After a steep fall of more than 6% in 2014, the European Federation of the Parquet Industry (FEP) reports that European wood flooring consumption increased both in 2015 and in the first few months of 2016. In 2015, FEP observed “a stabilisation in parquet sales across Europe, with an upward tendency during the last months”. And in early 2016, FEP report market recovery across much of Europe.

Preliminary forecasts, which FEP announced during the Domotex flooring show in Hannover, Germany, suggest 0.5% growth in European wood flooring sales last year. Final figures will be released at the FEP’s annual General Assembly in Thun, Switzerland, in June.

Meanwhile a study by Interconnection Consulting is even more positive about recent trends in the European wood flooring market. The organisation estimates that wood flooring sales in the “top eleven European countries” increased 2.2% to 82,7 million m2 in 2015, according to a press release by Global Flooring Alliance. The Interconnection Consulting study forecasts continued growth of 2% per year until 2019. However, prices are not forecast to rise significantly due to competitive pressure from Eastern European and Asian manufacturers.

According to FEP, an encouraging sign in Europe’s wood flooring market in 2015 was rising momentum in Southern Europe, notably Spain, for the first time since the economic crises. There was also good performance in Sweden, Hungary, the Netherlands, Belgium, Poland and, to a lesser extent, France. The large German, Austrian and Swiss parquet markets were stable at a high level.

FEP reported further improvements in the first quarter of 2016. Austria, the Baltic States, France, Germany, the Netherlands and Poland all reported growth rates between 2% and 3% during the period. In Italy and Denmark, growth ranged between 1% and 2% and the Belgian market was stable.

However performance in the Nordic countries was relatively poor. The situation in Finland was described by FEP as “the most difficult in Europe”, with an estimated fall in wood flooring sales of 5-10% in the first quarter. Sales in Norway were down by around 4%.

A slight improvement in building figures was referenced as the main reason for the overall improvement in European wood flooring consumption. The refugee situation is not believed by FEP to have any impact on European wood flooring consumption, as less costly flooring solution would generally be utilised for equipping emergency housing.

FEP highlighted that the wood flooring sector still faces stiff competition from other materials. The main source of competition varies between countries. For example, the challenge comes particularly from luxury vinyl tiles (LVT) in Germany and from ceramic tiles in Italy.

According to FEP “it is becoming increasingly difficult for consumers to differentiate parquet from competitive flooring alternatives with a wood look surface.” Shortage of raw materials and price increases are mentioned as additional problems facing the European wood flooring sector.

Wooden planks and natural look in fashion

With regard to wood flooring types, FEP note that wooden planks continue to attract customers. A review of trends at the Domotex show notes that “floor boards with grooves, knot holes and irregularities and a country home look that seems to have just come from the saw mill are very much the rage“. The Domotex report identifies oiled instead of sealed surfaces as another trend.

Interconnection Consulting reports that multilayer parquet floors now account for 84% of the European wood flooring market by volume, the majority comprising three-layer parquet (roughly 70 % of total market volume). Solid wood flooring accounts for 14% of the market. Interconnection Consulting also notes “a trend for real wooden floors to become customised and exclusive.”

