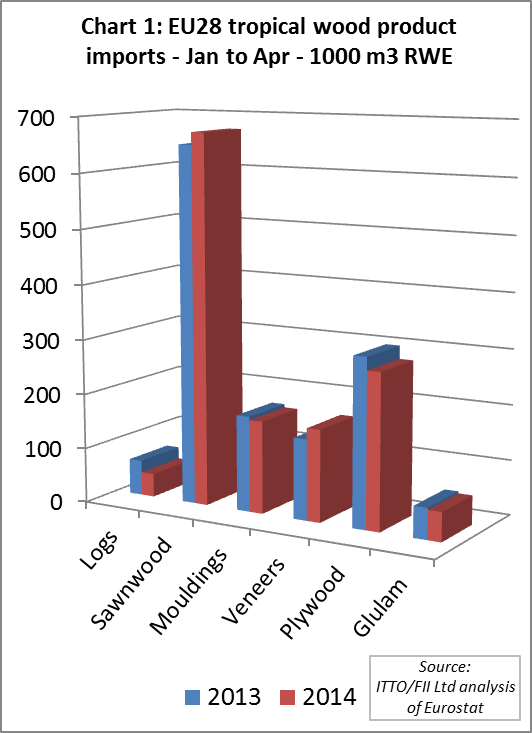

While economic indicators are beginning to turn upwards in the EU and market confidence is rising, these trends are filtering only very slowly into the European tropical hardwood trade. The latest EU trade data indicate imports of tropical hardwood products in the first four months of 2014 were 1.385 million m3 in roundwood equivalent terms, down 1% compared to the same period last year (Chart 1). Although imports of tropical hardwood sawn and veneer have increased this year by 3% and 14% respectively, these gains have been offset by declining imports of tropical hardwood logs (-34%), mouldings and decking (-3%), plywood (-8%) and glulam/window scantlings (-6%).

In addition to slow consumption, the European market for tropical wood during the first quarter of 2014 suffered from supply constraints, notably from Cameroon and Congo where shipments were significantly limited due to major issues with handling operations and administrative procedures at Douala Port. The situation has improved since the start of the year but the backlog of wood destined for Europe at the port is being shifted only slowly. Lead times between ordering and delivery into Europe of the main African commercial species such as sapele and framire has now fallen to 3 to 4 months compared to 6 months at the start of this year.

Another reason for slow imports of tropical wood in 2014 is the change in GSP status of several key tropical suppliers, notably Malaysia and Gabon. This led to a rise in European import duties on timber products from these countries on 1 January 2014. An immediate effect was to encourage a short-term build-up of stocks before the deadline and subsequent fall in imports from these countries in the first quarter of 2013.

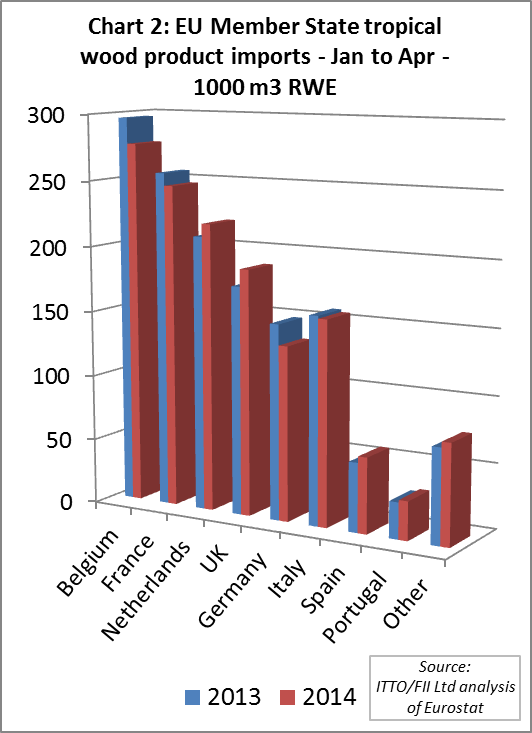

Declining imports into France and Belgium

In the first four months of 2014, the volume of tropical hardwood imports[1] fell into both Belgium (-7%) and France (-5%), the two largest volume European destinations for these products (Chart 2). Both markets are currently affected by consolidation of operators in the tropical wood industry and rapidly changing trends in demand. In France economic conditions remain difficult and generally uncertain. Building permits in France declined 22% in the three months to end February 2014. There are also concerted efforts underway in France to boost demand for locally grown hardwoods, for example through continued expansion of thermal treatment facilities to increase their durability and use in outdoor applications previously dominated by tropical woods.

