The value of UK imports of tropical wood products was US$360 million in the first four months of 2020, 19% less than the same period last year. Although a significant decline, the downturn is perhaps less than might have been expected given the exceptional circumstances surrounding COVID-19.

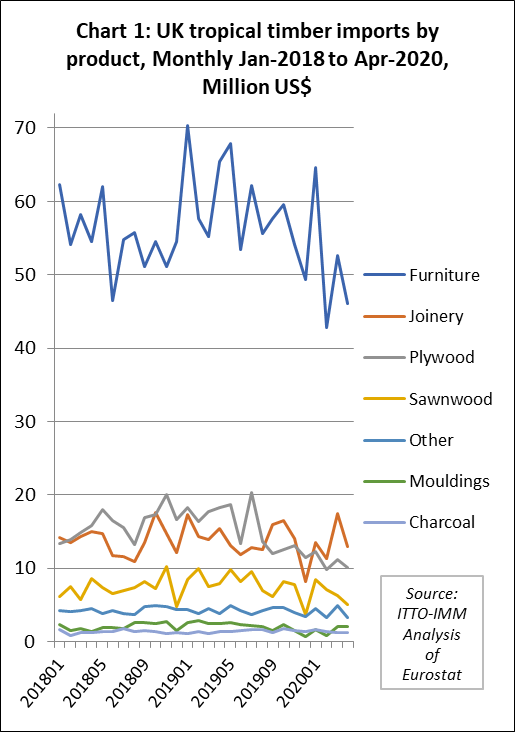

It is also notable that the start of the decline for most products predated the period of lockdown initiated in the UK from 24th March. UK wood furniture imports from tropical countries have been weakening since the start of 2019 and were particularly slow in February this year. Imports of tropical plywood and sawnwood have also been sliding since the middle of 2019 (Chart 1).

The trade data to end April implies that the market was slowing even before the lockdown was implemented and has probably captured only a small portion of the COVID-19 downturn. A more severe downturn can be expected in May and June.

To some extent weak imports in February and March this year were due to the earlier implementation of COVID-19 lockdown measures in Asian countries which disrupted raw material supplies and exports, particularly of wood furniture from South East Asia and tropical hardwood faced plywood from China.

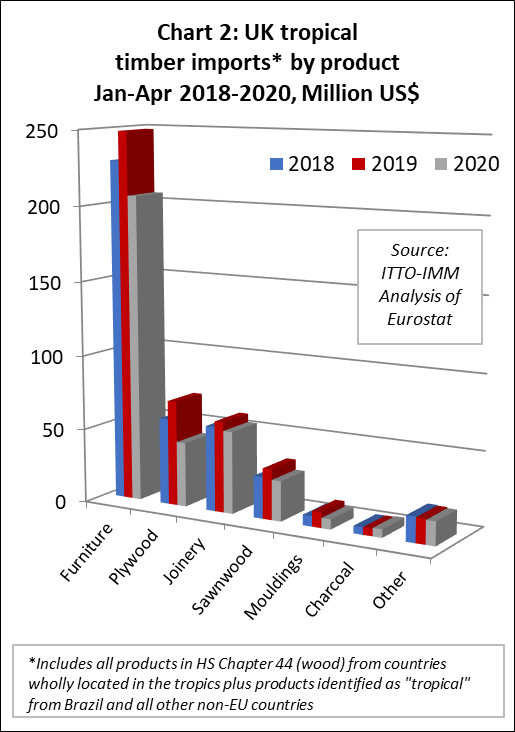

Comparing the first four months of 2020 with the same period the previous year, UK import value of wood furniture from tropical countries fell 17% to US$206.1 million, while imports of tropical plywood were down 39% at US$43.4 million, tropical joinery products were down 9% at US$55.2 million, tropical sawnwood fell 20% to US$26.9 million, and mouldings/decking declined 35% to US$6.8 million (Chart 2).

