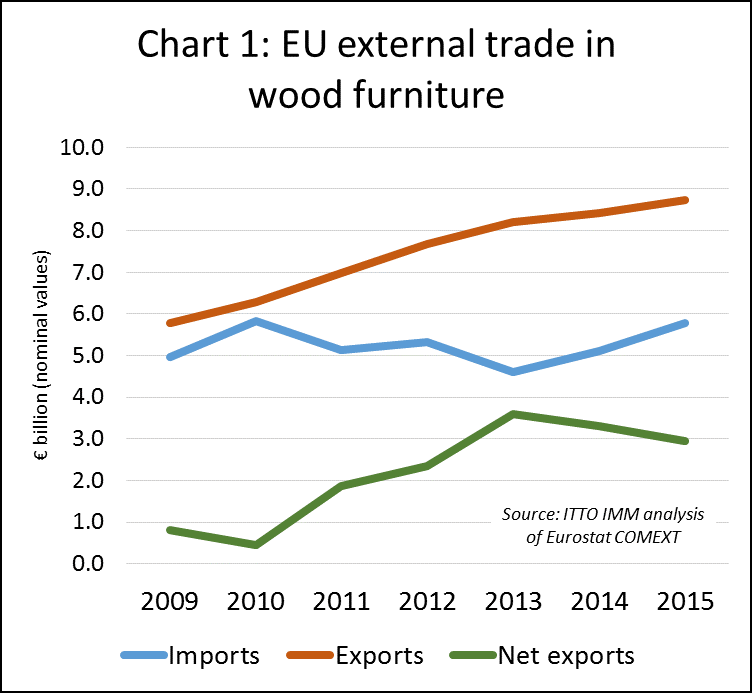

EU countries imported wood furniture worth €5.78 billion from outside the EU in 2015, 13% more than in 2014 and 16% more than in 2009, when the financial crisis had reached its climax. At the same time, EU exports of wood furniture rose to €8.73 billion in 2015, up only 3.5% from 2014 but 51% more than in 2009 (Chart 1).

As such, EU exports of wood furniture are now around 51% higher than imports. Back in 2009, import and export values were more closely aligned: exports were worth €5.77 billion, 16% more than imports, which stood at €4.97 billion.

However, EU exports of wood furniture subsequently increased constantly over the last six years, with growth rates ranging between around 3% and 11% per annum. Imports of wood furniture, on the other hand, have experienced a less consistent development: an increase in 2010 was followed by a fall in 2011, which again was followed by growth in 2012 and decline in 2013. 2014 and 2015 were the only two successive years to show growth since 2009.

Stabilisation of EU wood furniture imports

After a rather patchy development between 2009 and 2013, when signs of growth were always immediately followed by renewed weakness, 2014 and 2015 finally saw some stability in EU wood furniture imports.

