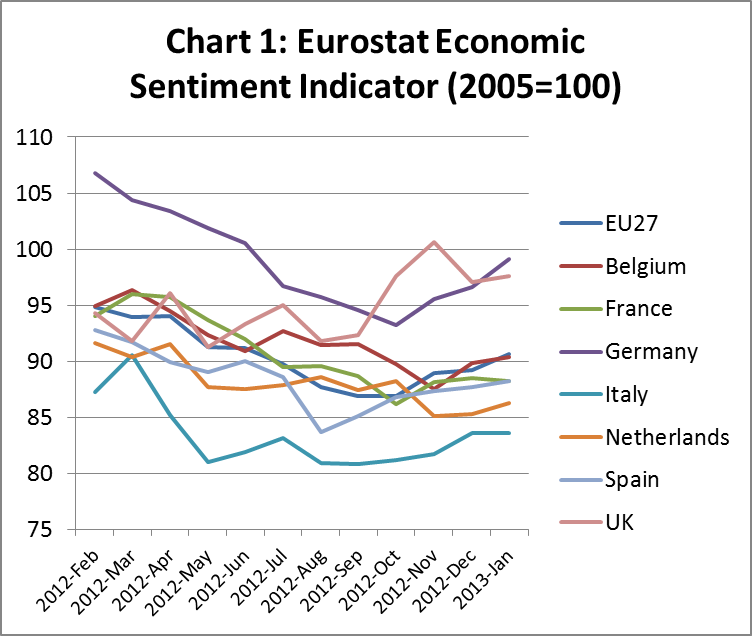

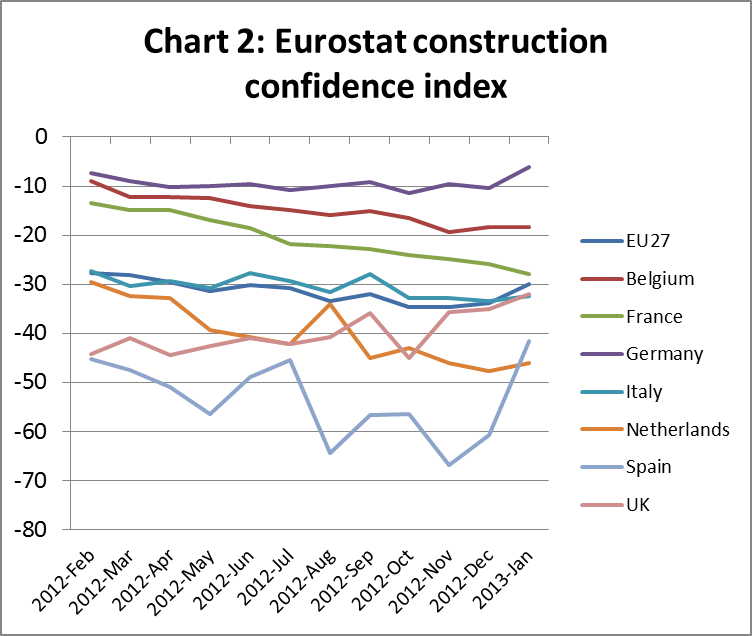

Prospects for the European economy seem more positive now than this time last year. The worst fears of a destructive “domino effect” that might have resulted from Greece or another country being forced out of the euro-zone have failed to materialise. The effects of the financial crises were largely contained within the most afflicted economies of southern Europe. The countries of central and north-western Europe, while experiencing higher than normal levels of economic volatility, have so far managed to weather the storm. Their relative stability has prevented the effects of the financial crises from trickling down throughout Europe. In recent months, several economic indicators in the EU, such as the Economic Sentiment Indicator and the Construction Confidence Index, have improved (see Charts 1 and 2). There is cautious optimism that economic reforms in the most troubled EU countries are beginning to work.

