European forward buying of African hardwood sawn lumber, particularly the major commercial redwoods such as sapele and sipo, remains very subdued and is slowing further now with the onset of the summer holiday season. There are reports that some buyers are using even minor shipment delays as an excuse for cancelling orders. The market for some whitewood species – such as ayous and koto – is a little better, while the European ban on the import of Burmese teak imposed in March this year has generated some new interest in iroko for the boat building industry.

Overall FOB price levels are stable for most species, although there are some reports of weakness in prices for sipo and also for framire due to slow demand in the UK and Ireland, the principle markets. Given current sluggish buying there are few reports of problems in forward supply, the only issues mentioned being lack of supply of good quality wawa sawn lumber from Ghana and of dimension products in certain species such as makore which is now in demand in parts of Eastern Europe.

While FOB prices are stable, prices for onward sales to European distributors and manufacturers of species which are heavily stocked on the European continent – notably sapele – remain under pressure.

European importers in no rush to buy Asian lumber despite CIF price rises

According to the German trade journal EUWID, South East Asian shippers have been pushing up CIF prices on offer in European markets for a wide range of products over recent months. These trends reflect relatively low availability in the Far East, rising freight rates and fuel costs, as well as reasonable demand from other export markets. Price rises are being resisted by many European importers as they are concerned about the difficulties of passing on the price increases to customers in the current uncertain market environment.

Prices for standard bangkirai decking products from Indonesia are now at around $1250/m3 CIF North Sea port, up around $100 compared to two months ago. There has been limited purchasing at the higher price levels as some importers have moved to fill gaps that have opened up in stock during the spring and early summer season. However EUWID suggests that overall stock levels of bangkirai decking products in the European market are quite high compared to current levels of demand with significant surpluses of older stock still hanging around in warehouses.

Indonesian shippers are also trying to push up prices for meranti laminated scantlings with minimum raw density of 450 kg/m3 on offer to European importers. These now range from $6.50/rm to $7/rm compared to a range of $6.20/rm to $6.50/rm two months ago. Malaysian shippers have also been pushing up prices for meranti sawn lumber. Delivery times for these products are extending. However, as with decking products, underlying consumption in the EU is slow so importers are in no rush to enter the forward market.

Myanmar teak alternative

The UK TTJ journal reports that the recent European ban on Myanmar teak imports is providing opportunities for some new entrants into the EU market. UK Timber Importer C Leary and Co is to exclusively market Equatoria Teak from Sudan as an alternative. The African product is produced by the Equatorial Teak Company and is aimed at the marine decking industry. According to Simon Kloos, MD of C Leary, boat builders in the EU “are experiencing an unprecedented level of uncertainty cause by EU sanctions banning the direct import of Burma teak”. Responding to rising concern about environmental issues, the product will be certified with Verified Progress certification leading to FSC certification.

