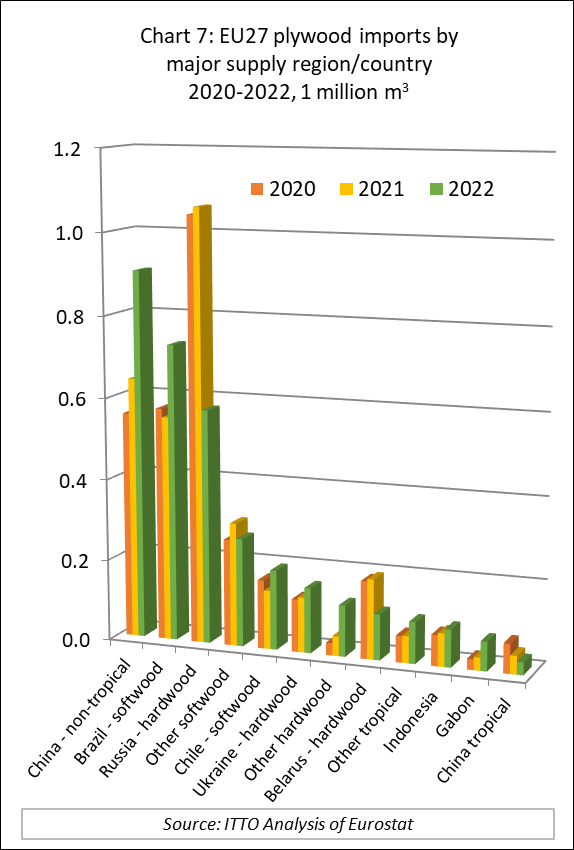

In 2021, logistical problems on the supply side in tropical countries during the COVID pandemic seemed to accelerate the long term trend away from tropical timber products in the EU27 market. The share of tropical products in the total value of EU27 imports of wood and wood furniture fell from 20% in 2020 to just 17% in 2021. However, last year the situation was transformed as tropical products recorded the largest increase in share for at least the last 15 years, rebounding to 21% of the total value of EU27 imports of wood and wood furniture (Chart 1).

The recovery in the value and share of tropical wood products trade with the EU in 2022 was driven both by normalisation of supply chains and falling freight rates after the severe disruption of pandemic, together with a sharp fall in available supply from Russia and Belarus during the year.

In 2021, the EU27 imported wood and wood furniture with a total value of USD4.95 billion from Russia and Belarus, nearly one quarter of total import value of these products. However this fell to just USD2.24 billion in 2022. The EU first imposed trade sanctions on Belarus timber products on 2 March 2022. These were extended to Russian timber products on 8 April 2022. On 10 March 2022, Russia’s Industry and Trade Ministry announced a ban on all wood and timber-related exports to “unfriendly countries”, including the EU, UK and US.

Both leading certification organisations, the PEFC and FSC, announced in March 2022 that all timber originating from Russia and Belarus would be categorised as ‘conflict timber’ (i.e. from a controversial source) and not eligible to be sold and promoted as PEFC- or FSC-certified. This had a significant impact on many European companies which had become heavily dependent on Russia and Belarus for their supplies of certified wood. Of total FSC global forest area of 237 million hectares at the start of last year, 63 million hectares (27%) was in Russia and 15 million hectares (6%) in Belarus. Of PEFC certified area worldwide of 328 million hectares at the start of last year, 32 million hectares (10%) was in Russia and 9 million hectares (3%) in Belarus. At the start of 2023, PEFC reported no certified forest in either Russia or Belarus. FSC is currently reporting zero certified forest area in Belarus but 39.5 million hectares in Russia despite the ‘conflict timber’ categorisation.

EU27 trade data indicates that these measures took time to take effect, with timber products continuing to be imported in significant volumes from both Russia and Belarus until July 2022. However EU27 imports from both countries fell to close to zero in the last five months of the year.