A very long hard road ahead

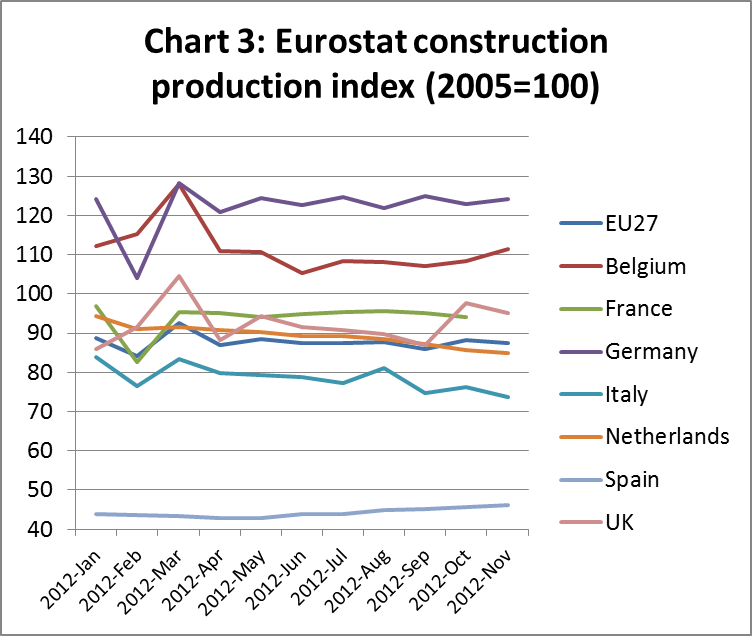

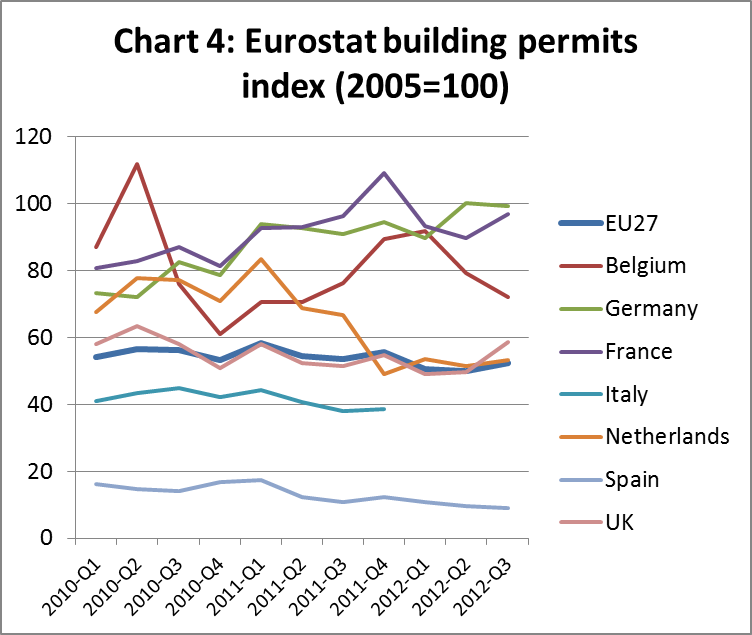

While confidence has risen, it is starting only from a very depressed level and remains well below pre-recessionary levels. Many serious underlying constraints to market growth remain. Financing and credit are still tight. Companies remain highly risk aversive. Activity in the construction sector remains very slow and may even decline further this year. Latest data for the Eurostat Construction Production Index (Chart 3) and Building Permits Index (Chart 4) have yet to show any sign that the market has turned a corner.

Fourth quarter 2012 GDP data for the large euro-zone economies – France, Germany, Italy, and Spain – has yet to be published, but economists are already pencilling in likely declines across the board. After a bouyant 3rd quarter of 2012, the UK economy shrank again (by 0.1%) in the last quarter of the year. Mario Draghi, president of the European Central Bank, was gloomy in his comments to the media on 7 February, suggesting that economic risk remains skewed to the downside and that there is likely to be further weakness in 2013.

Reports suggest EUTR already driving changes in EU trade

Already reports are emerging of significant changes in the EU wood import trade with China as a result of the EU Timber Regulation (EUTR). The legislation will be enforced from 3 March 2013. Most reports relate to plywood which is widely expected to be targeted by environmental groups hoping to raise awareness of EUTR by encouraging an early prosecution case.

EUTR makes importers personally liable and subject to potentially severe sanctions if they are found to be handling wood from an illegal source. They are also liable if they fail to demonstrate implementation of a “due diligence system” in line with requirements set out in the regulation. EU government authorities have generally been slow to build up capacity to enforce the law. However many importers are already taking action to ensure legal compliance. This is due as much to the fear of the negative publicity and business disruption surrounding a prosecution case as it is to the legal sanctions.