German tropical wood imports plummet

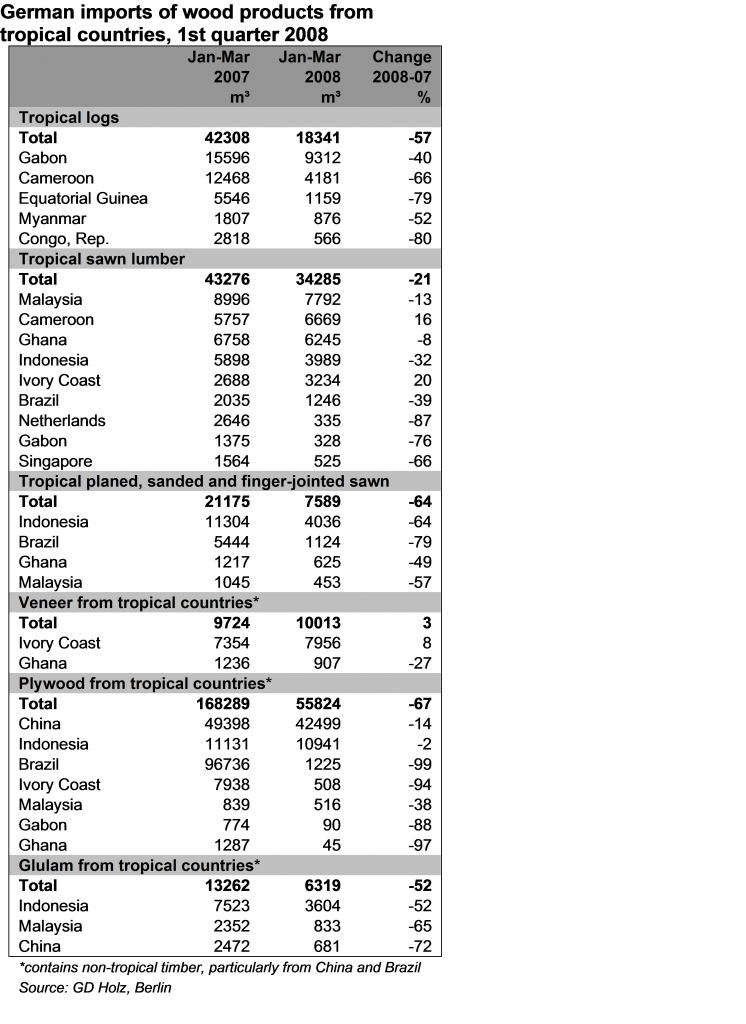

An indication of the scale in the downturn in Germany’s tropical hardwood market this year is provided by the first quarter 2008 trade data just published by GD Holz, the German timber trade association (see below). Imports of tropical logs fell by a massive 57% during the first quarter of 2008 compared to the same period last year. Declining log imports were recorded from all the major tropical hardwood supply countries. Imports of tropical hardwood sawn lumber fared a little better, but still fell by over 20%. The biggest declines were recorded from Indonesia and Gabon. There was also a dramatic decrease in Germany’s tropical sawn lumber imports trans-shipped through the Netherlands during the review period. However Germany’s direct imports of tropical sawn lumber from Cameroon and Ivory Coast were up during the review period. Germany’s imports of planed and sanded tropical sawn wood declined by a massive 64% during the review period, with a huge drop in imports from Indonesia and Brazil. Germany’s imports of plywood from tropical countries declined by 67% with imports from Brazil falling to near zero. The decline in plywood imports from China and Indonesia was much more modest. Glulam imports also fell by over 50% during the review period.

European Commission reveal more details of illegal logging legislative proposal

Speaking at the Chatham House Illegal Logging Update meeting in early June, John Bazill of the European Commission (DG Environment) provided an overview of the current state of EU deliberations on possible legislation designed to prevent imports of illegal wood. Bazill noted that three legislative options had been considered by the EC through a process of public consultation and a formal impact assessment including. These options included: a requirement for border controls requiring mandatory legality licensing of all wood imports; an obligation placed on EU importers to prove that wood is legal when challenged; and a law modelled on the US Lacey Act that would allow prosecution of EU importers if it can be shown that wood derives from illegal sources.

Bazill noted that “all discussed options have serious drawbacks”. Key objections to the options of universal legality licensing and an obligation on wood importers to prove that wood is legal are the massive amount of red tape that would be required and a belief that such a law would be disproportionate to the scale of the problem. Objections to a Lacey-style Act in the EU included the difficulty of establishing a chain of evidence to bring any prosecutions, and the unwillingness of EU courts to take decisions based on the laws of a foreign country.

As a result the EC is now considering another option of directly imposing a requirement for due diligence on wood trading companies in the EU. The details of the proposed legislation are still being worked out but Bazill provided a broad outline. The aim would not be for the regulatory authorities to capture or monitor individual shipments to ensure they are legal, but to ensure that EU trading companies have effective management systems to reduce the risk of trade in illegal wood. The legislation would build on existing private sector initiatives (although not mentioned directly, obvious examples are initiatives like the WWF Global Forest and Trade Network, TFT, and national trade association procurement policies like the TTF Responsible Purchasing Policy). The product scope of the proposed legislation is expected to be wider than the FLEGT VPA process (which only covers logs, sawn, plywood and veneers) extending to further processed products. There would be scope for companies to use risk assessment as part of the due diligence process. There would be formal recognition for FLEGT VPA licenses in the legislation. For product for which these are available, EU companies would need to take no further action to demonstrate due diligence.

Bazill emphasised that “no final decision has been taken” on this legislation. The EC Communication on additional legislative options, originally scheduled for April, has been delayed and is now not expected until mid July. Bazill also emphasised that the Communication itself will only amount to an EC proposal which must then be considered by both the European Parliament and the European Council. During this lengthy process, there are likely to be major amendments to the proposal, or it might even be rejected outright. On the other hand, Bazill suggested that the process of formal public consultation on this issue was now ended and that all EC Directorate General’s are in broad agreement on the approach to be adopted. Bazill also emphasised that the principle of “comitology” is likely to apply in this instance, whereby the primary legislation that is eventually passed would set out a broad administrative framework, while the details of implementation would be worked out through further negotiation at national level and based on practical experience on the ground.

PDF of this article:

Copyright ITTO 2020 – All rights reserved