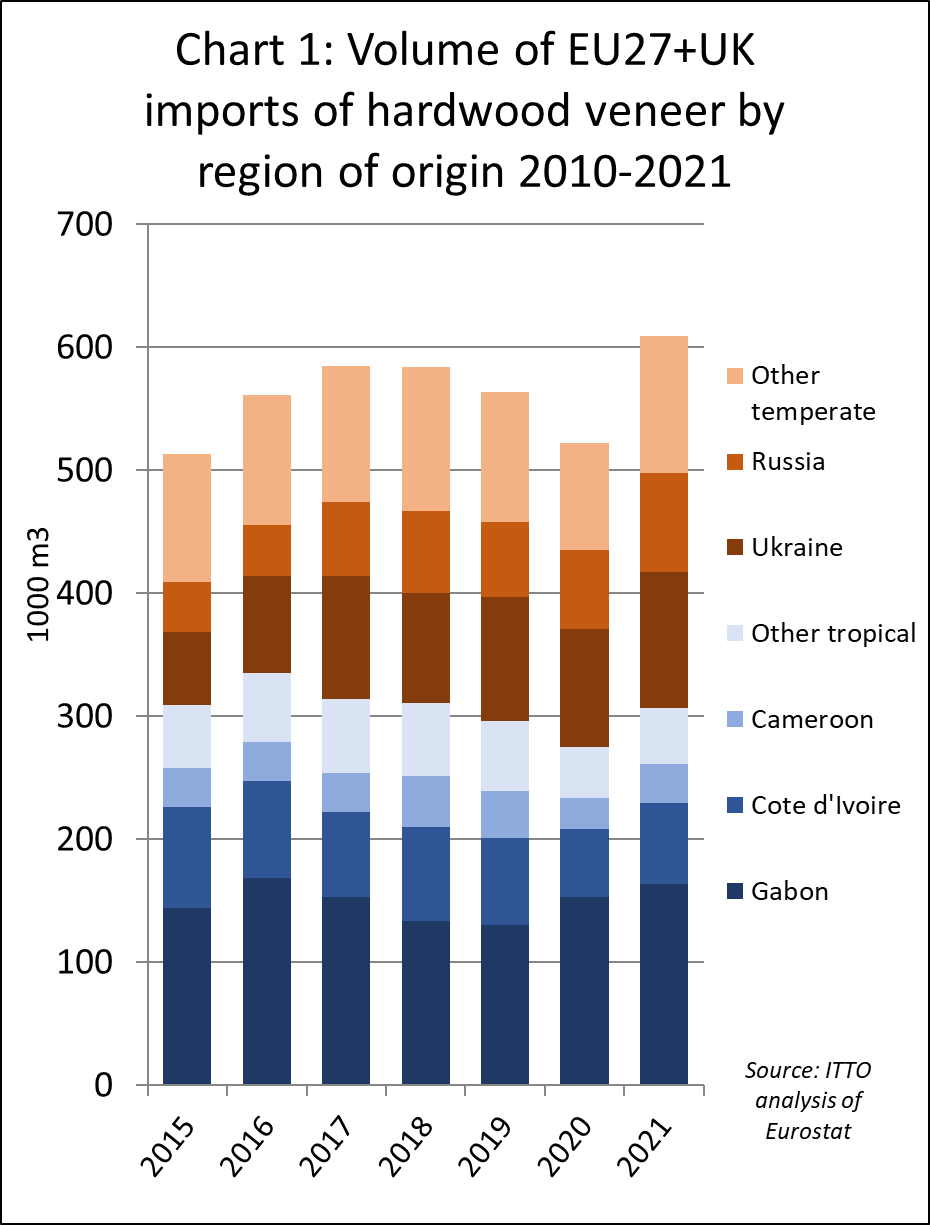

In 2021, the 27 countries of the EU together with the UK (UK27+UK) imported 609,000 m3 of hardwood veneer from outside the region, 17% more than in 2020. EU27+UK imports from temperate countries increased 23% to 303,000 m3 in 2021 while imports from the tropics were up 11% to 307,000 m3 (Chart 1).

In 2021, tropical hardwood accounted for just over 50% of EU27+UK hardwood veneer imports, down from 53% in 2020 and continuing a long term decline from nearly 70% a decade before. The tropical loss of import share in this sector in recent years is primarily due to rising EU27+UK imports of veneer from Ukraine and Russia as both countries tightened log export controls and attracted new investment in veneer production facilities.

