At the time of writing, the 63200-tonne dwt Konya was unloading its cargo of plywood and other wood products at the UK port of Tilbury. It was the first timber breakbulk vessel out of Port Klang, Malaysia to London in years and a sign of the times.

Some European plywood importers report that container costs out of Asia have started to come off their pandemic peak. Others, however, say that they are still being quoted charges which one described as ‘unreal’. “We’ve recently been offered rates for a 40ft container of $15,000 to $20,000,” they said. “That compares with $1,500 to $2,000 in October 2020. It’s crazy.”

Even those who report some softening in container rates confirm they remain at historically high levels. Hence widespread migration to breakbulk.

The unprecedented inflation in container charges is principally attributed to the impact of the pandemic on trading patterns, which has left containers in the wrong places, with major quantities stacked empty at ports in consumer countries.

“Changes in consumption and shopping patterns triggered by the pandemic, including a surge in electronic commerce, as well as lockdown measures, have led to increased import demand for manufactured consumer goods, a large part of which is moved in shipping containers,” stated a briefing note on the situation from UNCTAD. “Carriers, ports and shippers were all taken by surprise. Empty boxes were left in places where they were not needed, and repositioning was not planned for.”

As the global economy more generally revived when lockdown restrictions eased, exporters in producer countries, notably in Asia, found themselves increasingly short of containers and prices rose accordingly.

“There’s also clearly been an element of profiteering at some shipping lines,” said a plywood importer. “The fact some are quoting container rates at half the value of the plywood contents is not all down to availability.”

Importers also point out that breakbulk is not a straightforward alternative, particularly for those who have not used it before. It involves more administration, the risk of penalties if cargoes are not at port on time or in the volumes booked and greater likelihood of product damage in transit. While considerably cheaper than container freight, it has also become more expensive.

“Breakbulk operators are seeing an opportunity to make money and their rates have roughly doubled in the last six months,” said an importer distributor.

And transport is just one of the challenges facing the European plywood import trade. Over the last three months, they report, global consumption has continued to gather pace, given added impetus by government economic stimulus measures. At the same time production in many parts of the world remains constrained by lack of personnel due to Covid-19 infection or isolation, plus pandemic safe work practices. Raw material supply is also cited as an issue for some manufacturers. Product prices have consequently continued to climb.

“We’re getting good margins, but obtaining product and managing allocation, keeping your key customers covered and reasonably happy despite the price rises, has made it an increasingly stressful business,” said an importer distributor. “It’s lucrative, but more challenging than at any time we can remember.”

Some European importers expected plywood demand to ease somewhat over the summer season. But, with tourism still depressed by the pandemic, others say they’re not expecting to see the usual degree of holiday slowdown. The general consensus is that for the time being consumption remains on an upward curve.

The European DIY and home improvement market is cited as a key plywood demand driver, as it has been since summer 2020.

“While pandemic controls are being relaxed, large numbers of people are still working from home at least part of the time, and that’s expected to be a permanent state of affairs for many. As a result they’re spending more on improving and enlarging their properties. Loft conversions and garden office building are at record levels,” said a UK-based importer. “Spending on holidays, which was absolutely decimated in 2020, also continues to be depressed this year, leaving more funds for investing in homes and gardens. The UK Construction Products Association stated that in normal times UK holiday expenditure alone exceeds £60 billion a year. So there’s a lot of surplus money around.”

Demand from new build is also reported to be looking increasingly healthy, not least due to fiscal support from governments which see construction as a key engine of economic recovery.

This is borne out by the June report from Euroconstruct. It says that European construction recovery is faster than expected and much of the loss in output due to the pandemic is expected to be recovered in 2021. It forecasts average building growth in the 19 Euroconstruct countries this year to be 3.8%, following last year’s 5.8% contraction. While recovery rates will vary from country to country, with Ireland and Hungary expected to show some further decline in 2021, this puts the industry overall on track to reach pre-crisis levels of activity in 2022 latest.

Besides construction, importers also report good growth in demand from joinery, furniture manufacture, packaging and boat building. “It’s pretty much across the board,” said one.

So far, the import sector reports little market push back on price.

