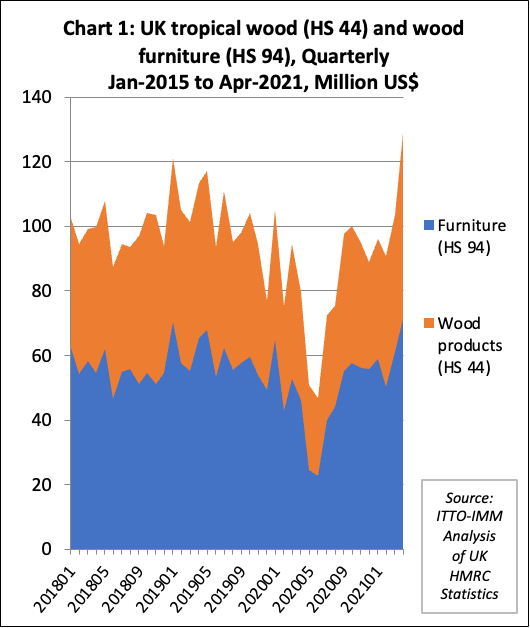

The UK imported tropical wood and wood furniture products with a total value of USD419 million in the first four months of 2021, an 18% increase compared to the same period in 2020. There was a particularly sharp increase in April when imports were USD129 million, the highest monthly import value recorded since before the financial crises of 2008-2009.

The strong performance in the first four months of this year reflect both a robust rise in consumption in the UK, supported by strong government stimulus measures, and the late arrival of delayed shipments from the previous year. The rise occurred despite severe logistical problems that have emerged in shipment of tropical wood products to the UK since the start of the pandemic.

Britain’s economy surged in June as private-sector businesses secured extra work and created thousands of new jobs, but analysts warned the boom could be short-lived if shortages of skilled staff and hold-ups to vital supplies continue into the autumn.

The manufacturing and services industries, which account for more than 80% of business activity, expanded at near-record rates in June, according to a survey by IHS Markit, building on the unprecedented burst in output growth in May. Firms were in a confident mood after the easing of Covid-19 restrictions and a rush by consumers to shop and visit bars and restaurants. Survey respondents were enjoying higher domestic sales and higher demand from the US, China and much of Europe for British goods and services.

The IHS Markit/CIPS flash UK output index measures the difference between the proportion of employers who say activity is above or below normal levels, where a figure of 50 separates contraction from expansion. The composite index was 61.7 in June, while the manufacturing sector posted a 64.2 figure, and the services industry stood at 61.7.

The UK construction sector, the leading driver of timber demand in the country, has recovered even more strongly.

According to the IHS Markit/CIPS UK Construction Purchasing Managers Index (PMI), UK construction companies signalled an exceptionally strong increase in output volumes in May, with continued recoveries seen in civil engineering activity, commercial work and house building.

The PMI posted 64.2 in May, up from 61.6 in April with construction output growth reaching its strongest since September 2014. New order volumes increased at the fastest pace since the survey began just over 24 years ago. Input cost inflation in the UK construction sector was also at a survey-record high during May, reflecting a surge in demand for construction materials and severe supply shortages.

UK wood furniture imports up 17% this year

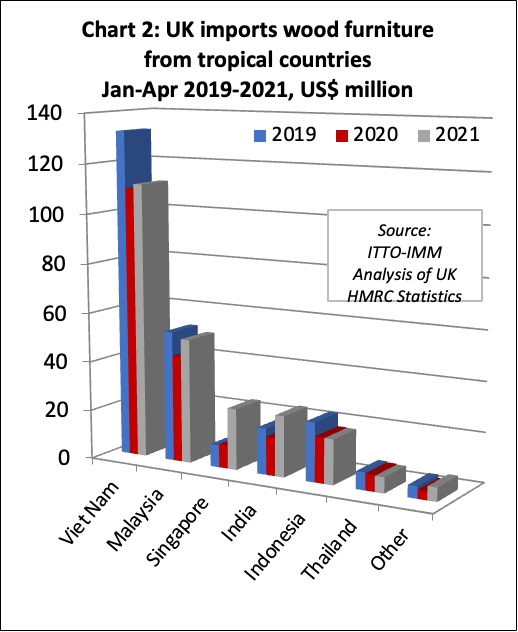

Overall the UK imported USD241 million of tropical wood furniture products in the first four months of this year, 17% more than the same period in 2020. In contrast to 2020, when imports began to nose-dive in April with the onset of the first COVID lockdown, UK imports of wood furniture in April this year, at USD71 million, were at a higher level than in any other single month for over a decade.