EU27+UK imports of tropical rotary veneer have also fallen as production of tropical hardwood plywood inside Europe has been replaced by imports of finished plywood products, and the tropical plywood sector as a whole has faced mounting competition from Chinese and Russian products. Demand for tropical sliced veneer has been affected in the long term by shifting fashions in the decorative hardwood sector away from tropical wood towards temperate species, particularly oak.

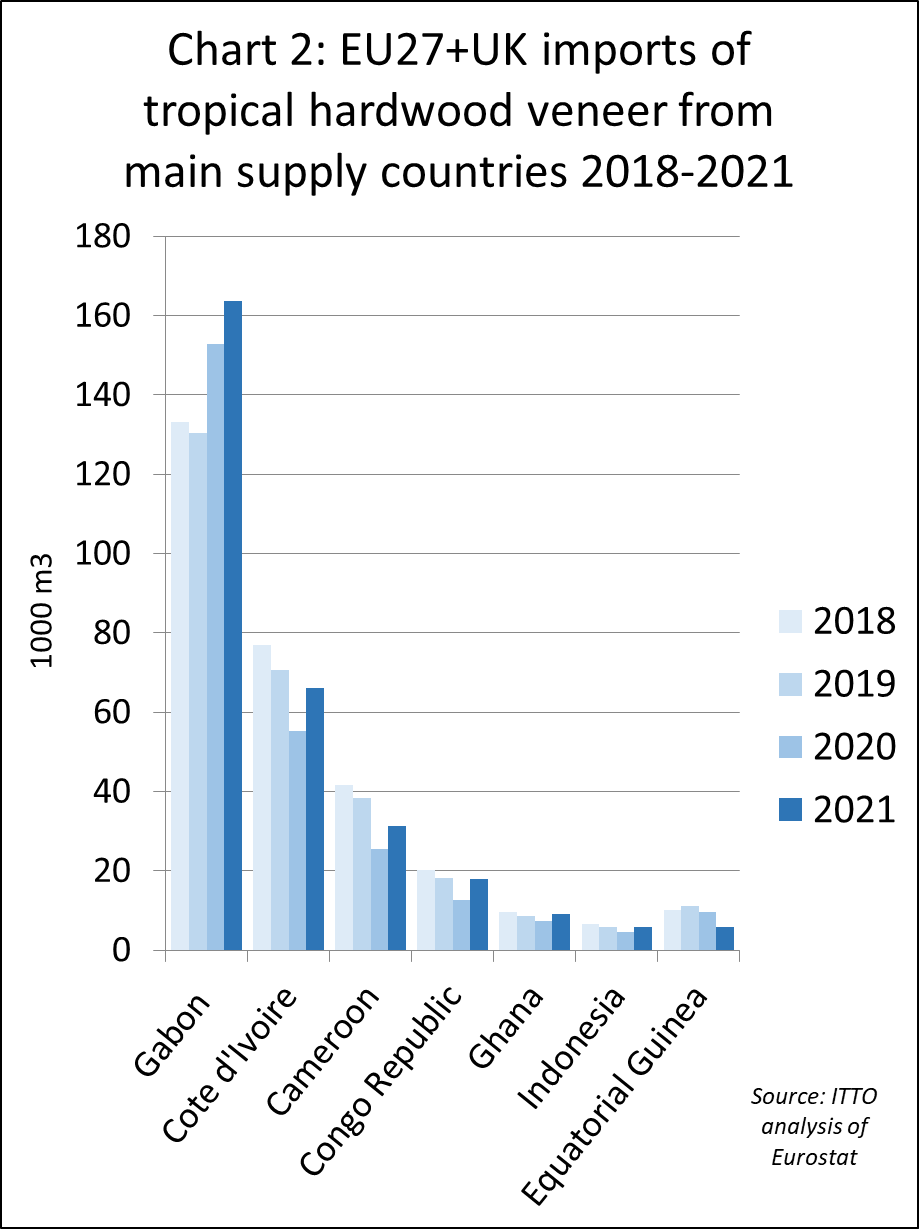

Gabon is now by far the largest tropical supplier of hardwood veneer to the EU27+UK, volume rising 7% to 164,000 m3 in 2021, following a 17% rise the previous year (Chart 2). Nearly two thirds (65%) of EU imports of veneer from Gabon are destined for France, with the remainder going to Greece (15%), Italy (10%) and Spain (5%).

