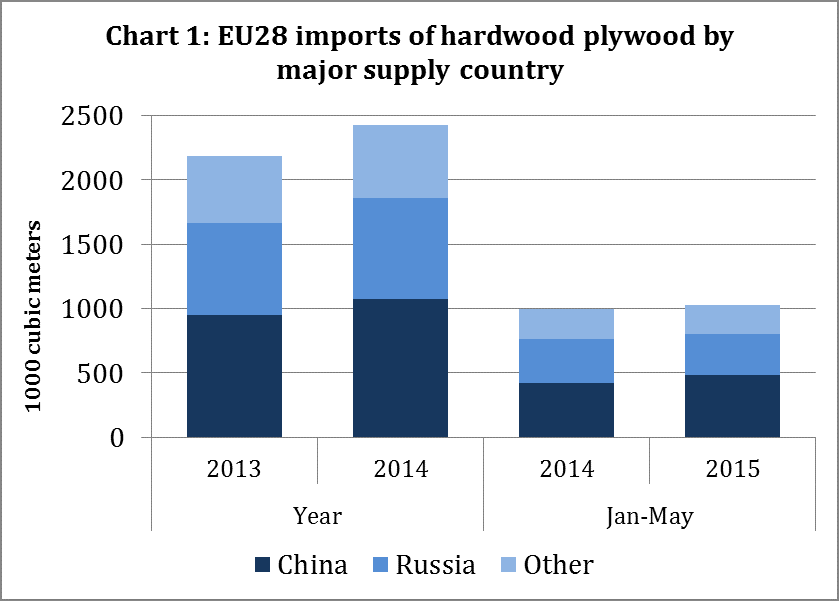

EU imports of hardwood plywood were 103.1 million m3 in the first five months of this year, 3.3% more than in the same period of 2014. However, import growth has slowed in 2015 compared to the 11.1% increase registered for 2014 as a whole, (Chart 1).

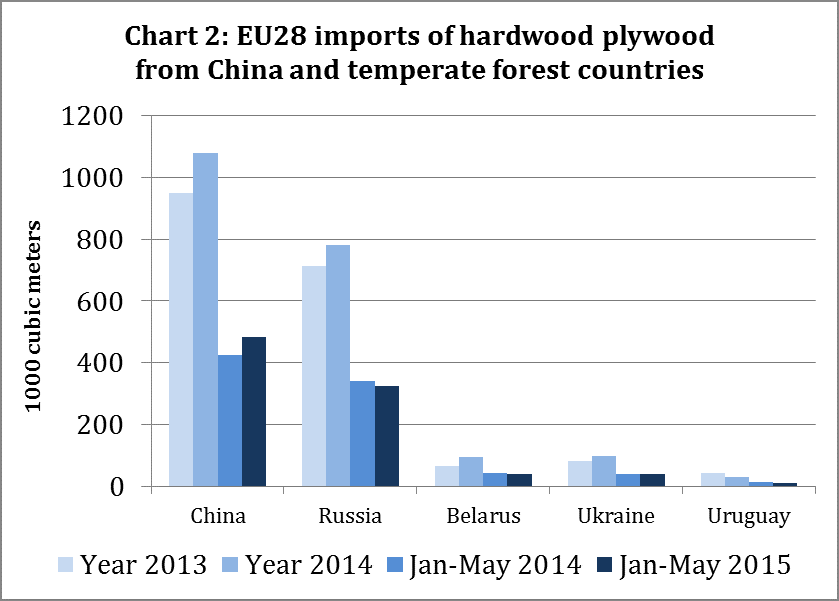

The increase in EU hardwood plywood imports between January and May this year was due almost entirely to higher deliveries of mixed light hardwood (MLH) plywood from China. Hardwood plywood imports from China – now dominated by MLH products – increased 13.6% to 482,400 m3 in the first five months of 2015. In contrast, imports of temperate hardwood plywood from Russia (-5.3% to 323,200 m3), Belarus (-5.3% to 39,500 m3), and the Ukraine (-5.3% to 39,300 m3) all declined in the first five months of 2015 after rising in 2015. Deliveries from Uruguay declined again in the first 5 months of 2015 (-17.5% to 10,900 m3) continuing the sharp downward trend registered in 2014 (Chart 2).