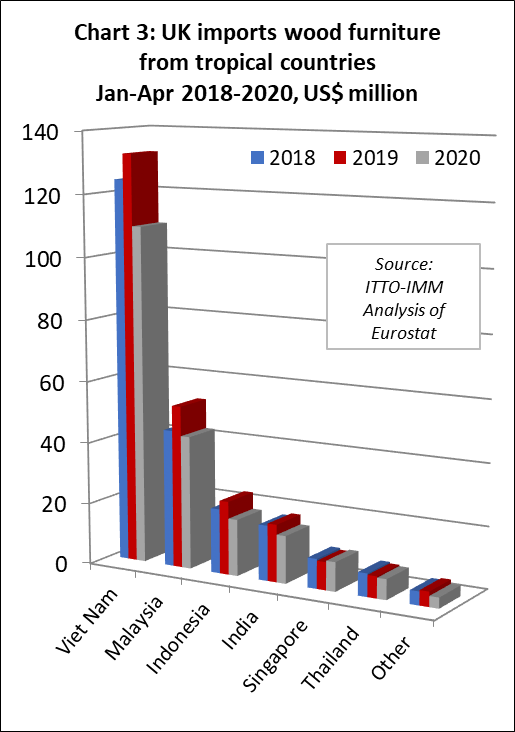

UK imports of wood furniture declined sharply from all the leading tropical supply countries in the first four months of this year (Chart 3). Imports from Vietnam were down 17% at US$109.5 million, imports from Malaysia fell 18% to US$43.2 million, imports from Indonesia declined 23% to 18.4 million, and imports from India fell 17% to US$15.4 million.

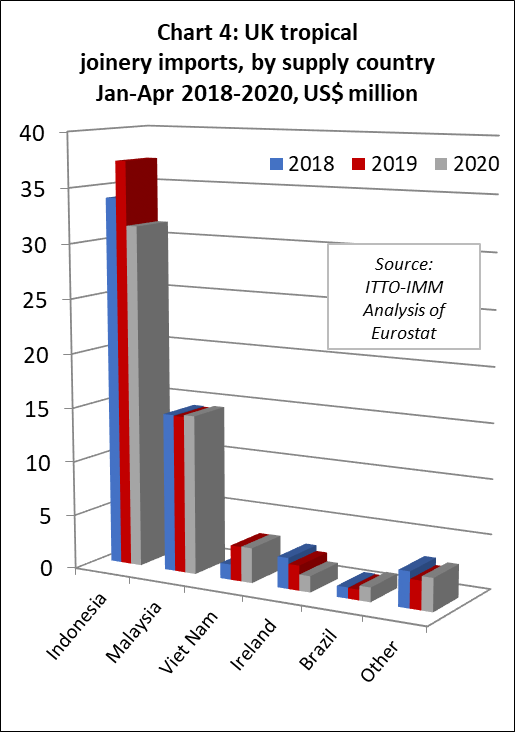

Indonesia loses ground in UK joinery market

After making gains in 2019, UK imports of tropical joinery products from Indonesia, mainly consisting of doors, fell 16% to US$31.5 million in the first four months of this year. In contrast, UK imports of joinery products from Malaysia and Vietnam (mainly laminated products for kitchen and window applications) made slight gains in the first four months of this year, increasing by 1.3% to US$14.7 million from Malaysia and by 0.8% to US$3.2 million from Vietnam. (Chart 4)