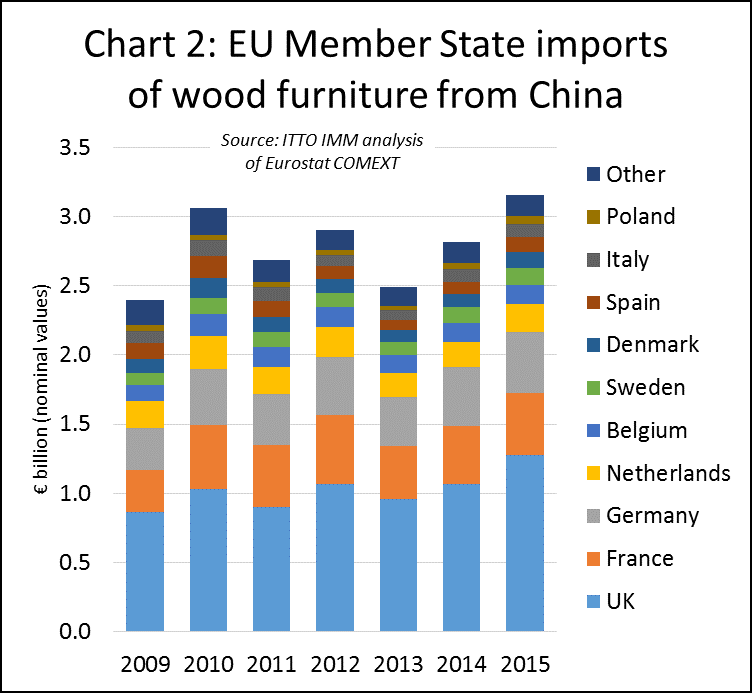

More than half of all EU wood furniture imports, €3.15 billion, came from China in 2015, with deliveries rising 12.1%. Chinese deliveries have therefore fully recovered from dips experienced in 2011 and 2013 and last year exceeded the previous peak level of €3.06 billion recorded in 2010 (Chart 2). Volatility in Chinese wood furniture deliveries to Europe over the last few years may be attributed to exchange rate effects and declining competitiveness of China relative to EU domestic producers.

The challenges of verifying timber legality in China’s complex supply chains may also have deterred some European buying following introduction of EUTR in March 2013. However the recent recovery in imports from China suggests that European buyers may now be more comfortable with the legality assurances provided by Chinese manufacturers.

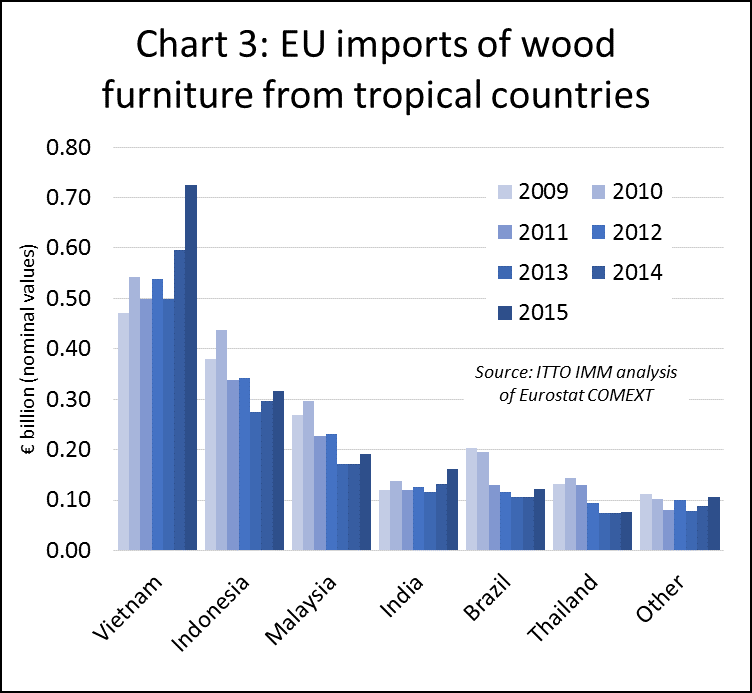

EU imports of wood furniture from tropical countries increased 16% from €1.47 billion in 2014 to €1.70 billion in 2015. While China remains the EU’s largest external supplier of wood furniture, Vietnam is the star performer in terms of sales growth. EU imports of wood furniture from Vietnam increased 21.6% to €725 million in 2015. This follows 19% growth the previous year and is a clear demonstration of Vietnam’s rising competitiveness in global furniture manufacturing (Chart 3).

Among the other major suppliers, EU imports from Indonesia increased by 6.6% to €316 million. This is disappointing compared to other major suppliers. EU imports from Malaysia, for example, increased 11.5% to €191 million and imports from Turkey increased 20.5% to €183 million. Imports from India also rose sharply, by 23.1% to €162 million.