At the end of 2012, there were reports of some EU plywood importers taking early action to build up landed stocks of sensitive products, notably uncertified plywood manufactured in China, in advance of the 3rd March 2013 deadline. The aim was to ensure they had sufficient material on the ground in Europe to give breathing space for introduction of the due diligence systems. As these systems are now being implemented, and any new orders will arrive after the 3 March deadline, European importers are now being much more selective in the plywood products being bought from China.

Poplar/bintangor plywood and mixed light hardwood plywood with bintangor, red canarium, red pencil cedar or similar types of wood are mainly affected. European importers are concerned that the legal origin of these wood types cannot be documented with sufficient certainty. Some importers are also not ordering birch plywood and softwood plywood with Russian spruce veneers made in China. This is due to concern that procedures for verifying the legality of Russian logs imported into China are inadequate and may be influenced by corruption.

EUTR likely to encourage consolidation in EU timber trade

Another potentially significant impact of EUTR is to encourage increasing consolidation of the international wood products trade. Representatives of some large European wood importers report that they are already seeing an upturn in business as many smaller importers are being discouraged by the risks associated with direct imports from outside the EU. EUTR controls and sanctions only apply to the company that “first places” wood on the EU market. This is leading to a situation whereby larger European companies with the resources and large networks required for effective due diligence of supply chains outside the EU are offering this as an extra service to European customers.

Although it is too early to tell for sure, one possible result of EUTR is that many smaller companies will stop importing direct from outside the EU. Instead they will only purchase timber products already placed on the market by larger importers.

Meanwhile EUTR is also expected to encourage greater consolidation amongst overseas suppliers into the EU. There are already reports of European importers concentrating their purchases of wood products amongst a more limited range of overseas suppliers. Purchases are focused more on those companies best able to provide credible evidence of legality – ideally through independent systems of certification or legality verification. There is also concern to simplify and increase transparency of overseas supply chains. These trends tend to benefit larger companies with more vertically-integrated supply chains and that have capital for investment in due diligence and certification. EU buying is also more likely to be concentrated on those overseas suppliers that own or manage their own forest concessions rather than those that source through third party trading companies.

Europe’s role in the international furniture sector

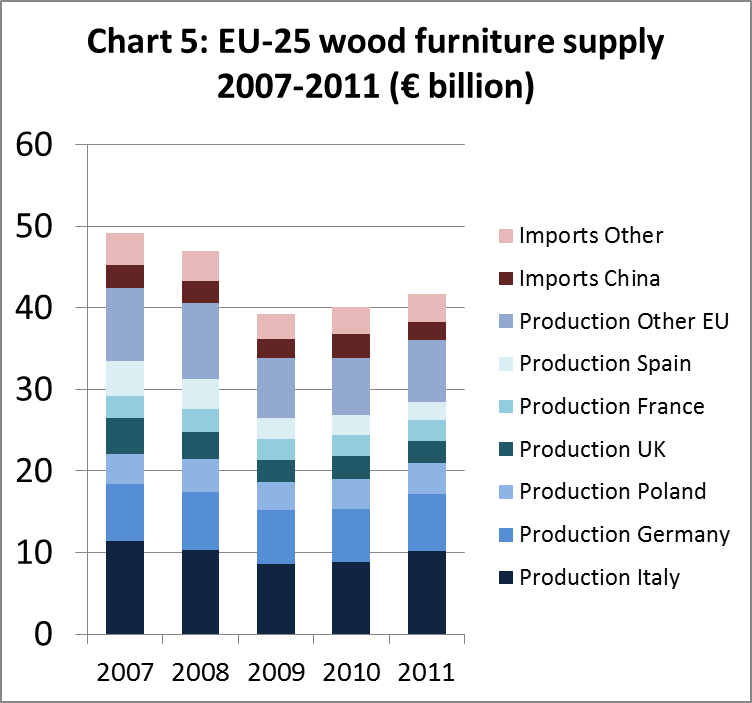

The EU’s furniture sector remains a major global player, not just due to its size but also because of its role to influence international fashion and design trends. The EU accounts for around one quarter of world furniture production and consumption. However, the EU’s role in the global furniture market has changed dramatically during the last decade, particularly during the financial crises in western countries. In 2011, EU production of wood furniture was valued at €36 billion, down from €42 billion in 2007 (Chart 5). The EU has moved from the first to the second position (after China) amongst the world’s major producing areas.

