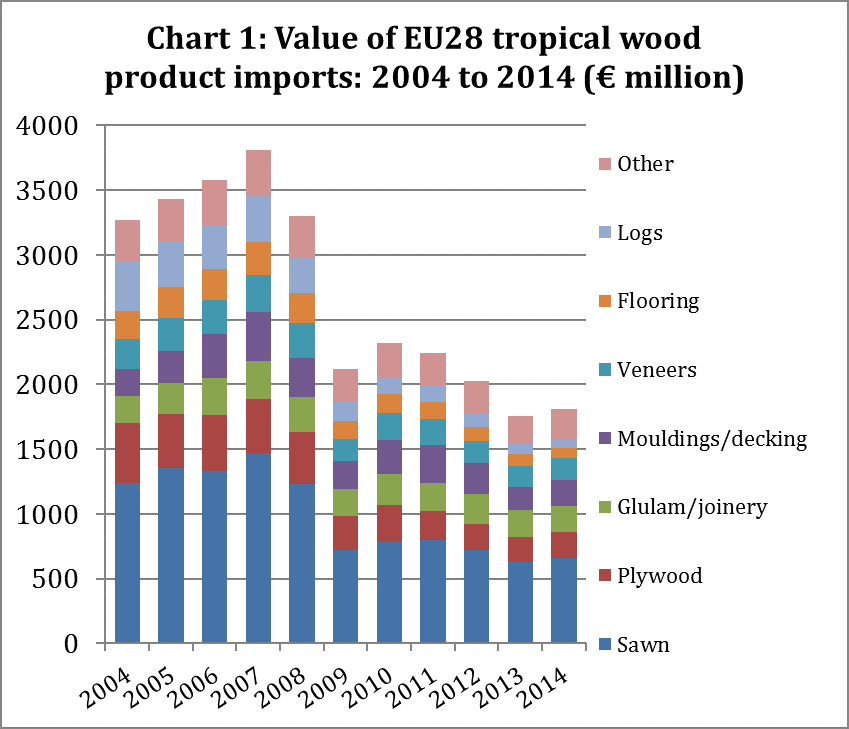

The EU imported tropical wood products worth €1.81bn in 2014, which represents a 3% increase over the ten-year low of €1.76bn registered in 2013. Between 2012 and 2013 imports had dropped sharply by 13.2 % and fell below the €2bn threshold for the first time. Even with the slight recovery, the EU’s 2014 tropical wood imports did not even reach half of what they were less than ten years ago (Chart 1).

The different product groups were showing mixed trends last year. Mouldings and decking (+12.9 % to €200 million) as well as “other” products (+10.1% to €240 million) grew by double-figure percentages and sawn wood also booked healthy growth of 5.5% to €663 million. Imports of plywood (+2.2% to €201 million) and veneers (+1.3 % to €166 million) climbed at a more moderate pace. At the same time, however, tropical log imports dropped again sharply, down 24.3% to €60 million. And deliveries of flooring (-5.8% to €83 million) and glulam/joinery (-3.8% to €200 million) were also lower than in 2013.

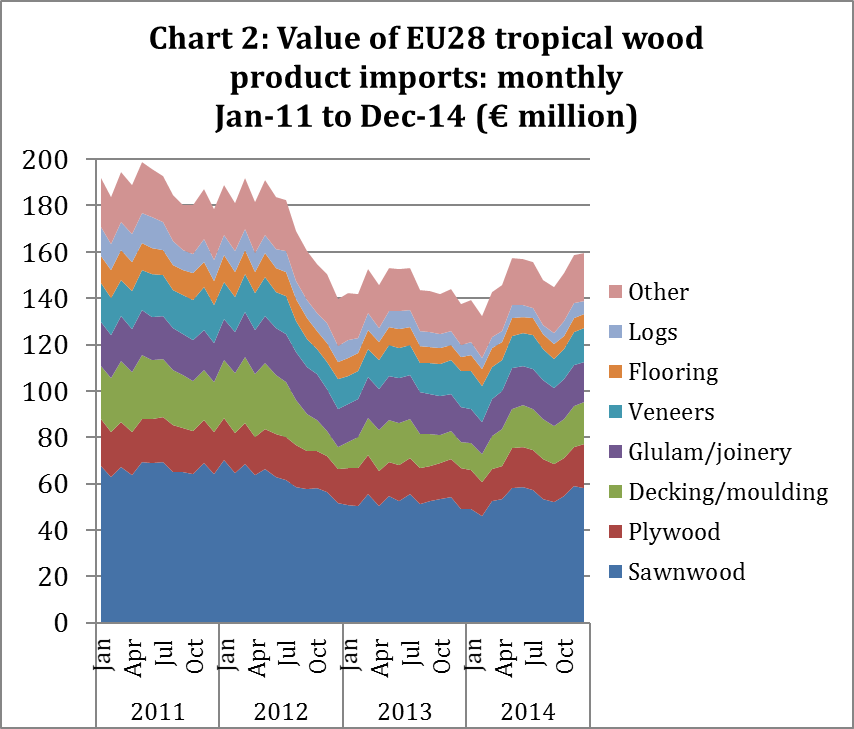

Closer analysis of monthly and quarterly data indicates that European tropical wood imports increased especially towards the end of last year. In fact, throughout the first quarter of 2014, imports were still lower than in the same period of the previous year. In the April to June period, imports then rose slightly over the same quarter in 2013. The rate of growth remained modest during the third quarter as well. However, in the final quarter of the year the European countries imported tropical wood products worth €469 million, which is 10.6% more than in the last quarter of 2013 (Chart 2).