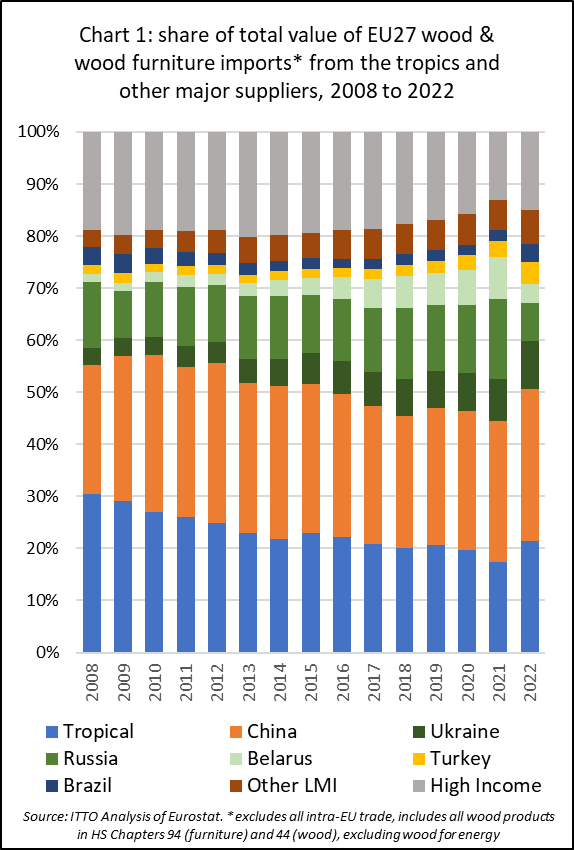

In value terms, tropical products were significant beneficiaries of the sharp fall in EU27 imports of wood products from Russia and Belarus during 2022. Whereas total EU27 imports of wood and wood furniture fell 4% from USD21.2 billion in 2021 to USD20.4 billion in 2022, imports of tropical products increased 18% from USD3.7 billion to USD4.4 billion during the same period. EU27 import value of wood and wood furniture from China increased only 4% to USD6.0 billion in 2022, although this did build on a massive 42% gain the previous year. Import value from Ukraine also increased by 9% to USD1.9 billion in 2022, despite the serious disruption due to the war, following a 55% gain the previous year. Other significant beneficiaries were Turkey, for which EU27 import value increased 32% to USD890 million last year, and non-tropical products from Brazil which recorded a 54% increase to USD 690 million in 2022 (Chart 2).

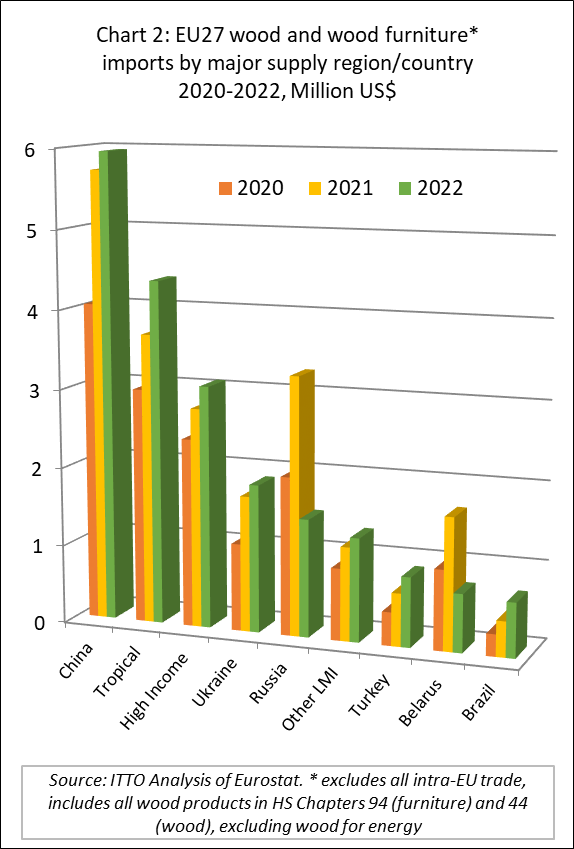

EU27 import value from the tropics increased across all wood product groups last year including furniture (+10% to USD1.73 billion), sawnwood (+22% to USD904 million), mouldings/decking (+21% to USD396 million), joinery (+27% to USD286 million), plywood (+52% to USD254 million), veneer (+13% to USD234 million), marquetry/ornaments (+55% to USD127 million), flooring (+45% to USD89 million), and logs (+10% to USD65 million) (Chart 3).