In April this year, imports of wood furniture surged from all the leading tropical countries supplying the UK including Vietnam, Malaysia, India and Indonesia. Imports from Singapore, which had been filling the supply gap due to problems of shipment out of other South East Asian countries earlier in the year, began to moderate during the month.

Overall during the first four months of 2021, UK wood furniture imports were up from all four of the leading tropical supply countries to this market; Vietnam (+2% to USD112 million), Malaysia (+17% to USD50 million), Singapore (+160% to USD25 million) and India (+59% to USD25 million). In contrast, imports from Indonesia, at USD18 million, were still 1% behind the same period in 2020, while imports from Thailand, at USD6 million, were 4% down on last year (Chart 2).

UK tropical wood imports rise 20% in first four months of 2021

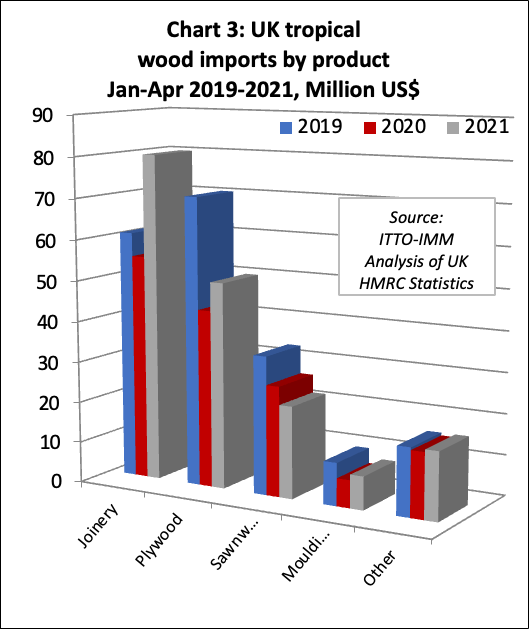

UK imports of all tropical wood products in Chapter 44 of the Harmonised System (HS) of product codes were USD178 million in the first four months of 2021, 20% more than the same period last year. With imports of USD58 million in April 2021, this was the highest monthly import value recorded since before the 2008-09 financial crises.

Comparing the first four months of 2021 with the same period in 2020, UK imports of tropical joinery products increased 45% to USD80 million while imports of tropical plywood increased 16% to USD50 million and imports of tropical mouldings/decking increased 20% to USD8 million. These gains offset a 16% decline in tropical sawnwood imports to USD23 million (Chart 3).

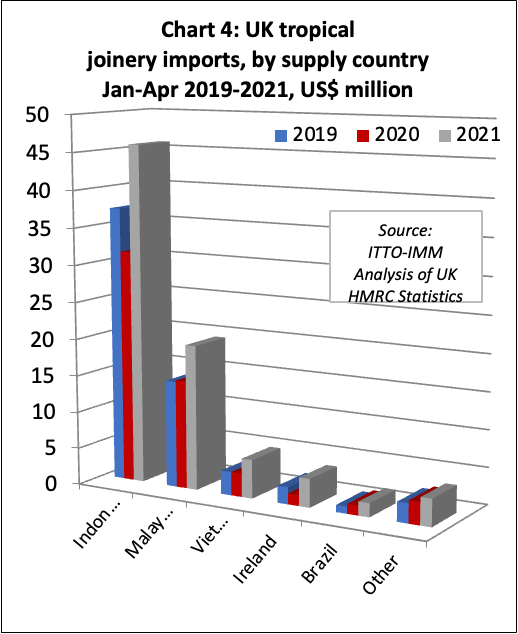

After the sharp dip in UK imports of tropical joinery products during the first lockdown period in Q2 2021, imports gradually built momentum until March this year and then surged in April. Imports from Indonesia, mainly consisting of doors, were USD46 million in the first four months of 2021, 46% more than the same period last year.

UK imports of joinery products from Malaysia and Vietnam (mainly laminated products for kitchen and window applications) also made strong gains in the first four months of 2021. Imports from Malaysia were USD20 million between January and April this year, 34% more than the same period in 2020. Imports of USD5.2 million from Vietnam were 63% more than in the same period in 2020. UK imports of joinery products consisting of tropical hardwood from neighbouring Ireland also increased by 159% during this period, to USD3.8 million (Chart 4).