Improving wood furniture demand throughout the EU

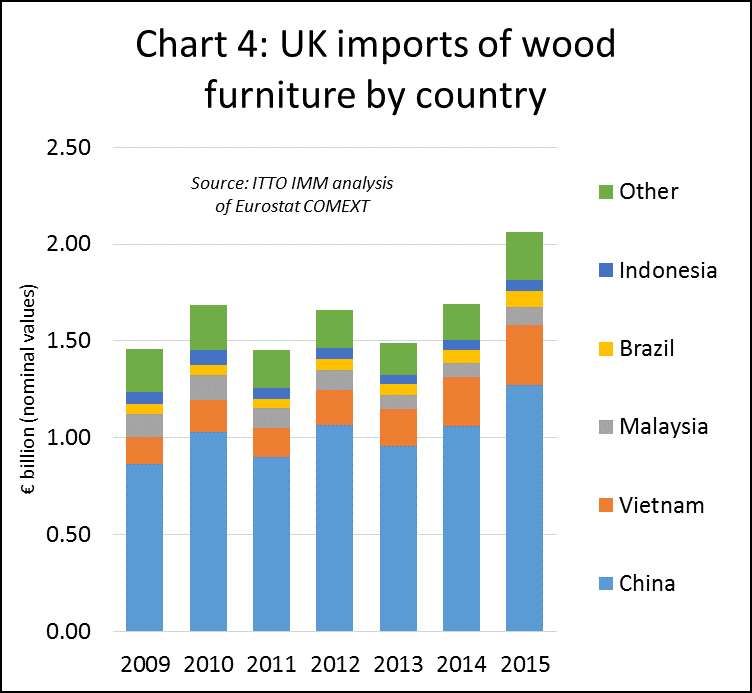

Of EU member states, the UK remains by far the largest single importer of wood furniture from outside the EU. In 2015, UK imports from non-EU countries increased by 21.9% to €2.06 billion (Chart 4). The British industry has shown a strong general performance over the last two years, with consumer confidence and new homes construction and completions increasing – and hence rising demand for furniture. According to national newspaper The Guardian, “the number of new homes in England jumped by 25% in 2014-15, the biggest increase in 28 years“.

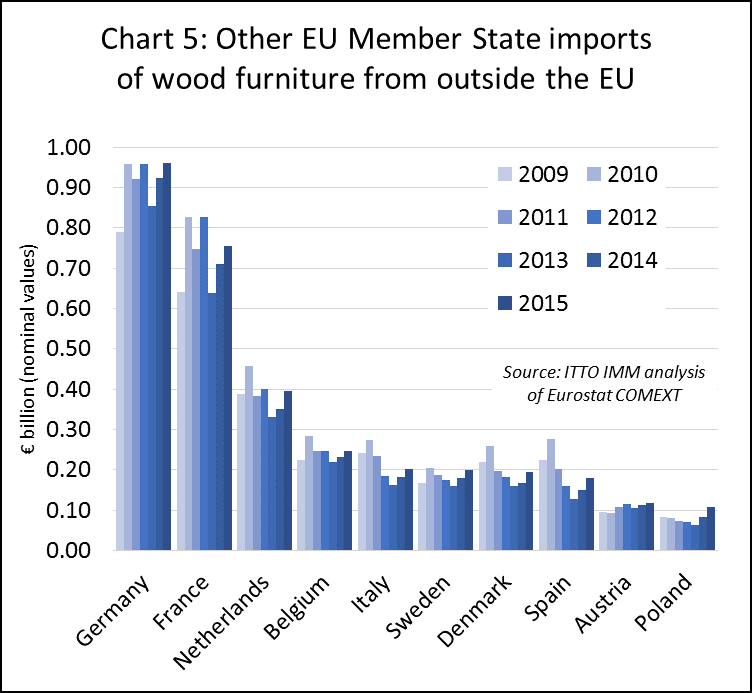

While the UK remained the dominant market, all ten of the next largest importers of wood furniture from outside the EU showed growth in 2015, many by double-digit percentages (Chart 5). There was healthy growth in imports by Germany (+4.1% to €969.2 million), France (+6.5% to €755.9 million), Netherlands (+13.1% to €396.2 million), Belgium (+6.9% to €247.6 million), Italy (+10.3% to €201.1 million), Sweden (+10.4% to €199.3 million), Denmark (+15.8% to €194.8 million) and Spain (+21.1% to €180.5 million).

