart 1). The EU imported 153,000 m3 during the first 6 months of 2012, 15% less than the same period in 2011. In the first half of 2012, tropical hardwood plywood imports into the EU from China were down 33% at 45,000 m3. During this period, tropical hardwood plywood imports from Indonesia fell 8% to 40,000 m3 and imports from Malaysia fell 9% to 20,000m3.

European domestic manufacturing of tropical hardwood plywood – using imported African okoume logs – has also fallen dramatically and is now negligible. This follows implementation of a ban on exports of okoume logs by Gabon in May 2010.

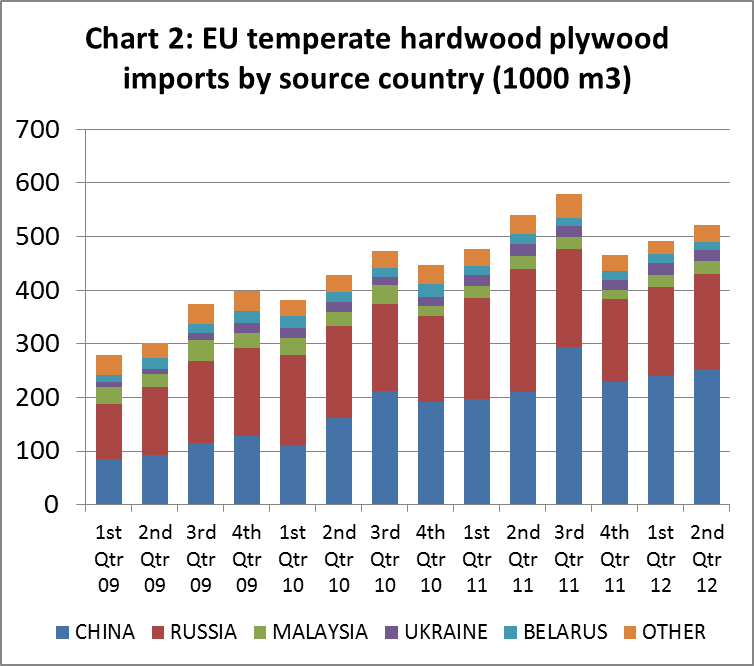

In contrast, EU imports of temperate hardwood plywood increased dramatically between 2009 and 2011 (Chart 2). In the first 6 months of 2012, imports were 1.01 million m3, little changed from the same period in 2012. Imports from China were up 21% at 493,000 m3, while imports from Russia were down 18% at 344,000 m3.

The recent switch from tropical hardwood to temperate hardwood plywood in the EU market is the result of various factors. These include relatively high and volatile prices associated with tropical hardwood plywood and lack of availability. These trends became strongly apparent following the tsunami in Japan in March 2011 which led to a large volume of tropical hardwood plywood being diverted to reconstruction work. EU plywood imports from Indonesia were particularly affected by shipment delays and large fluctuations in container rates during this period.

Meanwhile China’s ability to competitively produce okoumé plywood for the EU market has been impaired due to imposition of anti-dumping duties on EU imports of this product from China since 2004. The duty levels imposed range from 6.5 % to 23.5 % for four Chinese producers and 66.7 % for all other producers.

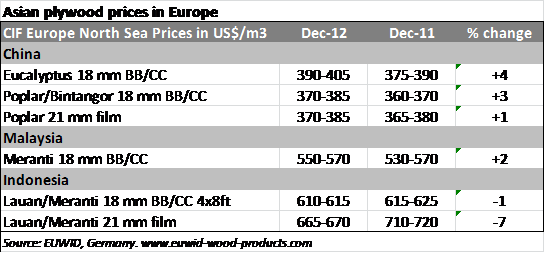

However, availability of poplar and eucalyptus plywood from China has increased rapidly. These products have become increasingly important in international plywood supply. Although not offering equivalent durability, strength and quality as tropical hardwood plywood products, prices for Chinese hardwood plywood products are extremely competitive (see table). The EU market has increasingly accepted these products for a wide range of utility applications requiring a lower level of technical performance.

There is speculation that tropical hardwood plywood from Indonesia and Malaysia may reclaim some market share in the EU market during 2013. This is partly because supply has improved over the last 12 months. Prices for South East Asian plywood have also remained more consistent and been less volatile than in the past. In addition, moves to develop comprehensive legality verification systems in these countries are expected to boost competitiveness following implementation of EUTR.

A notable trend in the EU hardwood plywood market during 2011 was replacement of Indonesian film-faced plywood with cheaper Russian birch plywood products. However availability of Russian birch plywood has declined in 2012. Russian plywood manufacturers have struggled to source adequate volumes of good quality birch logs. This has led to a particularly sharp fall in the availability of high quality 5x10ft birch plywood from Russia. This situation is expected to ease in January and February 2013 with the onset of large scale winter felling in Russia.

