The Euroconstruct research agency reports that the European construction industry is growing slowly after several years of declining or low activity. In its latest half-yearly report issued in June, Euroconstruct revised it forecasts for 2015 and 2016 upwards and also revealed positive expectations for 2017.

Construction output for the EU is now expected to grow by 1.9% in 2015, slightly faster than 1.8% growth forecast in last year’s report. For 2016, Euroconstruct now forecasts that construction output will rise by 2.5%, a sharp upward revision compared to 1.8% forecast last year. Growth in 2017 is now expected to continue at a rate of 2.5%.

Euroconstruct estimate that the total value of European construction activity will be around €1,366 billion this year. Based on current forecasts, this figure will grow to €1,436 billion by 2017. However, Euroconstruct notes that this would still be 14% below the level of output in 2007 before the global economic and financial crisis.

Euroconstruct forecasts growth in all main segments of the construction market, although the rate of growth will vary considerably. The highest growth rate of 3.1% is expected in civil engineering, driven by infrastructure projects in Central and Eastern Europe. Growth in residential construction is expected to remain slow at only 1.7% this year.

Euroconstruct expects all the largest European construction markets to trend upwards between 2015 and 2017 (Chart 1).

Amongst Europe’s largest construction markets, the UK is showing the strongest upward trend, with Euroconstruct forecasting growth of 5.7% in 2015 and 3.5% in both 2016 and 2017. Recovery in Spain, Italy, the Netherlands and France is also forecast to continue between 2015 and 2017. Output in Germany, which recovered from the recession earlier than other European countries, is forecast to stabilise at a relatively high level.

The highest growth rates in the period 2015 to 2017 are expected in Ireland and Poland, averaging 10.8% and 8.6% per year respectively. However, growth in Ireland follows a dramatic fall of almost 70% between 2007 and 2013. Growth in Poland will be mainly the result of sharp rises in civil engineering.

European wood flooring production down again in 2014

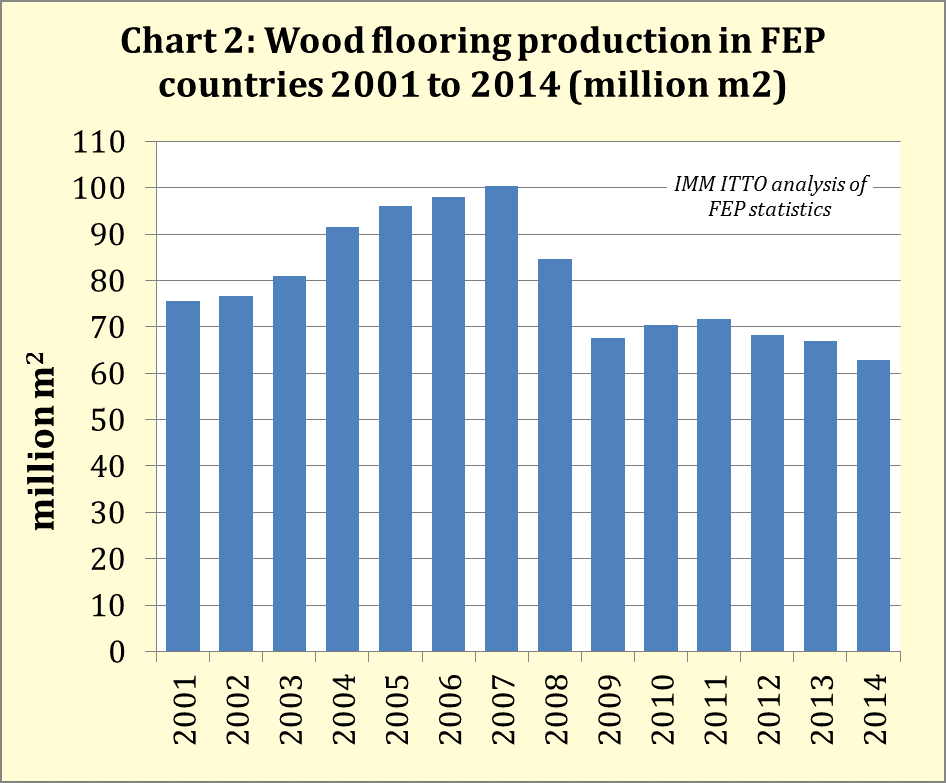

The European wood-flooring sector has yet to benefit from the turnaround in the building industry. According to a report by the Global Flooring Alliance, production of “real wood” flooring (not including laminate flooring) in the 17 countries covered by the European Federation of the Parquet Industry (FEP)[1] fell by 6.6% in 2014, after a moderate decline of 1.8% in 2013 (Chart 2).