“It can’t last forever, and if we’re not seeing some more significant price easing in two or three months, there may be more resistance, especially if there’s any degree of economic slowdown,” said one importer. “So far though, customers accept that this is a market-wide phenomenon. They’re doing good business, so they’re willing to pay.”

Despite logistical difficulties, added to which are longer manufacturing lead times, most importers are reported to be ‘well covered for purchases’ over coming months.

“But stocks on the ground are still very short, there’s little in the way of a product buffer,” said an importer. “Whatever comes in is delivered immediately. Nobody is saying, why don’t you hold on to our shipment and we’ll take it in four to six weeks. Customers are waiting for vessels to arrive to receive their cargoes. They want it straight away.”

In terms of source of supply, China is reported to be keeping up with demand, albeit with longer lead times, but prices have been rising increasingly steeply.

“In the first quarter increases were moderate, but in Q2 we’ve seen rises of 15-20% F.O.B.,” said an importer. “Compared to Brazilian, that’s not too bad, but when you factor in freight rates it makes quite a difference.”

Chinese producers are also reported to have become increasingly assertive.

“Some are trying to renegotiate outstanding contracts,” said an importer. “For orders placed April/May they’re maybe asking for another $15-20 per cube. They say they’re facing rising costs for raw materials, including glues, logs and veneer. If you don’t pay, you risk the plywood not being produced and, if you’ve booked the breakbulk ship space, you then risk incurring dead freight and demurrage charges from the shipping line.”

Chinese ports are also reported to be congested with breakbulk vessels and shipping lines are asking for surcharges to cover added waiting times.

Brazilian price inflation is attributed primarily to the combination of the impact on manufacturing of the severe Covid-19 situation in the country, plus huge demand from the US construction market.

“For standard 18-20mm elliottis plywood we were paying $250-300/m3 last October/November. Lately the asking price from Brazil has been $500-600/m3. Basically they’ve doubled up,” said an importer. “Unless they desperately needed a specific product, European importers more or less stopped buying Brazilian in March/April this year when prices reached this level. More recently we’ve heard that there have been shipping line issues between Brazil and the US and we’ve had more spot volume offers from Brazilian producers at slightly lower prices. Whether this is the start of a wider downward trend remains to be seen. Despite these shipping problems, the US remains a booming market, the government is injecting more money into the economy and, even at recent high price levels, Brazilian plywood remains the cheapest Americans can get for the quality.”

Brazilian prices are in turn said to be helping push up Chinese.

“People who used to buy volume from Brazil have been trying to replace it from China, adding further inflationary pressure to their products,” said an importer distributor.

Russian birch plywood supply is reported as tight, sold until September, and prices have also reached new heights.

“Yesterday we were asked to pay £62 per board for 18mm. At the start of last year pre- pandemic it was £17,” said a UK importer.

Adding a further market challenge is the preliminary anti-dumping duty imposed on Russian plywood by the EU on June 15. This has been set at 16% DAP (delivered at place) and will remain in place until December, when the EU will decide on the rate going forward.

“This has also led more European buyers to look to Asia, but freight rates are limiting the extent to which it’s viable to switch from Russian,” said an importer-distributor.

But for the cost of containers, importers thought Indonesian producers, in particular, would be able to capitalise on the anti-dumping duty and substitute Russian film-faced with their products.

“We saw an increase in Indonesian timber imports into Europe from 2016-2019, partly due to rising consumption generally, but we also feel to an extent due to FLEGT licensing and the fact it has a green lane through the EUTR,” said an importer. “If it wasn’t for the container rates, they could potentially now have a real opportunity to replace Russian film-faced. With quotes on containers from Indonesia at $13,000-15,000, however, it isn’t a viable proposition. Switching to breakbulk on Indonesian is also problematic. To make it feasible you need shipments of 1,000m3 to 2,500 m3. That’s OK in China, but more difficult to organise in Indonesia. Delivery to port is less reliable and you risk incurring charges from shipping lines if cargo doesn’t show. We’ve got outstanding orders from Indonesia set for departure in June, which we’re now told won’t be shipped until the end of September. We’re hearing producers are facing log shortages too. Clients are not really interested in placing orders if they’re going to face three month delays, or possibly longer. So Indonesia has potential to be an interesting partner for us, but with this combination of negative factors, it isn’t the attractive option it could be. Things could change. If container rates come down to $7,500, the dollar doesn’t get too strong and, with the EU anti-dumping duty on Russian in play, then Indonesia could be in business. But there’s a lot of what ifs and question marks there.”