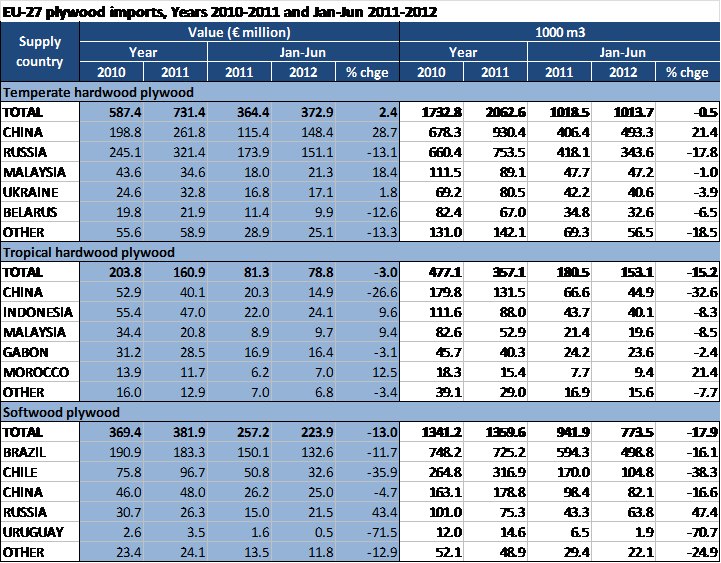

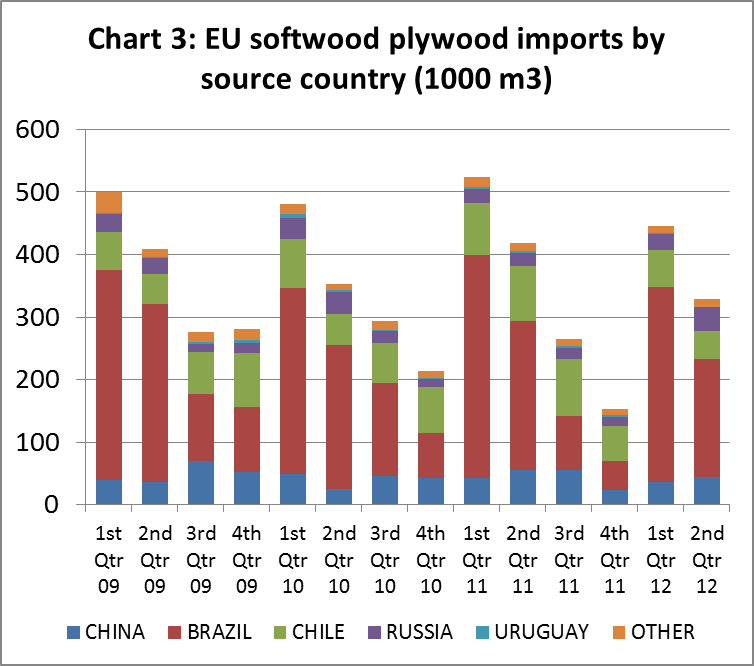

Softwood plywood imports subject to quota

EU imports of softwood plywood are subject to quota whereby the first 650,000 m3 imported in the year incur duty at 0%. Any product imported above 650,000 m3 incurs 10% duty. As a result, EU imports of this commodity follow a “saw tooth” pattern (Chart 3). Most softwood plywood arrives in the first half of the year as EU importers rush to avoid missing the duty-free quota. However, overall annual imports of softwood plywood into the EU have remained quite stable in recent years. Slow consumption meant a slow start to the year in 2012. Compared to the first 6 months of 2011, EU imports of softwood plywood were down 18% at 773,000 m3 during first 6 months of 2012. EU imports of this commodity from China were down 17% at 82,000 m3 during this period.

Slow plywood consumption in recent months

The market for plywood in the EU during the last quarter of 2012 has been very challenging. Weak construction sector activity meant that plywood consumption was very slow. However production costs for plywood manufacturers have continued to rise. But with supply generally in excess of demand, it is very difficult to raise prices. Margins in the trade have been declining. Some Chinese suppliers of plywood to the EU are seeking price increases of 2-3% to compensate for rising production costs and strengthening of the yuan against the US dollar. But these efforts have proved unsuccessful so far.

Significant freight rate increases were being discussed for the Asia-Europe route from mid-December 2012 onwards. However latest reports suggest that demand for container space has remained low overall. It now seems unlikely that shipping companies will be able to push through the rate increases.

One result of low demand for container space is that European importers are having little difficulty securing stock. Importers can satisfy their immediate needs for most plywood products quite easily and lead times between ordering and delivery of new stock are short. For example lead times for delivery of Indonesian plywood to Europe currently average around 5 weeks.

Despite relatively high log prices in Malaysia, Malaysian shippers of tropical hardwood plywood to Europe have been reducing prices in recent months in an effort to maintain market share. But while the price differential in Europe between comparable Malaysian and Chinese products has reduced in recent months, it is still more than 10%.

