Total EU27 (i.e. excluding the UK) import value of tropical wood and wood furniture products was US$2.48 billion between January and October last year, 12% less than in 2019. This is a significantly higher level of import than forecast earlier in the year when the first waves of the COVID-19 pandemic hit the continent leading to widespread lockdowns with severe implications for the EU27 economy and on the supply side in tropical countries.

However, with the onset of a second wave of the virus, and signs that the EU27 is now experiencing a double dip recession, trade may be receding once again.

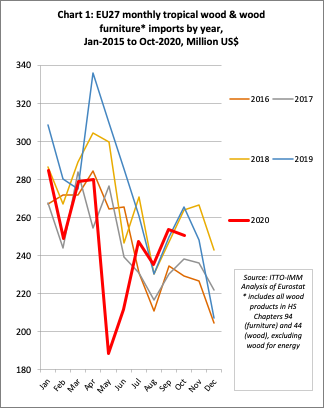

Chart 1, which shows the value of EU27 imports of tropical wood and wood furniture products each month during the last five years, highlights that while imports fell sharply in May last year there was a very strong rebound in June and July. Although imports declined again in August, they were at a five year high for that month (which is typically very slow during the European summer vacation period), and then recovered well in September.

With the easing of lockdown measures from May onwards and boosted by the introduction of large government stimulus measures, the economy picked up across the EU27 in the third quarter. According to Eurostat, seasonally adjusted GDP in the EU27 increased by 11.5% during the three month period. The rebound was almost sufficient to offset the 11.3% decline in EU27 GDP in the second quarter of 2020. During this period, EU27 imports were given a boost by the relative strength of the euro on international exchange markets, the euro-dollar rate rising sharply from a low of 1.06 in March to 1.22 by the end of the year. The dollar’s weakness is due to political uncertainty during and after the presidential elections and the continuing severity of the pandemic in the United States.

Renewed signs of stress in the EU27 economy

A slight dip in EU27 tropical wood product imports in October is more worrying as it coincides with renewed signs of stress in the EU market in the last quarter of 2020. The second waves of COVID infection across Europe during the winter months have grown to be significantly larger than the first waves last year leading to renewed and more widespread lockdowns.

According to the Oxford “stringency index”, which records the strictness of ‘lockdown style’ policies to limit the spread of COVID-19, since mid-October most of Europe has been subject to restrictions as severe as those imposed in the first lockdown between March and June last year. The expectation is that these renewed measures will be in force in most European countries at least until mid-February and probably much longer.

Meanwhile, the relative strength of the euro is creating a headache for the European Central Bank which has become alarmed at the impact on export competitiveness of EU27 manufacturers at a time when other factors are weighing down heavily on demand.

Bloomberg Economics estimates euro-zone GDP fell 1.5% in the last quarter of 2020, bringing the decline for 2020 as a whole to 7%. Bloomberg Economics now expects another 4.1% decline in eurozone GDP in the first quarter of 2021. Two consecutive quarterly falls is the formal definition for a recession. The Bloomberg forecast therefore implies that Europe is in the grips of a “double dip” recession following the downturn already recorded in the first two quarters of 2020.

However, there have been sizable divergences among EU member states. Germany has benefited from its greater reliance on manufacturing, with factories staying open while government-mandated lockdowns shut non-essential shops and much of the hospitality sector. Bloomberg Economics says Europe’s biggest economy probably managed to post some growth in the fourth quarter and may have avoided the “double dip”. Economists polled by Reuters in the first week of January now expect German economic growth to come in at minus 5.1 per cent for the whole of last year.

European countries like France that are more reliant on services have been hit harder. The French central bank reported that the economy likely contracted by 4% in the final quarter of 2020, which would confirm a previous estimate that the economy shrank by 9% last year.

Forward looking indicators show that economic momentum in the EU27 is unlikely to pick up pace in the first quarter of 2021. The IHS Markit Eurozone PMI Composite Output Index rose from 45.3 in November to 49.1 in December. However a score below 50 indicates that a majority of those surveyed recorded a decline in purchasing during the month. Services were the principal drag on economic output, with activity here falling for a fourth successive month in December. Manufacturing remained the principal bright spot of eurozone economic performance, expanding for a sixth successive month and at a faster rate than in November.