UK imports of tropical hardwood plywood from China fall 66%

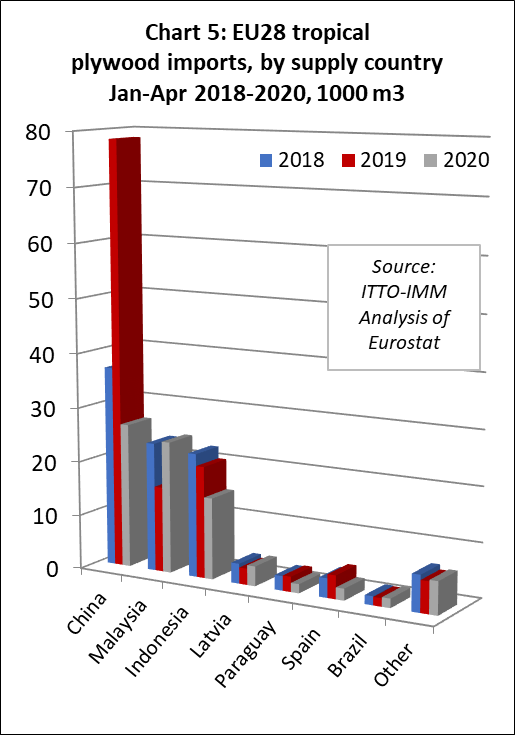

The UK imported 26,600 m3 of tropical hardwood faced plywood from China in the first four months of this year, 66% less than the same period last year. UK imports were at unusually high levels in the first half of 2019 after a period of slow buying in 2018 due to Brexit uncertainty. However, the market suffered from over-stocking in the second half of last year as consumption slowed. This year, UK imports have been further dampened by COVID related supply problems in China.

Likely due to supply problems elsewhere, UK imports of plywood from Malaysia, which have been in long term decline, recovered ground in the first four months of 2020, rising 55% to 24,200 m3. However, imports from Indonesia fell 27% to 15,000 m3. In recent years, the UK has been importing small volumes of tropical hardwood faced plywood from Latvia. Imports of this commodity were up 21% at 3,600 m3 in the first 4 months of 2020. (Chart 5)

UK tropical sawn hardwood imports down 12% in year to April

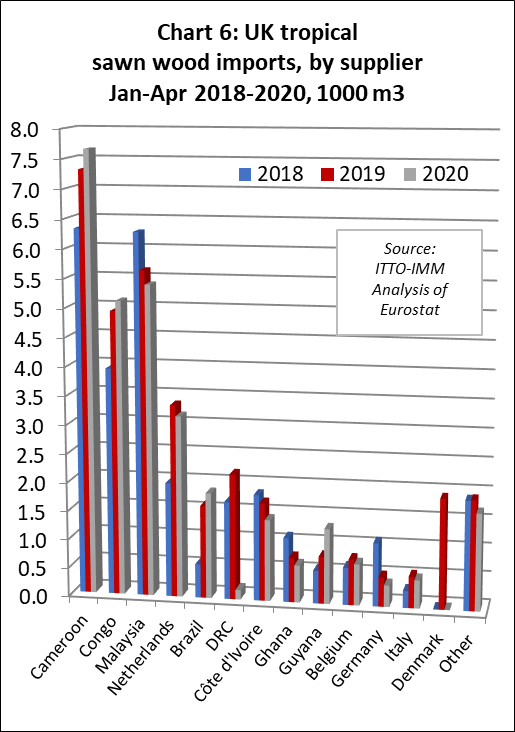

The UK is now a relatively minor market for tropical sawn hardwood, importing less than 100,000 m3 in each of the last two years, making it only the fifth largest European importer for this commodity (after Belgium, Netherlands, France and Italy). UK imports of 30,000 m3 in the first four months of 2020 were 12% less than the same period in 2019.

UK tropical sawn imports are sourced from a large range of countries, both directly in the tropics and indirectly from other European countries (Chart 6). UK imports from Cameroon, the leading supplier, increased 5% to 7,700 m3 during the four-month period, while imports from the Republic of Congo were also up, by 4% at 5,100 m3. However, imports from DRC fell to negligible levels in the first four months of 2020 after reaching more than 2,200 m3 in the same period last year.

UK imports from Malaysia were 5,400 m3 in the first four months of 2020, 4% less than the same period in 2019. Indirect imports into the UK via the Netherlands were down 6%, at 3,200 m3, after significant growth last year. Imports from Brazil increased 14% to 1,800 m3, while imports from Guyana were up nearly 60% at 1,300 m3.

Many UK merchants lack space and finance to carry the ideal inventory of tropical sawn hardwood which should include a wide range of boards in different widths and lengths for bespoke joinery work. Most UK merchants therefore therefore focus on stocking just the more familiar types of hardwood, in defined ranges to suit particular market segments.

