In 2007, prior to the economic crises in Europe, the EU as a whole contributed 22% of the value of all global imports of timber products (Chart 1). As such, it was the world’s largest single importer of timber. Since then, the EU has declined in relative importance, in 2011 accounting for 17% of global wood imports, and is now a smaller importer than China (which in 2011 accounted for 19% of global timber imports). The relative decline is associated both with the rising importance of China as a consumer and manufacturer of timber products and with the dramatic decline in European consumption in response to broader economic trends. Nevertheless, Europe maintains a prominent position in the global wood trade, not only because of trade volume, but also due to the leading role of European retailers, manufacturers, designers and brands in wood product innovation, design and marketing, and of European policy makers in setting of technical and environmental standards.

The economic situation in Europe

The financial crisis in the western world began in 2007 and 2008 with credit losses in the US mortgage market, which quickly spread to Europe where many banks were heavily exposed to the US property market. This in turn led to a major tightening in availability of mortgages in Europe and a rapid contraction in the European housing market and a collapse in new construction. Highly indebted European governments struggled to bail out the weakened banks, particularly as tax receipts fell with rising unemployment and falling consumer spending. Governments lacked resources to boost public spending to tide the economy over the recession and instead were forced to implement tough austerity measures.

This in turn has led to rising political tension in the euro-zone between more heavily indebted nations and less indebted countries, notably Germany, that are being asked to provide additional financial support. Disagreements among key policymakers over the appropriate crisis response, and a complex EU policy-making process have increased anxiety over the future of the single currency in financial markets.

Financial market pressure against several euro-zone countries increased during the summer of 2012, when there was concern that the crisis was spreading from Greece, Ireland, and Portugal, three relatively small economies, to Italy and Spain, the third- and fourth-largest economies in the euro-zone. More recent developments have temporarily calmed markets, including a pledge by the European Central Bank to intervene in bond markets to help troubled euro-zone countries, and agreements by EU countries to establish a permanent European rescue fund and a single banking supervisor.

But more broadly, many of the fundamental challenges in the euro-zone remain, including lack of economic growth and high unemployment and many still question the euro’s future. The EU’s official statistics agency Eurostat recently confirmed that the combined GDP of euro-zone members fell by 0.2% in the second quarter of 2012, an annualized drop of 0.7%. An index of output in manufacturing and services from Markit, a research firm, based on purchasing-manager reports in July and August, is pointing to a further fall in GDP in the third quarter.

The big bright spot within the 17-country euro-area has been Germany’s continuing strength. Its economy, which makes up over a quarter of the euro zone’s output, expanded by 0.3% in the second quarter, leaving it 1% bigger than a year earlier. But the German light is dimming, too. In September the Organization for Economic Cooperation and Development said the economies of Germany and France have been shrinking since the end of second quarter, and will continue to contract until the end of the year.

Outside the euro-zone, there is better news in the UK. The squeeze on income is easing as inflation falls and wages edge up. Business surveys suggest activity is picking up. A slight fall in GDP in the second quarter of this year is expected to be followed by positive growth in the third quarter. However the country’s recovery is likely to be modest.

Construction sector activity

Demand for wood products in Europe is closely tied to construction sector activity. Demand for sawn softwood and OSB, used widely for structural applications particularly in Northern and Central Europe, is mainly driven by new residential construction. Demand for sawn hardwood, used mainly for higher- class joinery and finishing applications, is more closely associated with repair, modification and improvement (RMI) activity. Despite competitive pressure from other panel products like OSB and MDF in some applications, Europe continues to consume a wide range of plywood products for numerous indoor and external applications. Demand for plywood is therefore driven both by new residential and RMI activity.

Western Europe, in the wake of the global financial crisis, has seen its 2011 average housing completions decline by 50% from a 2006 peak. But the decline was not consistent throughout that region. In Spain, the housing market dropped from 866,000 starts in 2006 to an estimated 76,000 in 2011 – a 91% drop. Although eastern Europe is doing better than western Europe, the absolute size of the former market is not sufficient to cover the lost demand in western Europe. The near collapse of the western European construction market since 2007 has translated into significantly lower-than-average demand; and with that, a downward pressure on prices for many wood products in Europe. Forecasts for construction activity, which seemed to be turning more positive in 2011, have deteriorated again during 2012. At its June 2012 conference, the European construction organisation “Euroconstruct” revised downwards forecasts for EU construction sector activity in 2012, now expecting a decline of 2.1%.

