Short term prospects for the European hardwood sector appear very poor. Hardwood consumption has been hit by serious economic disruption resulting from the bursting of the property bubble and associated credit crunch. This has created a vicious downward spiral as lack of credit to businesses and individuals is now causing severe cash flow problems and reducing economic activity further, contributing to rising levels of unemployment, higher debt default rates, and further falls in consumer spending. Media reports highlighting these problems are helping to reinforce and deepen negative sentiment. It should be said, however, that the world keeps turning, there is economic activity and wood is being consumed. Although the market is extremely competitive, those with the right stock at the right price are finding buyers.

But there is no disputing that these are extremely tough times for hardwood traders in the EU. According to many importers – whether of logs, lumber or plywood – these are the worst trading conditions they have ever experienced. Many suggest that there was particularly abrupt deterioration in market conditions with the banking crises that emerged in early October.

At present it is too early to say with any degree of certainty how much of the demand lost since the onset of the economic crises will be lost and for how long. Some large European importers report that they have bought hardly anything for forward shipment for six months. Generally cash flow is extremely tight and efforts are still being made to reduce inventory. This in turn is feeding through into even lower prices for landed stock. At some point stocks will reach a level where it becomes essential for buyers to move into the forward market, but most reports suggest that stage has yet to be reached.

Giving accurate price indications in such market conditions – where the major focus is on reducing existing grounded stock levels and there is very little forward buying – is extremely difficult. Forward prices are generally being quoted across a wide range. All that can be said with any degree of accuracy is that there are cheap offers around on many standard items. These are coming from those shippers most desperate for cash flow and that have been slower to react to changing market conditions by reining in production levels.

Statistics show steep declines in EU imports of hardwood commodities during 2008

Unfortunately the reports of an abrupt downturn in EU demand during the last quarter of 2008 cannot yet be tested with reference to trade statistics. The most recently available comprehensive EU import statistics available to this correspondent run only until the end of the third quarter of 2008. These show that while the hardwood trade in some European countries was holding up reasonably well to the end of September 2008, trading conditions in others has been in steep decline all year.

The following charts show the volume of hardwood primary and secondary wood products (logs, rough sawn timber, veneer and plywood) imported from developing countries by the EU-25 group of countries (i.e. all EU countries excepting new

members Romania and Bulgaria). The data is for quarterly imports beginning in the first quarter of 2007 and ending in the third quarter of 2008.

Chart 1, which breaks the data down by product group, highlights that EU imports of hardwood logs from developing countries declined dramatically from the start of 2008 onwards, while imports of hardwood sawn lumber, veneer and plywood were also sliding downwards, although at a slower pace.

Chart 2 shows that the biggest decline in EU imports of hardwood products from developing countries in the first 9 months of 2008 was recorded by France which has seen a significant fall in the volume of log imports, particularly from Africa. It also shows that Italian imports have been on a downward trend at least since the start of 2007, a sign of longer term economic problems in that country. Meanwhile imports into Spain and Portugal were rising strongly throughout 2007, but fell dramatically from the start of 2008 onwards with the popping of Spain’s housing bubble. Anecdotal reports indicate this trend continued and intensified in the fourth quarter of 2008. Spanish wood importers suggest that overall hardwood sales in 2008 may be down as much as 30% to 40% compared to the previous year. The German and Dutch markets were characterised by a steady slide in imports from around the third quarter of 2007 onwards. Interestingly, both the UK and Belgian hardwood markets were performing reasonably well until the end of September 2008, but anecdotal reports indicate an abrupt change of sentiment from October onwards.

Chart 3, which shows data by major supplying country, indicates that EU hardwood imports from Brazil have declined very dramatically, with third quarter imports in 2008 being only around 50% of imports in 2007. Imports of hardwood from China – which mainly consist of plywood destined for the UK – have been extremely volatile, which is not particularly unusual in the commodity plywood sector. EU hardwood imports from China in 2008 have been lower than in 2007, but on a quarterly basis were tending to recover during the first 9 months of the year. This reflects particularly low levels of EU plywood imports from China in the first quarter of 2008 owing to uncertainty over possible introduction of anti-dumping duties on Chinese manufacturers.

The fortunes of African countries supplying the EU have varied widely over the last 12 months. Imports from Gabon – much of which are destined for France – fell away rapidly in 2008. EU imports from Congo Democratic Republic rose strongly at the end of 2008 and into the first quarter of 2008, but then fell dramatically thereafter. Imports from Cameroon, Ivory Coast and Ghana have generally remained more stable, showing only a steady decline during the first 3 quarters of 2008.

Meanwhile EU hardwood imports from Malaysia actually strengthened during 2008 and imports from Indonesia, although still a shadow of their former size, also showed some recovery. Both countries were benefiting from mounting plywood supply problems amongst their major competitors in China.

German demand for African wood products

In a recent report on German demand for African hardwood, the trade journal EUWID notes that demand worsened significantly in the closing weeks of 2008. Some African

exporters were cutting prices to German buyers in an effort to obtain supply contracts but without much success. EUWID note that “indications of actual prices are rather vague as many importers simply have not placed any new orders in Africa”. As a result, EUWID report that price quotes for standard lumber items are ranging very widely. For example, FOB prices for FAS air dried sapele lumber in random lengths are quoted in the range €400/m3 to €500/m3 (down from €500-600/m3 at the end of September 2008). Equivalent prices for sipo are quoted at €500/m3 to €650/m (down from €650-€700 at the end of September 2008). EUWID note that prices quoted for logs by African shippers to German importers seem to be more stable but low levels of actual purchasing make any meaningful assessment of real market prices difficult.

