A single word describes the current state of the joinery sector in Europe. That word is “flat”. It’s also a reasonable description of the state of the European economy as a whole. There are a few bright spots – notably the UK – but not enough to offset slow demand elsewhere.

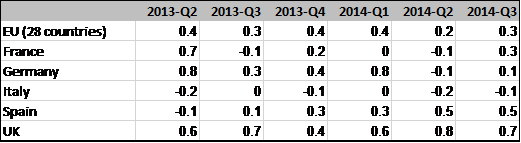

Total GDP across the EU expanded by 0.3% in the third quarter of 2014, only slightly better than 0.2% growth recorded in the second quarter (Table 1). Growth in the UK and Spain was good in Q3 2014. France recovered sufficiently in Q3 2014 to avoid entering a technical recession (usually defined by a fall in GDP in two successive quarters). Germany also avoided this fate, but just barely. Italy continued to decline.

Table 1: Quarterly change in GDP for the EU28 and selected EU countries

Note: shows GDP growth rates with respect to the previous quarter – source Eurostat

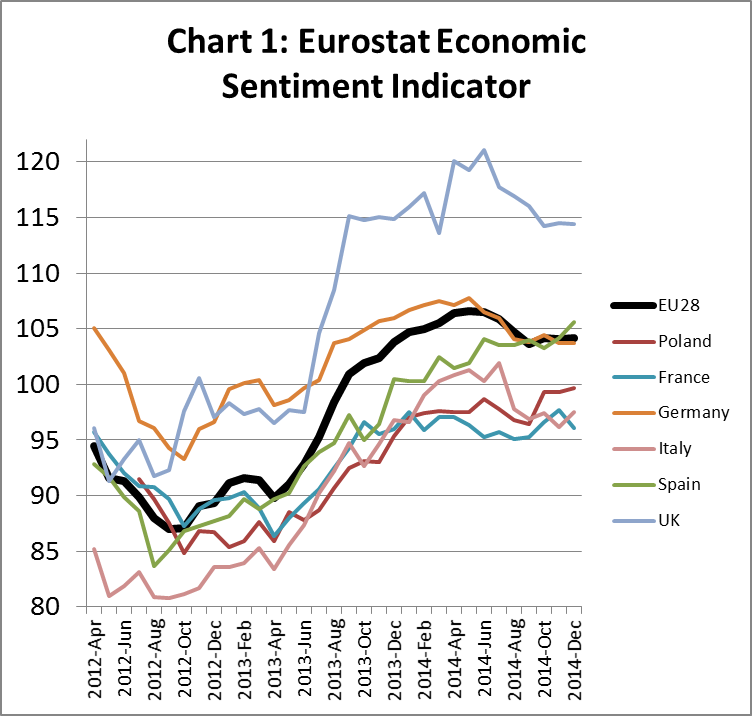