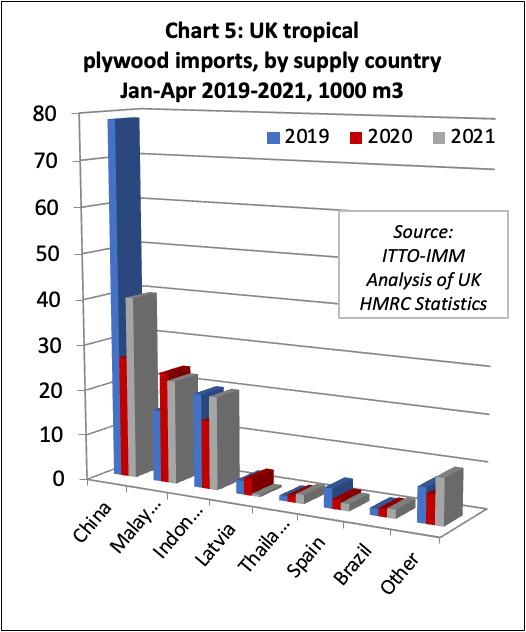

In the first four months of 2021, the UK imported 99,100 cu.m of tropical hardwood plywood, 22% more than the same period in 2020. Imports from the UK’s three largest suppliers of tropical hardwood plywood – China, Indonesia and Malaysia – have followed very different trajectories this year (Chart 5).

The UK imported 40,000 cu.m of tropical hardwood faced plywood from China in the first four months of this year, 51% more than the same period in 2020. Imports from Indonesia also made gains during this period, rising 36% to 20,400 cu.m. In contrast, imports of 22,700 cu.m from Malaysia in the first four months of 2021 were 6% down on the same period in 2020.

As with other hardwood product groups, UK demand for tropical hardwood plywood has been strong this year, driven by high levels of construction activity and shortages of competing materials. The main market challenges have been on the supply side, notably the considerable escalation in freight rates on Asian routes to the UK. In the past six months there was a 4-5 fold increase in container freights from South East Asia. During December and January, this virtually halted shipments of hardwood products from the region to the UK.

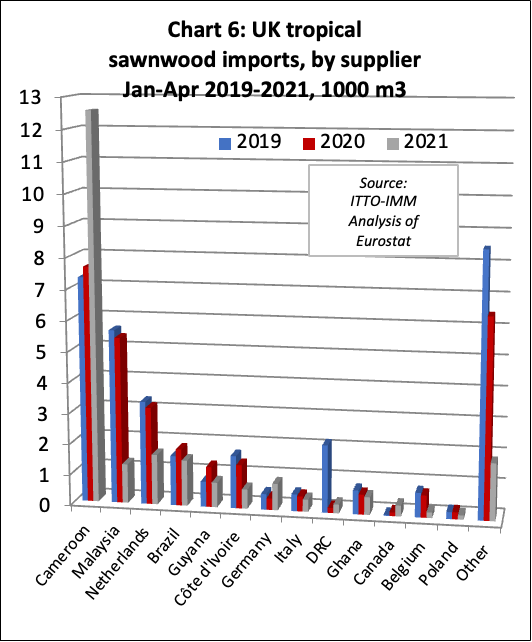

After falling sharply in May and June last year, UK imports of tropical sawnwood strengthened between July and December but the momentum has slowed this year. UK imports were 23,000 cu.m in the first four months of 2021, 23% less than the same period in 2020. Although imports from Cameroon, now by far the leading supplier to the UK, increased by 64% during the four-month period, imports from all other leading tropical sawnwood supply countries declined (Chart 6).

The large increase in imports of sawnwood from Cameroon was due to the long lead time in shipment of contracts placed back in 2020. UK importers now report that supply for hardwoods from Cameroon and other African supply countries is very limited. Global demand for species such as sapele, sipo and iroko, accompanied by production delays and logistical difficulties, have been such that many African mills placed a moratorium on taking new orders in late March and throughout April this year. The few mills with capacity to take orders which can be produced and shipped relatively quickly are taking advantage with high premiums being requested.

Even African hardwood species such as ayous and okoume are limited in supply, in part due to the fact that consumer markets are seeking new alternatives to their customary products such as American tulipwood which is hardly available at present.

UK imports of tropical sawnwood from Côte d’Ivoire were no more than 630 cu.m in the first four months of this year, 56% less than the same period in 2020. The UK was previously a significant buyer of framire from Côte d’Ivoire but UK importers report that this species is proving increasingly difficult to source, both due to a lack of raw material in the forest and the challenges of obtaining assurances of legality that satisfy UK Timber Regulation requirements.