Declining wood flooring imports from China

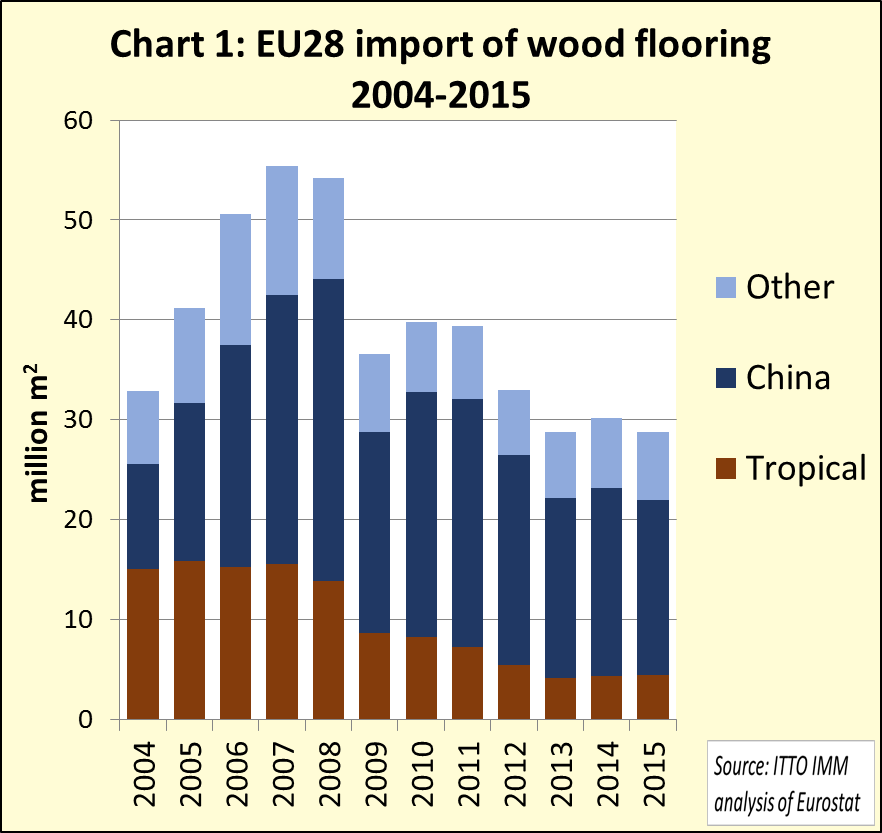

While consumption and sales of wood flooring manufactured in Europe improved in 2015, imports came under pressure last year. The 5% rise in imports recorded in 2014, after a lengthy period of weakness, proved to be short-lived. The EU imported 28.82 million m2 of wood flooring last year, 4.6% less than 2014 and only just exceeding the recessionary low in 2013. These figures compare to imports of nearly 40 million m2 in 2010 and a high of 55.40 million m2 in 2007 (Chart 1).

Wood flooring deliveries from China, by far the EU’s largest single external supplier, fell 7.4% to 17.50 million m2 in 2015, the lowest level since 2005. While China’s exports to the UK increased by 2% to 5.19 million m2, there was a significant decrease in China’s exports to Belgium (-4% to 2.90 million m2), Netherlands (-8% to 2.07 million m2), Italy (-21% to 1.96 million m2), Germany (-10% to 1.75 million m2), and France (-47% to 0.44 million m2).

Overall the signs are that Chinese flooring became less competitive in the EU market in 2015. This is probably due to a combination of factors notably the weakness of the euro and concerted efforts by domestic and other overseas manufacturers in South East Asia and Brazil to regain share of the European market. Tightening enforcement of the EU Timber Regulation, combined with publicity surrounding the Lumber Liquidators prosecution under the U.S. Lacey Act in relation to wood flooring from China may also have discouraged sourcing of Chinese product in 2015.