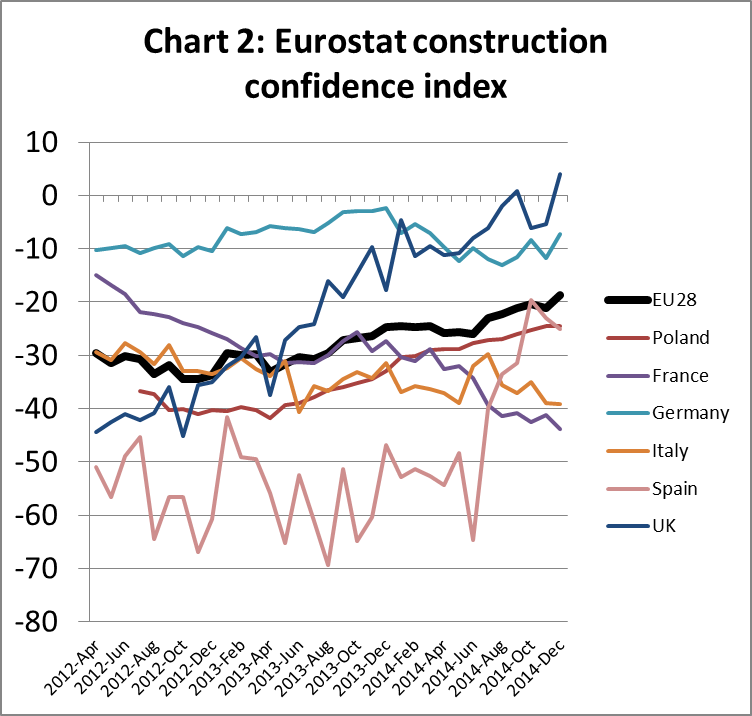

Economic Sentiment in the EU was rising in the first half of 2014 but falling in the second half of the year (Chart 1). Construction confidence in Europe continued to rise to the end of 2014 (Chart 2). However this was mainly on the back of better performance in the UK and Spain and overall sentiment is still in negative territory (meaning that a majority of construction companies still expect order books and employment levels to fall in the next 3 months).

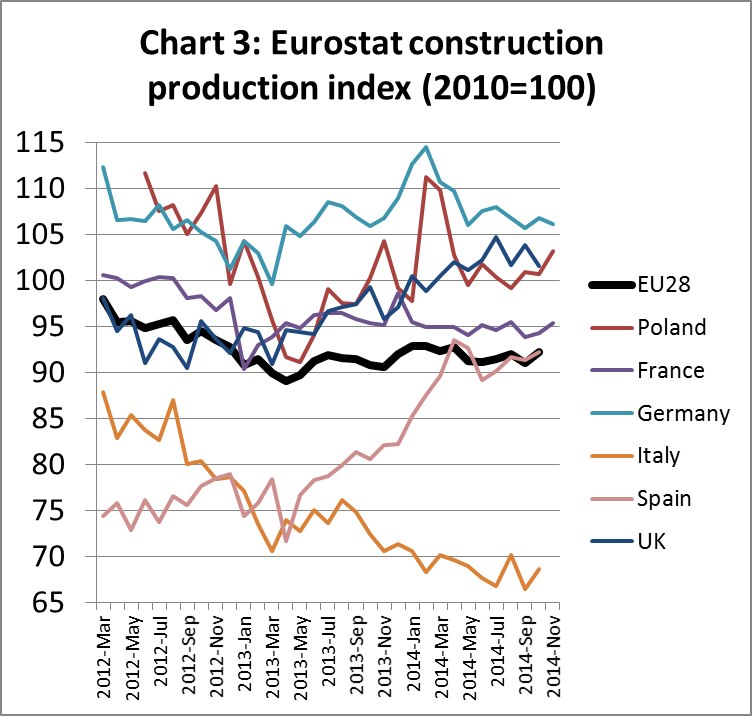

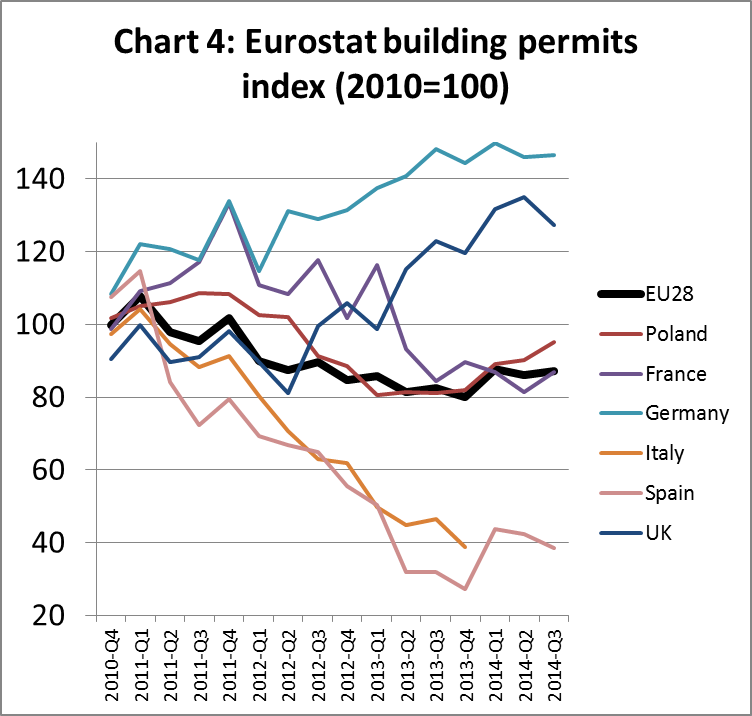

Having recovered a little in the second quarter of 2013, EU construction production remained stubbornly stuck at 8% below the 2010 level at least until November 2014 (Chart 3). Data on building permits is more encouraging. These increased across the EU in the first quarter of 2014 and remained at the higher level in the next 2 quarters (Chart 4).