The main tropical hardwood species in demand in the UK now are sapele, meranti, utile and, for decking, Bangkirai. Sapele is strongly favoured as a good all rounder for both internal and external joinery with reasonable density and good machining capabilities and good for paint applications. Utile is still favoured as it tends to be more stable than many external hardwoods. Idigbo/framire (mainly from Cote d’Ivoire, was formerly popular but importers report having difficulty obtaining assurances required for EUTR compliance.

Meranti is still popular in UK window and door manufacturing, although wide variation in the density of meranti supplied has been an increasing issue for some importers and manufacturers. Many merchants also stock meranti mouldings for the replacement market, including skirtings, architraves and window cill sections.

Challenges, but some cautious optimism in UK

Further insights into the status of the UK sawn hardwood market came from a webinar organised by the London Hardwood Club in early June, featuring speakers from the UK tropical import sector alongside American and European hardwood producers. The event, which attracted 48 participants, covered pandemic impacts, species supply and demand trends, UK market acceptance of further processed hardwood products and market outlook.

Despite the COVID 19 lockdown measures, in place now in the UK for nearly two months, there are some more positive signs emerging in the UK hardwood market. Several seminar participants said that the market remained ‘some way off the norm’, but that business was picking up. “At the start of the Covid-19 lockdown we were looking at the sharp end of doing very little at this point and in April sales were down 60-65%,” said one importer.

“But through May into June we’ve seen renewed activity and we’re now back to around 60% of normal levels.”

Another said they had gradually upped activity: “We closed for two or three weeks, but now we’ve got 50% of staff working. We don’t see sales returning to 100% in the near future, but we hope to have all our people back by the end of the government furlough programme in October.”

Focusing on West African supply, Guy Goodwin of NHG said that, bar a temporary shutdown in Ghana, the pandemic had not to date significantly hit production. Prices for red hardwoods also remained firm, underpinned by renewed buying in China and Vietnam.

Mr Goodwin anticipated mills ‘in the tiers below mainstream producers’ being most affected by wider contraction in demand, leading to some price cutting. Cancelled orders had also seen some ‘distressed parcels’ coming on to the market.

However, he did not anticipate the tropical price slump and capacity contraction seen after the 2008 economic crash. “Mills learned the lesson from that and became more cautious and reactive to the market situation, so there’s less over-production,” he said.

“Also, many concession holders are at the end of 25-30-year harvest cycles, so forest being worked is less rich in commercial species. We expect this to keep prices firm, particularly for kiln-dried, certified, EUTR-compliant timber.”

For the European hardwood supply sector, Alex Boisson of Italian-based oak producer Florian Group, said the pandemic had reduced demand internationally and the outlook was uncertain. The Asian market was particularly hard hit and overall the post-pandemic so-called ‘new norm’ had yet to take shape. “Business is moving, but not as we knew it,” he said. “Requests are day to day.”

Florian had faced mill operational challenges due to COVID-19, but its key concern was the three month shutdown in harvesting in Croatia and Hungary, where it also has mills in addition to those in Italy and France. Resulting tight supply was underpinning log prices, which, Mr Boisson forecast, would lead to lumber price inflation, despite demand levels.

He also said that it was imperative to develop the market for the ‘central part of the log’. Hardwood sawmills need to sell lumber from the entire thickness and grade spectrum of the log, both to turn a profit and avoid finished stock build up and associated bottlenecks and overheads.

Demand for lower grade European lumber had been hit by the pandemic, notably in South East Asia and this compounded the effect of deterioration in European raw material quality.

“In the last 10- 15 years European logs have declined in quality and diameter,” said Mr Boisson. “Previously the resource was yielding 30% A quality logs. Today that’s down to 15-20%. We increasingly need to be creative and find an outlet for lower grades, perhaps through modification, or engineering and new applications. It’s key to how we survive as sawmills.”