Looking further ahead, some European importers anticipate Russia’s log export ban, set to come into force in the New Year, having plywood market repercussions.

“It shouldn’t affect production in Europe unduly, as its Russian birch log imports are limited,” said an importer. “But China imports huge volumes of logs from Russia in all species, including birch. So unless the two strike a bilateral deal, Chinese manufacturers may face a raw materials challenge and we could see further pressure on their production and prices.”

The option of plywood importers buying European product rather than expensive imports from elsewhere has been limited by manufacturers’ capacity.

“European prices have also been rising,” said an importer-distributor. “We’ve bought a little Polish recently, but pricewise, they’ve also followed the international trend.”

An added issue for UK businesses has been fallout from Brexit. They report increased transport costs from mainland Europe, with haulage companies upping rates to offset the increased time taken by new port and customs procedures. There are issues too trading with Northern Ireland and Ireland. Under the UK’s EU exit deal, Northern Ireland remains in the EU single market. That means plywood and other timber products from the British mainland imported into Northern Ireland have to undergo EU Timber Regulation due diligence.

“Also if we ship goods to Northern Ireland for transit to Ireland, they incur further duty, even if we’ve paid duty on them entering the British mainland,” said a plywood company with sites in England and Northern Ireland. “There are ways around this, but it really isn’t a satisfactory arrangement.”

European plywood imports rebound strongly since September last year

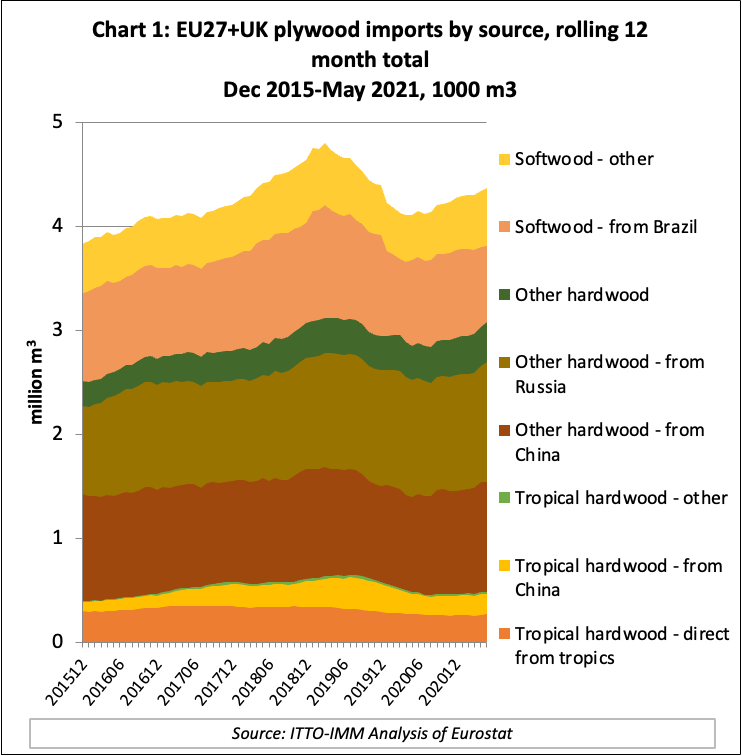

Latest analysis of Eurostat figures underlines the recent volatile conditions in the EU and UK plywood trade. Total EU+UK imports from outside the rose to a peak of 4.8 million m3 in the 12 months to March 2019 before declining sharply to a low of 4.1 million m3 in the 12 months to March 2020. The decline in imports predates the first Covid-19 lockdown in Europe and was due to weakening construction sector activity and overstocking in the pre-pandemic period. The rebound in construction and DIY activity after the first lockdown period is mirrored by a sharp rise in imports starting in September last year and continuing until May this year (Chart 1).