[1] Refers to total roundwood equivalent volume of logs, sawnwood, mouldings & decking, veneers, plywood and glulam

11% fall in German tropical wood imports despite improving economy

There was an 11% fall in imports of tropical hardwoods into Germany during the first four months of 2014, despite evidence of stronger economic conditions and robust growth in demand for wood products in the construction and garden furniture sectors.

According to EUWID, the German Timber Federation GD Holz reported strong growth in total German timber trade revenues in the first four months of 2014, up 13% in the first quarter and a further 8% in April. GD Holz reported that revenues in the garden wood sector were up 50% in the first quarter of 2014 compared to the same period in 2013, particularly owing to much better weather conditions during the late winter months this year. Unfortunately these gains have not led to improved demand for tropical wood which has come under considerable competitive pressure from wood-plastic composites in the garden wood sector during 2014.

Another factor that has reduced demand for tropical wood in Germany this year is uncertainty over the legality of some tropical products. This follows the German EUTR Competent Authorities’ seizure in August last year of a consignment of wenge logs imported from the Democratic Republic of Congo (DRC).

According to a recent report in EUWID, the wenge logs remain confiscated despite receipt of another letter from the DRC government to the German authorities confirming the legality of the concession held by Bakri Bois Corporation (BBC) where the logs are claimed to have originated. However, according to EUWID, the German EUTR authorities remain unsatisfied that there is sufficient proof that the logs in question derive from the specified concession.

Rising tropical wood imports by the Netherlands and UK

Declining imports of tropical wood into Belgium, France, and Germany have been partly offset this year by rising imports into the Netherlands, UK, Spain and Portugal. Tropical wood imports into the Netherlands were up 5% in roundwood equivalent volume terms in the first four months of 2014. After many years of very depressed activity, the Dutch construction sector is now improving with architects and builders reporting better order books and turnover.

Although new building permits issued in Netherlands have slowed a little in recent months, the Dutch market is now benefitting from the temporary VAT reduction on renovation activities implemented since early 2013 and due to remain in place until the end of 2014.

UK imports of tropical hardwood increased 8% in roundwood equivalent volume terms during the first four months of 2014. Consumption has been rising at a time when UK landed stocks of most hardwood products are quite low, encouraging stronger UK engagement in the import trade. The recovery in UK construction has become stronger and broader this year, with rapid increases in private house building, together with growth in renovation, infrastructure and commercial construction activity.

While the 8% rise in UK imports of tropical hardwood products is encouraging, there are signs that tropical wood may be losing share to temperate hardwood in this market during 2014. The American Hardwood Export Council recently reported a 66% increase in UK imports of American sawn hardwood in the first quarter of 2014 compared to the same period last year.

Spain shows signs of improvement

For the first time since the start of the Global Financial Crises, the Spanish market has shown slight signs of improvement this year. In roundwood equivalent volume terms, Spain’s imports of tropical hardwood products were up 9% in the first four months of 2014 compared to the same period the previous year.

According to the latest survey of European architects by Archivision, a market research firm, the long-term decline in Spanish architects order books hit bottom at the start of 2013 and architects have become more positive during every subsequent quarter of the year. However, Archivision also note that the more positive attitude amongst Spanish architects is not in line with trends in building permits, especially the non-residential sector which is still showing decline.

The volume of imports of tropical hardwood into Italy in the first four months of 2014 was at the same low level as in 2013. Although some large Italian tropical hardwood importers report stronger sales into other parts of Europe this year, the domestic market remains weak. There seems little prospect of any improvement in the Italian construction market, probably the main driver of demand for tropical wood now that Italy’s furniture sector is so focused on temperate species, particularly oak. Archivision forecast that Italian construction will shrink by 9% in 2014 and by a further 4% in 2015.