Chinese hardwood plywood performing well in UK and Benelux region

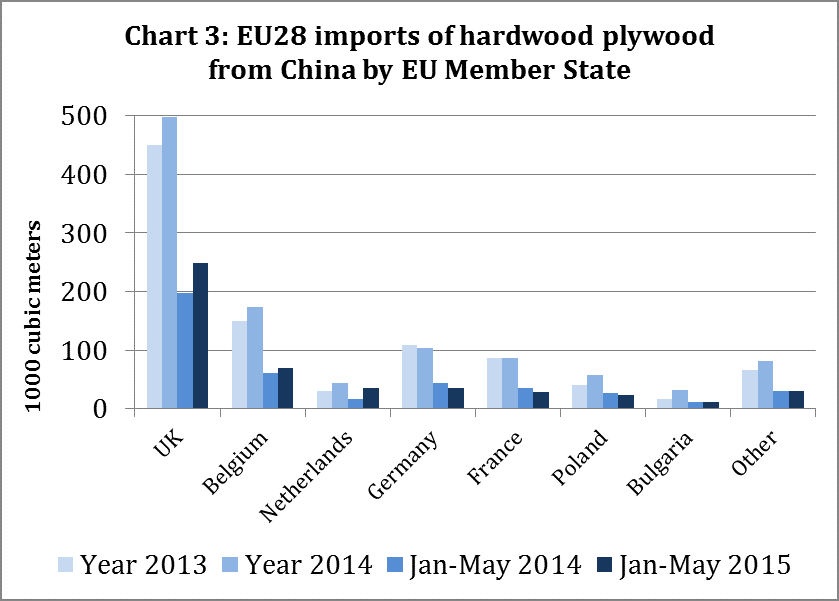

Continued growth in Chinese hardwood plywood deliveries to Europe in 2015 is almost entirely due to three countries: the UK, Belgium and the Netherlands (Chart 3). The UK remains China’s most important European market. UK imports jumped 25.6% to 247,900m3 in the first five months of this year, after a 10.7% increase in 2014 as a whole. Roughly half of all China’s hardwood plywood deliveries to the EU market are now destined for the UK (Chart 3).

The recovery in Chinese hardwood plywood imports observed in Belgium and the Netherlands in 2014 has continued into 2015. Imports into the Netherlands increased 105% to 36000 m3 in the first five months of this year. During the same period imports into Belgium increased 14% to 69,900 m3. In contrast, Chinese hardwood plywood imports into France fell 20.8% to 28,500 m3 between January and May 2015, while those to Poland declined 13.4% to 23,500 m3.

German customs dispute disrupts Chinese plywood trade

German imports of hardwood plywood from China continue to be affected by a dispute between the German trade and customs officials. In the last three years, customs officials, particularly at the port of Bremerhaven, have been checking Chinese plywood to ensure that boards are cross-laminated rather than laid parallel to each other. According to German customs, boards should be reclassified as LVL if not fully cross-laminated. This is frequently the case with lower-quality Chinese plywood manufactured using small veneer pieces for the cores. LVL incurs a higher rate of duty of 10% compared to 7% for plywood. According to EUWID, roughly 40% of Chinese hardwood plywood deliveries into Germany were reclassified in this way in 2012.

German import merchants and the timber trade federation GD Holz have held talks with German customs to try to more clearly define which products should be considered plywood and which LVL. According to GD Holz, these talks have been unproductive so far and customs continue to reclassify Chinese plywood. Several German importers have now filed lawsuits and results are still pending. At the same time, GD Holz report that since 2014, several importers have been reimbursed for some instances of excessive duty paid. However, customs has not revealed why reimbursements were offered in some cases but not in others.

The uncertainty created by the dispute in Germany may partly explain the recent rise in imports of Chinese hardwood plywood into ports in Belgium and Netherlands. German buyers may be avoiding excess duty by buying from stocks landed in these neighbouring European countries.