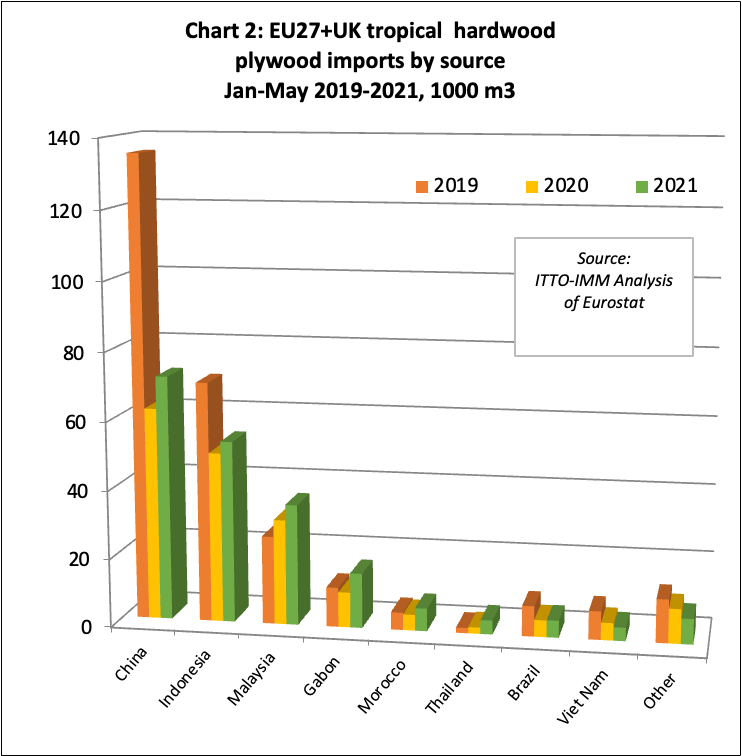

Overall EU+UK plywood imports declined 2.9% to 4.3 million m3 in 2020 but rose 5.1% from January to May 2021 compared to the same period the year before to 3.8 million m3. Following a fall of 11.8% in 2020, hardwood plywood imports from the tropics in the first five months of this year were up 11.5% to 122,000 m3, while tropical hardwood plywood imports from China, after contracting 30.3% in 2020, rose 15.3% to 72,000 m3. Looking at individual tropical plywood suppliers, EU and UK imports from Indonesia from January to May 2021 were up 7% at 53,000 m3, from Malaysia 14.8% at 35,000 m3, Gabon 16% at 16,000 m3 and Thailand 122.8% at 4,000 m3, while those from VietNam were down 23.4% at 4,000 m3. Those from Morocco were up 43.7% at 7,000 m3 and from Brazil 2.1% at 5,000 m3 (Chart 2).

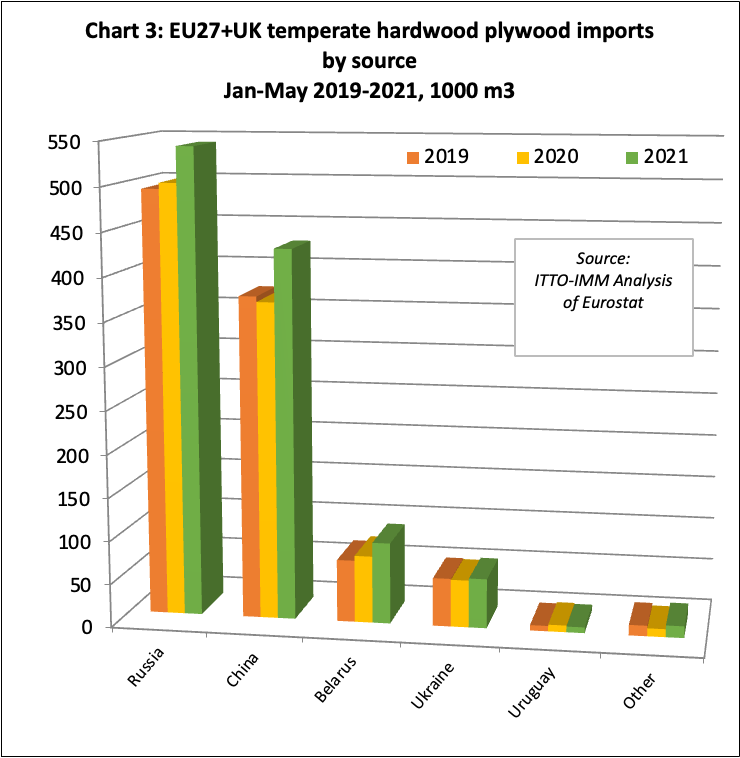

In the first five months of 2021, temperate hardwood plywood imports from China were up 16.5% at 428,000 m3, while those from Russia increased 8.3% to 542,000 m3 and from other non-tropical countries 14.7% at 172,000 m3 (Chart 3).

