Severe winter weather across much of north western Europe made for a slow start to plywood business this year, keeping both traders and builders away from work. Although weather conditions improved later in January, few are expecting a significant upturn in business at least during the first half of the year. Even with clear indications that CIF prices for tropical hardwood plywood are now rising, there are reports of UK distributors off-loading stock at below replacement cost in the face of very slow consumption. This suggests that prospects for any significant increase in forward orders are limited, at least in the short term.

Significant rises in European CIF prices for tropical hardwood plywood are expected on the back of dramatic freight rate increases together with limited stocks in South East Asia and Brazil and efforts by producers to recoup higher raw material costs. While CIF prices for raw BB/CC Malaysian plywood sold into the European market are currently being quoted over a wide range, the general consensus is that UK importers will have to contend with price increases of around 10-20% between January and March 2010.

Only relatively small volumes of Brazilian and Indonesian tropical hardwood plywood are now being sold into the European market. Production capacity has fallen significantly in both countries and products are generally not price competitive against Malaysian plywood in the European market. In Brazil, a larger proportion of product is also now been diverted to the domestic market.

Prices for Chinese plywood are also been quoted over a wide range, although indications are that FOB prices are relatively stable while CIF Europe prices are rising due to the freight rate increase. Quality problems have led to a general switch away from imports of Chinese poplar core products in favour of products with a eucalypt core.