[1] Austria, Belgium, Czech Republic, Denmark, Finland, France, Germany, Hungary, Italy, Netherlands, Norway, Poland, Romania, Slovakia, Spain, Sweden and Switzerland.

Production in FEP member countries fell from 67.04 million m2 in 2013 to 62.80 million m2 in 2014. Production has fallen 37% from a peak of 100.33 million m2 in 2007.

The decline in wood flooring production in Europe as whole, including countries not belonging to FEP, was less dramatic. According to FEP data quoted by the Global Flooring Alliance, production throughout the region fell by only 1% to around 76 million m2 in 2014.

Consumption of wood flooring down 6.4% in 2014

Wood flooring consumption in the countries covered by FEP showed a similar trend last year. Consumption increased in only a handful of countries, including the Netherlands, Hungary, Slovakia and Sweden. Overall consumption in all FEP countries was down by 6.4% at just over 77 million m2.

The finalised figures for 2014 are a disappointment to FEP members who, at the FEP meeting in June 2014, suggested that the outlook for real wood flooring in Europe was improving and that demand should pick up in the second half of 2014. Hopes that the improved level of consumption registered in some northern European countries would filter through into large southern European markets for wood flooring failed to materialise.

EU wood flooring export trend turning negative in 2015

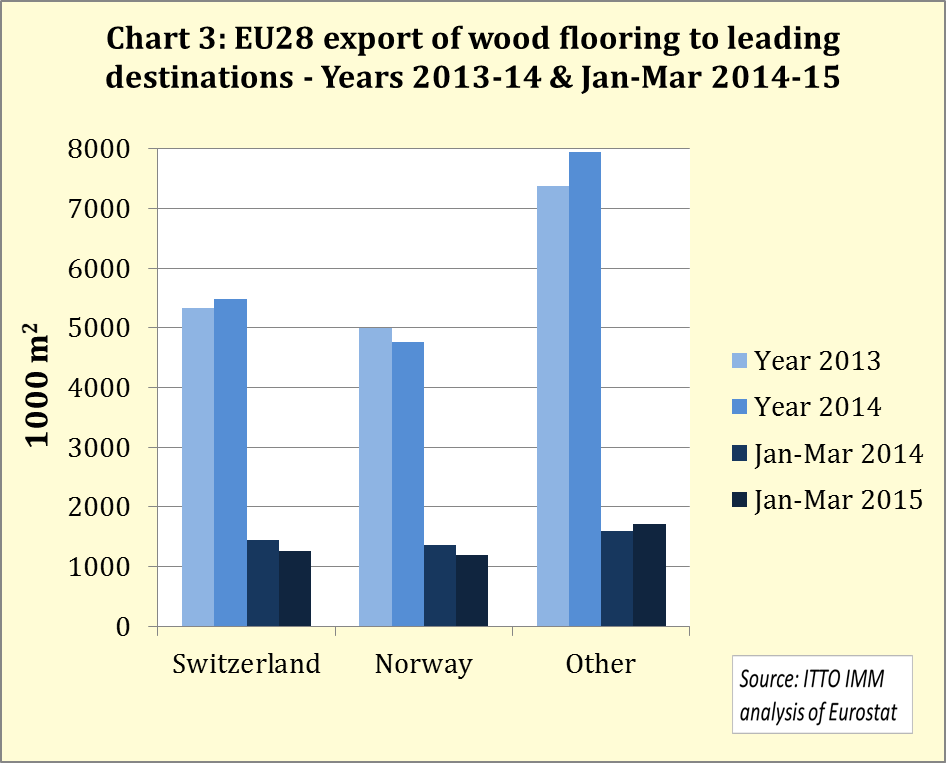

EU exports of wood flooring were rising in the five years between 2009 and 2014, as manufacturers diversified into new markets during a period of slow demand in Europe. Exports increased by 4.7% to 17.707 million m2 in 2013 and by another 2.7% to 18.179 million m2 in 2014.

However, the positive export trend has slowed since the last quarter of 2014. In the first quarter of 2015, EU wood flooring exports were 4.174 million m2, 4.7% lower than in the same period the previous year.