On the UK, Mr Boisson said there was more hardwood stock on the ground than elsewhere in Europe, the consequence of ‘excess buying’ prior to lockdown, with importers hedging against anticipated logistical problems. The market, he added, was also historically more resistant than European neighbours to value-added, further processed products. By contrast, German window producers, for instance, tended to use fingerjointed and laminated hardwood exclusively.

This sentiment was echoed by a UK timber importer who noted that “UK end users are conservative. They’re wary of anything new and not particularly fashion-led.” However, there were signs of UK end users coming around. Mr Boisson commented that “five years ago, our engineered exports to the UK were zero. Today they comprise 25% of the total. We expect the trend to continue and that we’ll be selling less solid, thick lumber to the market.”

Speaker Dennis Mann, export sales manager of Baillie Lumber, a leading US hardwood exporter, emphasised that the poor prospects for lower grades was also a major issue facing the American hardwood industry. “Our key challenge is what to do with the centre of the log. Right now, there’s just no home for sleepers, cants, truck deck flooring, pallet timber, or chips for paper mills,” said Mr Mann. “A lot of these products are tied in with transportation of goods and as that’s significantly reduced, so has demand.”

Mr Mann suggested that as economies emerge from pandemic lockdown more widely, this industrial lumber logjam should gradually ease, but the timescale was uncertain and, while unresolved, it could cause further problems. Difficulties in moving lower quality material inevitably impact supply of better grades and Mr Mann predicted tightening supply in 1.5-2” and thicker white oak in coming months.

Turning to the UK, Mr Mann said it had not only remained the U.S. hardwood sector’s biggest European market, and fourth biggest export market overall, it was also among its most consistent. Its annual U.S. imports averaged around $83 million for the last four years, comprising 75-80% white oak, tulipwood and walnut.

One question from a webinar participant was on future supply of American ash given the emerald ash borer infestation. Mr Mann responded that there were still areas of pest-free forest, particularly away from roads. “Ten years ago we thought it would all be gone by now,” he said. “Today we estimate there’s still another three to five years supply of viable, unaffected timber.”

Mr Mann was also asked about U.S. supply of FSC-certified and said demand for it was mainly from the UK. “FSC requests are 90- 95% UK, with inquiries monthly. From elsewhere we’ll get two or three every few months.”

One importer saw increasing prospects for modified temperate hardwoods to widen applications for less durable material. “We’ve done a number of successful projects in thermally modified U.S. tulipwood, with another significant one in the pipeline,” they said. “We think it’s got a good future.”

UK still in lockdown while rest of Europe eases restrictions

Lockdown measures in the UK, one of the nations most affected by COVID-19, are being eased but more slowly than elsewhere in Europe. Strict social distancing is still in place, with restrictions on the numbers of people that can meet from separate households. People who can work from home should continue to do so “for the foreseeable future”.

UK workplaces may only open if made safe for staff, with more cleaning, staggered working shifts and, for office workers, no hot-desking. Most people entering the UK – including British citizens – must self-isolate for 14 days. UK citizens are strongly advised not to travel abroad. Most schools are still closed.

In continental Europe, lockdown measures are being lifted cautiously, in phases. Businesses are reopening and many children are back in school. Many of Europe’s internal borders will be open again from mid-June and there are hopes that external borders will be lifted from 1 July.

Germany began reopening shops in April. In early May control of lifting the lockdown was handed to the 16 federal states. But Chancellor Angela Merkel stressed that an ”emergency brake” will be applied anywhere that sees a surge in new infections.

Italian lockdown restrictions were eased from early May and people are now able to travel for longer distances, as well as visit their relatives in small numbers. On 3 June, Italy unilaterally reopened its borders and ended regional travel restrictions.

In France, restrictions began to ease on 11 May, and phase two of the easing began on 2 June, including an end to a 100km (62-mile) travel limit. Nearly all of France is now in a so-called “green zone”, where restrictions can ease faster. Paris has moved from a red to an orange zone.

Belgium, the world’s worst affected country in terms of the number of deaths per head of population, entered a third phase of deconfinement measures on 8 June, with the reopening of hotels, bars and restaurants, extended social life and eased tourism restrictions.