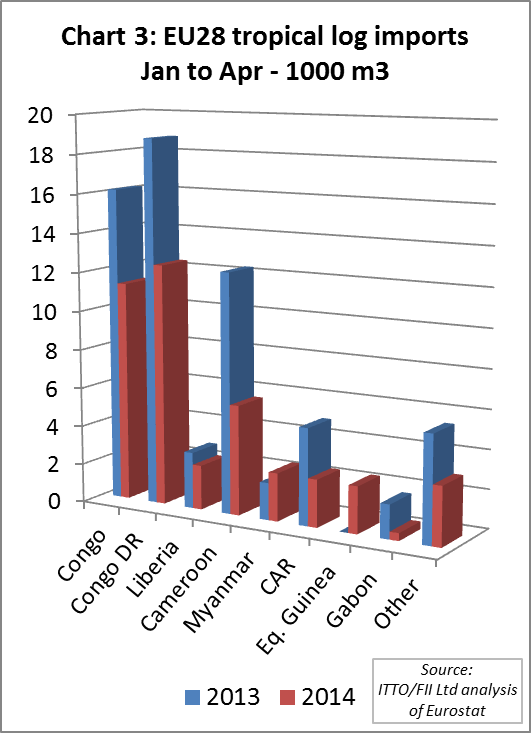

EU imports of tropical hardwood logs down 34%

EU imports of tropical hardwood logs were 42,000 m3 in the first four months of 2014, 34% less than the same period of 2013. Imports fell particularly heavily from the Congo countries, Cameroon, and Central African Republic (Chart 3). This is due to the combined effects of shipping problems at Douala Port, the civil war in Central African Republic, and EUTR-related concerns over the reliability of legality documentation.

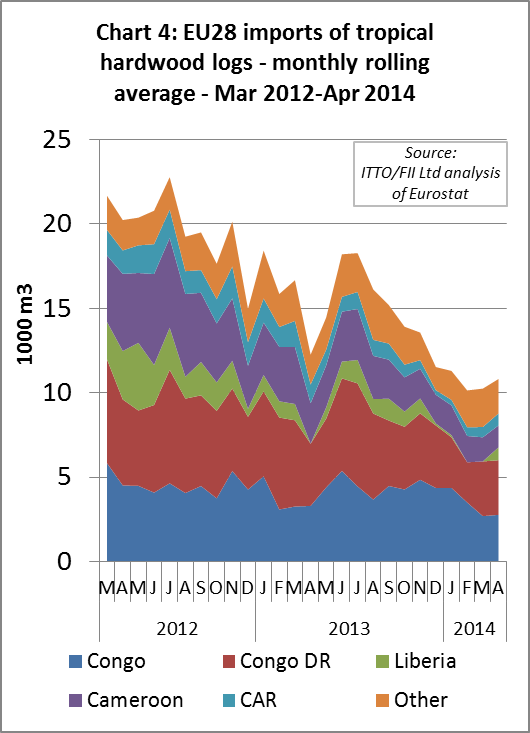

While total EU imports of tropical hardwood logs were down over the four month period, closer analysis of the monthly trend suggests a slight improvement in April compared to the first quarter of the year (Chart 4).

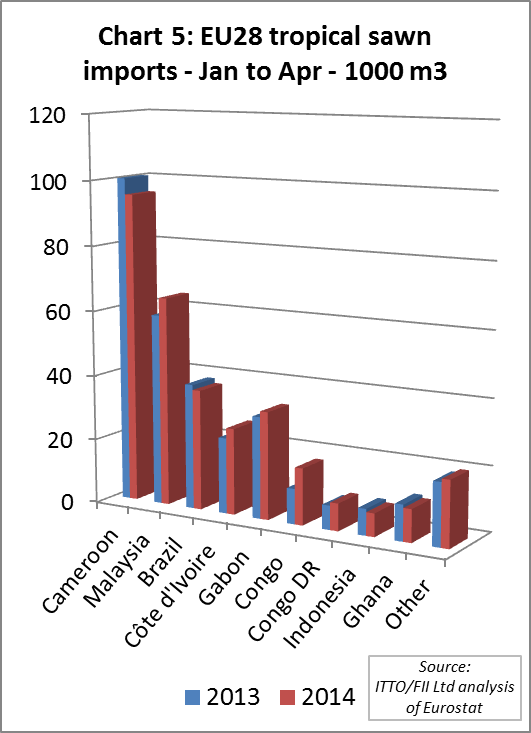

Malaysia & Ivory Coast fill gap in Cameroon sawn supply

Improving demand in the UK and Netherlands boosted EU imports of sawn hardwood in the first four months of 2014. Imports were 320,000 m3 during this period, 4% more than the same period in 2013. Rising imports from Malaysia, Ivory Coast and Gabon, helped to fill the gap caused by supply disruption in Cameroon (Chart 5).