The reclassification process has led to inconsistencies in the statistical data on German hardwood plywood imports. Data derived from Eurostat (used in Chart 3) indicates that German imports fell by 18.3% to 34,700 m3 in the first five months of 2015. This followed a decline of 5.5% to 103,000 m3 for the whole year 2014.

However, the Eurostat data deviates from figures published by the German Federal Statistical Office (Destatis) which indicate a 62% increase in German hardwood plywood imports from China in the first quarter of 2015. On enquiry, Destatis note that they have adjusted their data downwards for 2014 to take account of plywood reclassified as LVL. However Destatis have not yet made the same adjustment to the 2015 data. As a result, Destatis data on deliveries to Germany appear to surge this year. Overall, once all adjustments are made, Destatis reckon German imports of Chinese hardwood plywood in the first five months of 2015 were probably around the same as last year.

Chinese plywood readily available

European importers report that Chinese plywood has been readily available during 2015 and that delivery times to Europe currently stand at around 4 to 5 weeks. The dominant issue for traders in the Eurozone is the rising cost of imports, especially since December 2014, due to the dramatic loss in value of the euro against the US dollar. Against this background, Chinese producers lowered their prices by an average of US$5-10/m3 earlier this year. FOB prices have now stabilised at this new level.

However, CIF prices for delivery of Chinese plywood to Europe have continued to fall due to an unexpected slump in freight rates in March/April after a slowdown in China’s overall trade. According to information from importers, freight costs per 40ft container from China to Central Europe temporarily fell to less than US$500, before stabilising at around US$700 in July. By contrast, rates in July 2014 stood at more than US$1200 per 40ft container. Shipping companies are currently pushing to increase prices to more than US$1000 per container for shipments in August.

Mixed fortunes for Russian hardwood plywood

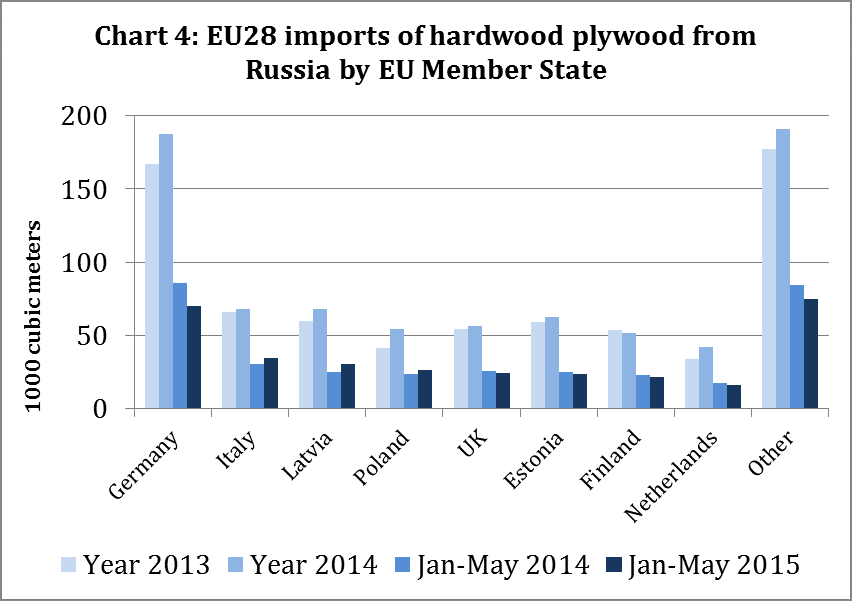

Russian hardwood plywood deliveries to the EU totalled 323,198m3 in the first five months of this year, down 5.3% compared to 341,328m3 in the same period of 2014. Deliveries to Germany, the largest single market, declined 18% to 70,320m3 (Chart 4). German imports fell particularly sharply in the first quarter due to stock build up at the end of 2014 when several companies ordered extra volumes to fulfil their purchasing quotas and receive related bonuses. However German consumption has remained stable and imports recovered a little in the second quarter.