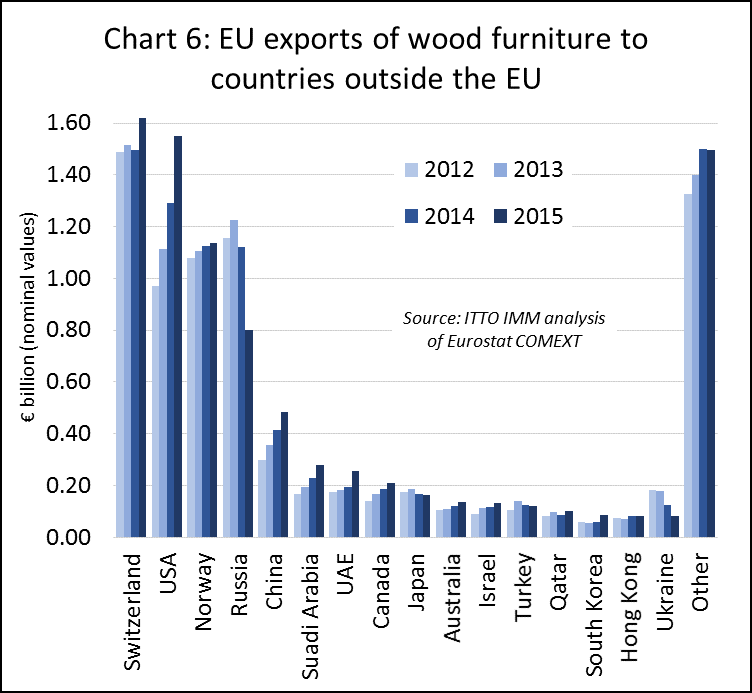

The three most important export markets for EU wood furniture are Switzerland, the USA and Norway. Taken together these three markets accounted for almost half of the EU’s wood furniture exports last year.

Exports to Switzerland (+8.3% to €1.62 billion) and the USA (+20.1% to €1.55 billion) increased particularly rapidly in 2015 (Chart 6). This is partly attributable to EU exports’ increased competitiveness due to the loss in value of the euro and other European currencies including the Polish zloty and the Swedish krona against the Swiss frank and the US dollar. For example, the average value of the euro was $1.11 in 2015, 16.5% less than in 2014 ($1.33). And compared to 2009 ($1.39) the average value was 20% less, according to the German federal statistics office Destatis.

In addition to the weakness of the European currencies, exports to the US were also boosted by gradual strengthening of the housing market, and further economic stabilisation and job creation in the US.

Russia was the only large export market for European furniture to show decline last year. In fact, exports to Russia fell sharply by 28.5% to €801.3 million, the lowest figure in seven years and even less than the value exported to Russia in 2009 (€861.8 million). Some of this is again due to exchange rate trends: the rouble was even weaker than the euro in 2015 and showed strong fluctuations during the year.

Russia’s economy is currently undergoing tough times, due partly to the low oil price and also to trade sanctions imposed by various nations in connection with the Ukrainian conflict. According to the World Bank’s Russia Monthly Economic Developments in December 2015, “consumer demand continued to dwindle amid high inflation and contracting real wages”.

EU wood furniture exports to China (+16.9% to €483.6 million), Saudi Arabia (+22.1% to €276.9 million) and United Arab Emirates (+31.7% to €256.2 million) all increased sharply in 2015 and also during the seven-year period between 2009-2015.