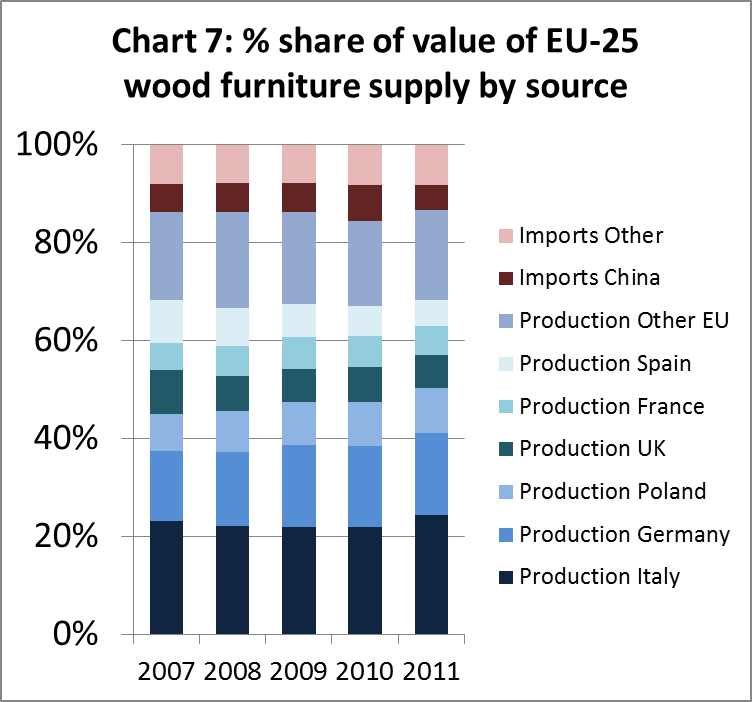

While furniture manufacturing in Eastern Europe has risen during the last decade, particularly in Poland, the traditional western European manufacturing countries still retain a very large share of EU furniture production capacity. In fact, the two largest western European producers, Italy and Germany, together account for over 40% of all wood furniture supplied into the EU, and this share was actually rising during the five year period between 2007 to 2011 (Charts 5 and 7). Despite widespread reports of declining consumption and intense competition during those years, the value of wood furniture production in the leading western European manufacturing countries remained very resilient.

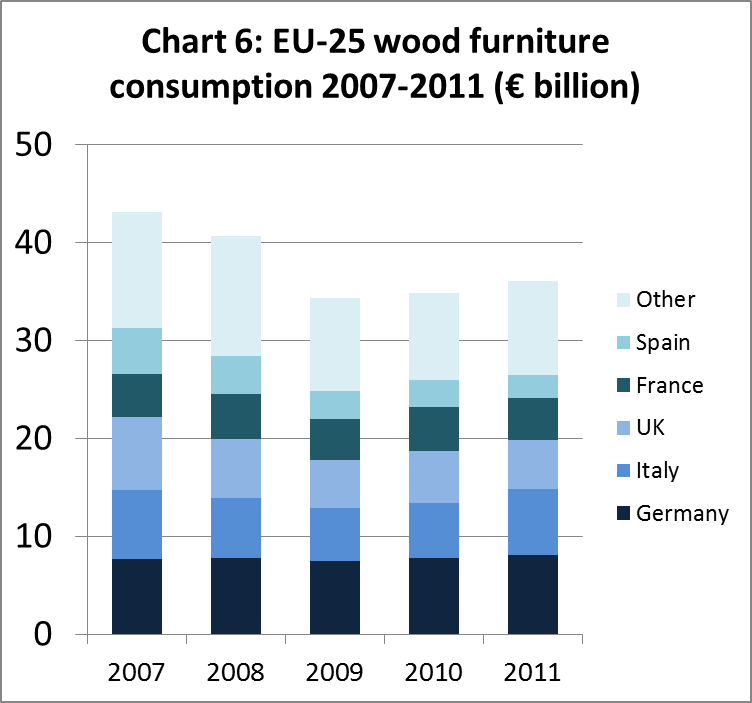

In addition to being major producers, European countries remain major consumers of furniture products despite the recession (Chart 6). EU wood furniture consumption fell from €43.2 billion to €34.4 billion between 2007 and 2009. Consumption then recovered slowly to 36.1 billion in 2011. The recovery was particularly robust in Germany, now the EU’s largest market. Germany consumed €8.1 billion of wood furniture in 2011, up from €7.4 billion in 2009. There was also strong recovery in Italy, the EU’s second largest market for wood furniture. Italian wood furniture consumption increased from €5.5 billion in 2009 to €6.8 billion in 2011. In the UK and France wood furniture consumption was quite stable between 2009 and 2011 at around €5 billion and €4.4 billion respectively. However consumption in Spain continued to fall during this period from €2.9 billion in 2009 to €2.4 billion in 2011.