In contrast, the RMI market has remained more robust during the recession, falling only 10% from the record levels of 2008-2009. Euroconstruct forecast that the sector is expected to return to record levels by 2014. This is partly due to home owners investing in improvements to their existing properties as it has become increasingly difficult to obtain mortgages to buy new properties.

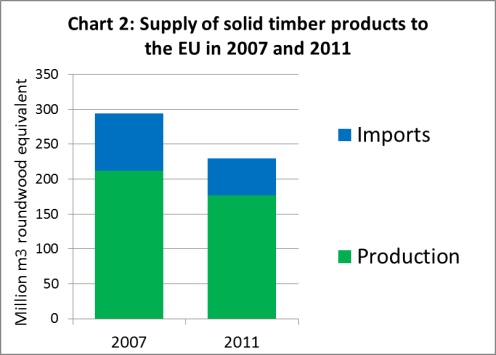

European supply of timber products from saw and veneer logs

Chart 2 summarises total supply of solid wood products[1] to the EU-25[2] group countries in 2011 and 2007 measured in roundwood equivalent (RWE) volume. It clearly shows the effect of the recession in Europe and associated decline in construction activity which has led to a big fall in consumption of wood-based products. Wood supply to the EU declined 22% between 2007 and 2011, from 294 million m3 to 230 million m3. Chart 2 also suggests that domestic producers have generally hung on to a greater share of the European market than the importing sector over the last 5 years. In volume terms, the share of domestic wood in the overall supply of solid wood products to the European market increased from 72% in 2007 to 77% in 2011. In 2011, supply comprised 176 million m3 of domestically harvested saw and veneer logs supplemented by 53 million m3 of wood products imported from outside the region.

[1] RWE volume data is provided for solid wood products assumed to be derived from saw and veneer logs. Composite panels, such as MDF and OSB, and pulp and paper products are not included as it is assumed these derive from small dimension logs or wood waste material. While imported wood joinery and wood furniture products contain a significant proportion of composite panels, for this analysis it is assumed these are made of solid timber. RWE volumes calculated for these products are therefore likely to be over-estimates.

[2] Data for EU-25 rather than EU-27 is used to simplify comparison between 2007 and 2011. While Romania and Bulgaria joined the EU on 1 January 2007, comprehensive trade data for these countries in year 2007 was not available for this review.

European wood supply is very heavily dominated by softwood, which accounts for around 90% of all saw and veneer logs harvested within the EU. The vast majority of this is converted into sawn wood and relatively little into veneer and plywood. As a result Europe is almost entirely self-sufficient in softwood sawn wood. European imports are much more heavily concentrated on hardwood products, particularly sawn wood and plywood, which are less readily available from domestic forests.

A number of factors explain the relative increase in share of domestic wood in overall European supply over the last five years. One important factor was the progressive increase in log export taxes in Russia between 2007 and 2009. This encouraged Finnish and Swedish processors to focus more on developing domestic log supplies. Another factor has been lack of access to credit amongst European buyers. This has encouraged greater risk aversion and concerted moves across the trade to greatly reduce inventory and increase dependence on short-term trading. In some sectors this has favoured domestic suppliers with shorter lead times.

There have also been technical innovations designed to increase the range of suitable applications of domestic woods. These include heat treatment techniques allowing use of European wood species for external applications formerly dominated by tropical wood, and a huge variety of staining and finishing techniques to alter the look and feel of European hardwoods, particularly oak.

While these measures have improved the competitiveness of domestic producers during the recession, these producers have still come under severe financial pressure. They have faced narrowing margins as consumption and prices for semi-finished and finished products have declined, while log and other raw material prices have remained stubbornly high. Many domestic operators have lost the battle for survival and there has been a wave of closures in the European wood processing sector over the last five years.