UK imports of tropical sawnwood from Malaysia were only 1,300 cu.m in the first four months of 2021, 77% less than the same period last year. Imports from Malaysia have been severely affected both by production problems during pandemic and extreme shortages of container space. The latter has led to the first breakbulk shipments of Asian meranti and keruing lumber into the UK for nearly 30 years, with the first arrivals in May (and therefore not appearing in these statistics).

With shortages in supply from other sources, UK importers were turning more to Brazil in the opening quarter of the year, but imports from the country slowed again in April. In the first four months of 2021, total UK imports of tropical sawnwood from Brazil were 1,500 cu.m, 20% less than the same period last year.

Indirect UK imports of tropical sawnwood from other EU countries also fell dramatically in the opening months of this year. Total UK imports from EU countries were 3,800 cu.m in the first four months of 2021, 29% less than the same period last year.

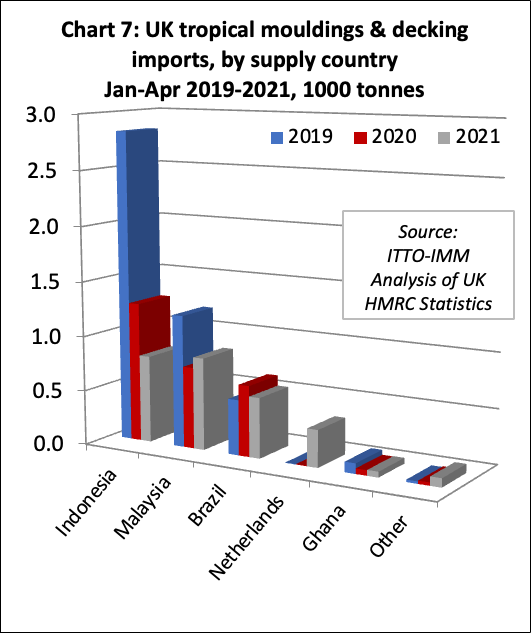

The UK imported 2,700 tonnes of tropical hardwood mouldings/decking in the first four months of 2021, 7% less than the same period in 2020. Imports declined 38% from Indonesia to 800 cu.m and were down 15% from Brazil to 500 cu.m. These losses were only partly offset by a 13% rise in imports from Malaysia to 800 cu.m and by imports from the Netherlands rising from close to zero to 300 cu.m this year (Chart 7).

The TTF reports that the UK market is currently suffering from severe lack of availability of bangkirai decking, “initially due to the freight hikes at the beginning of the year but, it seems, in the past 3 months or so, due to suppliers selling UK bound stocks to other markets at a time when the availability of (replacement) logs and lumber suddenly dried up”.

The number of Indonesian mills offering bangkirai for sale to UK importers is now very restricted and the few offers being made are “at prices about 50% higher than where they were back in December which has led to significant interest in cheaper Brazilian Decking species”, according to the TTF.

UK timber imports from the EU at record levels despite Brexit

An impact of the UK’s departure from the EU single market and customs union on 1st January this year was meant to be a decline in the quantity of UK timber imports from the EU. This forecast followed expectations of logistical problems as new controls were introduced at the UK border, increased scrutiny of the plant health and legal status of EU wood products imported into the UK, and sluggish economic activity in the UK due to post Brexit uncertainty.

However, not only did UK imports from the EU fail to decline in the opening months of 2021, but they were at record levels for the time of year.