Germany and Italy achieve healthy export growth

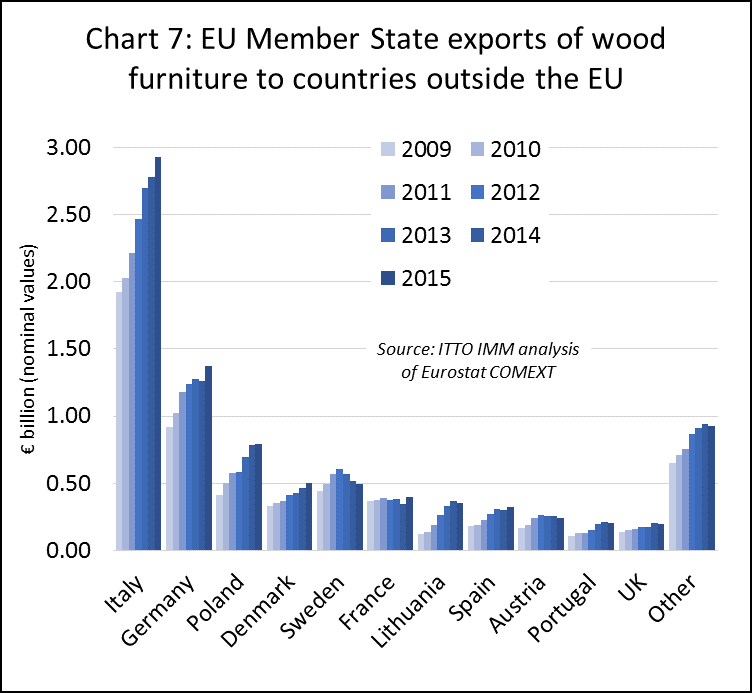

Germany and Italy, the traditional heavyweights in European furniture making, both achieved above-average growth in their wood furniture exports to countries outside the EU last year. German wood furniture exports were up 9% to €1.37 billion and Italian exports grew 5.5% to €2.93 billion (Chart 7).

According to the German furniture federation VDM, Germany’s total furniture exports exceeded €10 billion for the first time ever in 2015. This figure includes all exports of wood and non-wood furniture to both EU and non-EU countries. VDM reports German furniture sales to markets outside of the Eurozone increased in particular. Exports to the US, for example, increased 25.6% in 2015. VDM believes that the weakness of the euro was one of the driving forces behind export growth, in addition to the reputation of the “Made in Germany” brand.

The Italian Center for Industrial Studies (Csil) also reports a positive recent trend for the Italian furniture industry in its World Furniture Magazine. Both Italy’s domestic furniture consumption and exports to European and non-European countries increased last year. For 2016, Csil reckons with further signs of growth in Italy. International demand is expected to remain strong but slow down slightly compared to 2015.

Growth in wood furniture exports from Poland, which is the third most important EU exporter and has seen large increases in most of the last seven years, slowed down to just +1.2% and a total of €791 million last year. Other non-Eurozone EU countries experienced similar or even weaker trends: exports from Sweden, for example, fell by 5.3% to €492 million, those from Lithuania by 4.1% to €351 million and those from the UK by 1.5% to €200 million. On the other hand, Denmark’s wood furniture exports increased 8.8% to €504 million. And Portugal and Austria were unable to benefit from the weak euro, with a fall in wood furniture exports by 4.4% to €204 million and 5.9% to €241 million, respectively.

Among the remaining important wood furniture exporters in the Eurozone, France recorded growth by 14.4% to €394 million and Spain by 7.2% to €322 million.

Uncertain furniture outlook

In spite of signs of a stabilisation and a more sustained recovery in various European markets as well as in the US, development of the world economy and of furniture demand over the next few years remains uncertain. Difficulties in Russia, the low oil price as well as a more subdued development in China might all have an impact on global wood furniture consumption in the near future.

In Europe, the financial crisis remains a threat lurking in the background and the short and long-term consequences of a potential “Brexit” – both for the UK and the EU – are impossible to predict.

The German IFO Institute’s Eurozone Economic Climate report expects recovery in the Eurozone to continue at a moderate pace. Private consumption is expected to be the main driver behind the small GDP upturn of around 0.4% in each of the first and second quarter of 2016.

IFO sees the main risks for further economic stabilisation in a possible escalation of the conflicts in the Middle East, which could “unsettle consumers, producers and investors across the world“. Moreover, the authors of the report also fear that “the ongoing structural transformation of the Chinese economy, from an export and investment-driven economy to a consumption-driven one (…) may once again lead to capital outflows from the emerging countries”. This could lead to renewed turbulence in financial markets.

EUTR enforcement

Another area of uncertainty for importers of wood products into the EU is the status of EUTR enforcement. Indonesian manufacturers will be expecting to build on and accelerate the relatively slow growth in sales of furniture and other products to the EU in 2015 when the first FLEGT licenses are issued for Indonesian products, now expected in the third quarter of 2016. These licenses, issued as one important outcome of the VPA between Indonesia and the EU, will allow Indonesian products to be placed on the EU market without the need for any further due diligence on the part of the importer.