EU imports of tropical sawnwood exceed 1 million m3 for first time since 2016

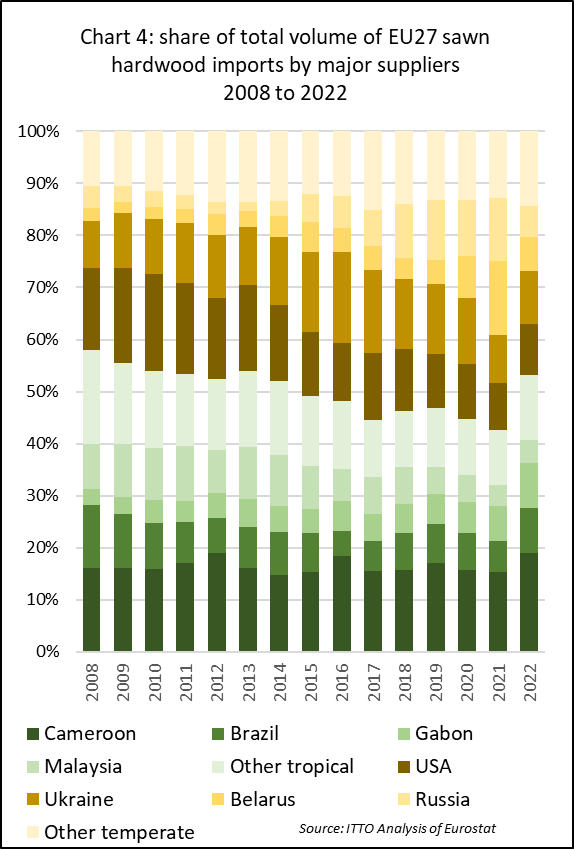

In volume terms, tropical sawn hardwood recorded a particularly large increase in share of total EU27 imports of sawn hardwood in 2022. EU27 imports of tropical sawnwood increased 18% to 1.01 million cubic meters during the year, exceeding one million cubic meters for the first time since 2016. In contrast, EU27 imports of temperate hardwoods fell 23% to 890,000 cubic meters in 2022. The share of tropical in total EU27 sawn hardwood imports jumped from 43% in 2021 to 53% in 2022, the highest share since 2013.

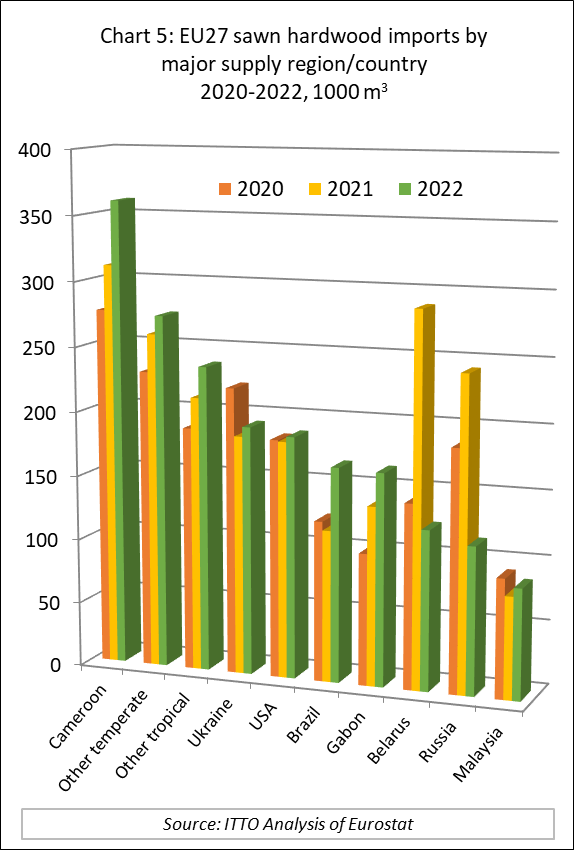

Tropical sawnwood was by far the largest beneficiary of the decline in share of Russian and Belarus sawn hardwood in 2022 as other suppliers of temperate hardwood made only minor gains. Imports from Ukraine increased just 4% to 192,000 cubic meters, while imports from the U.S. were up only 2% to 187,000 cubic meters. This compares to gains of 16% to 360,000 cubic meters from Cameroon, 42% to 166,000 cubic meters from Brazil, and 19% to 164,000 cubic meters from Gabon (Chart 5).

