The European hardwood import trade is now very focused on stock reduction and receiving delivery of outstanding contracts. While hardwood stock levels across the main European markets have been whittled down during the course of 2008, the general view is that they are still adequate to meet current very subdued levels of demand.

There is very little forward purchasing across the board at present resulting in rather vague price quotes for some products. Forward prices for most African hardwoods which are invoiced in euros are generally regarded as stable although there continue to be some reports of downward pressure on sapele lumber prices due to excess stocks and weak demand. However African hardwood agents suggest that tight margins in the African supply chain place strict limits on the ability of shippers to reduce sapele prices much further. And many importers are also now more sceptical of the value of reducing prices for onward sales since experience is showing that in the current European market even significant price discounts do not greatly increase the outflow of products.

There has been rapid strengthening of the US$ against the euro and sterling in recent weeks. In normal trading conditions, this trend would stimulate more forward buying of dollar-denominated stock in Europe as importers take steps to cover their future position and to exploit the progressive increase in the euro value of their stock. However due to market uncertainty and weak consumption, there is very little evidence that the recent shift in exchange rates has encouraged any pick up in European forward buying of dollar denominated stock. Instead shippers in the Far East and South America are coming under significant pressure from European importers to reduce prices. European purchasing from both supply regions has remained extremely slow, with importers only seeking to cover their most basic requirements. Despite efforts to cut-back on production, importers report they are able to place orders for most products and grades from the Far East without encountering any major problems.

With respect to future market development, the general feeling is that there is very unlikely to be any real change for several months with very little forward buying until at least the first quarter of 2009.

Expanding requirements for CE Marking

The phased introduction of CE Marking of products used in the construction sector throughout the European Union is having a significant impact on attitudes towards product quality. Requirements for CE marking in construction are imposed on products covered by the Construction Products Directive (CPD), one of the so-called European ‘New Approach Directives’ which set out these requirements in a range of economic sectors. The aim of CE Marking is to ensure that products which are fit for their intended use can be freely traded throughout the European Union. This applies both to products produced within the Community and to those imported from countries outside the Community.

CE Marking is designed to overcome the problems which have prevailed through the application of different technical requirements in the member states of the EU. CE Marking aims to remove these technical barriers to trade within the single market by establishing a single, agreed, standard for demonstrating the performance of particular products, and a system of certification and test bodies which are recognised as competent throughout the Community. CE Marking is, in effect, a “passport” for manufacturers to market their products throughout the EU. CE marking requires that a manufacturer has documented and independently assessed conformity to an internal production control system.

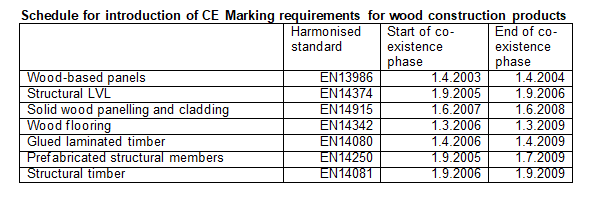

CE Marking has been possible for certain products since 1997, based on European Technical Approvals (ETAs), but the real increase in the CE marking started with the introduction of harmonized European Standards (ENs) in 2001 which are intended to replace national standards. Since then a series of harmonised standards covering a wide range of wood products has been developed. Following publication, these standards are generally introduced on a voluntary basis initially during a “co-existence phase” when they are applied alongside national standards for a set period of time. At the end of this period all national standards are withdrawn and replaced by the EN standard.

The E.C. Construction Products Directive requires each member state to establish systems of regulation and enforcement designed to ensure that construction products are sold for the correct end-use. Nearly all European countries have opted to include mandatory requirements for CE Marking of materials supplied to the construction sector as the new harmonized standards are progressively introduced. Others, like the UK, do not require CE marking but all materials suppliers to the construction sector are now legally obliged to ensure that all products are correctly labelled and to demonstrate that products are fit for their intended use. Even in those countries where CE Marking is not mandatory, it is increasingly seen as the most effective way to demonstrate compliance with the CPD.

The current schedule for introduction of CE standards relating to key wood products in the construction sector is shown in the table below. Particularly relevant this year to the tropical timber industry has been the introduction of mandatory requirements in most EU member states for CE Marking of solid wood panelling and cladding. Major events next year will be the introduction of mandatory requirements for CE Marking in most EU member states for CE Marking of wood flooring from 1 March 2009 and structural timber (including decking) from 1 September 2009.

PDF of this article:

Copyright ITTO 2008 – All rights reserved