Domestic manufacturers continue to dominate European market

While the EU’s presence on the global furniture market has declined in recent years, European manufacturers have remained very dominant in their domestic markets. The share of imports in total EU wood furniture supply peaked at only 16% in 2010 before falling away again to 13% in 2011 (Chart 7). This is in contrast to the United States, for example, where a very large section of the furniture manufacturing industry shifted to lower cost locations, particularly China, during the 2000 to 2008 period.

The continuing dominance of local manufacturers in the European market might seem surprising given relatively high labour and other costs of production in Europe. There a number of reasons for this. One factor is the high level of investment in machinery and product development in the European furniture sector. This has reduced the relative contribution of labour to overall costs, and placed a premium on technical, design and market knowledge. It has boosted the general quality of European products and perceived value of European brands. European manufacturers have built on this through sophisticated marketing and communication campaigns. This in turn has encouraged high levels of loyalty to European products amongst consumers.

European manufacturers have also exploited other advantages of proximity to the consumer. Increasingly important factors in wood furniture marketing include the ability to supply quickly on demand, respond rapidly to changing tastes, and to provide customers with support services – including “no-questions-asked” guarantees for customers wanting to return products.

In many European countries, the retailing sector is quite fragmented with many smaller companies. Selling into these countries requires local knowledge and a large network of contacts. It’s no accident that the UK, where the retailing sector is more dominated by large companies, is also the European country with the largest market penetration by Chinese and other Asian suppliers.

For all these reasons, European manufacturers choosing to relocate during the last decade have tended to opt for countries in Eastern Europe which offer a good compromise between lower costs of production and continued proximity to the large consuming markets of Western Europe. German manufacturers have tended to shift to Poland, while many Italian manufacturers opted for Slovenia.

The IKEA factor

It’s not possible to discuss the distribution of wood furniture manufacturing in Europe without reference to IKEA. The Swedish-based corporate giant operates a network of 332 stores in 38 countries and has a global annual turnover of $31 billion. As such, IKEA claims 6.1% share of the entire world furniture market. Around three quarters of IKEA’s sales are in Europe where it is hugely dominant at the budget end of the market.

While IKEA has been expanding sales operations into other parts of the world, its manufacturing base remains firmly rooted in Europe. IKEA’s wood furniture manufacturing facilities are operated by the IKEA subsidiary Swedwood. This company currently manages 49 production units, all but two of which are in Europe (the others being in Russia and the USA). Swedwood facilities employ around 17,000 people and manufacture approximately 100 million units of furniture each year. Around two thirds of Swedwood production is in eastern European countries, with a high concentration in Poland. Much of the rest of production is located in Western Europe (Sweden, Germany and Portugal).

Operating under its lean production concept, the Swedwood Way of Production (SWOP), the organisation has forced down costs by focusing heavily on efficiency and waste reduction. There is considerable investment in R&D, both to increase efficiency and product quality. This is seen as vital to the company’s reputation and success. The business has become a leader in robotic automation of the furniture manufacturing process. Swedwood also sees it as vital to be located close to its market in order to respond to local demands.

Until the onset of recession, Swedwood was very actively increasing production activity close to large consuming markets in Europe and North America. In 2008 it opened five new state-of-the-art factories in Sweden, Poland, Russia, the US and Portugal. Since then the company has temporarily suspended its plans to increase capacity. However its’ long term strategy, once demand begins to pick up, is to further expand manufacturing in Europe and other large consuming markets.