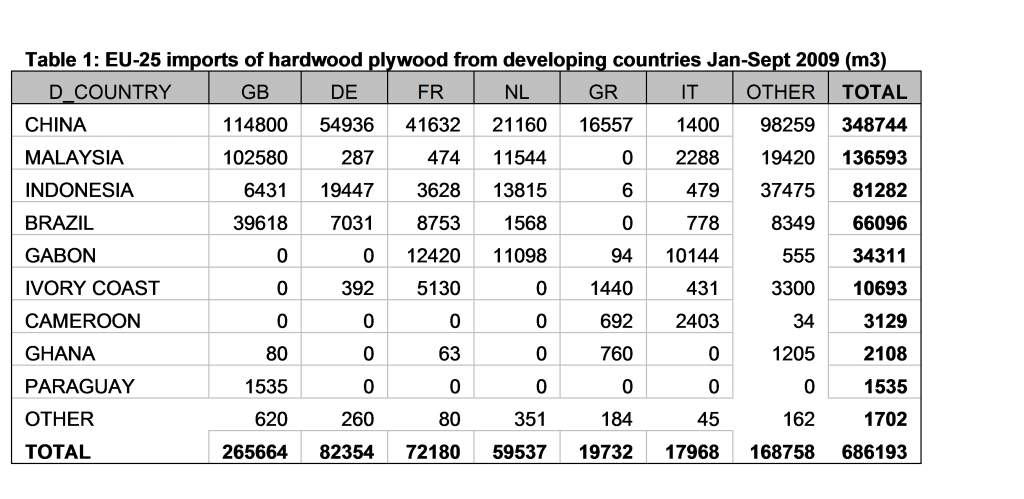

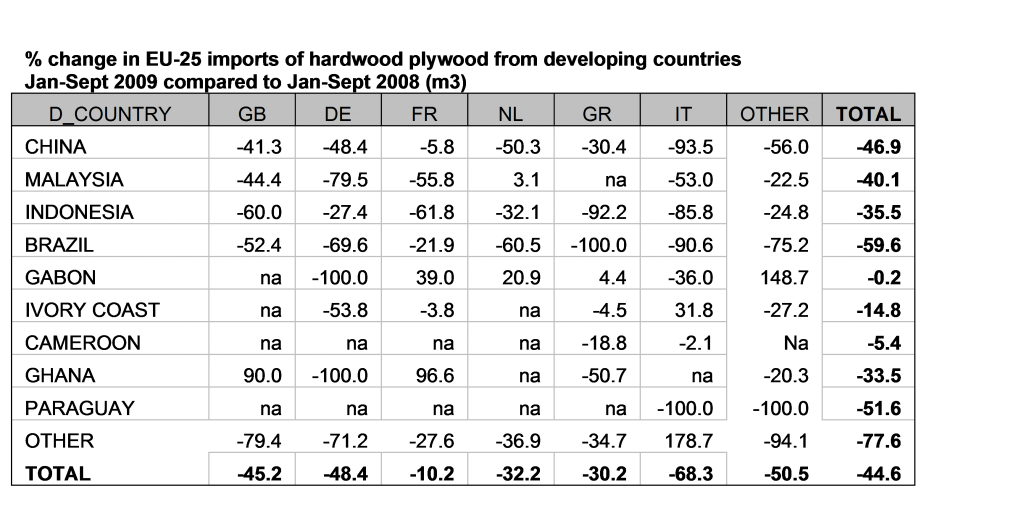

An indication of the dramatic decline in tropical hardwood plywood trade into the EU in recent times is provided by the latest Eurostat data to end September 2009 (see table 1). Overall EU imports of hardwood faced plywood from developing countries were down nearly 45% compared to the same period the previous year. All the major EU importing countries with the exception of France suffered very substantial declines. The fall in plywood imports into France was less dramatic only because of a significant shift in okoume plywood manufacturing capacity away from French territory into Gabon. European imports from all four of the leading suppliers of tropical hardwood-faced plywood declined dramatically during the 9 month period – although imports from Indonesia and Malaysia faired marginally better than imports from China and Brazil.

European veneer plants running at only 50% capacity

The German trade journal EUWID (www.euwid-wood-products.com) reports that the European veneer industry is currently facing major capacity utilisation problems. EUWID suggests that Central European veneer plants are running at no more than 50% to 70% of available capacity. Although this is largely due to weak veneer consumption, lack of supply of quality veneer logs is another contributing factor. Veneer mills are struggling to obtain appropriate raw material as harvesting levels throughout the world’s major hardwood producing regions have been curtailed in the face poor demand from the lumber sector. Levels of demand for the best quality veneer hardwood logs are currently in excess of the very low levels of supply.