FLEGT licences are expected to greatly simplify and reduce the costs of EUTR conformance for individual EU operators dealing in products from Indonesia. They should also give Indonesian products an edge over competitors from non-VPA countries. However this is heavily dependent on effective enforcement of EUTR by EU authorities.

To date EUTR enforcement activities have been fairly low key, a situation partly explained by the time it has taken for EU Member States to introduce sanction regimes, and to build capacity and experience at national level. EUTR is an innovative and complex regulation and it is perhaps inevitable that there have been teething problems in implementation.

EUTR implementation has been particularly challenging during a period of austerity in the EU which has meant that in some Member States there has been unwillingness to commit resources. Indeed the European Commission was forced in late 2015 to start legal action against four Member States – Hungary, Greece, Romania and Spain – for their failure to introduce the necessary enforcement measures.

Meanwhile other Member States, while introducing the necessary legal frameworks, deliberately introduced a grace period to provide time to build understanding both in government agencies and the timber trade of the practical steps required for effective due diligence,

However there are now signs that enforcement agencies in some Member States are moving out of the implementation phase and becoming more determined to take action against operators in breach of the legislation.

According to a recent article by Forest Trends, Sweden and the Netherlands have formally notified two companies that imported wood products from Cameroon and Myanmar—allegedly without undertaking effective Due Diligence—that they may be subject to sanction.

Both these actions, announced almost simultaneously in mid-March, were primarily civil enforcement measures aimed at stopping the marketing of potentially illegal wood. These are not currently criminal cases such as those which have been prosecuted in the United States under the Lacey Act. However, if the importing companies fail to act within the given timescales, administrative sanctions can be imposed. The Dutch case has been presented to the public prosecutor as a potential criminal case, with a decision pending.

According to Forest Trends, the Netherlands Food and Consumer Product Safety Authority (NVWA) has issued an injunction notice to Fibois BV Purmerend for importing wood from CTT Ltd, a supplier in Cameroon. If the Dutch company doesn’t stop placing the wood on the market in the Netherlands, it will face a fine. Drawing on information from the Dutch Timber Trade Federation (VVNH), Forest Trends emphasise that Fibois plans to appeal the government’s action.

In addition, Forest Trends note that the case has been sent to the National Prosecutors’ Office, and could be brought before a judge for a potential criminal law sanction. The NVWA cited the failure of the company to mitigate the “risk of illegal harvesting” inherent in purchasing wood from Cameroon given the “political situation in the Congo Basin.”

In announcing the case, the Dutch Government also noted that its main enforcement focus in the future will be on furniture imports from China, Vietnam, and India.

With respect to the Swedish case, Forest Trends report that this involves imports of teak flooring by a Swedish company called Retlog Ltd. The flooring was processed in Thailand using logs from Myanmar. The Swedish enforcement agency publicly referenced the high incidence of forest sector corruption in the source country as a key determinant of risk. This was reinforced by the EUTR Guidance Document Feb 2016 issued by the European Commission in February, which explicitly noted corruption as a criterion for judging risk in an EUTR-compliant Due Diligence System.

Forest Trends observe that the Swedish case is also significant for the involvement of Bureau Veritas in its role as EUTR Monitoring Organisation. Monitoring Organisations are formally recognised by the European Commission as competent to develop and support implementation of due diligence procedures on behalf of groups of operators. They form a key part of the EU’s strategy to ensure EUTR conformance is not too burdensome on small operators in the EU.

Forest Trends suggest that Bureau Veritas considered shipments under 1,000 cubic metres to be of negligible risk. However neither the EUTR legislation nor any guidance have such a threshold, so it is unclear how Bureau Veritas arrived at this assumption. This raises important questions about where liability lies if a Monitoring Organisation, which is formally endorsed by the EC, promotes due diligence requirements that might be viewed as non-conformant by individual EUTR Competent Authorities.

PDF of this article:

Copyright ITTO 2020 – All rights reserved