There follows more detailed consideration of construction sector activity at national level in the EU. This draws on results of the latest European Architects Barometer (EAB) survey of 1,600 architects undertaken by Archi-Vision in eight European countries for the third quarter of 2014.

Germany: there are clear signs of slowing growth in both the national economy and construction sector. The EAB survey showed only very slow growth in architect’s order books and turnover in Q3 2014. All three economic confidence indicators (consumer, industrial and construction) declined slightly in Germany during the same period. Archi-Vision estimates German construction grew 1% in 2014 and will grow at the same slow rate in both 2015 and 2016.

UK: the construction sector continued to strengthen in the second half of 2014 but at a slower pace than in the first half. Building permits for both residential and non-residential construction in the UK are stable, although some confidence indicators show a slight decrease. The EAB indicates that UK architectural firms remained positive in Q3 2014 with strong order books and expectations of good turnover development. Archi-Vision estimate that the UK construction market increased 3% in 2014 and will continue to grow at the same rate in 2015. Growth is forecast to slow only slightly to 2% in 2016.

France: construction sector activity is contracting again. The EAB indicates architects order books fell sharply in Q3 2014. Archi-Vision estimates French construction activity fell 2% in 2014 and will fall another 1% in 2015 before stabilising at the lower level in 2016.

Spain: while well down on pre-recession levels, the construction market is slowly improving. The Eurostat construction production index indicates significantly higher levels of Spanish output in 2014 compared to the previous year. According to EAB, architects order books increased in each of the first three quarters of 2014. However these positive figures do not align to the building permit trend. Permits for residential construction in Spain have been stable but there was a fall in non-residential permits in the second and third quarters of 2014. In contrast to Eurostat, Archi-Vision reckon that Spanish construction fell around 4% in 2014. Archi-vision forecast a further 1% contraction in 2015 and zero growth in 2016.

Italy: the construction market continues to slide and the outlook remains very poor. The EAB indicates architects order books were falling in the first three quarters of 2014. In Q3 2014, 50% of Italian architects reported negative developments in their order book and only 11% reported positive developments. Data on Italian building permits in 2014 has yet to be published, but data for 2013 showed permits at only 40% of the 2010 level. This will dampen construction activity for several years. After declining 11% in 2013, Arch-Vision estimates that Italy’s construction market fell 7% in 2014 and will fall a further 4% in 2015 and 1% in 2016.

Netherlands: the construction market is recovering, but only very slowly. The EAB survey indicates that architects order books increased again in the third quarter of 2014, continuing a rising trend which began in the second half of 2013. Positive architectural sentiment is also reflected in other economic indicators including consumer, industrial and construction confidence. The Eurostat construction production index indicates activity remained flat at around 90% of the 2010 level throughout 2014. Archi-Vision estimate that construction activity in the Netherlands increased by 1% in 2014 and that growth will pick up to 2% in 2015 and 3% in 2016.

Belgium: the market is slow but tending to rise overall. However signals from various indicators of construction activity are mixed. The Eurostat construction production index shows rising activity between March 2013 and March 2014, but then a slight decline in activity during the rest of the year. In contrast, EAB indicates a marginal improvement in architects’ order books in the second and third quarters of 2014. The building permit figures also show contrasting developments: a big fall for residential permits but a steady increase for non-residential. Archi-Vision estimate 2% growth in Belgian construction activity in 2014 and predict equivalent levels of growth in both 2015 and 2016.

Poland: construction market activity was only moderate in 2014 but is growing slowly. Unlike other large EU economies, Poland’s construction sector relies heavily on new build which accounts for 73% of total volume. Eurostat’s construction production index for Poland increased sharply between May 2013 and March 2014, but then slipped in April 2014 before stabilising at a moderate level for the rest of the year. The EAB indicates architects order books improved in the first half of 2014, but weakened a little in the third quarter of the year. The Eurostat construction confidence index for Poland was rising throughout 2014, but still remains in negative territory. However there was good growth in building permits in the first 3 quarters of 2014 suggesting better prospects in 2015. Archi-Vision estimate that construction activity increased 2% in 2014 and forecast the same rate of growth in 2015 rising to 3% in 2016.