China’s position in the EU furniture market

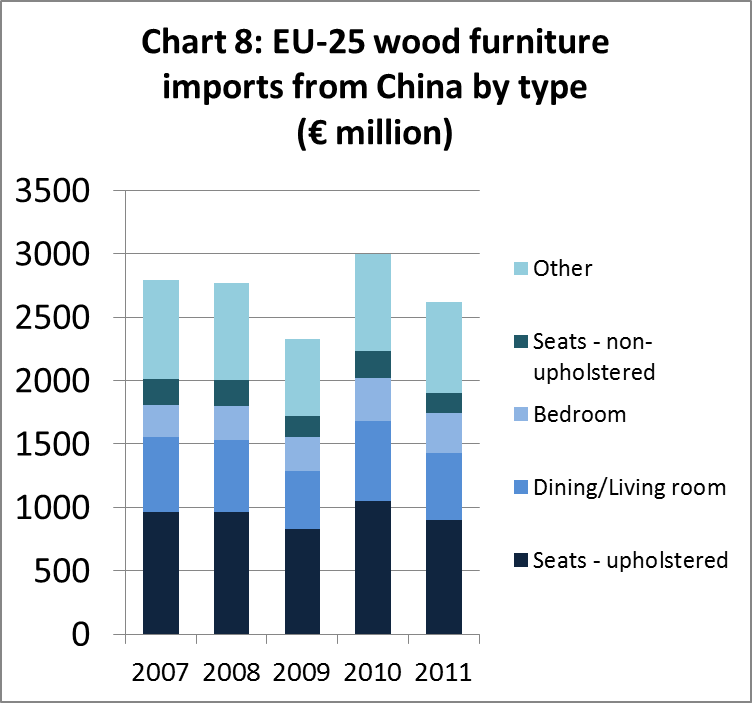

EU imports of wood furniture from China have been very volatile in recent years (Chart 8). Imports fell sharply at the height of the financial crises, from €2.8 billion in 2008 to only €2.3 billion in 2009. However they then rebounded strongly to reach a peak of €3 billion in 2010. However, this import level seriously over-shot actual consumption and imports fell back again to €2.6 billion in 2011. In 2011, upholstered seating was the main wood furniture product imported into the EU from China, accounting for 34% of import value. Of the remainder, 20% was dining/living room furniture, 12% was bedroom furniture, 6% was non-upholstered seating and 28% other product categories.

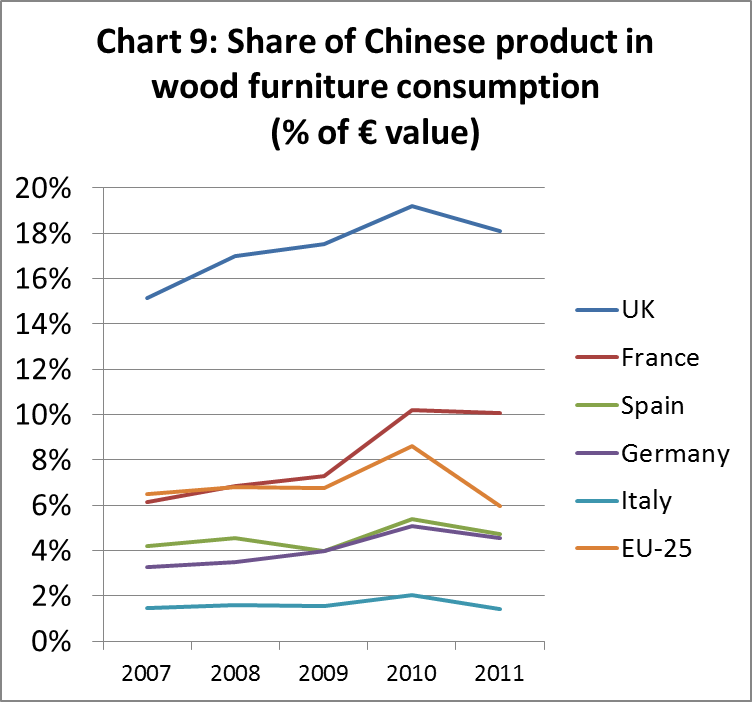

China’s share in total EU wood furniture consumption peaked in 2010, at 8%, before falling away to 6% in 2011 (Chart 9). China’s penetration of the market varies widely between EU Member States, from 16% in the UK to less than 2% in Italy.