Apart from Gabon, the other large tropical veneer suppliers to the EU27+UK are Cote d’Ivoire (+21% to 66,000 m3 in 2021, mainly to Italy, Spain and Romania), Cameroon (+23% to 31,000 m3 in 2021 mainly to Italy and Spain), and the Republic of Congo (+41% to 18,000 m3 in 2021, mainly to Greece and France).

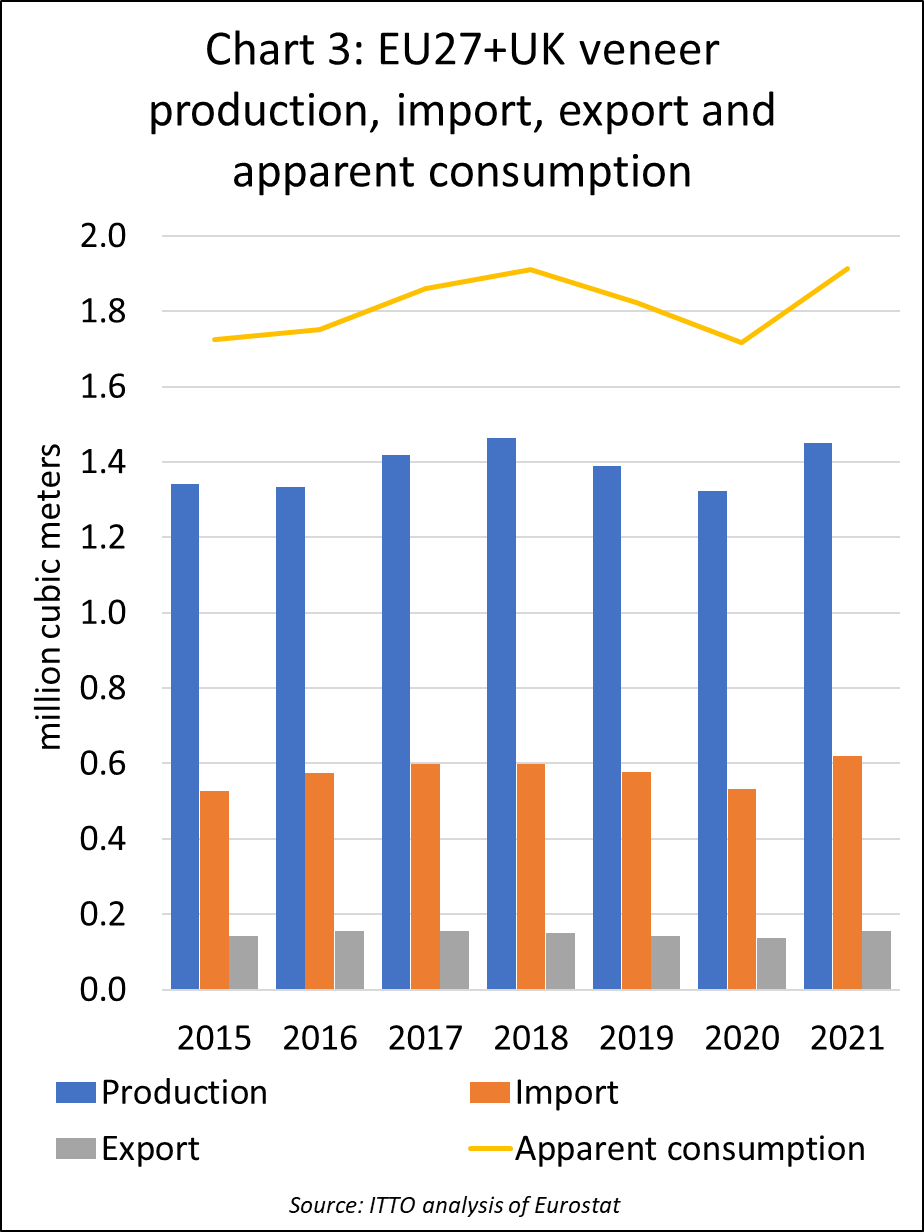

Total consumption of hardwood veneers in the EU27+UK was already falling in 2019 before the onset of the pandemic, driven by declining confidence in the European wood products manufacturing sector as the European and global economy showed signs of stagnation. A 5% fall in consumption in 2019 was followed by a 6% decline in the first year of the pandemic in 2020. However, consumption rebounded strongly, by around 11% to reach 1.9m m3 in 2021, recovering the ground lost in the previous two years (Chart 3).