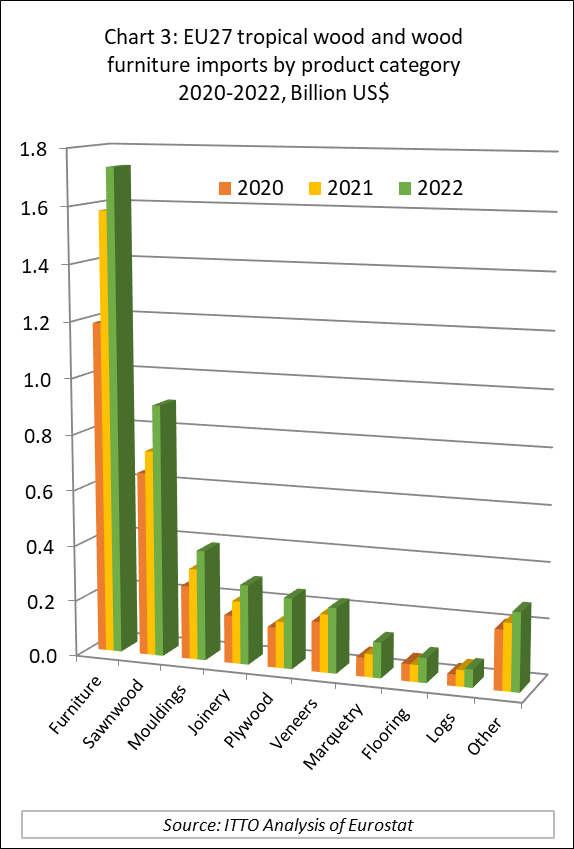

War in Ukraine has massive impact on EU27 plywood market

Russia’s invasion of Ukraine had a massive impact on the EU market for plywood in 2022. ITTO interviews with EU plywood importers during the year indicated a huge rush for products from the tropics where mills were encouraged to ramp up production as much as possible for the EU market. Tropical manufacturers were particularly encouraged to launch (or relaunch) production of thicker film-faced boards, mostly supplied to the EU by Russia in recent years.

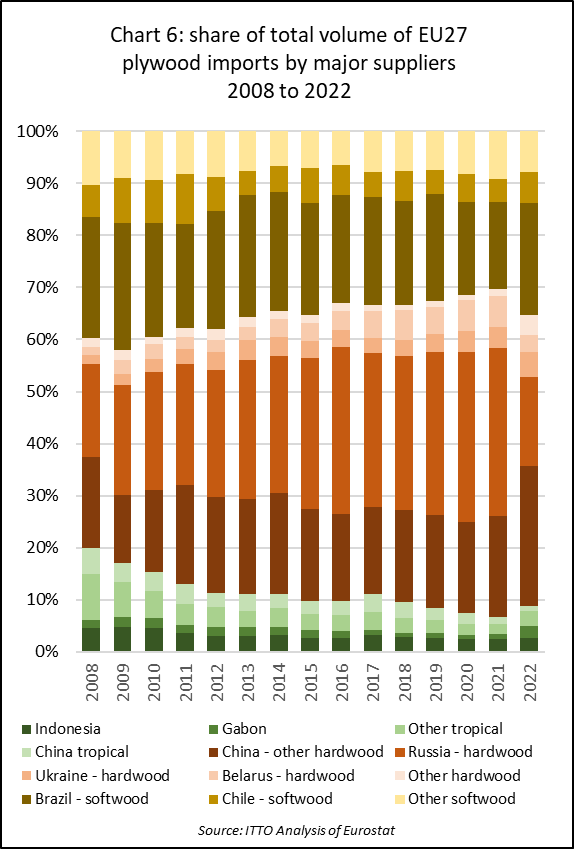

The share of tropical products in total EU27 plywood imports, which fell to an all-time low of just 7% in 2021, rebounded to 9% in 2022, close to the level prevailing in the decade before the pandemic (Chart 6).

Total direct imports of plywood from the tropics increased 48% to 266,000 cubic meters in 2022, with imports from Indonesia up 13% to 92,000 cubic meters and from Gabon up 124% to 72,000 cubic meters. Imports of tropical hardwood plywood from China decreased 32% to 31,000 cubic meters.

In contrast to the decline in EU27 imports of tropical hardwood plywood from China, imports of non-tropical hardwood plywood from the country surged 41% to 906,000 cubic meters. Other plywood products making significant gains in the EU27 market in 2022 were softwood plywood from Brazil (+32% to 730,000 cubic meters) and Chile (+35% to 196,000 cubic meters), and hardwood plywood from Ukraine (+18% to 160,000 cubic meters) (Chart 7).