In the first five months of 2015, Italy (+14.7%), Latvia (+22.7%), and Poland (+10.7%) all imported more plywood than in the same period in 2014. In contrast, deliveries to the UK (-4.9%), Estonia (-5.4%), Finland (5.5%) and the Netherlands (-9.8%) were all lower than one year ago.

European importers report that availability of Russian birch plywood has been good this year. There were widespread reports of overstocking at Russian mills earlier in the year. However the supply situation is gradually becoming better balanced as some smaller producers have reduced production and demand has picked up in export markets. This has been boosted by price concessions of up to 20% granted by Russian producers and the sharp loss in value of the rouble against the euro. Prices are now beginning firm again, according to importers.

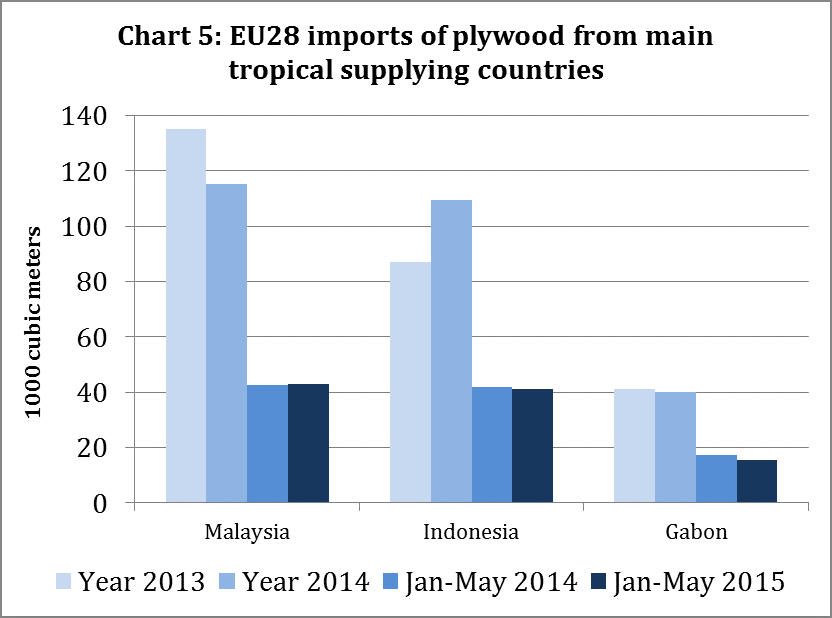

Imports from Malaysia stabilise while Indonesian boom comes to an end

After a significant shift away from Malaysian plywood in favour of Indonesian and Chinese product in 2015, EU imports of plywood from tropical countries have stabilised this year (Chart 5).