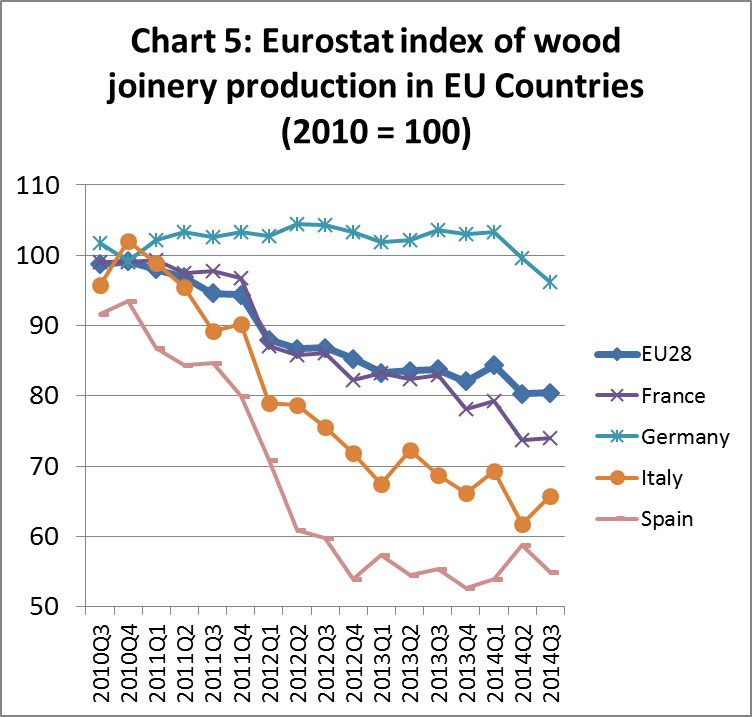

No change in EU joinery production in third quarter of 2014

The Eurostat index of joinery production in EU countries (which excludes flooring but includes doors, windows and glulam) shows that production was stationary at around 80% of the 2010 level in both the second and third quarters of 2014 (Chart 5). A slight upturn in production in Italy and the UK was not sufficient to offset a decline in Germany and Spain.

Downturn in European window and door market forecast for 2015

According to an article in EUWID, the European timber trade journal, the German building fittings producer Roto Frank AG is forecasting a further downturn in European window and door markets in 2015. Roto Frank AG also highlights that Polish manufacturers are playing a more important role in the overall European market.

Roto Frank AG reports that the European window and door market softened more than expected in 2014. A big decline in sales in South and Eastern Europe more than offset slightly higher sales in the UK, Germany and Switzerland.

Roto Frank AG also reports that growth in window and door consumption in Germany during 2014 was mainly supplied by imports from other European countries, notably Poland. In 2014, Poland’s output of windows and doors jumped sharply despite a fall in the domestic market. As a result more Polish-made products are now being exported to other European countries.

Sales by German manufacturers in 2014 were around 6-8 % lower than the previous year. Manufacturers in France and Italy also posted sharp falls in sales in 2014, while the Spanish market has stabilised. The Russian market for windows and doors is believed to have recorded double-digit decreases due to the Ukraine crisis, sanctions and unfavourable exchange rates.

Roto Frank AG suggests sales by German window and door manufacturers will decline again in 2015, primarily due to persistent weakness in the renovation sector. With the exception of the UK, Roto Frank AG expects the European market to stagnate in 2015. The slump in Russia and Ukraine is expected to intensify.

European joinery product import trends

As noted in previous reports, imports make up only a very small component of EU consumption of joinery products. In 2013, only €275 million (4.5%) of the €6.06 billion of wooden doors supplied to the EU were imported. In the case of wood windows, €23 million (0.4%) of the €5.96 billion supplied were imported. In 2013, glulam imports were 112,000 m3, only 4% of the 2.76 million m3 supplied to the EU.