Uncertainty created by EUTR

In addition to slow consumption, there is much uncertainty in the EU plywood market concerning the likely impact of the EU Timber Regulation. In the short term, EUTR has led to very large bookings of product from China to arrive in December and January, prior to the Chinese New Year festivities in February and just before the law is due to be enforced in March. These orders are well in excess of demand anticipated in the first quarter of 2013. In contrast, forward orders of both Chinese and tropical plywood for arrival after the beginning of March 2013 have been very subdued.

The longer term impacts of EUTR are difficult to predict. There is still some uncertainty as to how effectively the law will be enforced. Many EU Member States have been slow to announce which government departments will take responsibility for enforcement and to set out details of monitoring systems and sanctions. The European Commission has yet to publish detailed guidelines for EU importers. This fact, combined with the high level of plywood import prior to the March 2013 deadline, suggest that it will take time for the full effects of EUTR to become apparent.

Nevertheless, EUTR may well be a game-changer for the EU wood products trade longer term. This is particularly true of the plywood sector which is traditionally heavily dependent on imports from outside the EU. It is also a sector which relies heavily on hardwood species from regions considered high risk of illegal wood supply, including tropical countries and Russia. EUTR enforcement action in Europe may be weak in the initial stages. But the personal liability imposed by the law, and the reputational risks to operators that fail to comply, suggest most will take it seriously. In fact, it’s possible many importers will become more risk adverse than strictly necessary under the terms of the EUTR.

Chinese plywood and EUTR

Some large EU importers have been working hard with their Chinese suppliers with the aim of ensuring that all plywood imported from the country complies with EUTR requirements. However, there is still scepticism in the EU trade that Chinese manufacturers will be able to secure robust documentary evidence of legality for many plywood product lines. This is due to the complexity of supply chains in China’s plywood manufacturing sector. It is also due to lack of reliable systems to demonstrate legal origin in many countries from which China imports logs for plywood manufacture.

An article in the UK Timber Trades Journal in December 2012 quotes a major UK plywood importer. He suggests that due diligence work in advance of EUTR has already ruled out 20% of the Chinese factories with which his company deals. Many more are expected to be added to the list as the process proceeds.

Particularly affected will be Chinese plywood manufactured from tropical species lacking FSC or PEFC certification. European importers are already identifying uncertified wood from Papua New Guinea, the Solomon Islands and most African nations as high risk. European imports of uncertified Chinese softwood plywood products, suspected of containing wood of Russian origin, are also likely to be scrutinised closely. Nothing short of FSC or PEFC certification of plywood containing these woods is likely to be accepted by most European buyers after March 2013.

On the other hand, EU importers are likely to be less concerned about Chinese plywood manufactured using only plantation-grown poplar and eucalyptus.

Environmental groups are keeping up the pressure and raising the stakes for European importers engaged in trade in Chinese plywood. They are sending out strong signals that wood products from China will be first in the firing line for EUTR scrutiny. The London-based Environmental Investigation Agency (EIA) has claimed in a new report “Appetite for Destruction: China’s Trade in Illegal Timber” that China is now the single largest international consumer of wood stolen by organised crime syndicates. The report claims that while China has taken laudable steps to protect its own forests, it has simultaneously nurtured a “ravenous” wood processing industry reliant on importing raw material, including large volumes from countries it claims are a high risk of illegal supply.

Malaysian and Indonesian measures to ensure EUTR compliance

Indirect imports of tropical hardwood plywood via third countries like China may well suffer as a result of EUTR. However, EUTR may again favour direct imports of tropical hardwood plywood from Malaysia and Indonesia. This is because of simpler supply chains and moves to develop third party certification. Indonesia is progressing rapidly towards full implementation of a Voluntary Partnership Agreement (VPA) with the EU on illegal logging. Under the terms of the VPA, all timber products exported from Indonesia into the EU will be subject to mandatory chain of custody certification to ensure legality of product. Similarly, a large proportion of Malaysian production is PEFC-certified. All these measures are expected to make the EUTR due diligence process for Malaysian and Indonesian plywood much simpler.

Search for substitutes to tropical and Chinese hardwood plywood

The high perceived risks associated with sourcing plywood from some tropical countries, or countries with complex supply chains like China, is already encouraging a search for replacement products. EU importers have been making more enquiries about radiata pine and eucalyptus plywood from plantations in South America.

European panel manufacturers have also been encouraged to develop new products that may be used to replace tropical hardwood plywood in external applications. For example, the Ireland-based MDF manufacturer Medite recently won the UK Timber Expo Innovation award for their “Tricoya” MDF panels. Tricoya utilises the latest advancements in acetylation technology, which naturally alters the wood’s chemical structure so that it is not affected by the effects of water absorption. According to the manufacturer’s claims, MDF may now be used even in highly exposed environments.

PDF of this article:

Copyright ITTO 2020 – All rights reserved