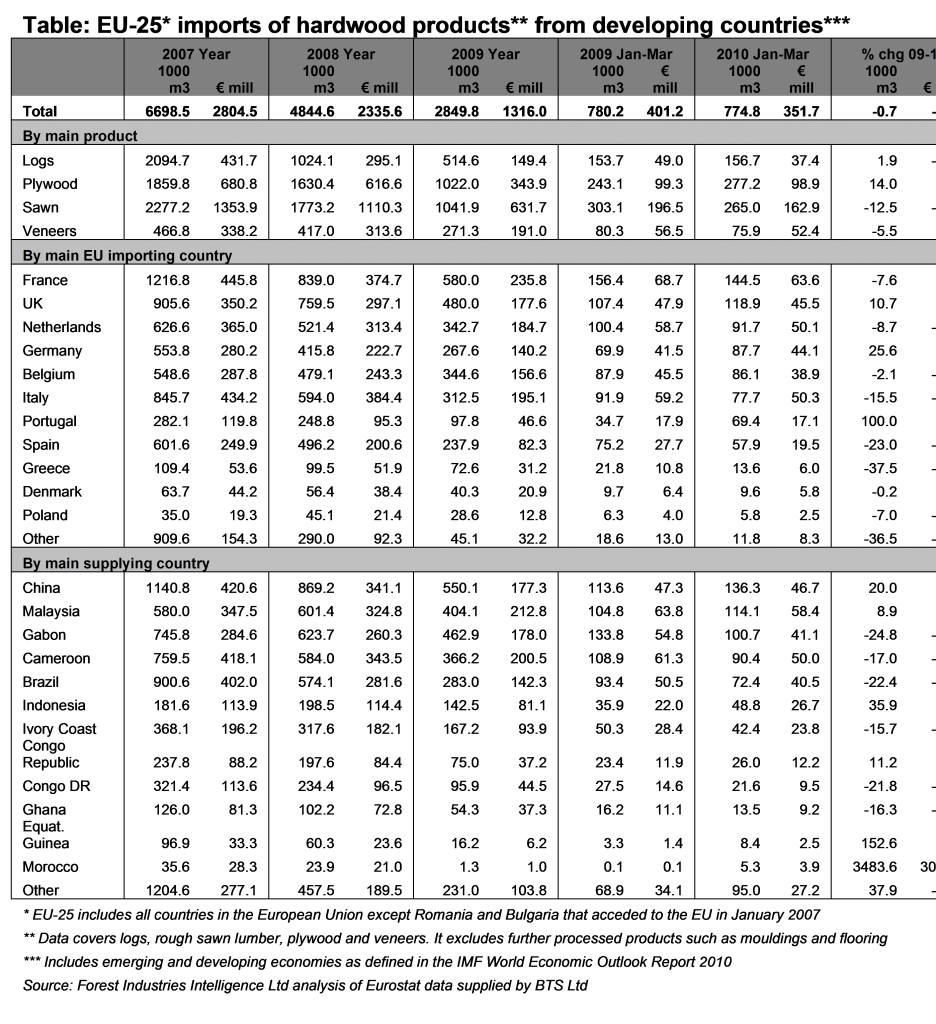

The latest EU-wide trade data indicates that imports of hardwoods from less developed countries (LDCs) remained at an extremely low level during the first quarter of 2010 (see table). During this period, European imports of hardwood logs, sawn, plywood and veneers from LDCs totalled no more than 775,000 m3. This is almost exactly equivalent to the volume achieved in the first quarter of 2009, a year when total European imports of LDC hardwood products fell by over 40%. The total value of EU imports of these commodities during the first quarter of 2010 was actually down 12% compared to the same period in 2009.

The significant decline in the unit value of EU imports of LDC hardwoods during 2009 seems surprising given clear indications of rising prices for many tropical hardwood products from mid-2009 onwards in response to declining availability. To some extent the overall unit value figures are distorted by their inclusion of eucalyptus logs (significant but rather inconsistent volumes of these very low-value “hardwood” logs are imported by Portugal and Spain from Uruguay every year to supply the paper sector). However, the fact that the decline in unit value was also apparent in the hardwood sawn and plywood data may by an indication that European importers and manufacturers are switching during the recession to lower grade and cheaper raw materials in an effort to cut costs. The figures certainly underline anecdotal reports suggesting that tropical hardwood shippers seeking to push through CIF price increases in Europe this year have continued to come up against firm resistance from European importers.