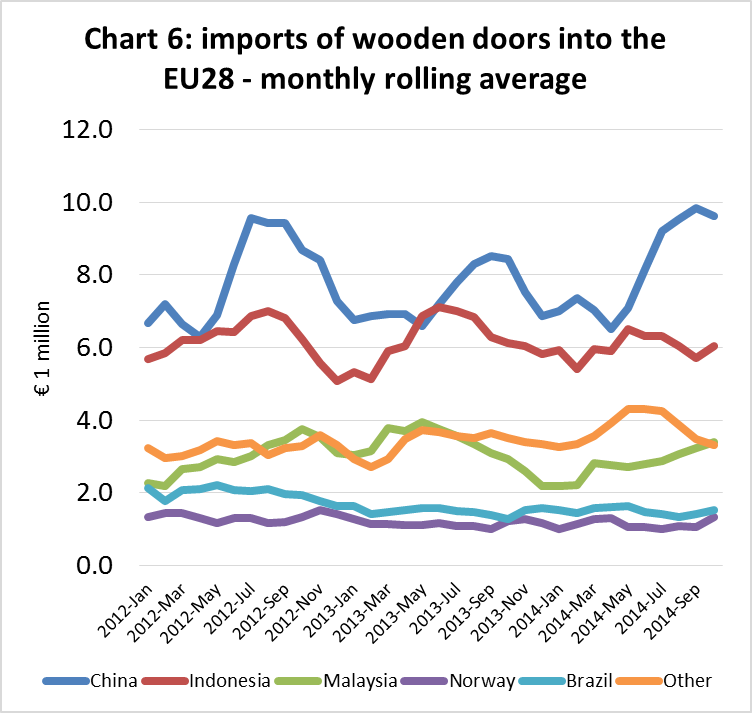

The monthly trend in wooden door imports into the EU from leading supply countries during the 2012-2014 period is shown in Chart 6. Imports from China, the largest external supplier to the region, have been volatile but generally rising during this period. There was a particularly sharp increase in EU wooden door imports from China between April 2014 and October 2014. The EU imported doors from China with a total value of €10 million in both October and November 2014, the highest level for several years.

EU imports of wood doors from Indonesia, now the second largest external supply country, have consistently averaged €6 million per month during the last three years. Imports from other supply countries have remained relatively stable at a low level over the same period.

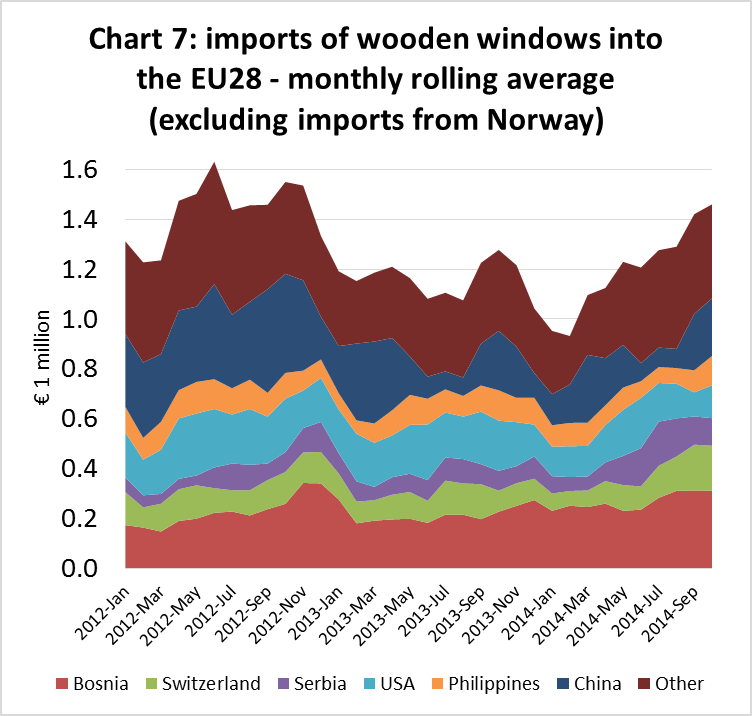

The small quantity of finished wood windows imported into the EU derive mainly from other European countries (Chart 7). This highlights the importance of proximity to the customer in the wood window sector.

Total EU imports of wood windows, which rarely exceed €1.4 million per month, were rising at the end of 2014, mainly from Bosnia and Switzerland. Imports from China are very limited and have declined in recent years. Most of the small volume of wood windows imported into the EU from the tropics derive from the Philippines.