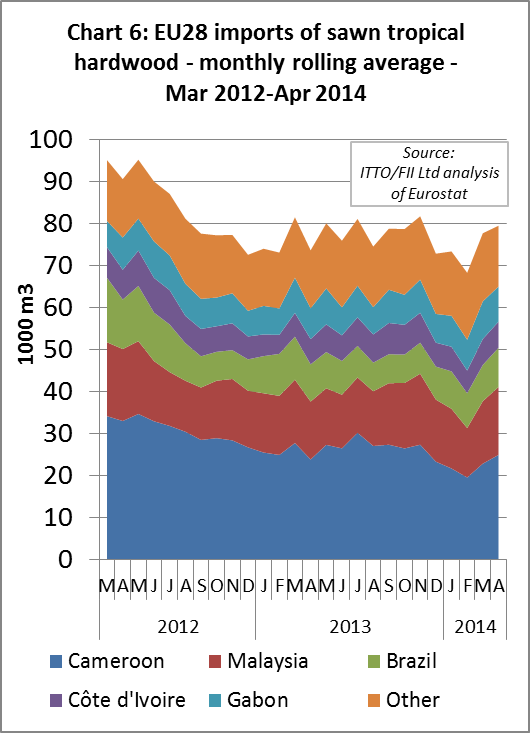

Monthly data reveals that after a sharp fall in January and February this year, the pace of EU imports of tropical sawn hardwood began to recover from March onwards. This was due to improved shipments from both Cameroon and Malaysia (Chart 6).

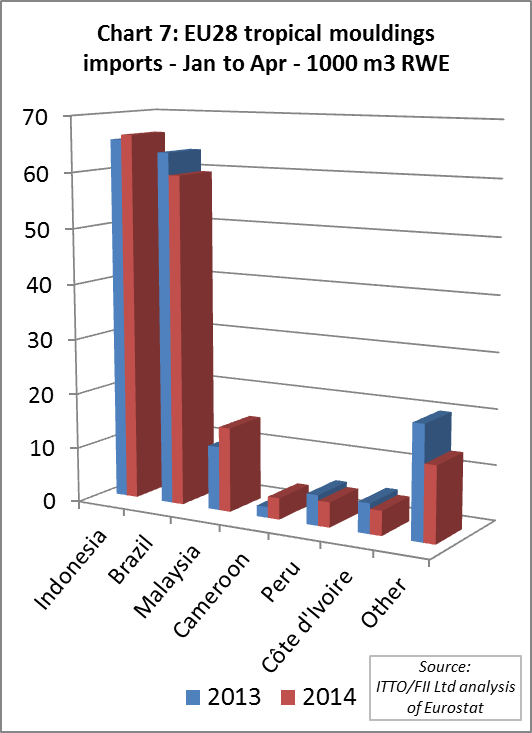

Indonesia & Malaysia increase share in EU decking imports

EU imports of mouldings and decking products were 168,000 m3 (RWE – Roundwood Equivalent) during the first 4 months of 2014, 4% less than the same period in 2013 (Chart 7). Improved supply conditions led to gains in imports from Indonesia and Malaysia and these countries gained market share, particularly at the expense of Brazil and other Amazonian suppliers.