EU wood flooring imports from tropical countries rise 3%

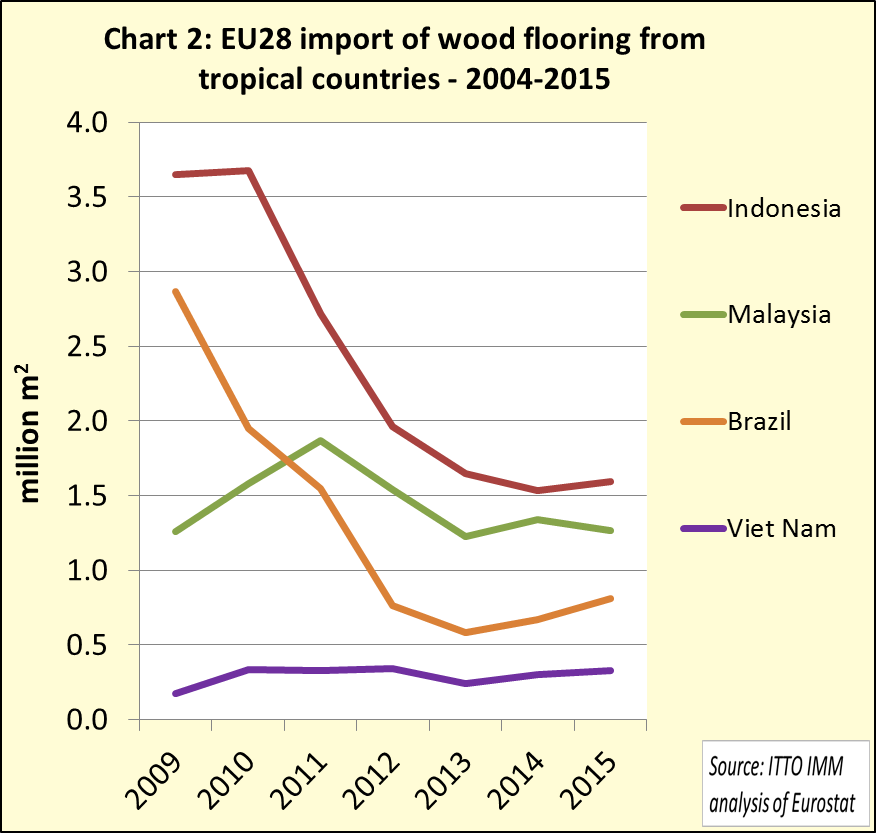

In contrast to EU imports from China, imports from tropical countries increased 3% to 4.46 million m2 in 2015. Indonesia remains the single largest tropical supplier of wood flooring to the EU. Although still low by historical standards, EU imports from Indonesia increased 4% to 1.59 million m2 in 2015. There was also a partial rebound in imports from Brazil (+21% to 0.81 million m2) and continued slow growth in imports from Vietnam (+9% to 0.33 million m2). However imports from Malaysia declined 5% to 1.27 million m2 (Chart 2).

A notable trend in 2015 was a significant switch in flooring imports by France away from China in favour of Brazil and Indonesia. However France’s increased imports from tropical countries was mirrored by a decline in imports into Belgium suggesting it might be partly due to changing distribution networks in continental Europe (Chart 3).

UK imports of wood flooring from tropical countries were flat during 2015, a rise from Indonesia and Malaysia being offset by a decline from Hong Kong and Vietnam. This may be explained by the more advanced state of legality verification systems in the former two countries as EUTR enforcement has been tightening in the UK.

Imports of wood flooring from tropical countries into Italy, formerly the largest EU market for this commodity, remained flat at a low level in 2015. Imports into Germany declined in 2015 after a brief recovery in 2015. German imports from Vietnam were particularly weak last year. However Sweden and Italy imported more from Vietnam in 2015.

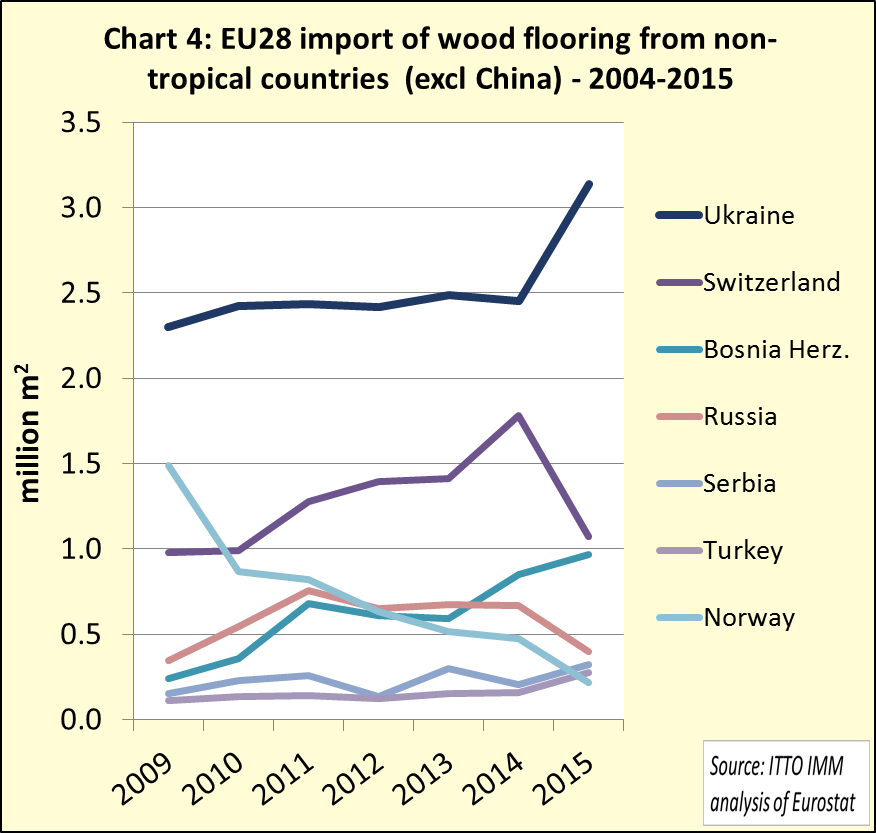

There was strong variation in EU imports from non-tropical countries in 2015 (Chart 4). Imports from Switzerland plummeted 40% to 1.1 million m2, probably due to the strong Swiss franc and related price increases for Swiss flooring in the Eurozone. Imports from Norway also dropped by 54% and those from Russia fell by 41%.

