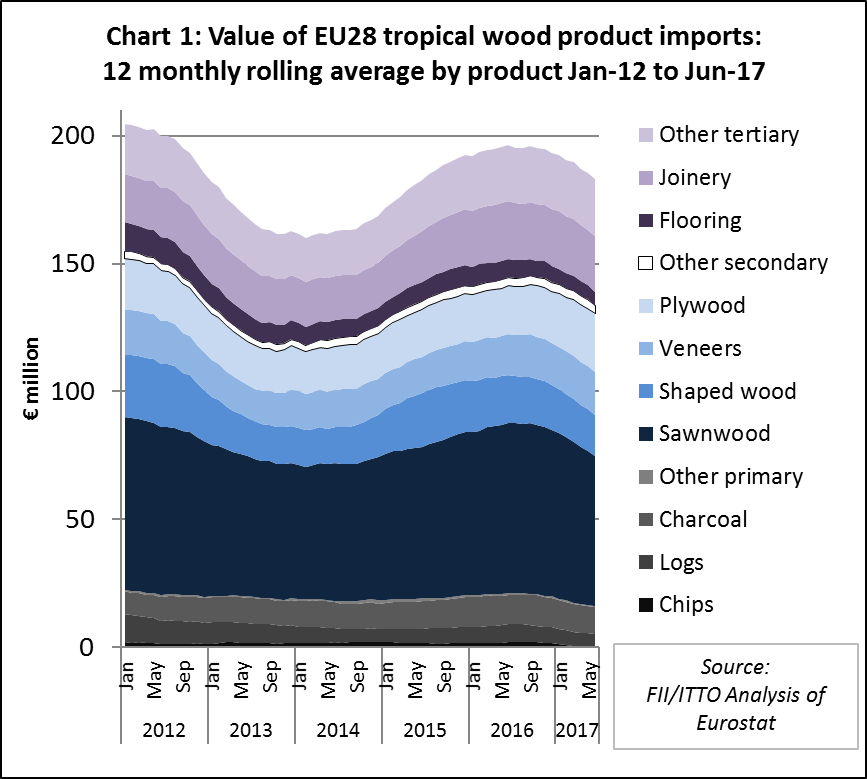

The slowdown in EU imports of tropical timber products registered in the first quarter of 2017 continued into the second quarter. Twelve monthly rolling average imports, which peaked at just below €196 million in June 2016, fell to €183 in June 2017. Most of the rise and subsequent slowdown in EU tropical imports was driven by sawn wood. (Chart 1).

The decline in EU tropical wood imports this year is, in some ways, even more troubling than other larger downturns which have regularly afflicted the European trade in the last decade. The downward trend runs contrary to broader economic conditions across the continent which, while hardly buoyant, are more robust than at any previous time in the last five years.

The downturn comes at a time when EU tropical wood imports have barely recovered from the all-time low of 2013 and affects nearly all products and EU markets.

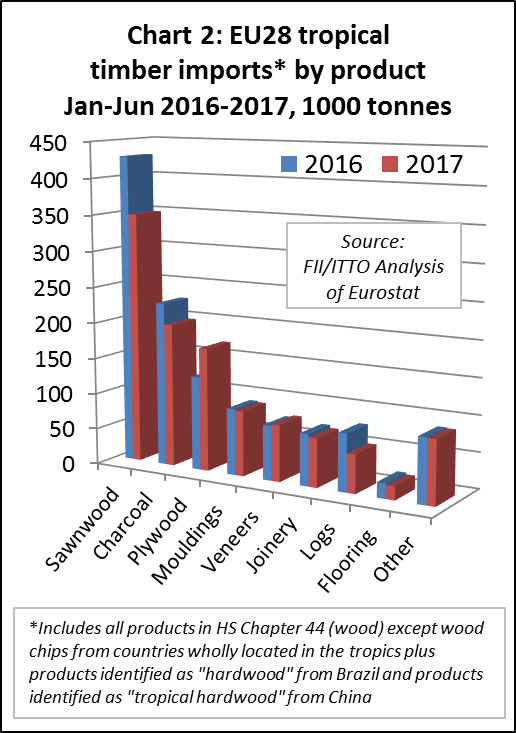

In the first half of 2017 compared to the same period in 2016, total EU imports of tropical timber products declined 8% to 1.12 million metric tonnes (MT). There was an 18% decline in EU imports of tropical sawn to 349,000 MT, a 13% decline in imports of tropical charcoal to 199,000 MT, a 33% decline in imports of tropical logs to 54,000 MT, and an 11% decline in imports of tropical flooring to 19,000 MT.

These losses were only partly offset by a 31% rise in imports of tropical plywood to 171,000 MT and a 3% rise in imports of tropical veneer to 78,000 MT. (Chart 2).

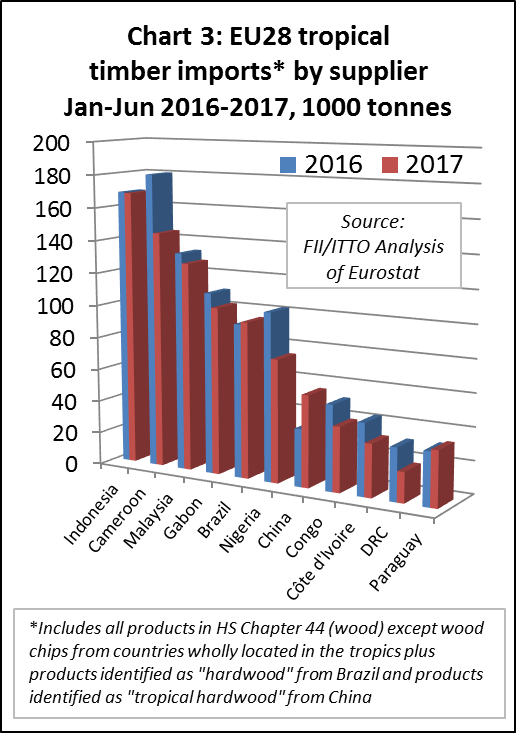

The EU imported 168,000 MT of tropical timber products from Indonesia in the first 6 months of 2017, exactly equivalent to the same period in 2016. This is much less than hoped since Indonesia became the first country to issue FLEGT licenses in November 2016. However, Indonesia has performed better than nearly all other tropical timber supplying countries in the EU market this year.