The latest PMI data for eurozone construction is also not encouraging. IHS Markit, who undertake the survey, commented in their 6th January report that “Eurozone construction companies reported a continued downturn in activity during December, while incoming business also fell at a solid, albeit softer pace. Concerns surrounding the longer term impact that the pandemic will have on the wider construction sector, alongside a lack of new projects in both the public and private sector being bought to tender resulted in an extension to the pessimistic outlook held by eurozone-based builders for a fifth month in a row”.

IHS Markit noted in relation to individual countries that “France and Germany continued to report further declines in construction activity, with the former signalling the steepest fall since May. Italian firms on the other hand registered marginal growth for the first time since September.”

Most economists now predict that it will be the second quarter that a recovery in the EU economy ultimately gets under way. Looking positively, the bounce-back could be sharp, at least initially, once restrictions are eased and infections subside, as more of the population is vaccinated.

Pent-up demand could see a chunk of the hundreds of billions of euros of consumers’ involuntary savings being unleashed. By the second half of the year, the EU’s unprecedented 1.8 trillion-euro ($2.2 trillion) recovery fund and multi-year budget should be supporting growth.

EU27 tropical wood product imports down across the board in 2020

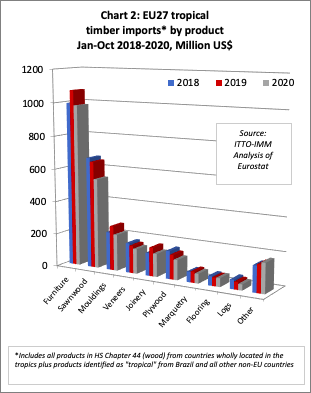

Unsurprisingly, EU27 imports of all the main tropical wood products fell in the first ten months of 2020, but in each case the decline was less dramatic than expected earlier in the year when the scale of the pandemic and associated lockdown measures were becoming apparent.

In the year to October, EU27 import value of wood furniture from tropical countries declined 8% to US$982 million, while import value of tropical sawnwood declined 16% to US$545 million, tropical mouldings were down 18% to US$220 million, veneer down 10% to US$150 million, joinery down 19% to US$139 million, plywood down 18% to US$121 million, marquetry and ornaments down 14% to US$58 million, and logs down 21% to US$36 million. Import value of tropical flooring actually increased slightly, up 3% to US$52 million (Chart 2).

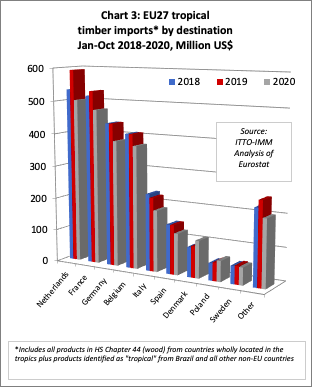

Import value fell into all six of the largest EU27 destinations for tropical wood and wood furniture products in the first ten months of the year. Import value was down 15% to US$502 million in the Netherlands, 11% in France to US$475 million, 12% in Germany to US$384 million, 8% in Belgium to US$375 million, 16% in Italy to US$187 million, and 16% in Spain to US$126 million. However, import value increased in Denmark, by 19% to US$113 million, and in Poland, by 12% to US$63 million. Import value in Sweden declined, but by only 4% to US$53.3 million (Chart 3).

EU27 wood furniture imports from Vietnam close to last year’s level

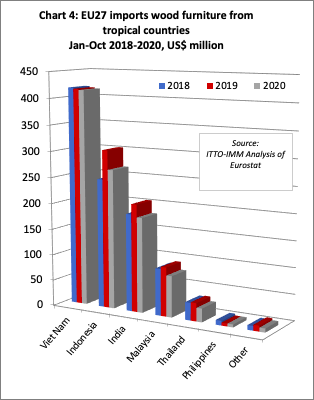

In the furniture sector in 2020, EU27 import value from Vietnam almost matched the previous years’ level in the first ten months, down only 0.4% to US$415 million. Imports from Indonesia were down 12% to US267 million in the first ten months of 2020, although this compares with a relatively strong performance in 2019 and imports were still higher than in the same period during 2018 (Chart 4).