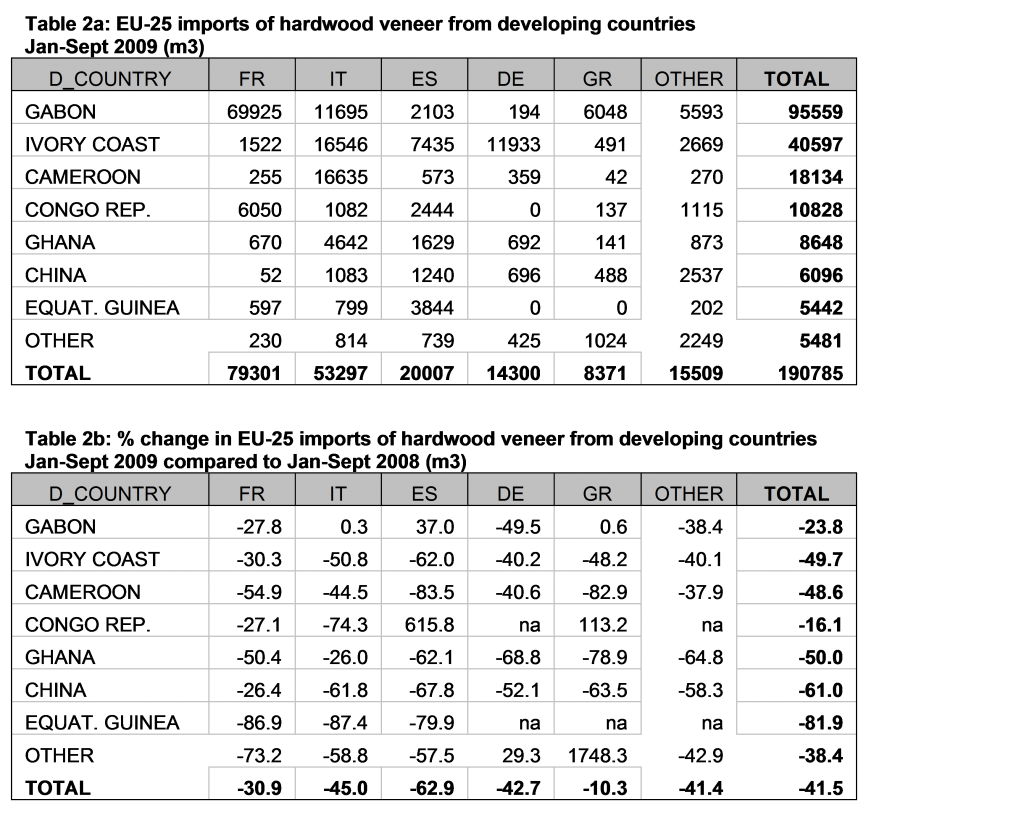

Latest Eurostat trade data to end September 2009 highlights that tropical hardwood veneer imports into all the major European markets also declined significantly last year (Table 2). The 62% fall in Spanish imports is particularly dramatic and is indicative of the huge downturn in Spain’s door sector when the property bubble burst. The data also indicates a noticeable shift in European sources of tropical hardwood veneer last year, with the Congo Republic and Gabon generally increasing share at the expense of Ivory Coast and Ghana. Interestingly China, despite a massive increase in veneer manufacturing capacity in recent years, has yet to make any real headway in supply of raw veneers to the EU.

European window market

A new European market analysis by the Association of Window and Facade Manufacturers (VFF) and the Institute of Marketing KIM Künzelsauer suggests that overall European demand for windows is likely to have fallen significantly in 2009, although the decline was not felt universally across the continent.

The VFF suggests that in France, Spain, the United Kingdom and Netherlands, market demand for windows declined sharply in 2009, following to downward trend in overall construction activity. However sales of windows in Germany increased by at least 2% in 2009 due to state funding and public commitment for energy-efficiency measures. Several other smaller markets also performed reasonably well in 2009, including Austria and Poland.

In their advance publicity for the report, VFF made available Europe-wide figures for window consumption in 2007 and 2008 (2009 forecasts are only available to those who purchase the report). Total market volume in the EU-27 Norway, Switzerland, Turkey, Russia and Ukraine reached around 158.9 million window units in 2007. This figure increased by 2.7 million units in 2008 to 161.6 million. PVC windows accounted for by far the largest share in 2008 at approximately 93.6 million window units. This compares to 35.7 million units in aluminum, 27.5 million units in wood, and 4.8 million units combining wood and aluminum.

The full report, which covers the EU-27 together with Norway, Switzerland, Russia, Ukraine and Turkey, can be purchased from VFF at Walter-Kolb-Straße1-7, D-60594 Frankfurt, Tel: 0699550540, Fax: 06995505411, vff@window.de, www.window.de

Construction

The latest Europe-wide construction forecasts for 2009 through to 2011 were issued in advance of the 68th Euroconstruct Conference organised by KOF Swiss Economic Institute on 26–27 November 2009 in Zurich. These forecasts indicate that 2009 was the worst year for the construction market in the 19 countries of the Euroconstruct area for more than ten years. Construction output fell by 8.4%, a significantly larger contraction than seen elsewhere in the economy (overall GDP is expected to have fallen by around 4% throughout the Euroconstruct area). The total construction output of the Euroconstruct member countries is expected to amount to €1,365 billion in 2009 and to account for 11% of the area’s GDP.

For 2010, Euroconstruct expect another, albeit smaller, decline in construction activity of 2.2%. Recovery is not now expected until 2011 and growth is unlikely reach a level comparable to that before the recession until at least 2012.