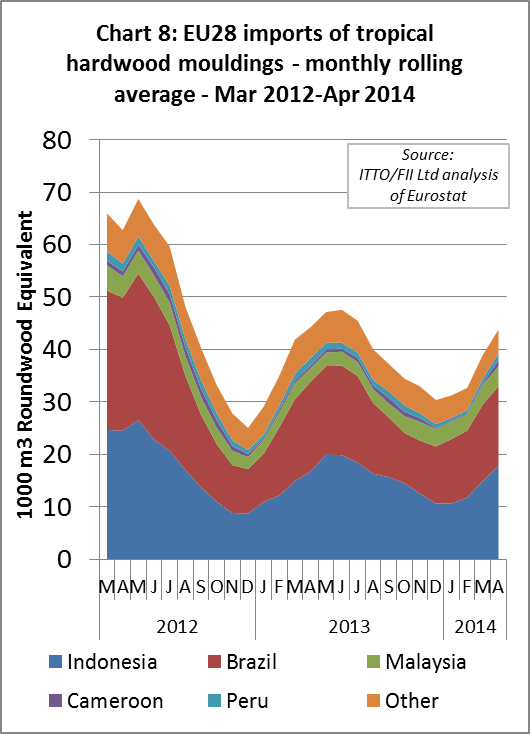

Monthly data reveals the strong seasonal pattern of EU mouldings imports, driven by the decking sector and timed to coincide with the European spring and summer garden season (Chart 8). Overall imports this year seem to be shaping up to be very similar to last year but still well below the level of 2012.

Rougier revenues rise in Africa but fall in Europe

Paris-based Rougier reports first quarter revenues for their Africa International branch of €27 million, up 11.7% on the first quarter of 2013. According to Rougier this growth reflects the positive trend for international tropical timber markets. In Gabon, business has also benefited from a dynamic local market. However, for Cameroon and Congo, shipments were significantly limited during the quarter as a result of logistical problems at Douala Port. Some deliveries have therefore been put back to the second quarter.

First quarter 2014 revenues of Rougier’s France Import-Distribution branch were €7.5 million, down 6.3% on the first quarter of 2013, but up 20.3% compared with the fourth quarter of 2013. According to Rougier, this trend highlights the French market’s volatility.

Rougier report that first quarter log sales were up 29.4%, particularly in Gabon thanks to sustained growth in sales to local industrial operators. Sawn timber sales were up 6.0% in relation to last year. This positive trend is being supported by the diversification of the regional mix, as well as demand for certain timber species and the good level of average sales prices in general. Plywood sales, generated primarily in European countries, were stable compared with the first quarter of 2013.

Faced with the slowdown in European markets, Rougier has continued moving forward with its strategy to diversify its regional markets, achieving strong growth in the Americas and Sub-Saharan Africa, particularly Gabon. Markets in the Mediterranean Basin and Middle East are gradually picking up again. In Asia, sales trends confirm the upturn on the Chinese market, as seen during the second half of 2013.

DLH report “challenging conditions” for tropical wood in Nordic countries

The European divisions of the Denmark-based DLH posted a turnover of DKK 399 million for the first three months of the year, 6% less than the same period last year. 2% of the decline in turnover was exchange rate related. This downturn came against the background of challenging market conditions in both the Nordic countries and France, the only areas of Europe where DLH now operates following recent divestment of other European divisions.

DLH note that the Swedish retail sector remains particularly challenging, while the Danish and Norwegian markets are showing signs of gradual improvement. In general, the industrial sector is showing a good development. Overall DLH reckons that there is continuing strong growth potential in the industrial sector in Sweden and Norway.

In France, DLH has decided to focus and optimise the business solely on one hub which supplies tropical hardwood in Sête in the south of the country. The objective is to create a smaller, more cash efficient and cash generating unit with a view to divestment under the current strategy plan. DLH report that turnover in France is at the same level as last year but margins have improved significantly due to the focus on decking business.

In Central Europe and Russia, DLH report that macro-economic conditions remain weak, but are showing signs of improvement. Turnover for the first quarter shows a decline of 5% to DKK 65 million, mainly related to the weakening of the Russian Rouble.

In contrast to the decline in turnover of European operations, DLH Global Sales Division delivered a 2% increase in turnover to DKK 108 million for the first quarter compared to the same period last year. This Division is engaged in tropical hardwood trading between and within Vietnam, China, Indonesia and Africa. DLH note that the Vietnamese market is showing particularly strong development while China is somewhat lower due to a more selective approach to bulk shipments.

PDF of this article:

Copyright ITTO 2020 – All rights reserved