The economic outlook in Europe has deteriorated rapidly and alarmingly in recent weeks. The following quote from the latest edition of the Economist is typical of current media coverage in the region:

“First Greece; then Ireland and Portugal; then Italy and Spain. Month by month, the crisis in the euro area has crept from the vulnerable periphery of the currency zone towards its core, helped by denial, misdiagnosis and procrastination by the euro-zone’s policymakers. Recently Belgian and French government bonds have been in the financial markets’ bad books. Investors are even sniffy about German bonds.

“Worse, there are signs that the euro zone’s economy is heading for recession, if it is not there already. Industrial orders in the euro-zone fell by 6.4% in September, the steepest decline since the dark days of December 2008. A closely watched index of euro-zone sentiment, based on surveys of purchasing managers in manufacturing and services, is also signalling contraction, with a reading of 47.2: anything below 50 suggests activity is shrinking. The European Commission’s index of consumer confidence fell in November for the fifth month in a row“.

Slow buying of bangkarai decking in Europe

According to the latest issue of EUWID, the Germany-based wood trade journal , central European importers were holding relatively high stocks of bangkirai decking at the end of the 2011 summer season and have therefore been off-loading these at below replacement value. This situation has arisen partly due to shipment delays which led to significant volumes of bangkirai decking scheduled for June arrival not reaching Europe until October or even early November. Economic uncertainrty combined with the existing surplus has dampened interest in new orders for the 2012 season.

EUWID also reports that CIF euro prices for Malaysian meranti window scantlings have been rising throughout 2011 and are now 20-25% higher than the start of the year. This is due to the rise in the dollar value against the euro combined with limited supplies of roundwood in South East Asia. Prices are now at such a level that European manufacturers are actively looking for substitutes.

On the other hand, according to EUWID, the supply situation is less tense for meranti lumber with currently available supplies still higher than existing weak demand. Falling freight rates and slightly lower FOB US$ prices offered by Malaysian exporters have helped to offset the impact of the weakening euro to keep CIF euro prices relatively level for European importers.

European furniture consumption weakening in 2011 after a decent rise last year

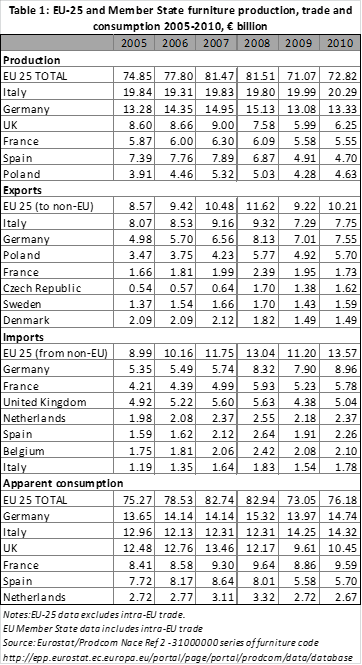

Last year, the value of EU furniture consumption increased 4% to €76.2 billion, supporting a 2% increase in production and a 21% increase in imports from countries outside the EU (Table 1). However signs are that furniture consumption is slipping back again during 2011 as economic uncertainty has mounted.

European manufacturers and brands continue to dominate the European furniture market. Last year, European furniture production was valued at €72.82 billion and domestic manufacturers accounted for well over 80% of the value of products supplied to the EU. This partly reflects strong consumer loyalty to European brands in some EU countries, combined with strong technical, design and marketing skills, particularly prominent in the major German and Italian furniture sectors. Together these two countries account for nearly half of all furniture produced in the EU.

Another factor limiting market opportunities for furniture suppliers outside the EU is fragmentation of retailing activities in many European countries. This greatly complicates the process of identifying buyers and marketing products. Domestic furniture manufacturers also benefit from their natural proximity to consumers, a factor which, if anything, has become more significant in these times of tight stock control and just-in-time trading. Proximity to the customer is particularly important in Europe’s large contract furniture sector involving supply of bespoke products and services, mainly to the hospitality sector (hotels, restaurants and bars) but also to the office, health, education, airport, and marine sectors. The contract sector accounts for a very significant share of all furniture demand in most European countries. In the UK for example the contract sector is believed to account for 30% of furniture sales.