EU construction has firmed in 2014

The slight growth in European tropical wood imports last year can be attributed to the continuing – if frequently slow – recovery in several important sales markets. Most notably the UK has reported strong demand for timber in general and also for tropical wood products last year. The Netherlands and Spain are showing signs of recovery as well and Germany has remained stable at a satisfactory level. France, on the other hand, has seen an economic slow-down which led to a further contraction in consumption of tropical timber last year.

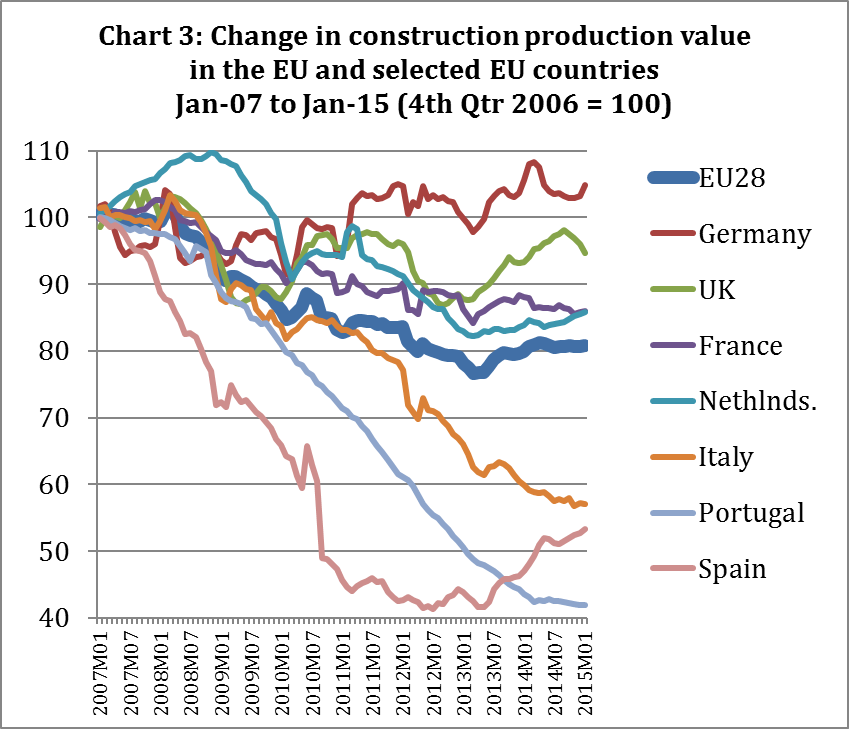

These trends are also reflected in EU construction activity. Chart 3 shows that the construction production value has continued to pick up in several key markets during 2014, even though the overall construction value throughout the EU still remains clearly below pre-crisis levels.

Construction in the UK picked up strongly from the start of 2013 and this trend continued throughout 2014. However growth slowed at least temporarily at the beginning of 2015. Construction value in France declined slightly during 2014. The same is true for Portugal and Italy. On the other hand, construction in the Netherlands continued its steady recovery last year. Spain has also shown a steady uphill trend since the start of 2013, although the recovery is from a very low level.

EU sawn tropical hardwood imports still lower than in 2012

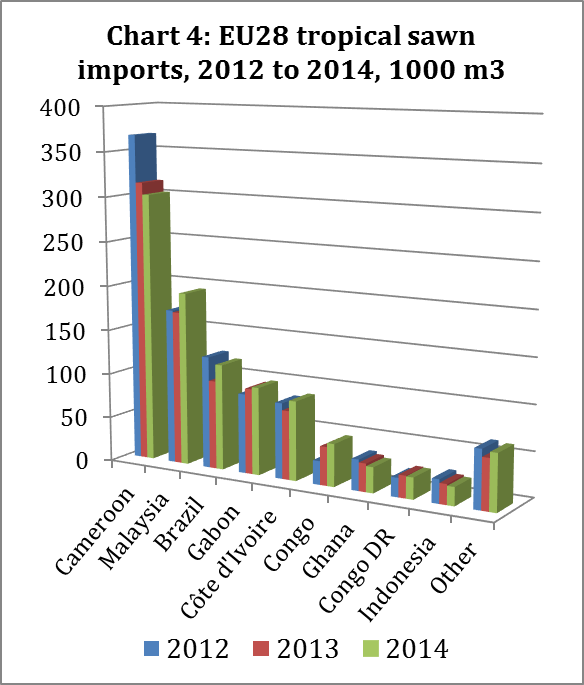

The recent 5% increase in European sawn tropical hardwood imports to 985,000 m3 was insufficient to offset the 8% drop in deliveries experienced in 2013. A closer look at the most important supplier countries reveals that Malaysia (+13%), Brazil (+19%) and Ivory Coast (+15%) boosted their deliveries to Europe significantly last year. This came after decline in imports from these three countries in 2013. Deliveries from the Congo Republic and Gabon also continued their positive trend last year. EU imports from Cameroon (-4%), Ghana (-9%) and Indonesia (-8%) continued their downhill slide in 2014. EU imports from the Democratic Republic of the Congo fell by 3% in 2014 following an increase in 2013.

PDF of this article:

Copyright ITTO 2020 – All rights reserved