EU wood imports from China and the rest of the world

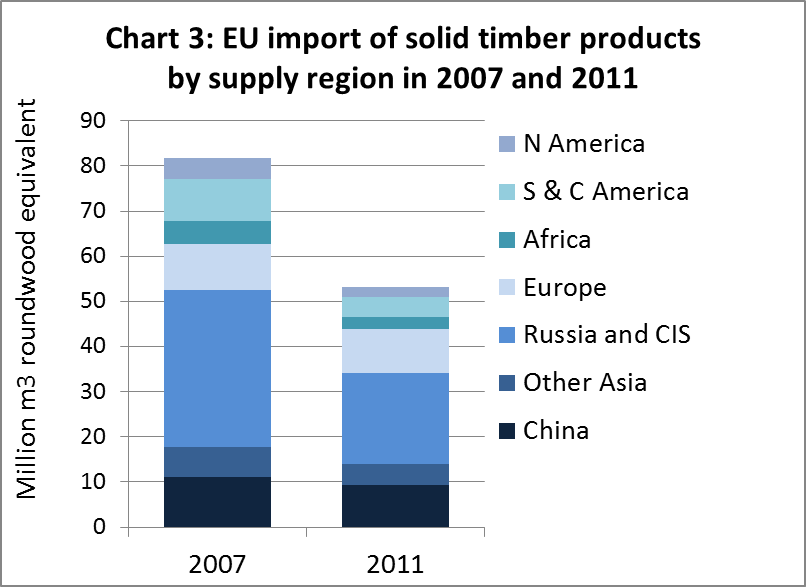

Chart 3 shows that overall EU-25 imports of solid timber products fell 35% from 82 million m3 (RWE) in 2007 to 53 million m3 in 2011. It highlights the decline in imports from the CIS region due to the introduction of log export taxes in Russia – a trend only partly offset by a slight rise in imports from European countries outside the EU.

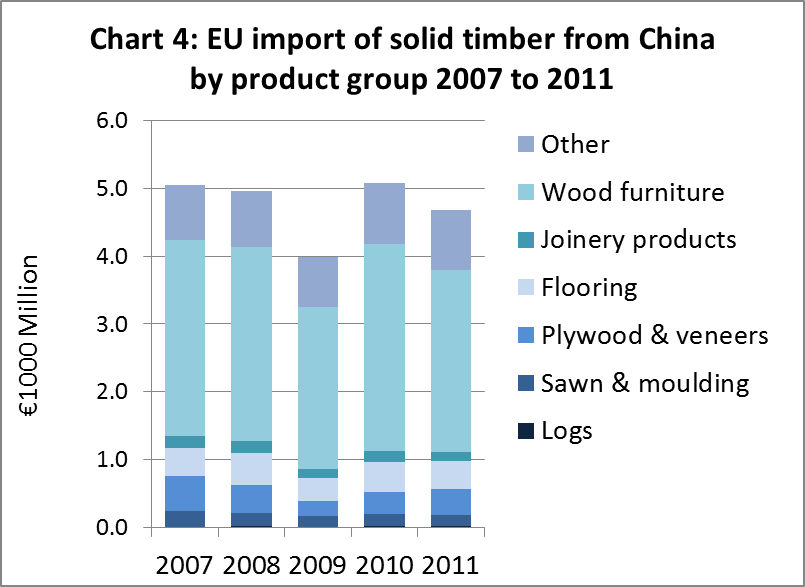

Chart 4 shows that EU imports from China are dominated by wood furniture, plywood and flooring. EU imports from China declined from €5 billion in 2007 to €4 billion in 2009 in the immediate aftermath of the economic crises, then recovered strongly in 2010, but weakened again in 2011. China’s share of overall EU wood imports increased dramatically during the economic crises, from 28% in 2007 to a peak of 36% in 2010. Rising costs in China and strengthening in the yuan-euro exchange rate from May 2011 onwards, combined with recent efforts by some European furniture manufacturers to improve international competitiveness, led to a minor erosion of China’s share of the European wood products markets during 2011, to 35%.

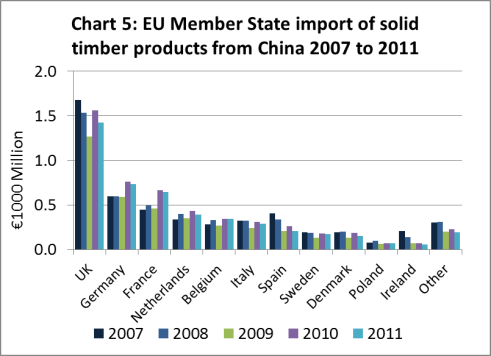

Chart 5 shows the value of wood products imported from China into EU Member States between 2007 and 2011. It highlights the significance of the UK as the leading market for Chinese wood products. UK imports of Chinese wood products are around €1.5 billion, well over double the value of imports into Germany, the next largest market. The UK’s importance is due both to the relative lack of a large domestic wood supply and high levels of consolidation in the UK retailing sector. As a result, it is been easier for Chinese manufacturers to identify buyers and market products in the UK than in other European countries where retailers are smaller and more fragmented. Nevertheless, Chinese exporters have been increasing sales into Germany and France over the last 2 years. On the other hand, economic recession led to a significant decline in Spain’s imports of Chinese wood products.