The Netherlands imposed a far less strict lockdown than neighbouring countries. Prime Minister Mark Rutte unveiled a five-phase plan for easing lockdown restrictions, which kicked in from 11 May and is now well advanced.

On 1 June, Spain moved into a second phase of the planned removal of lockdown for 70% of Spaniards. However, Madrid, Barcelona and some other regions continue under tighter phase-one restrictions. The state of emergency is to end on 21 June, restoring freedom of movement.

Portugal, which has had fewer coronavirus cases and deaths than some other south European nations, is now near the end of a three-phase plan announced on 4 May to reopen different sectors of the economy every 15 days.

Greece, another country so far less affected by the pandemic, has been relaxing lockdown measures since 28th April and has declared that the tourist season will start on 15 June, with the opening of seasonal hotels on the same day.

Poland is due to open borders with other EU countries on 13 June, lifting restrictions, mandatory quarantine, and border controls for EU nationals who will be free to travel and transit through the country. Fitness clubs, cinemas, theatres, and amusement parks, which have remained closed for two months, were allowed to open from 6 June.

OECD predicts UK to suffer largest economic downturn

The UK is forecast to suffer the worst recession of the world’s 37 rich nation economies as GDP shrinks by up to 14 per cent this year and one in ten workers are left unemployed. In its latest global forecasts, the Organisation for Economic Cooperation and Development (OECD) ranks the UK alongside France, Italy and Spain, saying that all four countries will lose more than a tenth of national output to the pandemic in 2020.

The OECD modelled two scenarios. The first assumes that the virus recedes and the second models a second spike in the final three months of the year. A second spike is judged by the OECD to be just as likely as the virus remaining under control.

In the benign scenario, the UK suffers the deepest recession of all OECD members, just ahead of France, as the economy shrinks by 11.5% in 2020 and unemployment jumps to 9.1% from 3.9% at the last official reading.

In the double hit scenario, Spain and France fare slightly worse as UK GDP falls 14% and unemployment climbs to 10.4%. Germany and the US shrink by just short of 9% in the worst case scenario. All countries recover some of the lost ground in 2021, with catch-up growth under both scenarios.

Sharp decline in European construction continues in May

Although the headline figures from IHS Markit Construction Purchasing Managers Index (PMI) for the eurozone and UK in May were better than in April, they still indicated a steep decline in construction activity. For the eurozone, the PMI rose to 39.5 in May, up from a record low of 15.1 in April (a score below 50 indicates contraction).

Survey data showed Germany and France recorded a third straight month of decreasing construction output in May, although the decline slowed markedly amid easing lockdown measures. Italy posted a marginal rise in construction activity in May following a collapse in April.

Business expectations among eurozone building companies remained negative in May, with the Future Activity Index coming in below the neutral 50.0 level for a third straight month. Concerns were linked to the longer-term impact of the COVID-19 pandemic on construction activity. Germany and France both reported a negative outlook, while Italian business sentiment turned positive for the first time in three months.

The UK construction sector also suffered one of its worst results in May since the PMI surveys began as building work was grounded by the pandemic and lockdown measures. Construction firms fear a recession and postponement of new projects in the next year despite a gradual reopening of sites in May.

The IHS Markit/CIPS UK Construction PMI registered at 28.9 in May, picking up from the record low of 8.2 in April. Around 64% of the UK survey panel reported a drop in construction activity during May, while only 21% signalled an expansion. Growth was attributed to a limited return to work on-site following shutdowns in April due to the coronavirus outbreak.

As in the eurozone, UK building companies remained downbeat about their prospects for the next 12 months. Recession worries and fears of postponements to new projects were commonly reported.

Throughout the eurozone and in the UK, construction supply chains remained under severe pressure in May, with delivery times continuing to lengthen at the second-quickest rate in the PMI series history. Anecdotal reasons suggested logistical bottlenecks, material shortages at distributors and limited supplier capacity due to social distancing rules.

PDF of this article:

Copyright ITTO 2020 – All rights reserved