The same factors that drove a sharp rise in EU27+UK sawn hardwood consumption in 2021 were evident in the veneer sector. This included the boom in private sector demand as homeowners invested in DIY, renovation and new furniture as spending declined on restaurants, vacations, and other leisure activities.

While this source of demand was abating in the second half of 2021, it was offset by rising activity in the commercial sector as large government stimulus measures began to kick in. In 2020 and 2021, these measures largely consisted of fiscal initiatives by national governments, such as VAT cuts, tax deferrals and loan guarantees for firms.

From 2022, money from the EU-wide €750 billion Recovery and Resilience facility is being disbursed with a focus on green investments, such as energy-efficient construction and building renovation. These funds are targeted towards highly indebted countries in Eastern and Southern Europe, notably Spain and Italy which are also large consumers of veneers.

Another factor driving rising demand for veneer in some parts of Europe is a partial switch away from solid lumber in favour of veneered panels. This shift was happening well before recent events, but there are reports from Spain, for example, that it has accelerated again following sharp rises in lumber prices since mid-2020. Continuing concern that the Spanish economy is recovering only slowly from the impacts of the pandemic, combined with general unwillingness of buyers in this country to pay higher prices, has led to a search for cheaper alternatives to hardwood lumber in the country.

The recovery in European furniture production during 2021, rising 8% during the year after a 7% decline in 2020 according to Eurostat data, was a major driver of rising veneer consumption last year. Although the war in Ukraine means the outlook for European growth in 2022 is now uncertain, the 4.4% growth in European furniture consumption forecast for this year issued by Italian furniture research organisation CSIL in January, is some grounds for optimism that veneer demand will remain strong in this sector.

The war in Ukraine has more immediate implications for the European veneer sector. Veneer imports from Ukraine and Russia, which are now by far the largest external suppliers of temperate hardwood veneer into the EU27+UK, is expected to largely halt this year. Together these two countries accounted for 64% of all temperate hardwood veneer imported into the EU27+UK in 2021. Between 2013 and 2021, EU27+UK imports of hardwood veneer from Russia and Ukraine increased by 210% and 177% respectively.

The ability of EU domestic production to take up the slack is impaired by the wider effects of the war on wood supply in the EU member states of Eastern Europe. This region, which now accounts for around half of all EU veneer production, was already struggling with log supply shortages due to COVID and following the introduction of a log export ban by Russia at the start of this year. Now the situation is even more challenging as logs are no longer available from Ukraine and Belarus.

The war is also creating wider logistical and other problems for manufacturers across Eastern Europe, notably a shortage of truck drivers, with many freight operators relying heavily on Ukrainian nationals, and sharply rising fuel and energy costs.

Surprising revival in Italian hardwood market

One of the more encouraging, not to say surprising, hardwood market trends in 2021 was a strong revival in demand in Italy, a country marked by an almost continuous decline in consumption in the previous decade and which suffered severely from the early effects of the COVID pandemic in 2020.

Italy experienced a large increase in hardwood consumption during 2021 as the construction and furniture manufacturing sectors were both growing strongly during the year. Prospects for continued consumption growth in 2022 also seem good, the main concerns now being on the supply side.

Italy’s growth has been particularly boosted by Next Generation EU funding for post COVID-recovery, a large share of which has been allocated to the country. In total, EUR 224 billion of Next Generation EU funding has been assigned to Italy in the 2021-2026 period, with about 50% earmarked for construction. There’s significant emphasis on projects that help the EU meet zero carbon goals in this funding package, including works to improve and rehabilitate older buildings to improve energy performance.

The IHS Markit Italy Construction PMI climbed to a new series high of 68.5 in February 2022, the 13th straight monthly expansion. The PMI for residential construction has been increasing at a record rate in Italy. After a 6.6% contraction in 2020, Italian construction output is estimated to have increased by about 12% in 2021.

Italy’s wood furniture sector is also now expanding rapidly. According to figures drawn up by Centro Studi FederlegnoArredo, production turnover in Italy’s wood furniture sector, including wood component manufacturers, was €49 billion, 26% more than in 2020 and up 14% compared to the pre-covid level in 2019. Italian wood furniture exports last year exceeded €18 billion, up 21% compared to 2020 and 7% more than in 2019. Wood furniture consumption in Italy’s domestic market was up 29% compared to the previous year and 19% on the pre-covid level in 2019.