However EU wood flooring imports from Ukraine increased 28% to 3.1 million m2 which may be partly due to a new law that entered into force in Ukraine in November 2015 which added oak to the list of “rare and valuable” timber species for which controls are imposed on a wider range of secondary and tertiary processed products. This may have encouraged importers to purchase additional supplies of oak flooring before November 2015 to beat the extra controls now in place.

EU wood flooring imports from Bosnia-Herzegovina also increased sharply in 2015, by 13.5% to 1 million m2. Bosnia is attracting more investment in wood processing industries attracted by the countries close proximity to the EU market, relatively low labour costs for the European region, and proximity to forest resources which cover 55% of the country’s land area.

Dominant role of laminates in European flooring market

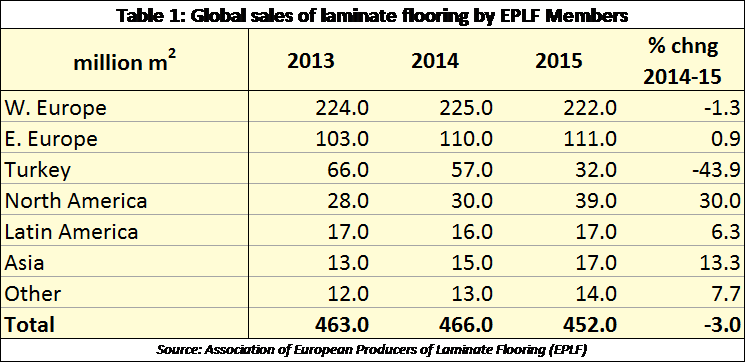

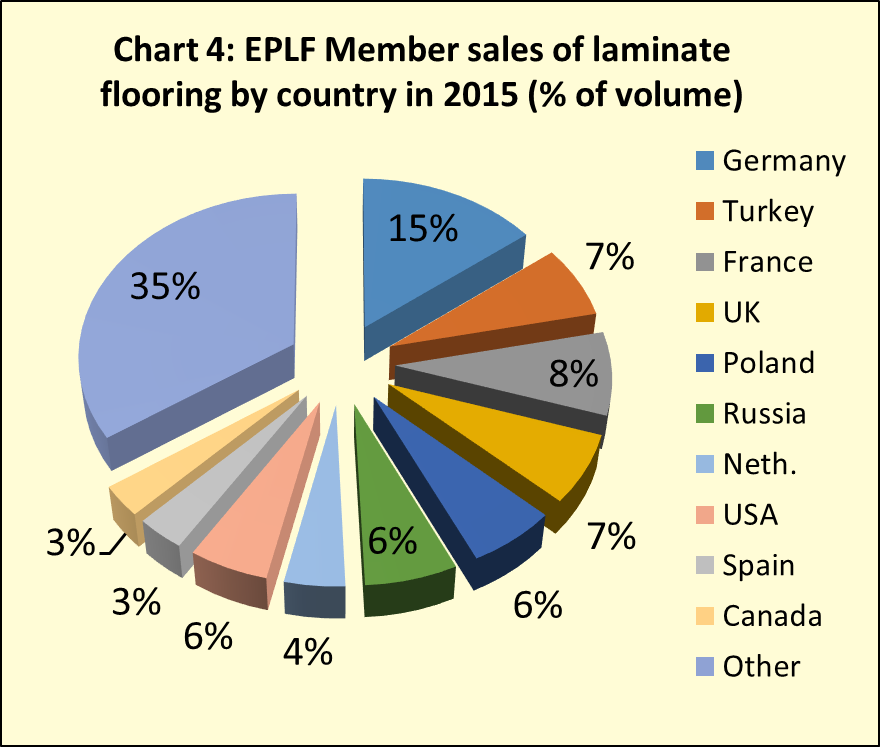

While the market for real wood flooring recovered some lost ground in 2015, data published by the European Producers of Laminate Flooring (EPLF) association highlight the scale of the challenge from laminate flooring. Members of the EPLF association sold 452 million m2 of laminate flooring last year, around 333 million m2 of which was in Europe, over four times the volume of real wood flooring consumption in the region.