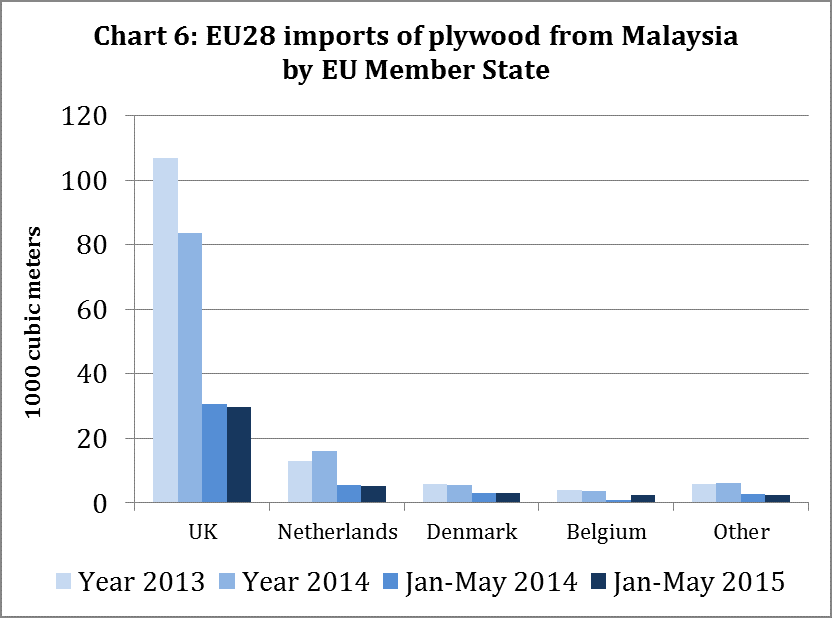

European imports of Malaysian plywood declined 14.8% to 115,300 m3 in 2015. Some of this decline was explained by relatively low purchases at the beginning of the year. Malaysia lost its GSP status on 1 January 2014 and European importers had built up stocks of plywood imported at preferential taxes in advance.

European importers also note that Malaysian producers lost market share to China. Although Chinese plywood products are, on average, considered lower quality than Malaysian products, prices are considerably lower. At the same time, European importers note that good quality, controlled and certified product ranges – for example BM Trada Q-Mark – can now be obtained in China at roughly the same price as Malaysian standard plywood. This type of material has also gained market share from Malaysian products.

Total Malaysian plywood deliveries to Europe in the first five months of 2015 were 43,000m3, very similar to the same period in 2014. However, there was a shift in the destination of product, with a rise in shipments to Belgium offsetting a slight decline in deliveries to the UK, Netherlands, Denmark and other countries (Chart 6).

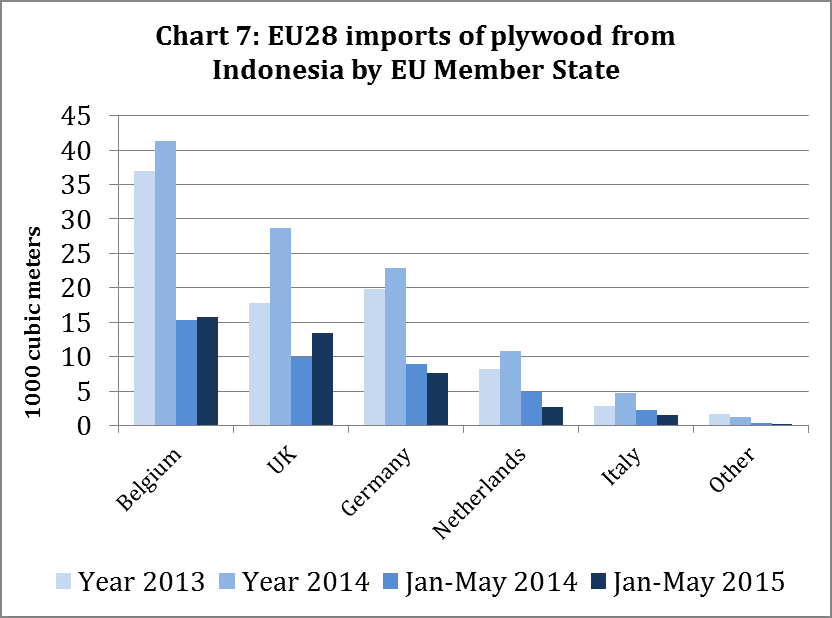

EU plywood imports from Indonesia increased 25.7% to 109,700 m3 in 2014. Imports were 41,200 m3 in the first five months of 2015, only 1.7% below the higher level achieved in the same period last year. However, as for Malaysian plywood, there has been a shift in the direction of European trade in Indonesian plywood this year.

Deliveries of Indonesian plywood to Belgium and the UK, the two largest European markets for this commodity, have continued to grow in 2015, but less rapidly than in 2014. There has also been a pronounced slow-down in deliveries to the Netherlands in 2015. Deliveries to this market rose 31.5% in 2014 but fell back by 46.2% in the first five months of this year. A similar trend is seen in Germany, where imports of Indonesian plywood increased 15.5% in 2014 but fell 15.7% between January and May of this year (Chart 7).