According to FederlegnoArredo growth in Italy’s domestic market is due to the “effectiveness of tax breaks such as the ‘bonus mobili’ and the rediscovered centrality of the home in the lives of Italians”.

Much of the new demand has come from the home furnishings and garden furniture sectors while the contract corporate and, particularly, the hospitality sectors have remained weak. Italy’s large tourist sector has been hit heavily by the pandemic. Istat data shows that in the first nine months of 2021 the number of guests in Italian hotels dropped by 44.3% while Assoaeroporti estimates that Italian air traffic in 2021 was still 59% down on the pre-pandemic level in 2019. On the strength of such evidence, FederlegnoArredo comment that “the contract sector will have to wait until at least 2023, if not 2024, to return to pre-covid levels.”

FederlegnoArredo also comment that, while the increase in domestic sales and exports during 2021 is encouraging and shows a return to pre-covid levels in Italy’s wood furniture supply chain, “the high cost of energy, shortage of raw materials, and rising logistics costs risk reversing the trend as early as the first months of 2022. And the war in Ukraine, with all its consequences, is worsening a situation that was already beginning to deteriorate”.

While Italian wood supply is more diversified than many other countries, FederlegnoArredo note that Russia and Ukraine are critical suppliers of wood material to the Italian and wider European wood manufacturing sector, while Russia is also an important export market for high-end Italian furniture, accounting for around €430m each year.

FederlegnoArredo point out that the inevitable wood supply squeeze due to war in Ukraine comes on top of an already critical supply situation. Depending on species, wood prices in Italy increased by 130% to 280% between autumn 2020 and August 2021 and only declined slowly after that and for many products were still more than double pre-covid levels when Russia invaded Ukraine in February 2022.

The situation in Ukraine is creating particularly significant problems in the in the supply of birch logs and associated products, for which Russia is the world’s largest producer. Lack of birch supply not only impacts on furniture and other wood manufacturing but has significant knock-on effects throughout European industry since birch is widely used for industrial packaging, trucking floors, floors and structural beams. The volumes involved are so large – together Russia, Belarus and Ukraine account for around 50% of all wood tonnage imported into the EU – that they cannot be readily replaced.

Commenting on the critical supply situation, FederlegnoArredo President Claudio Feltrin notes that “it is necessary and urgent to find alternative sources of supply, such as poplar or beech, possibly of national origin, accelerating the objectives and actions envisaged by the National Forest Strategy”.

However the ability to increase domestic log harvests in Italy, as in many other parts of the EU, is constrained, at least in the short to medium term, by high levels of fragmentation in the forest sector. Although Italy is host to over 11 million hectares of forest (38% of national land area) and to a globally significant wood processing sector, around 80% of wood material supply to this sector is imported.

Efforts are being made to mobilise more wood from Italy’s domestic forests, for example a draft new Consolidated Forestry Law was published in 2018, and now awaits a series of implementing decrees, which aims to standardize and simplify forestry regulations across the country. But this can go only so far to improve wood supply in a country in which two thirds of forests are in the hands of tens of thousands of small forest owners, and which lacks a primary wood processing industry.

According to Gian Paolo Potsios, managing partner for the European branch of the US management company Timberland Investment Resources, speaking to the Italian business journal Economia, “Italy has one of the most important forest assets in Europe, in terms of quality and quantity. Unfortunately, with certain exceptions mostly in Northern Italy, it is a neglected heritage, managed in a confused way, with too many intermediaries, which constrain the sector, making it difficult and unappealing to exploit this resource.”

FederlegnoArredo has various initiatives in place to overcome these constraints. For example it is collaborating with Chambers of Commerce and other institutions to create an Italian wood exchange, a digital platform designed to bring together buyers and sellers of Italian wood. It is also working with universities and research bodies to ensure that the most common species in Italy (such as beech and chestnut) are certified as materials suitable for use in construction.

But these projects will take time to significantly influence the supply situation. In the short term FederlegnoArredo is joining with other European wood manufacturing in calling for regulations to prevent the export of logs from the EU. Even this measure would only marginally improve the supply situation. FederlegnoArredo conclude their most recent market analysis with the gloomy observation that “our companies could find themselves managing a situation in which they are unable to process orders due to the lack of raw materials while they are oppressed by the high cost of energy, which is already being reflected in the price lists of finished products”.