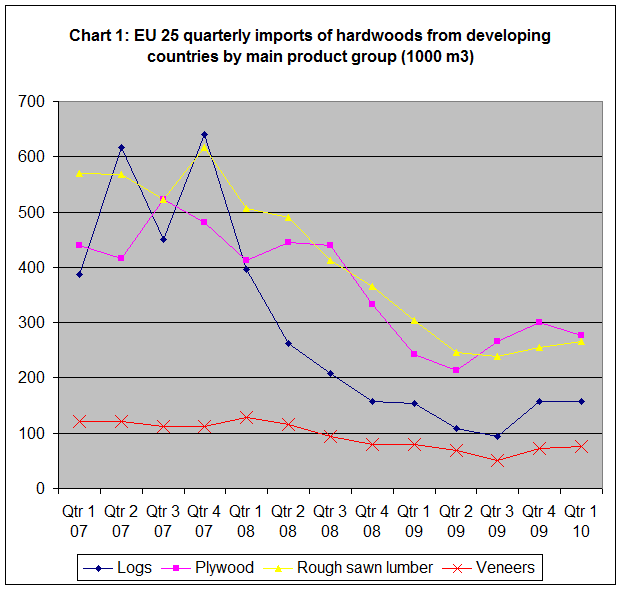

The continuing weak hardwood import performance in the first quarter of 2010 is all the more disappointing because it seems to confirm that the apparent upturn in European buying in the last quarter of 2009 was not a response to any real improvement in European consumption. Rather, as many suspected, it seems to have been the result of short-term efforts by importers to fill gaps in heavily depleted stocks at a time when CIF prices seemed set to rise. Chart 1 shows that European imports of hardwood sawn lumber, logs and veneers from LDCs made very little ground in the first quarter of 2010 compared to the last quarter of 2009. Imports of hardwood plywood from these countries actually showed a quarter-on-quarter decline.

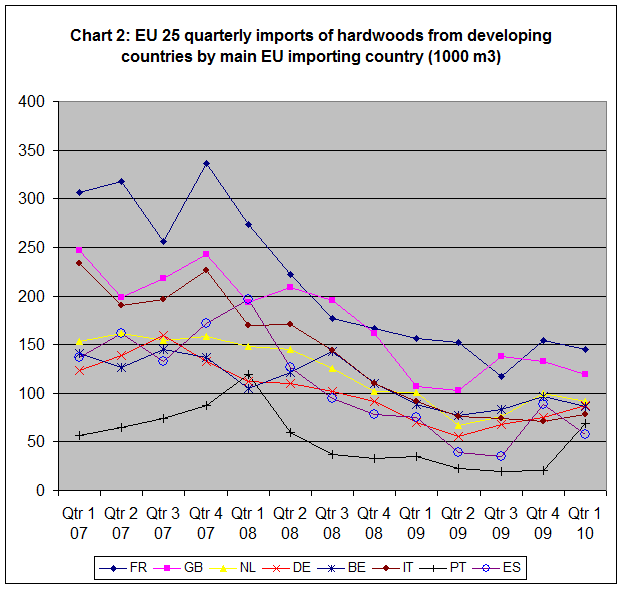

Chart 2 shows that imports of LDC hardwood products by France, the UK, Netherlands, and Belgium were slightly weaker in the first quarter of 2010 compared to the last quarter of 2009. The best that can be said for Italy’s imports is that they appear, at last, to have hit bottom in the final quarter of 2009 and showed some slight signs of upward movement in the first quarter of 2010. Of all large European buying countries, only Germany seems to be showing signs of a sustained increase in imports of LDC hardwood products. This is in line with GDP data which indicates that the economy in Germany is bouncing back more vigorously than in other European countries.

The rather volatile data for Spain and Portugal shown in Chart 2 needs careful interpretation because it is strongly influenced by eucalyptus log imports from South America. Spain experienced a spike in these imports in the last quarter of 2009 while Portugal experienced a similar spike in the first quarter of 2010. If the eucalyptus numbers are removed, the data suggests that Spain’s imports of hardwoods from LDCs improved slowly in the first quarter of 2010 while Portugal’s imports continued to flat-line.

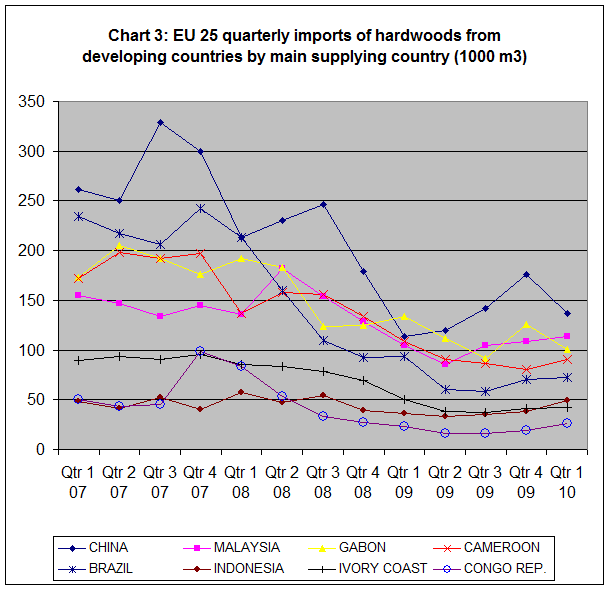

Chart 3 shows that the first quarter of 2010 saw a significant reversal in EU imports of hardwood products from China (mainly plywood). Increased arrivals of Chinese plywood at the end of 2009 met with stagnant demand in the European construction sector so that importers greatly curtailed imports during the opening months of 2010.

Chart 3 also shows that European (mainly French) imports of hardwood products from Gabon spiked in the last quarter of 2009. This was due to a rise in log imports in anticipation of Gabon’s log export ban from January 2010. Although implementation of the ban was subsequently delayed until May, the statistics suggest that most European buyers completed their efforts to stock up on Gabon logs at the end of 2009 and that imports were already falling away again in the first quarter of 2010. Chart 3 indicates that the first three months of 2010 saw some minor quarter-on-quarter increases in European imports of hardwood products from Malaysia, Cameroon and Indonesia. However imports from Brazil and Ivory Coast remained static at low levels.

PDF of this article:

Copyright ITTO 2020 – All rights reserved