The decline in EU wood flooring exports in the first quarter was primarily due to significantly lower deliveries to Switzerland (-12.4%) and Norway (-11.4%), the two largest European markets outside the EU (Chart 3). This is surprising in the case of Switzerland. The Swiss franc has gained considerably in value against the euro since the end of last year when the Swiss currency was untied from the euro exchange rate. Wood flooring produced in the EU has therefore become much cheaper for Swiss buyers.

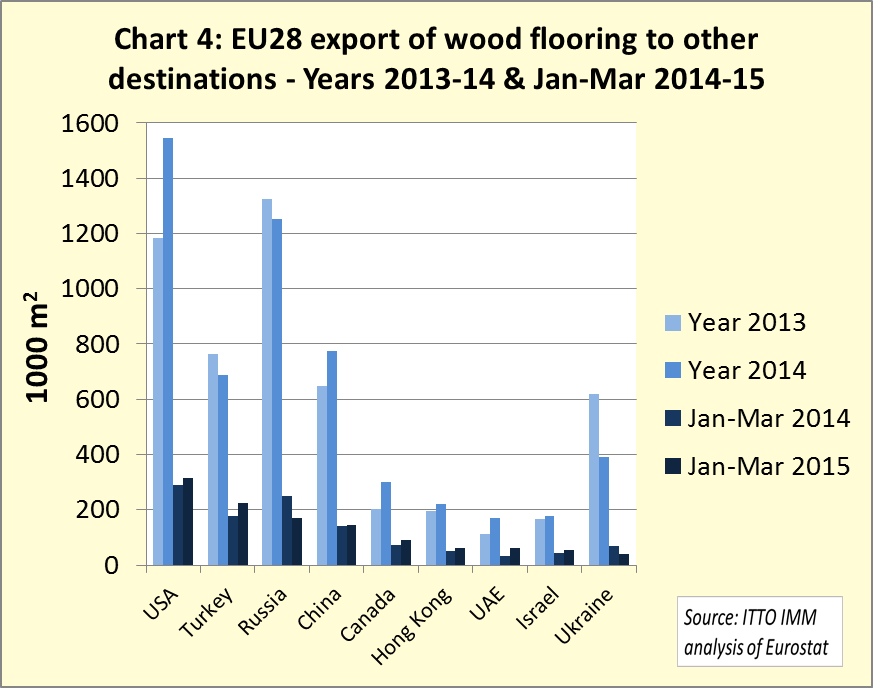

EU wood flooring exports to countries outside the EU varied widely in the first quarter of 2015 (Chart 4). Exports increased to the USA (+8.8%), Turkey (+27.2%) and China (+2.9%) during this period. Exports also continued to rise strongly to Canada (+20.6%), Hong Kong (+26.3%), the United Arab Emirates (+85%) and Israel (+26.1%) in the first quarter.

In contrast, the collapse in the value of the Russian rouble led to a 31.7% decline in EU exports of wood flooring to Russia in the first quarter of 2015. The unstable situation in the Ukraine caused exports to this market to fall sharply by 36.7% in 2014 and again by 45.3% in the first three months of this year.

Wood flooring imports from China growing sharply

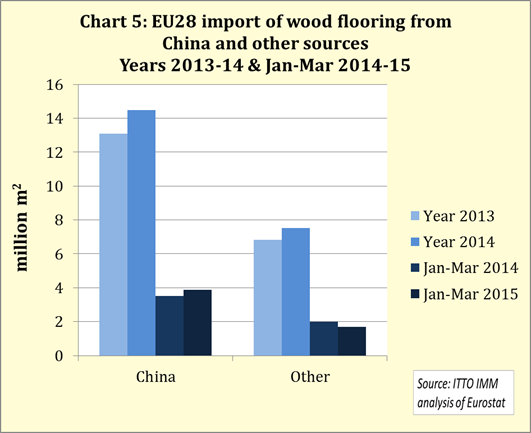

Imports of real wood flooring from outside the EU declined in 2013 but started to recover in 2014. Total EU real wood flooring imports in 2014 climbed by 10.4% to 22 million m2. This positive trend continued in the first quarter of 2015, but at a much slower rate of growth. Imports in the first quarter were 5.6 million m2, 1.2% more than same period the previous year. Imports from China continued to rise rapidly, up 10.3% in the period. However these were offset by a 14.9% decline in imports from all other countries (Chart 5).