EU27 imports of wood furniture declined sharply from Malaysia and Thailand in the first ten months of 2020, respectively down 16% to US$79 million and 25% to US$26 million. However imports from the Philippines were more stable, falling only 2% to US$5.5 million.

EU27 imports of wood furniture from India were down 12% to US$182 million in the first ten months of 2020. Partly due to supply side issues, imports from furniture from India almost came to a complete halt in May last year, but then rebounded very strongly in the third quarter to record levels for that time of year.

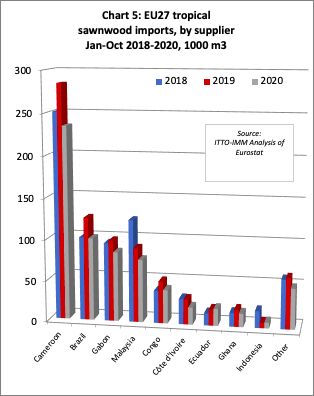

EU27 tropical sawnwood imports fall 17%

In quantity terms, EU27 imports of tropical sawnwood declined 17% to 650,800 cu.m in the first ten months of 2020. Imports fell sharply from all major supply countries; down 18% from Cameroon to 234,600 cu.m, 20% from Brazil to 100,300 cu.m, 14% from Gabon to 84,400 cu.m, 15% from Malaysia to 76,400 cu.m, 20% from Congo to 40,700 cu.m, 31% from Côte d’Ivoire to 20,900 cu.m, and 22% from Ghana to 16,400 cu.m.

However Ecuador bucked the downward trend, with EU27 imports of sawnwood from the country rising 6% to 20,700 cu.m, much destined for Denmark and likely driven by strong demand for balsa for wind turbines. Imports of sawnwood from Indonesia also increased slightly, by 9% to 7,100 cu.m, but this follows a 74% reduction in 2018 (Chart 5).

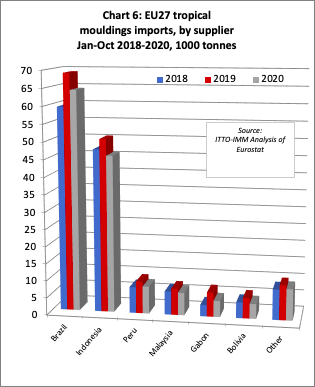

The decline in imports of tropical sawnwood in the first ten months of 2020 was mirrored by a similar decline in EU27 imports of tropical mouldings/decking. Imports of this commodity were down 11% overall at 143,000 tonnes, falling 7% from Brazil to 64,200 tonnes, 9% from Indonesia to 45,800 tonnes, 15% from Peru to 8,000 tonnes, 15% from Malaysia to 6,600 tonnes, 33% from Gabon to 4,700 tonnes, and 27% from Bolivia to 4,400 tonnes (Chart 6).

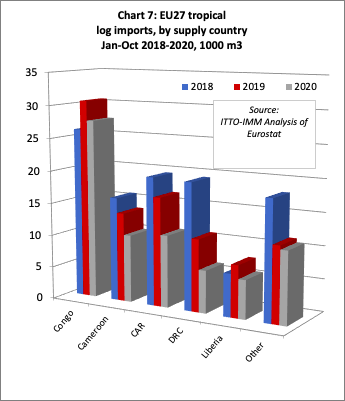

EU27 imports of tropical logs were down 21% to 72,400 cu.m in the first ten months of last year. Imports held up reasonably well from the Republic of Congo, down only 10% to 27,600 cu.m, but fell sharply from all other leading supply countries including Cameroon (-24% to 10,400 cu.m), Central African Republic (-34% to 11,000 cu.m), DRC (-41% to 6,500 cu.m), and Liberia (-26% to 5,900 cu.m) (Chart 7).