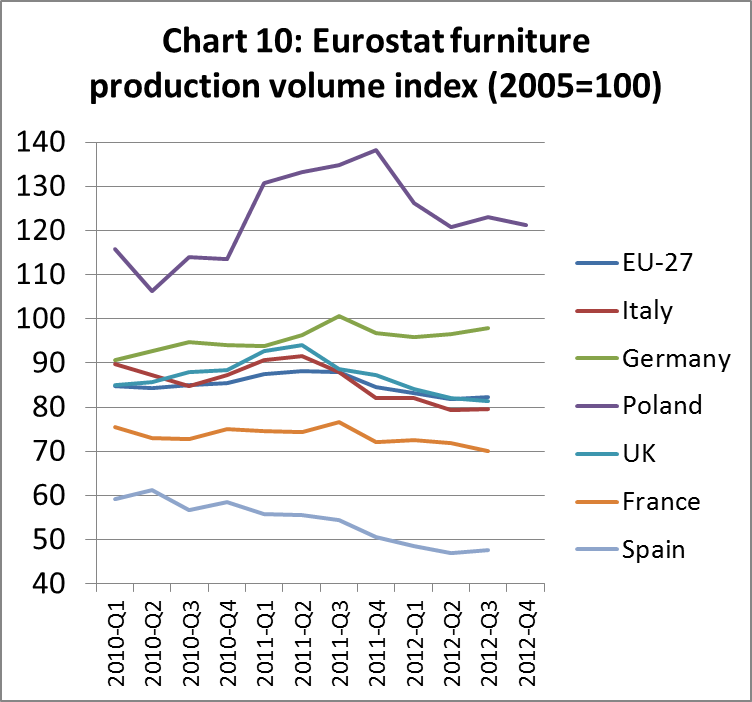

Recent trends and outlook for the European furniture market The most recent Eurostat data indicates that wood furniture production across the EU region was only around 83% of pre-recession levels during 2012 and still trending downwards (Chart 10). Furniture production during the first nine months of 2012 in Italy, Poland, the UK, France and Spain was significantly lower than during the same period the previous year. However production in Germany during 2012 was higher than in 2011.

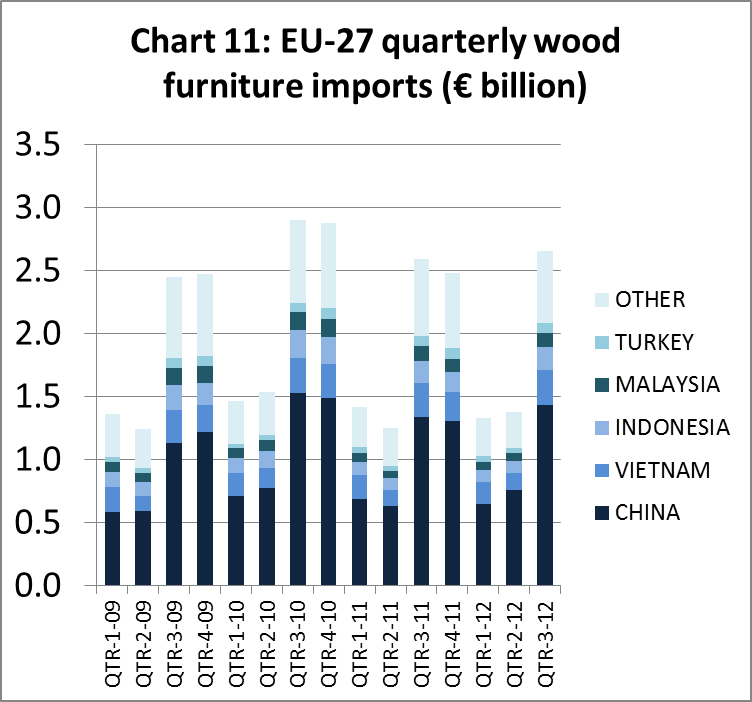

Trends in EU wood furniture imports during 2012 are more difficult to assess due to the highly seasonal nature of trade and lack of published data for the last quarter of the year – when a large proportion of product is imported in time for Christmas and the January sales period (Chart 11). However, quarterly data to end September 2012 suggests that imports last year were very similar to 2011 but still well down on the 2010 peak.

One potentially significant trend is a gradual but consistent increase in the share of total EU wood furniture import value derived from China from 46% in the 3rd quarter of 2009 to 54% in the same quarter of 2012. Much of China’s increase in share has been at the expense of South East Asian countries, including Vietnam, Indonesia and Malaysia.

Forecasts for the European furniture industry issued by the research organisation CSIL in December 2012 are quite cautious. CSIL suggest the value of European furniture consumption fell by -1% in 2012 and is likely to remain stable at this lower level in 2013. CSIL forecast that over the next 12 months, demand will be slightly stronger in the Scandinavian countries, stable in the UK and Central Europe, but will weaken further in southern European countries.

PDF of this article:

Copyright ITTO 2020 – All rights reserved