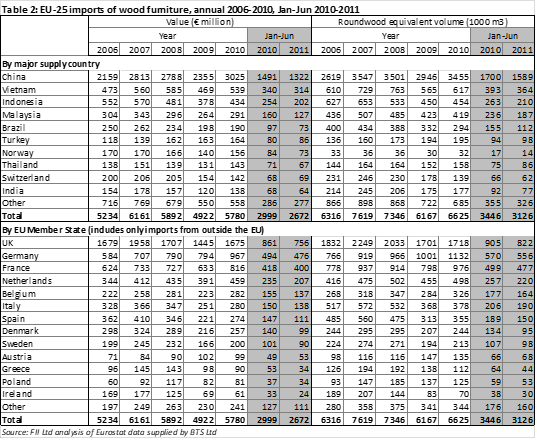

Despite these obstacles, the value of furniture imports into the EU from outside the region increased by 21% last year to reach €13.57 billion, with particularly strong growth in imports from China, Vietnam, Indonesia, and Malaysia. Table 2 provides more detailed information on recent trends in EU imports of wood furniture from outside the region. It highlights that after the significant decline in the value of imports in 2009, imports of wood furniture rebounded strongly by 17% in 2010 to reach nearly €5.8 billion. EU wood furniture imports rose strongly last year from China (+28%), Vietnam (+15%), Indonesia (+15%), Malaysia (+10%), Thailand (+10%) and India (+15%). This strong rebound in imports was evident in all the major EU consuming countries including the UK, Germany, France, Netherlands, Belgium, Italy and Spain.

However, as austerity has begun to bite and other signs of economic strain have emerged in Europe during 2011, EU imports of wood furniture have weakened again in 2011. In the first 6 months of the year, the value of imports fell by 11%. Imports were down from all the major supply countries including China (-11%), Vietnam (-8%), Indonesia (-20%), Malaysia (-21%) and Brazil (-24%). As with the upturn, the downturn has been almost universal across all EU Member States.

Unfortunately the trade data does not allow for any reliable separation of furniture into exterior and interior products. In the past, tropical countries have dominated markets for weather-resistant exterior furniture products, while temperate countries have dominated markets for interior furniture products where diversity of look and grain is more important. This simple division has been breaking down rapidly. Tropical countries like Vietnam, Indonesia and Malaysia have increasingly diversified into interior furniture products. This trend has been driven by a combination of tightening supply and rising prices for tropical hardwoods and the competitiveness of South East Asian countries able to draw on relatively low labour costs and traditional wood-working skills.

Originally, most interior products supplied to Europe by South East Asian countries were based on local plantation timbers, notably rubberwood. However, these countries are now importing increasing volumes of temperate hardwoods, from both Europe and the United States, for manufacture and re-export of interior furniture.

Product innovation increases pressure on tropical hardwood garden furniture

Meanwhile, the growing expense and rarity of good quality tropical hardwoods suitable for exterior furniture, combined with the environmental concerns of European retailers and innovations in other material sectors, has meant tropical hardwoods have continued to lose share in the European garden furniture sector.

This is well illustrated by a recent report on new trends in European garden furniture contained in the latest issue of World Furniture published by CSIL, the Italian furniture research organisation (http://www.worldfurnitureonline.com/). There is no mention of tropical hardwood in the report which instead focuses heavily on new High Density Polyethylene (HDPE) fibres which allow manufacturers to design furniture suitable for all weather use. This synthetic rattan is typically woven onto a lightweight metal structural frame and is available in a multitude of colours and weaving patterns. The article claims that HDPE is non-toxic and recyclable and that it also offers high Grey Scale ratings (low rate of colour loss due to weather exposure).

The article also highlights the development of new products based on “recycled and recyclable” materials, for example combining hemp fibre, specially treated against UV radiation, with stainless steel tubing which is “electrolytically polished” to remove surface ferrous particles and ensure increased resistance to atmospheric corrosion. These products may be designed to ensure that all components can be fully disassembled, thus simplifying the recycling process and helping to reduce the environmental impact.

While it may be little consolation to wood producers, many of these products supplied into Europe are also now manufactured in South East Asia.

Large retailers increasingly dominate the UK furniture sector

The latest edition of CSIL’s World Furniture magazine provides commentary on other key trends impacting on Europe’s furniture sector. A special article on the UK furniture retailing sector highlights that major structural changes are underway.

While the UK imports large volumes of furniture from Germany, Italy and Poland, relatively high levels of consolidation in the retail sector has been a major factor behind the UK’s emergence as by far the largest importer of furniture from countries outside the EU, particularly China but also including Vietnam, Indonesia and Malaysia. World Furniture reports that UK imports from Germany and Italy have generally been declining in recent years, while imports from China, South East Asia and Poland have tended to rise.

According to World Furniture, the UK market remains tough with little or no growth this year. 2011 has seen some significant bankruptcies in the furniture retailing sector. In May 2011, the Focus DIY group, with 178 stores and a turnover of €524 million has been the largest retail bankruptcy in the UK this year. It was closely followed in June by national furniture retailer Habitat which operated a network of 30 stores around the country. Most recently, the Homeform Group has also gone into administration, and is trying to sell its Moben and Dolphin brands in an effort to save its Sharps and Kitchens Direct businesses.

The structure of the UK furniture sector is now shifting, says World Furniture. Smaller independent furniture retailers have suffered the most during the recession, while larger retailers have continued to increase their dominance. This includes department stores led by Home Retail Group, Marks & Spencer and The John Lewis Partnership, furniture retailer chains like IKEA and Furniture Village, together with kitchen specialists like Magnet, Harvey Jones and Moben, and upholstery specialists like DFS and Reid Furniture. Buying groups are also becoming increasingly important in the market.