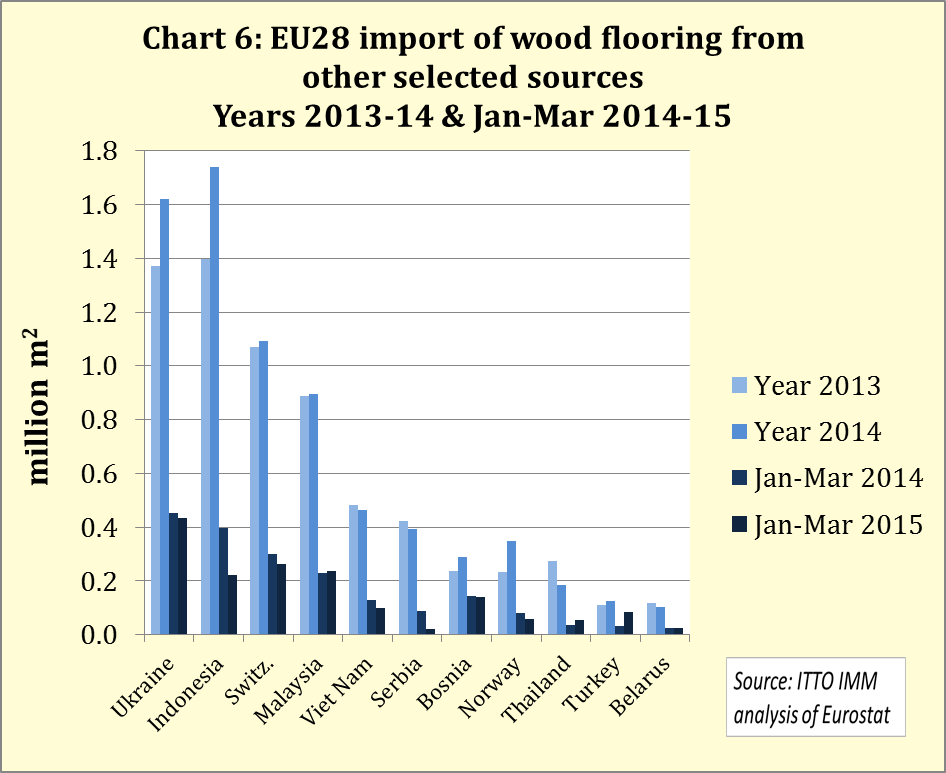

In the first quarter of 2015, EU imports were significantly lower than the same period in 2014 from Ukraine (-4.4%), Indonesia (-44.6%), Switzerland (-12.5%), Vietnam (-22.4%), Serbia (-77.2%), and Norway (-27.4%). However imports from Malaysia (+2.4%), Thailand (+47%) and Turkey (+178%) all increased (Chart 6).

Slow recovery in European laminate flooring sales continued in 2014

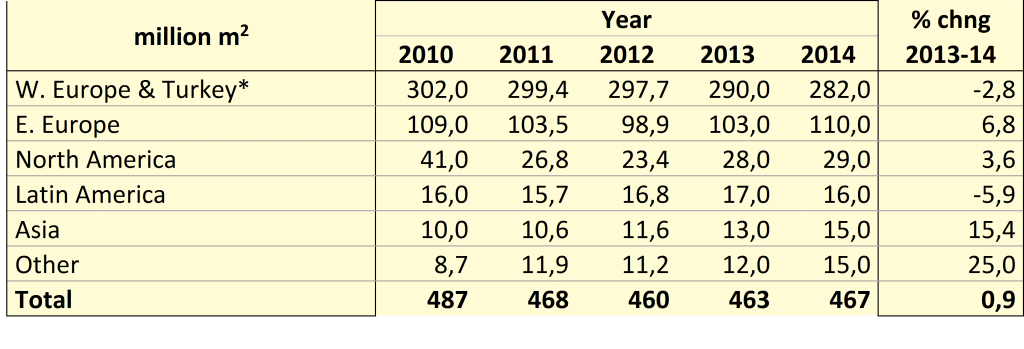

According to final figures published by the European Producers of Laminate Flooring (EPLF) association, laminate flooring sales by EPLF members increased slightly by around 1% to 467 million m2 last year. Final sales were thus slightly higher than initial figures published earlier this year, which put total sales in 2014 at 465 million m2.