Composite wood panels

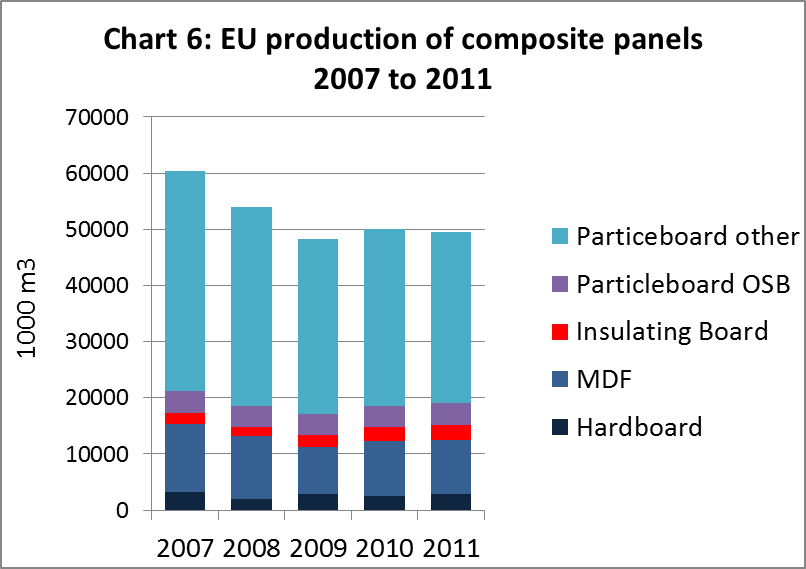

So far, this analysis of European wood supply has covered only “solid timber products” – that is products derived from saw logs and veneer logs. However, it is also important to consider the large volume of wood panels like MDF, OSB and other particleboard which are manufactured in Europe from smaller logs and waste material. Before the economic crises, Europe experienced a massive increase in production of these panels which peaked at around 60 million m3 in 2007.

Expanding production capacity of these panels has gone hand in hand with the development of a wide range of technical treatments and surface finishing technologies. Over time, there has been a substantial improvement in the dimensional accuracy, durability and surface properties of wood-based panels. Applications have expanded widely and now encompass flooring, furniture, kitchens, decorative panels, doors, mouldings, carcassing, concrete forming, packaging, structural elements and even, more recently, external joinery. Modern composite panels have been progressively eating into markets for solid timber products and real wood veneers. This trend has intensified as cost pressures have mounted during the recession.

Nevertheless, the European wood panels sector has faced significant challenges over the last 5 years. Chart 6 shows that European production of composite panels fell from 60 million m3 to 50 million m3 between 2007 and 2009 in response to the decline in construction activity and slowdown in European manufacturing of furniture, flooring and doors. Production has remained stable since then. Meanwhile prices of raw material have been rising at a time when there have been limited opportunities to raise product prices. Costs of pulp logs and wood waste have been increasing as EU policy measures have been encouraging diversion of more wood for “renewable” energy production.

The European wood panel sector has responded to these pressures in various ways. Output is being reduced. The constant search for opportunities to expand the range of end-use applications has continued. There’s also been a partial switch from higher cost locations in western Europe to lower cost production sites in parts of eastern Europe.

Outlook

This brief overview of the European wood supply and demand situation shows the high level of uncertainty in the market. The prolonged economic crises is the main source of uncertainty, but other factors include the threat to long term wood supply as demand increases from the energy sector, and the introduction of new products and technologies which threaten the market position of more traditional products.

Another complication is introduction of the EU Timber Regulation, due to be imposed across the European wood industry from 3 March 2013 in response to concerns about illegally sourced wood. The content and implications of this new law for suppliers in China and for the wider European wood trade will be considered in the November report.

As things stand, there seems little prospect of any significant upturn in European demand for wood products before the end of 2013 at the earliest. The best that can be hoped for over the next 12 months is for the market to remain stable, but significant downside risks remain. However for Chinese exporters, signs of slow improvement in the UK economy are encouraging and at least provide a reason for optimism.

PDF of this article:

Copyright ITTO 2020 – All rights reserved