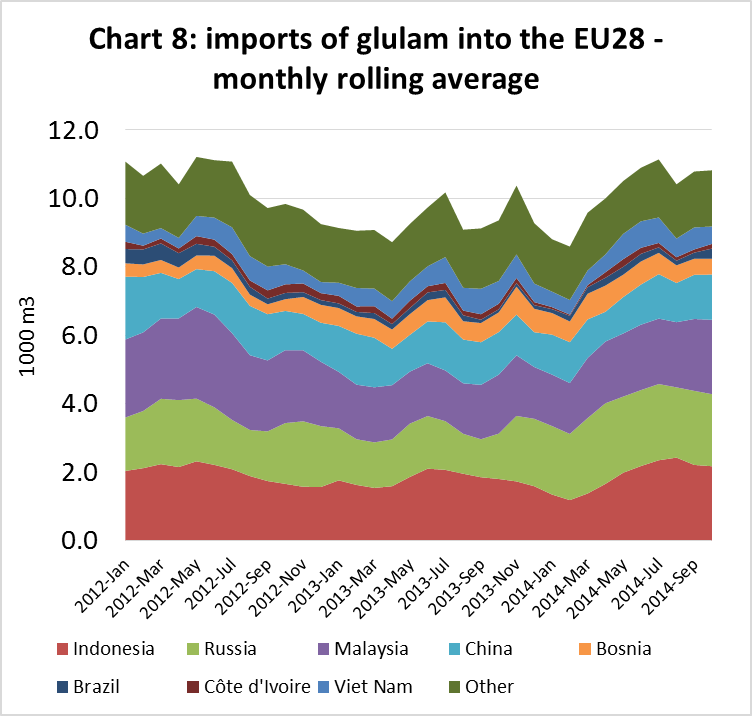

In line with the overall trend in the joinery sector, EU imports of glulam have remained flat over the last three years, averaging around 10000 m3 per month (Chart 8). Much of this product comprises relatively small dimension glulam for window frames. There was a slight increase in imports of meranti scantling from Indonesia and Malaysia, and of Siberian larch scantlings from Russia and China in the second half of 2014.

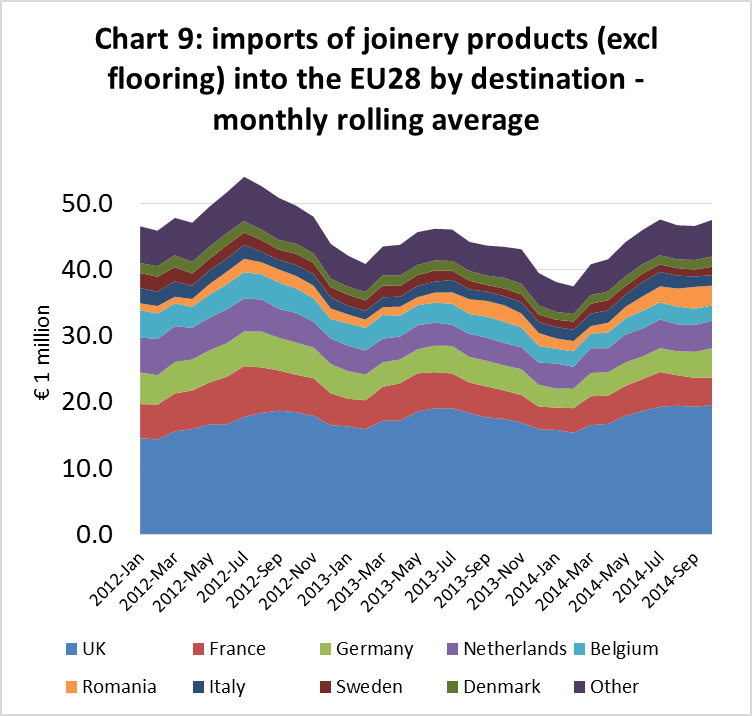

Chart 9 shows that much of the recent growth in EU imports of joinery products from outside the region is destined for the UK, which alone accounts for around 40% of all import value. Of other EU import markets, only Romania showed signs of growth during 2014. Imports from outside the EU into France, Belgium, Germany, and the Netherlands were either stable or slightly declining.

PDF of this article:

Copyright ITTO 2020 – All rights reserved