However, Table 1 shows that the moderate growth in EPLF members’ laminate flooring sales in 2013 and 2014 was not enough to compensate for the sharp fall in sales in 2011 and 2012.

Table 1: Global sales of laminate flooring by EPLF Members

The drop in sales compared to five years ago is attributed by EPLF primarily to the economic crisis, coupled with competition from new materials, such as Luxury Vinyl Tiles (LVT), as well as from cheaper laminate floorings made outside Europe.

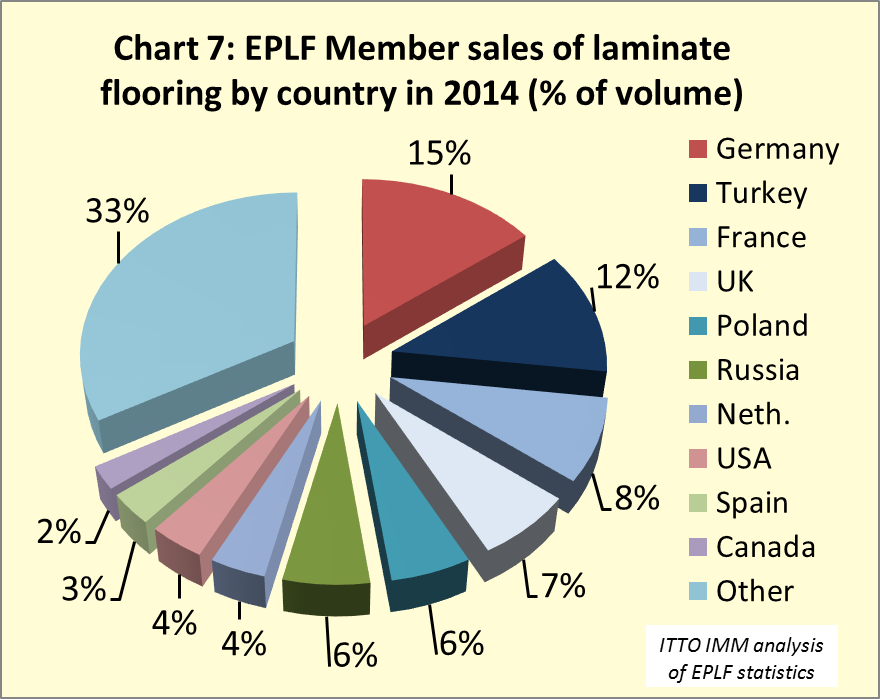

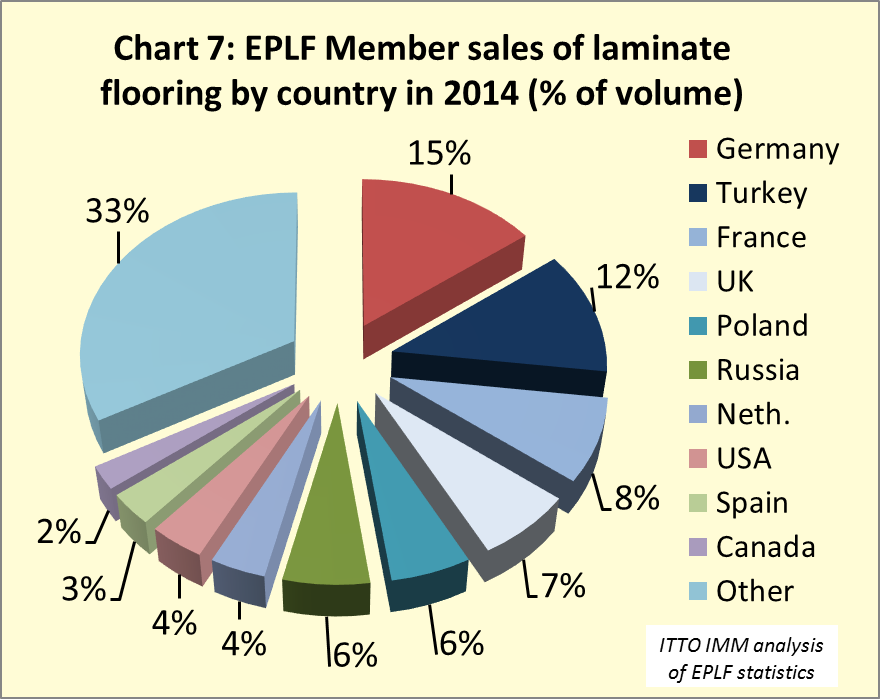

Market conditions for laminate flooring manufactured in Europe have varied widely by sales region. Chart 7 illustrates the importance of the different sales markets for EPLF members.