Large DIY retailers like B&Q and Wickes, more concentrated now following the collapse of Focus, are also playing a more important role in the market, particularly at the bottom end and in the garden furniture segment. However, according to World Furniture, the fastest growing segment is mail order business, much of which is controlled by existing dominant retailer brands through their new direct sales divisions.

German furniture demand remains bouyant

The latest edition of World Furniture also highlights that Germany has been one of the few bright spots in Europe’s furniture sector this year. Furniture production is expected to be up 5% overall in Germany this year, with particularly large increases in office furniture production (+22.8%) and shop fitting (14.9%). Most other sectors are forecast to record production growth of between 4% and 6% this year, with only the upholstered furniture sector giving any cause for concern. German import and export flows are also expected to remain positive for 2011 as a whole.

Interaction between European and Chinese furniture sectors

Nowadays, no review of the furniture sector in any part of the world would be complete without mentioning China. An interesting dynamic is emerging between China, the world’s largest furniture producer and exporter, and Europe which still plays host to the world’s largest and most innovative furniture design community and most desirable furniture brands.

In the early days of China’s efforts to penetrate the European furniture sector, manufacturers were seemingly content to focus on a volume-driven rather than a product-and-design-driven industrial strategy. The early emphasis was on contract manufacturing, mainly at the lower end of the market, rather than on own-brand furniture manufacturing. However, there has been growing recognition amongst Chinese manufacturers that this will lead to progressive loss of competitiveness as the barriers to entry in contract manufacturing are relatively low and there will always be opportunities for manufacturers in lower-cost locations to take market share.

Therefore, as labour and other costs in China have been gradually rising, the future growth of the Chinese furniture industry is closely tied to its penetration of the middle range. According to World Furniture, this is now beginning to happen. Many of China’s leading firms (Kuka for upholstered furniture, Matsu for office furniture, Oppein for kitchens) today use a combination of Chinese, Asian and European designers for their own production. They are also introducing first class technologies into all the major furniture districts.

Another factor affecting the dynamic between European and Chinese firms is the beginnings of a “reversal in trade”. No longer is it just about Chinese furniture firms increasing penetration of the European market. It is also about European firms taking a share of the potentially vast opportunities emerging in China’s domestic market. The recent revaluation of the Remimbi (from a rate of 10 to the Euro, to the current 8.5) is beginning to make Chinese exports more difficult and imports more accessible. Rising income and emergence of a new middle class of consumers means that China is becoming more interesting for European furniture players.

According to World Furniture, German and Italian producers of high-quality brand-name furniture are becoming more engaged in selling to China. They now face the difficult choice between exporting to China and producing locally. Some firms have failed in their attempt to produce locally (e.g. Decoro) or have chosen to sell to third parties (Faram). Others have been more successful, for example Natuzzi has become one the best-selling brands in China, while Colombini which specialises in children’s furniture now has almost 100 sales outlets in China.

Russia to accede to the WTO in 2012

The World Trade Organization finalised terms for Russia’s membership in early November, which should enable it to gain final approval from WTO trade ministers at a meeting in December and to join the body early next year. To gain admittance, Russia had to bring its own laws into line with WTO rules and satisfy the 153 existing members that it is committed to enforcing WTO standards.

The accession agreement states that the tariff ceiling for imports of wood and paper products into Russia will be reduced from the current level of 13.4% to 8%. In the long term, this is expected to provide new opportunities for suppliers in other countries to develop sales in Russia.

However, a more immediate and dramatic effect of WTO accession may be to liberalise Russia’s log exports. Russia was formerly a key source of raw logs, mainly softwood, to the international market. This changed when Russia increased its wood export duties in 2006 from 2.5 euros ($3.3) per cubic meter, reaching 15 euros in 2008. Russia’s log exports fell from 51.1 million m3 in 2006 to only 21.4 million m3 in 2010. Following Russia’s accession to WTO, export tariffs are expected to be progressively cut on birch and aspen logs by 75% and on spruce and pine logs by 50%.

In the European market, this move is expected to have a particularly dramatic effect on log supply to the pulp and paper sector in Scandinavia. Scandinavian companies imported around 12.3 million cubic meters of Russian logs in 2008, but with imposition of the export tariffs these imports halved the following year and stood at 7.3 million cubic meters in 2010. This had a particularly profound effect on the Finnish industry which subsequently announced closures of 10 paper and pulp mills and reduced overall production by nearly a fifth in 2007-10.

Russia’s accession to the WTO will open the door once again to EU log imports from Russia. However, due to the closure of some Scandinavian mills previously dependent on the supply, and the development of alternative sourcing strategies by remaining mills, there is little expectation that European imports will ever return to previous levels.

PDF of this article:

Copyright ITTO 2011 – All rights reserved