With the exception of Switzerland (3.3%) and Poland (5.3%), all other countries experienced negative growth in construction output in 2009. The greatest declines were reported in Spain (21.5%) and Ireland (32.2%). Construction output has also declined very strongly in Finland and the United Kingdom: by 14.2% and 12.6%, respectively. Portugal, Slovakia and Italy also performed poorly, with construction output declining more sharply than the Euroconstruct average. The explanation for the downturn is to be found in the huge drop in new residential construction (22.5%), as well as in the sharp decline in new non-residential construction (12.7%), a segment which was still growing in 2008. Civil engineering is the only market segment which did not decline in 2009.

Overall construction output is not expected to decline much further after the strong downturn in 2009, but will remain stagnant across much of the continent until 2012. However new residential construction and new non-residential construction segments are expected to continue their downturn in 2010 and 2011. To counteract the economic downturn, several countries launched fiscal stimulus packages of various sizes in 2009, some of which targeted the construction sector. But the phasing out of these stimulus packages together with required consolidation of public finances is expected to negatively impact public sector construction in the coming years.

The construction sectors in Poland, Slovakia and Sweden are expected to have the strongest growth rates in 2010 and 2011.

Some encouraging signs for the furniture industry at imm cologne

Germany is a key player in the international furniture sector, both as a sales outlet and as a trend platform. Only one country in the world imports more furniture than Germany – the USA. In 2008, the United States imported furniture with a total value of around 16.3 billion euros. Germany’s import volume was around half that figure at 7.8 billion euros. Germany is also the world’s fourth largest furniture manufacturer (after China, US, and Italy) with annual production estimated at around US$24.5 billion in 2008 by the CSIL furniture research organisation in Milan.

For almost 60 years now, a key date in the German furniture industry calendar has been the international furniture fair imm cologne. Every January, manufacturers and dealers from all over the world gather for a few days in Cologne, at the heart of central Europe, and determine prospects for the coming year.

To the relief of many in the industry, the 2010 imm cologne show ended with a positive closing balance. Despite being shortened by a day, the fair managed to equal the previous year’s result with around 100,000 visitors. The number of exhibitors also marginally exceeded last year’s level, rising around 1% to 1,053 companies. There was strong growth (7%) in the number of domestic firms taking part. Although the numbers of foreign companies were down, these still accounted for 58% of all exhibitors.

The positive show results are a boost to an industry that struggled badly in 2009. According to figures issued by VDM, the German furniture industry association, sales generated by the industry fell by 12.7% to €12.75 billion in the year to end October 2009. Office and shop furniture sales declined more dramatically (-17%) than home furniture (-12.1%) and kitchen furniture (-10.6%).

The figures in 2009 come after a positive year in 2008 when German furniture producers ended the year with growth of 1.6%. Although there was a slight decline in German domestic furniture sales in 2008, this was more than offset by export growth of 4.3 percent as compared to the previous year

It should also be noted that while German furniture manufacturers were in the doldrums last year, Germany’s furniture retailers were in more buoyant mood. Despite the downturn, the country’s three largest furniture retailers – Ikea, Hoffner, and XXXLutz – were all expanding their sales area in Germany during 2009.

In a recent interview, Hans Strothoff, President of the Federal Association of the German Furniture, Kitchen and Furnishings Industry (Bundesverband der deutschen Möbelindustrie, BVDM) suggested that German furniture retailers have seen the recession as an opportunity to exploit consumer’s need for greater comfort and security in their own homes: “In times like these certainty is a rare thing, so it’s hardly surprising that people’s homes are becoming increasingly important to them. Retailers are sensing this – which is why they would be wise to ensure their range and services are consistent with this trend.”

Some other key industry trends identified by the imm cologne organisers during the show include:

- increasing use of dark wood, preferably combined with glass and stainless steel.

- more “green” furniture with a strong environmental message.

- introduction of large-format dining tables and dining room armchairs that may be sat on comfortably for a long time.

- the “kitchen – dining room – living area” as a spatial unit, now joined by private spa oases in which the bedroom and bathroom merge into a single unit.

The next imm cologne will take place from 18th – 23rd January 2011

PDF of this article:

Copyright ITTO 2020 – All rights reserved