Sales in Germany, the largest single market, fell 4% to 69 million m2 in 2014. EPLF believes that much of this decline is due to a shift towards LVT flooring in Germany.

Sales to Turkey – the second largest target market for EPLF members – fell by 13% to 57 million m2 in 2014. EPLF attributes this development to a weaker economic situation, shortages in the supply of raw materials and the temporary shutdown of production plants in Turkey.

EPLF member sales of laminate flooring in the important French market stabilised at 39 million m2 in 2014, the same amount as the year before. However sales in the UK increased by 10% to 32 million m2 in 2014, boosted by growth in construction sector activity and improving consumer confidence. There was also a 4% increase in sales in Spain to 14 million m2.

In Eastern Europe, EPFL members saw a much better trend than in the west. Combined sales in this region rose by 6.8% to 110 million m2. Growth in Eastern Europe was primarily owing to strong development in Russia, where sales increased by 19% to 28 million m2 and Poland, which showed an improvement of 6% at 26 million m2. Sales volumes in Romania and Hungary were also higher than the year before.

In North America, the positive trend that started in 2013 continued into 2014. Most of this growth was attributable to the USA, where sales rose from 16 to 18 million m2. Sales in Canada were practically unchanged in 2014 at 11.2 million m2.

In Asia, EPLF members booked a strong 15.4% increase in sales to 15 million m2. EPLF member sales to China increased by around 25% in 2014, but at 5 million m2 are still very small compared to the overall size of the market.

Downward trend in laminate flooring sales in early 2015

According to a press release issued following the EPLF annual general meeting in May, the market for laminate flooring produced by EPLF members showed slight decline in the first quarter of 2015 compared to the same period the previous year. In most cases, trends experienced by the individual markets and regions in 2014 have continued this year. Sales in Eastern Europe and Asia have continued to grow and the downward trend in Western Europe has also continued. However unlike last year, the North American market has deteriorated slightly in the first three months of this year.

The European market for laminate flooring is being influenced this year by Turkey’s decision to impose anti-dumping duties on laminate flooring imported from Germany. EUWID reports that four German laminate flooring manufacturers that cooperated in a Turkish anti-dumping investigation launched in 2013 were assessed individual anti-dumping duties. All other German laminate flooring manufacturers have to pay a punitive duty of US$1.05/m2. The duties took effect upon publication of the ruling on 13 June 2015.

EPLF “Task Force Russia” has started working

European laminate flooring manufacturers have express concern about alleged widespread counterfeiting of products on sale in the Russian market. In a statement last year, EPLF said that: “the high proportion of inferior-quality and incorrectly declared goods imported from Asia [into Russia] makes things difficult for EPFL manufacturers as it tends to cause lasting damage to the image of laminate flooring”.

In response to these concerns, EPLF decided to set up a so-called Task Force Russia. The first meeting of this working group was held in March 2015 in Moscow. It was decided that “a technical working group of companies who produce in Russia will set about developing a new GOST standard along the lines of European standards”. Moreover, a second working group will be established at a later date to actively promote quality laminate flooring in Russia.

Quality, design and environmental performance to create a competitive edge

At its annual general meeting EPFL announced new initiatives to help ensure that European laminate flooring maintains a “leading role on the world markets”. A new, generic Environmental Product Declaration for laminate flooring was established in June, which “sets a new standard for the ecological quality of laminate flooring”, according to EPLF.

In addition new test procedures for displaying measurements on deeply structured laminate flooring were also presented. Deeply structured surfaces create a “rustic” or “used” look that has dominated laminate flooring design in recent times – mirroring the fashion for rustic oak and other rustic wood surfaces in the real wood sector. A first series of tests on deeply structured surfaces conducted by IHD Wood Technology Institute in Dresden, which examined the surfaces in highly trafficked areas, found that deep structures do not wear faster than shallow ones. According to EPLF, the so-called “Test Abrader” method for measuring abrasion resistance will be modified accordingly.

EPLF also noted the need for the organisation to become more actively involved in international communication and promotion activities, particularly as the European market for laminate flooring continues to show signs of weakness in 2015.

PDF of this article:

Copyright ITTO 2020 – All rights reserved