EU imports declined from all other major tropical supplying countries in the first half 2017, with the lone exception of Brazil. Imports from Brazil were 95,000 MT during the period, a slight (2%) increase compared to the first half of 2016. EU imports of tropical products (nearly all plywood) also increased 60% from China to 56,000 MT in the first half of 2017.

In contrast, direct EU imports of tropical products from Cameroon declined 20% to 145,000 MT, Malaysia declined 4% to 128,000 MT, Gabon declined 8% to 102,000 MT, Nigeria declined 27% to 75,000 MT (mainly charcoal), Congo declined 24% to 40,000 MT, Côte d’Ivoire declined 27% to 32,000 MT and DRC declined 43% to 19,000 MT. (Chart 3).

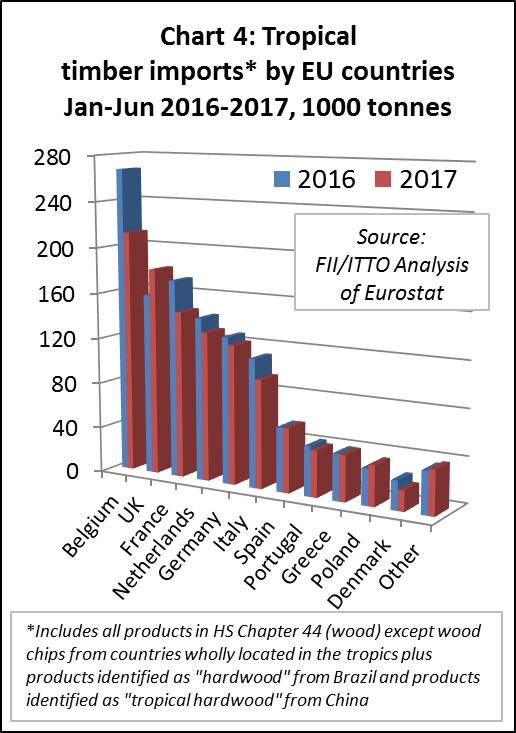

After rising strongly in 2016, imports of tropical timber products in Belgium declined 21% to 212,000 MT in the first half of 2017. Imports in France, Germany and Italy, which were sliding in 2016, declined further in the first half of 2017. Imports fell 16% to 146,000 MT in France, 5% to 122,000 MT in Germany and 16% to 95,000 MT in Italy. After showing signs of recovery last year, imports in the Netherlands weakened in the first half of 2017, falling 8% to 131,000 MT. (Chart 4).

The decline in tropical wood imports into eurozone countries is surprising given evidence of improving economic conditions in the region. Growth in the eurozone picked up to its fastest pace since 2011 in the second quarter of this year, with GDP in the past 12 months rising by 2.2%. In the three months to June the eurozone economy grew by 0.6%, matching the same healthy number from the first quarter of the year. German GDP grew by 0.6% in the quarter, Spain’s by 0.9%, France’s by 0.5% and the Netherlands by an unexpectedly strong 1.5%.

This positive trend has contributed to a sharp increase in the euro-dollar rate, from 1.05 in early January 2017 to nearly 1.20 by the end of August. It’s possible that this rise in rates is acting temporarily to discourage imports. EU buyers are often unwilling to build stock at a time when euro import prices are falling and they anticipate further price decreases in the future.

It is significant that the UK is the only major EU market where tropical wood imports held up well in the first half of 2017. UK imports increased 21% to 90,000 MT during the period.

Again, this seems to conflict with underlying economic trends. The UK grew by 0.3% in the second quarter of 2017, a significantly slower rate of increase than the major eurozone economies. Much of this growth was driven by the service sector. Industrial output shrank by 0.4% and construction contracted by 0.9% during the same period as uncertainty has mounted since the Brexit vote.

This uncertainty is also reflected in exchange rates. The British pound has weakened sharply against the euro and stayed quite flat against the dollar this year. In contrast to eurozone importers, those in the UK had an incentive to build stock in the first half of 2017 in expectation of a further weakening in the exchange rate and rising import prices later in the year.

If the divergent trend in UK and eurozone imports of tropical timber in the first half of 2017 is driven mainly by short-term changes in exchange rates, then a reversal may be expected in the second half of the year – UK imports are likely to slow and eurozone imports to rebound again.

However, if the downward trend in the EU tropical timber trade continues, even as economic activity recovers in the eurozone, then it will be necessary to look to more fundamental causes.

It is possible, for example, that the combined effect of increased EUTR enforcement, limited availability of independently certified or legally verified tropical timber, the difficulty of demonstrating negligible legality risk in the absence of such certification, the existence of large alternative markets where there is still little demand for such assurances, and the further development of wood and non-wood substitutes, will be a long-term and ever deepening slump in the EU market for tropical timber products.

PDF of this article:

Copyright ITTO 2020 – All rights reserved