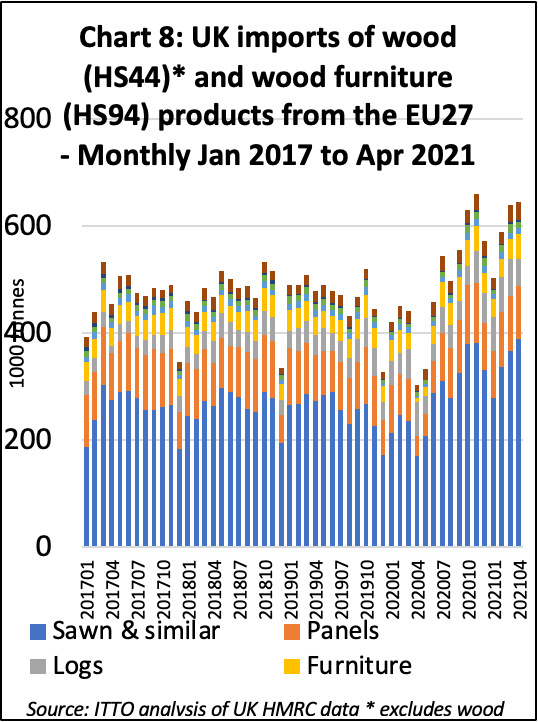

Chart 8 shows the quantity of UK imports of all wood and wood furniture products from the EU (excluding wood for fuel) on a monthly basis since the start of 2017. Following the dip in imports with the introduction of the first lockdown in April and May last year, imports recovered strongly through to November. They cooled a bit in December and January, but less than usual for the time of year, and then rebounded rapidly between February and April.

In total, the UK imported 2.38 million tonnes of wood products from the EU27 in the first four months of 2021, 47% more than the previous year, which of course was COVID-affected, but also 21% more than in 2019, the last “normal” year. In fact, the quantity of UK imports of wood and wood furniture from the EU27 in the first four months of 2021 was at the highest level since at least 2005.

Most of this growth was concentrated in softwood sawnwood and logs and panel products, which dominate UK imports from the EU27 (at least in tonnage terms). However, imports of furniture and hardwood products which compete more directly with imports from the tropics also grew strongly from the EU in the opening months of this year.

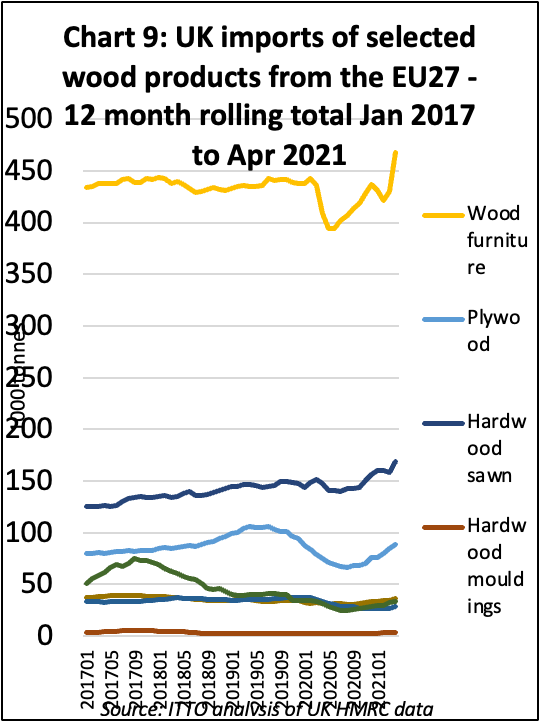

Chart 9 showing 12 month rolling total imports into the UK from the EU27, highlights that following a sharp fall in UK imports of wood furniture from the continent during the first lockdown in April/May last year, imports gradually recovered in the second half of 2020. They then weakened only slightly in January this year and surged in March and April. In contrast, a gradual long term rise in UK imports of sawn hardwood from the EU seems to have been little impacted by either the COVID lockdown or the UK’s departure from the single market.

UK imports of plywood from the EU27 fell sharply from the middle of 2019, when the market was seriously affected by over-stocking, and this downward trend continued until the last quarter of 2020. However, UK imports of plywood from the EU27 have been recovering again this year.

Similarly, UK imports of flooring, doors and veneer were all sliding throughout 2019 and 2020, but the downward trend has haltered this year and there has been a slight upturn.

Of course, it is early days for the UK outside the EU single market, and the UK timber market is currently experiencing unprecedented conditions due to the COVID pandemic. A massive government stimulus, including low interest rates, a stamp duty holiday, and an additional £2bn spending on infrastructure, has combined with a huge surge in home and garden renovation activity as people have either moved house or improved their existing homes. Cash usually spent on vacations and other recreational activities has instead poured into construction.

Meanwhile supplies of wood products from sources further afield, in China, South East Asia, North and South America, and Africa, have been severely disrupted. All this has fed a huge upturn in UK demand for timber imports from the EU and in prices which, for now, have encouraged importers and distributors to overcome the new logistical and bureaucratic challenges of sourcing from the EU.

The only questions now are: for how long will this extra-ordinary market situation in the UK continue; and, if and when there is a return to “normality”, will the long-expected UK pivot away from the EU to other supply sources then take place or will the UK’s renewed dependence on EU suppliers be maintained for the long-term?

PDF of this article:

Copyright ITTO 2021 – All rights reserved