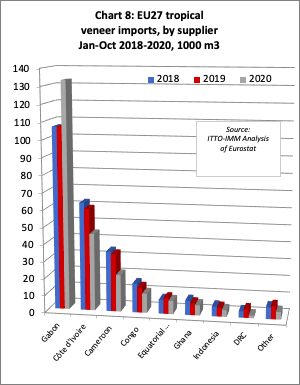

EU27 tropical veneer imports from Gabon on the rise despite pandemic

EU27 imports of tropical veneer declined 6% to 235,000 cu.m in the first 10 months of 2020. Imports from Gabon bucked the wider downward trend, the EU27 importing 133,100 cu.m from the country between January and October last year, 25% more than the same period in 2019, mainly destined for France. Veneer imports declined from all other major tropical suppliers, including Côte d’Ivoire (-24% to 45,200 cu.m), Cameroon (-36% to 21,700 cu.m), Equatorial Guinea (-16% to 7,800 cu.m), Ghana (-14% to 6,000 cu.m), Indonesia (-24% to 3,900 cu.m) and DRC (-69% to 1,600 cu.m). (Chart 8).

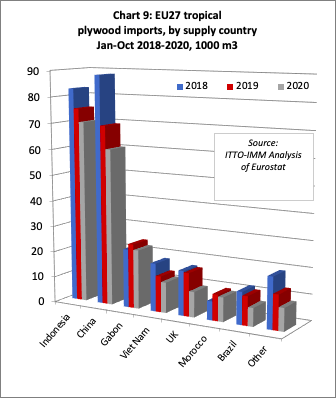

Although there were signs of an uptick in the pace of EU27 imports of tropical hardwood faced plywood in September and October last year, total imports of 207,000 cu.m in the first ten months were still down 15% compared to the same period in 2019. Imports fell from all the leading supply countries including Indonesia (-7% to 70,200 cu.m), China (-13% to 60,400 cu.m), Gabon (-8% to 22,700 cu.m), Vietnam (-15% to 11,700 cu.m), Morocco (-8% to 9,300 cu.m) and Brazil (-37% to 7,000 cu.m). EU27 imports of tropical hardwood faced plywood from the UK – a re-export since the UK has no plywood manufacturing capacity – declined 41% to 9,700 cu.m (Chart 9).

EU27 tropical flooring imports rise while other joinery imports decline

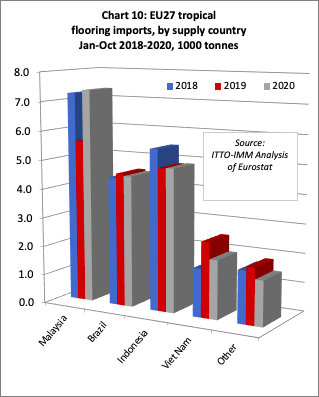

Given the situation in the wider market, one of the least expected trends in EU27 import data was a slight recovery in imports of tropical flooring products in the first ten months of last year. This follows a long period of continuous decline. Imports increased 4% to 20,400 tonnes, with the gain due to a 31% rise in imports from Malaysia to 7,600 tonnes, mostly destined for Belgium. Imports from Indonesia increased slightly, by 0.4% to 4,900 tonnes and declined only moderately from Brazil, down 1% to 4,500 tonnes. Imports from Vietnam fell more rapidly, by 22% to 2,000 cu.m (Chart 10).

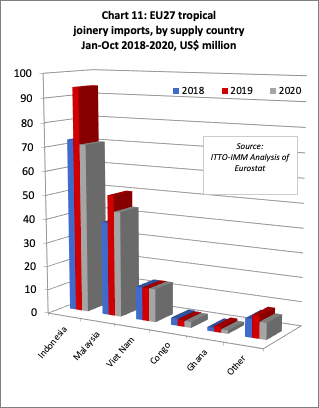

EU27 import quantity of other joinery products from tropical countries, which mainly comprise laminated window scantlings, kitchen tops and wood doors, declined 19% to 139,000 tonnes in the first ten months of 2020. Imports were down 25% to 70,600 tonnes from Indonesia and 13% to 44,000 tonnes from Malaysia. Imports from Vietnam were static at 13,700 tonnes. For African countries, EU27 imports of this commodity fell 8% to 2,500 tonnes from the Republic of Congo and were down 39% to 1,400 tonnes from Ghana. (Chart 11).

PDF of this article:

Copyright ITTO 2021 – All rights reserved