Overall world-wide sales of EPLF members declined 3% in 2015. However the decline was almost all in Turkey due to one Turkish company leaving EPLF and anti-dumping proceedings by the Turkish Ministry of Economy against several German flooring manufacturers which ran until the summer of 2015 (Table 1).

A slight decline in laminate flooring sales in Western Europe was offset by a rise in Eastern Europe in 2015. European flooring manufacturers were also increasing sales in North and South America and Asia last year. This is due both to the weak euro and an export market development strategy centred on higher-end quality products and adherence to European technical and environmental standards.

The single biggest market for laminate flooring sold by EPLF members is Germany, which alone accounted for 66 million m2 in 2015, a fall of 4.3% compared to 2014 (Chart 4). Like solid wood flooring, laminate flooring is also under pressure in Germany from substitute products, especially LVL.

Laminate flooring sales in France, the second largest market, declined 5.1% to 37 million m2 in 2015. The positive trend in the UK recorded in 2014 also ended last year, with sales falling 3.1% to 31 million m2 despite continuing growth in the construction market. In contrast, recovery in the Netherlands and Spain is reflected in laminate flooring sales figures. Sales in the Netherlands increased 11.8% to 19 million m2 and sales in Spain were up 4.8% at 15.3 million m2.

EPLF member sales in Russia, the largest Eastern European market for laminate flooring, increased 2% to 29 million m2 in 2015, despite economic difficulties. Sales in Poland increased 7% to 28 million m2 and Bulgarian sales jumped 25% to 5 million m2 during the year. Romania and Hungary were stable compared to 2014, accounting for sales of 11 million m2 and 6 million m2 respectively in 2015. However sales to Ukraine fell 38% to 5 million m2 last year.

Germany accused of restricting trade in construction products

According to EPLF, the German Institute for Building Technology (DIBt) is considering introduction of special rules for building products that go well beyond the CE mark requirements for compliance with the European Construction Products Regulation and which would effectively “seal off the German construction products market from the EU single market”.

According to the EPLF, the approach now being considered may be in breach of a decision taken by the European Court of Justice in October 2014 that Germany’s national requirements for building products created unnecessary barriers to free trade in the European free market and must be phased out. At the time of the Court’s decision “the only building products that could be used in Germany were those bearing an Ü mark complying with the DIBt’s own specifications, which were independent from European harmonisation”, according to EPLF.

Following the decision, DIBt has adopted a new approach to quality control which would evaluate whole buildings rather than individual construction products. A draft document to this effect was circulated among affected institutions and associations at the end of 2015 and comments were invited until 25 February 2016.

According to EPLF, which is very critical of this approach, the draft contains exhaustive requirements regarding components, emissions, and measurement procedures. These requirements include a mix of DIBt’s own stipulations for substances and the EU’s minimum emission requirements.

The draft has led to protests from industry both in Berlin and in Brussels. EPLF quotes lawyer Michael Halstenberg: “in my view, the draft is once again incompatible with European law. The DIBt doesn’t understand that setting building product requirements through an indirect road (through redefining them as “building requirements”) isn’t permitted either”.

EPLF believes that small and medium-sized companies would particularly struggle to tender for public construction projects in Germany in the future. However, the association concedes that other EU countries, such as France, Belgium, and Sweden, among others, have adopted a similar approach.

The draft has also been criticised by the German Multilayer Modular Flooring Association (MMFA) and the Association of the German Wood-based Panel Industry (VHI). The full EPLF press release can be found at: https://www.eplf.com/en/press/eplf-and-mmfa-surely-cannot-be-political-intention-german-working-draft-new-requirements .

German timber companies launch campaign against FSC

A group of 25 German forestry and timber companies headed by Eurobinia have published a letter calling for abolition of FSC certification in public forests and asking that FSC be dropped as a requirement in German public procurement policy. According to a report by the Global Timber Forum (GTF), the letter was sent through a lawyer and addressed to “responsible politicians”. A press release was also distributed to timber industry media.

According to the GTF, FSC Germany responded that the criticism was too far-fetched for the organisation to comment officially. The website also quotes German public procurement and certification specialist Ulrich Bick from Thünen-Institute as saying that he saw no occasion to change public procurement requirements – which currently require that timber be either FSC or PEFC certified. Ulrich Bick also suggested there is a broad consensus between German ministries to maintain the current system.

The full article and a related forum discussion can be found at http://bit.ly/1Uc5mFM and http://bit.ly/21ccmDC.

PDF of this article:

Copyright ITTO 2020 – All rights reserved