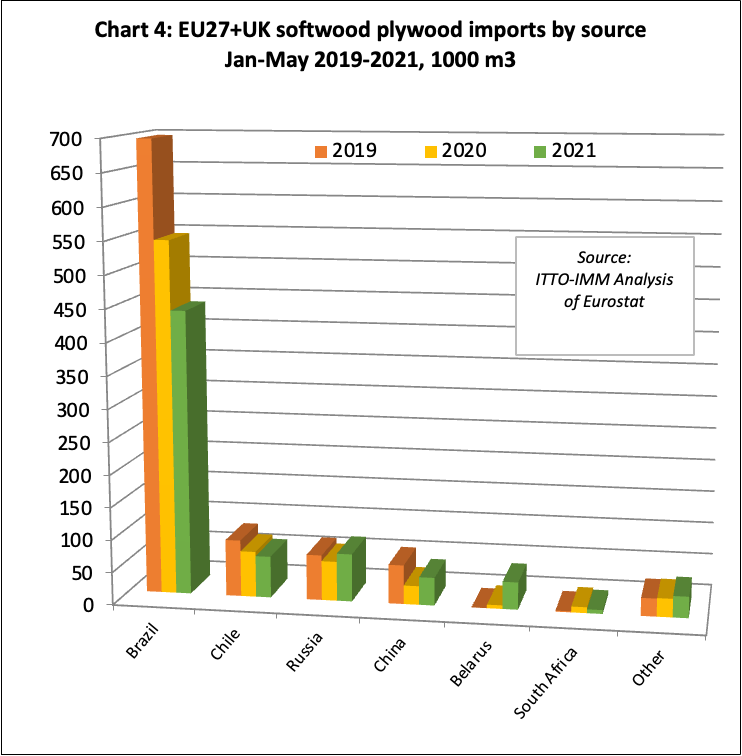

Underlining the European shift away from Brazil due to the rise in prices triggered by US demand, Brazilian softwood plywood imports dropped 19.5% from January to May 2021 to 439,000 m3. Softwood plywood imports from other countries were up 28.6% to 261,000 m3, with those from China ahead 48.7% at 43,000 m3(Chart 4).

Heat expected to come off the plywood trade in second half of 2021

The outlook for the broader marketplace according to European plywood importers is for little change from current trading conditions over the next few months. But, with some qualifications, there’s a feeling the heat could start to come off the trade heading into Q1 2022 and possibly sooner.

“We’re seeing raw materials costs across all industries, not just wood products, at unprecedented levels due to the combination of recovering demand and continuing production restrictions due to the pandemic,” said an importer. “Estimates are that this has pushed the cost of building the average home in Europe up 25%, for instance. So families who previously were looking at spending €400,000-€500,000 on a house are now having to find €500,000-600,000. That’s going to have repercussions in financing and beyond the medium term it’s not sustainable. Add in government stimulus measures winding down and we wouldn’t be surprised to see a slowdown early in the New Year.”

Another importer distributor generally agreed.

“The unknown factor is the course of the pandemic. It may yet put more pressure on prices and logistics,” they said. “But there are signs of the market anticipating supply and demand moving more into line and prices coming off their peak. Our customers are generally bought up for the next three months and business is increasingly hand to mouth. From October there’s more hesitancy, as people don’t want to commit that far ahead, then see prices fall and have to write off expensive stock. There is already talk of price corrections in Brazilian and Russian. The hope is, of course, that we get a gradual adjustment, rather than prices that have doubled over the last 18 months, halving overnight. That could really destabilise the market. We’ll just have to wait and see and, in the meantime, keep business tight, keep customer communications open and not over commit.”

PDF of this article:

Copyright ITTO 2021 – All rights reserved