No sign of light in the UK plywood market

“Desperation to clear stock heightens competition” – the headline of the UK Timber Trade Journal’s most recent report on the UK plywood market gives an idea of the scale of the challenges currently facing the sector. Writing in mid December, TTJ note that “in many cases customers cheque books were locked away several weeks ago and have not reappeared. It has become almost impossible for plywood importers to quote a price that would encourage a purchaser to buy ahead of the Christmas period”. At that time, UK importers were off-loading stock as fast as possible, putting strong downward pressure on landed stock prices. TTJ reported that offers of Chinese plywood “at very low levels”, supported in part by the Chinese government’s decision to raise tax rebates on plywood and other panels from 5% to 9% in an effort to support export sales, had yet to have any impact on UK purchasing decisions. Some of the UK’s largest importers of Chinese plywood are believed already to be sitting on several month’s stock and some of those that have placed forward orders have been requesting delays to shipment and even attempting to renegotiate contracts. TTJ notes that prices for Malaysian plywood on offer to UK buyers have also weakened on the back of the generally negative market sentiment.

European construction holds out prospect for longer term growth

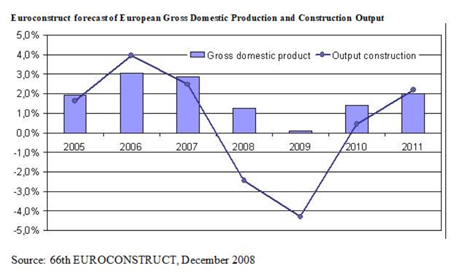

Given that the European constructions sector is estimated to account directly for around 70% of all European consumption of wood products, future activity in this sector to a large extent holds the key to future market demand. A comprehensive forecast of future trends was one outcome of the Euroconstruct Conference which brought together 180 experts in early December. This suggests that, despite the short-term gloom, there are reasons to be optimistic about medium and long term prospects.

According Euroconstruct, the construction market in Europe is worth nearly 1,650 billion (thousand million) euros, a figure which exceeds the entire GDP of Italy. While much of the news surrounding European construction in recent times has focused on the rapid deterioration of residential construction in several western European markets – notably in Spain, the UK and Ireland – Euroconstruct highlight that this is only part of the story.

Euroconstruct emphasise the huge variations in construction sector activity that exist throughout Europe. For example, Eastern European markets (Poland, Czech Republic, Slovakia, Hungary) differ greatly from the market of the Western countries. In the West, residential covers nearly 50% of the market, while in the countries of the East,

civil engineering and non-residential construction are more important. The average budget spent per capita in construction in Western Europe is still three or four times more than the spending made in the Eastern countries. Nevertheless, according to the Euroconstruct forecasts, Eastern Europe will be the focus for construction sector growth in the short to medium term. Euroconstruct note that no European country will be spared by the economic crisis, even in the construction field. Construction output is falling or remains at best positive in Western Europe for the 2008-2009 period. Ireland and Spain are, in this respect, the countries most affected by the crisis. These two countries excepted, participants at the conference predicted growth of 0.2% for 2010 and nearly 1.5% in 2011.

In Eastern Europe, Euroconstruct forecast that construction will continue to grow in 2009 but less markedly than in previous years. Despite the global economic crises, Poland is still going through a good period thanks to work starting on large infrastructure projects. What’s more, from 2010, growth is expected to be more sustained for all the Eastern countries.

Euroconstruct’s general analysis of the sector for 2009 shows that, until recently, it was above all residential that was experiencing difficult times. Although non-residential escaped this negative trend for a while, it appears that it is now caught in the storm. This trend will also affect the civil engineering segment, which will see a reduction in growth though most often without going into the red. Again however, forecasts in this field are less alarming for Eastern Europe.

The figures for renovation throughout Europe are expected to follow a downward trend in 2009 but on a smaller scale than the other segments of the sector. This is good news for hardwood given that renovation projects often use a relatively higher proportion of real hardwood products compared to softwoods and other materials than new build projects.

Euroconstruct are also optimistic about longer term prospects forecasting recovery in the sector from 2010 onwards. The rate of recovery will however vary widely by construction segment. The first to get its head above water should be civil engineering, closely followed by renovation. On the other hand, no improvement in new construction is expected until at least 2011.

Euroconstruct also note that the economic crisis is not the only challenge currently faced by the European construction industry. Other key factors affecting the sector will be a forecast rise in demand for single family homes and a general ageing in the European population. And overshadowing all this is the strong and intensifying political focus on combating global warming which is expected to have huge repercussions on all the construction segments.

Speakers at the Conference were unanimous in the view that sustainable construction is an opportunity waiting to be seized. The issue of global warming highlights the need for infra-structure developments that can better withstand climate fluctuations, for superior energy performance, and for wider use of materials that sequester carbon. Euroconstruct point out that in order to meet EU targets for reduced greenhouse gas emissions over the next half century, a large proportion of Europe’s existing housing stock will have to be either renovated or replaced to ensure they meet much higher insulation levels.

The medium and long term opportunities implied by the Euroconstruct forecasts for increased consumption of wood, which is the most energy efficient building material available, are obvious.

More information about the economic situation and course of European construction can be obtained from two reports (“Summary Report” and the “Country Report”) published by EUROCONSTRUCT. These can be ordered them from the organizer of the Euroconstruct conference (info@aquiec.be).

PDF of this article:

Copyright ITTO 2009 – All rights reserved