European importers note that Indonesian and Malaysian plywood have been at a disadvantage compared to Russian material in the Eurozone this year, as the US dollar has strengthened against the euro while the rouble has weakened considerably. While Russian producers have been able to reduce their euro-denominated sales prices, prices for South-East Asian plywood, which is traded in US dollars, have increased for buyers in the Eurozone. This development has been particularly significant for thicker panels of 12mm, 15mm, 18mm or 21 mm. European demand for thinner Asian hardwood panels (4mm and 8mm) has been less affected by the trend according to importers.

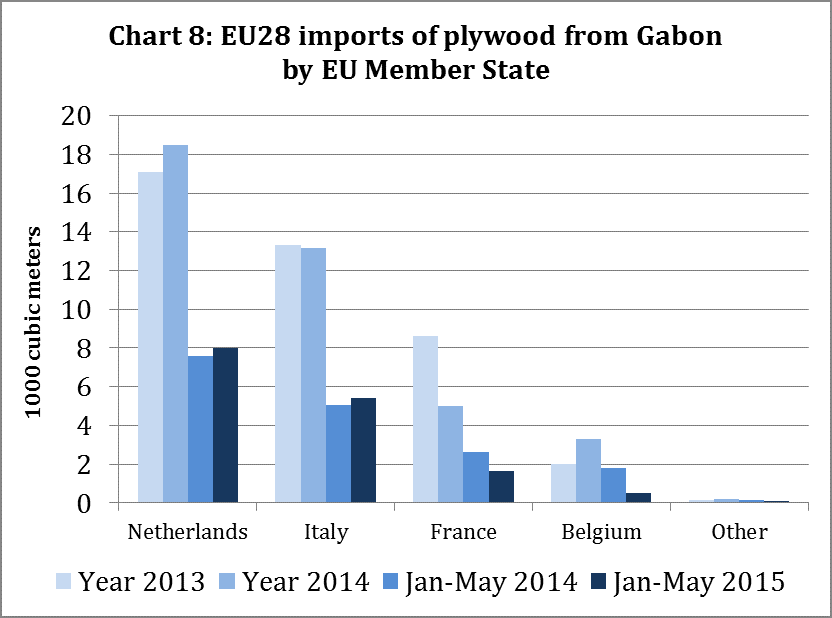

European demand for okoumé plywood remains low

In 2015, European imports of okoumé plywood from Gabon have declined further from the low levels recorded in 2014. European imports of Gabonese plywood declined 8.9% to 15,700 (17,200) m3 in the first five months of 2015, following a 2.6% fall to 40,200 m3 in 2014.

Although there has been some small recovery in the main Dutch and Italian markets for okoume plywood in 2015, this has been offset by a decline in sales to France and Belgium (Chart 8).

The French company Rougier, which operates plywood and veneer mills in Gabon, attributed its 3% lower plywood sales in the first quarter of 2015 to the continuing “unfavourable environment in European markets”, according to the financial report.

Opportunities for Chinese producers to engage in Europe’s okoume plywood market may open up again in 2016. Since 2 February 2011, four Chinese plywood manufacturers have been subject to anti-dumping duties of between 6.5% and 23.5% on their exports of okoume plywood to the EU, while all other producers have been subject to 66.7% duty.

In a notice issued on 14 May 2015, the EU announced that these anti-dumping measures would be lifted at midnight on 3 February 2016. This is according to the schedule of 5 years after the date of the original ruling in 2011. However EU producers may yet appeal against the lifting of the duties. They have until 2 November 2015 to lodge a written request for review. According to the EU, this request must “contain sufficient evidence that the expiry of the measures would be likely to result in a continuation or recurrence of dumping and injury”. The notice is available at:

http://trade.ec.europa.eu/doclib/docs/2015/may/tradoc_153444.imp-exp.en.C161-2015.pdf

New Chilean softwood plywood capacity reaches Europe

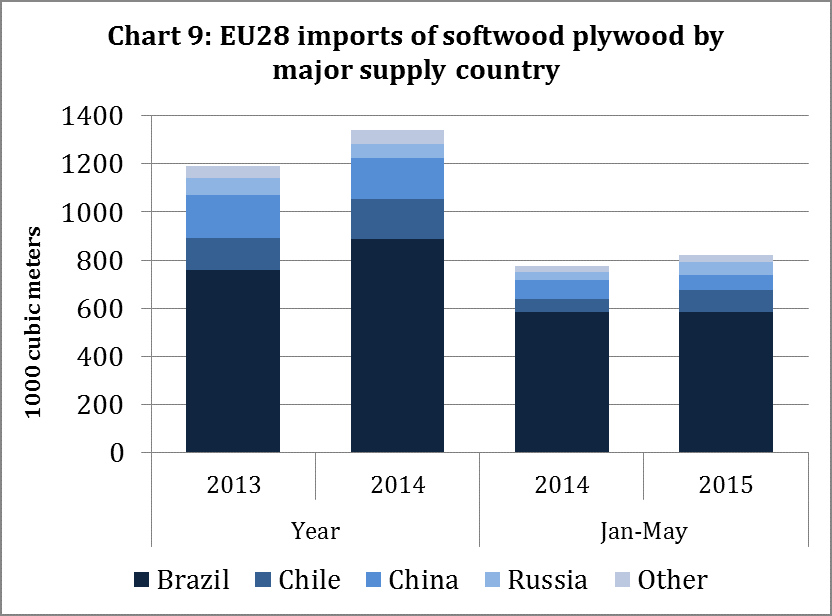

EU softwood plywood imports during 2014 increased 12.5% to 777,400 m3 in 2014. Growth in imports has continued this year, although at a slower rate. In the first five months of 2015, imports increased 5.9% to 823,100 m3, mainly due to higher imports from Chile and Russia. European imports of softwood plywood from Brazil, still by far the largest supplier, were stable at 584,600 m3 (Chart 9).

In Chile, the two largest plywood producers Paneles Arauco and Empresas CMPC both brought additional production capacity online in 2014. The extra volume now available is reflected in a 62.1% increase in EU softwood plywood imports from Chile in the first five months of 2015. Arauco reports higher production and stable prices for its plywood products in the company’s financial report for the first quarter of 2015. CMPC says its plywood production increased by 70% in the first quarter, thanks to better utilisation of its new production line.

For Brazilian plywood, European importers are reporting exchange rate and demand-related uncertainty. Elliotis pine plywood is typically traded in US dollars with the result that weakening of the euro-dollar rate made the Brazilian product more expensive for European buyers in the early months of 2015. However this is now being offset by reductions in FOB prices and a further decline in freight rates this year. The loss in value of the Brazilian real against the US dollar has given producers some space to reduce dollar prices in recent months. As a result, importers say that elliotis pine plywood – after import tax – has recently been cheaper than plywood ordered as a part of the duty-free quota earlier in 2015.

Availability is currently not a problem in the softwood plywood trade. On the contrary, European importers report that stocks of elliotis pine plywood are still high in several EU countries. Stocks are also reported to be readily available from Brazil as both the domestic and some export markets have slowed in 2015.

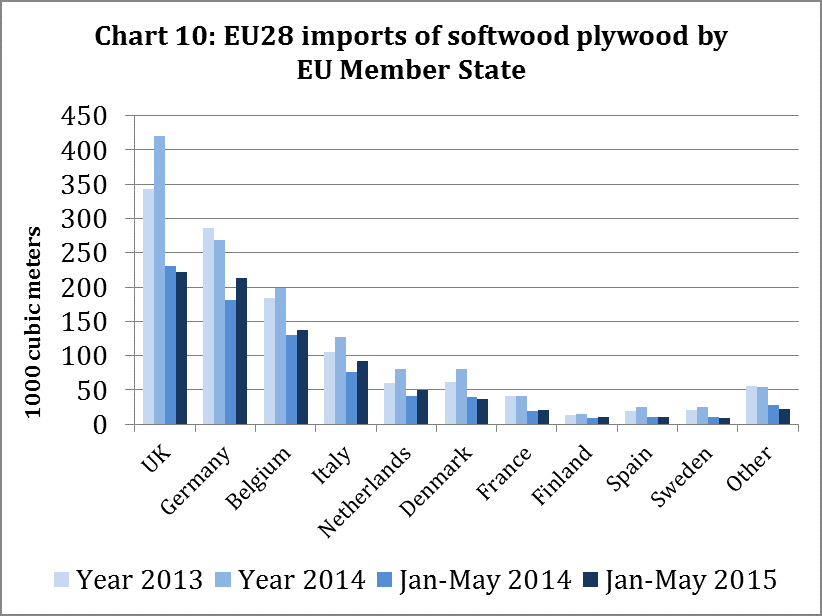

UK weaker, but Germany rebounds

Within Europe much of last year’s growth in softwood plywood imports was due to the strengthening UK market, which imported a total of 420,700 m3, 22.5% more than in 2013. This trend reversed in the first five months of 2015, as UK imports fell 4.1% to 221,800m3. In contrast, imports into Germany, the second largest European market, increased 18% to 213,300m3 during the same period. Imports of softwood plywood also increased into Belgium (+6.1%), Italy (+21,2%) and the Netherlands (+19,7%) (Chart 10).

Prospects for the European markets still uncertain

While plywood importers are generally satisfied with the market situation in Central and Northern Europe in the first half of 2015, there is still uncertainty about the future. There is particular concern about the French market which has again disappointed in recent months. But other markets are also being slow to pick up momentum this year.

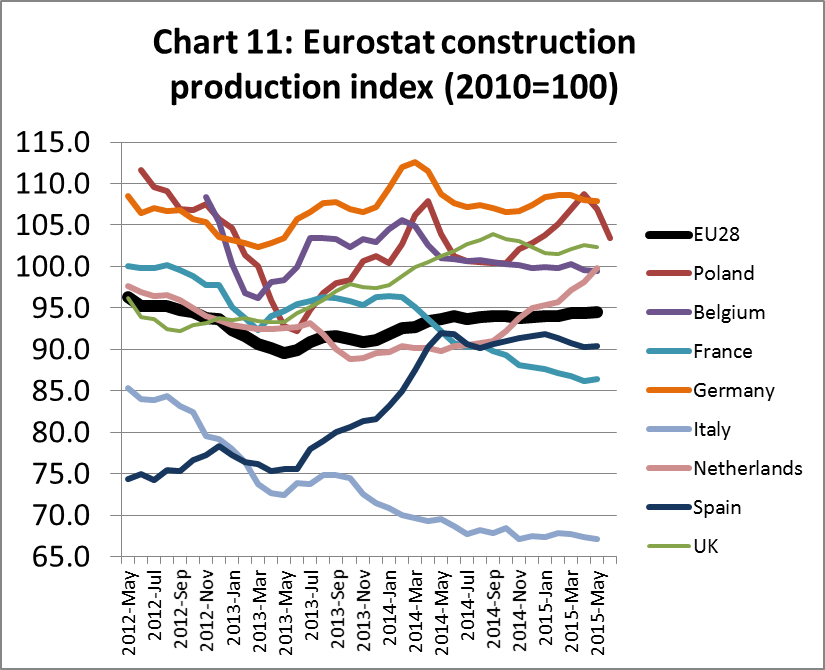

After a brief growth spurt in 2014, the Eurostat construction production index has largely stagnated –in some months even softened a little – from the level reached in June 2014. The index value in all large EU countries with the exception of Poland, Germany and the UK is still below 100 – in other words construction production is lower than in the base year 2010. The Netherlands is the only construction market to have made significant gains so far in 2015 (Chart 11).

Uncertainty in Europe’s plywood trade is also fed by exchange rate fluctuations – especially in relation to the euro against the background of severe economic problems in Greece. Container rates remain volatile. There are also continuing reports of slowing economic conditions in other major consuming countries, including China and Russia, raising the prospect that prices might weaken in the future. Taken together, these factors continue to discourage more far-reaching moves by European plywood importer to build stocks.

PDF of this article:

Copyright ITTO 2020 – All rights reserved