The EU wood joinery sector continued to grow only very slowly in 2018, well below the pace of increase in the wider construction sector. While joinery production and consumption gained momentum in Germany, Austria, Spain, the Netherlands and Belgium last year, it remained subdued in Italy, the UK, France and Scandinavia.

Growth in the EU wood door sector slowed in 2018, while the wood window sector was close to a new record low. There was some evidence of wood making up some lost ground against plastics in these sectors, but wood continues to face stiff opposition from other materials. Where wood is being used, it is increasingly combined with metals, or used in engineered form, to ensure greater strength and durability.

These are the main conclusions to be drawn from analysis of newly released Eurostat PRODCOM data which provides a snapshot of the production and consumption value of wood joinery products in the EU in 2018.

EU joinery not keeping pace with construction sector growth

The independent research agency Euroconstruct estimates that the value of construction activity in the EU increased 3.1% in 2018, building on 3.1% growth the previous year. However, analysis of newly released Eurostat data indicates that activity in the European wood joinery sector has been relatively unresponsive to this wider expansion in the building sector.

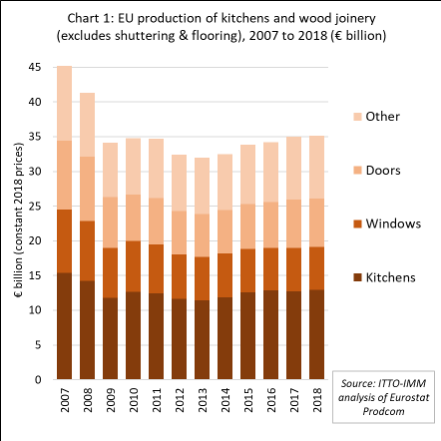

Eurostat PRODCOM data shows that the production value of wood joinery and related products in the EU increased only 0.3% to €35.1 billion in 2018 following growth of 2.4% in 2017. Although 2018 marked a high point for EU joinery sector activity in the last 10 years, activity was still down more than 20% compared to the period before the global financial crises (Chart 1).

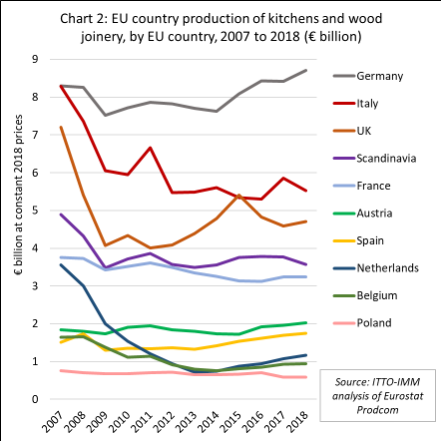

The trend in wood joinery activity has varied widely between EU countries in recent years (Chart 2). After levelling off in 2017, growth in joinery activity in Germany resumed last year, rising at 3.3% to €8.70. After a brief bounce in 2017, joinery production in Italy fell back 6% to €5.52 billion in 2018, only just above the historically very low levels recorded in 2015 and 2016.

In the UK, joinery production increased 2.6% to €4.71 million after slowing over 5% the previous year. Joinery production declined in Scandinavia, by 5.6% to €3.57 billion in 2018. Joinery production in France increased only 0.3% in 2018, to €3.25 billion, after rising 3.7% the previous year.

However, there has been more consistent growth in joinery production in several other EU markets including Austria rising 3.3% to €2.03 billion in 2018 (+2.2% in 2017), Spain rising 3.6% in 2018 to €1.75 billion (+4.6% in 2017), the Netherlands rising 8.5% in 2018 to €1.17 billion (+11.7% in 2017), and Belgium rising 1.5% in 2018 to €0.95 billion (+8.8% in 2017).

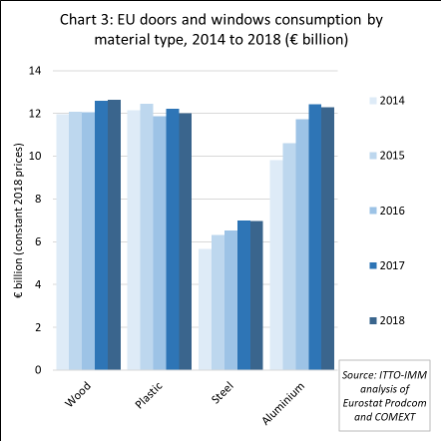

Part of the explanation for the slow increase in wood joinery activity in the EU compared to growth in the wider construction sector and economy is increased substitution by alternative materials. However, there is some evidence to suggest that the pace of substitution slowed in 2017 and 2018. This is revealed by comparing the total EU apparent consumption value of doors and windows in various materials (Chart 3).

Between 2014 and 2017 total EU consumption value for doors and windows increased 26% in aluminium and 28% in steel. The consumption value for wood increased only 4% during this period, while consumption of plastic stagnated.

Overall the share of wood in the total value of EU door and window consumption fell from 30% to 28% between 2014 and 2017, while the share of aluminium increased from 25% to 28%, steel increased from 14% to 16%, and plastic decreased from 31% to 27%.

During this period, the growth in aluminium consumption in the EU windows and doors sector was particularly dramatic. Aluminium has always remained the default windows product in the commercial market but has enjoyed considerable resurgence within the residential window and door market.

An important driver behind this has been aluminium bi-fold and sliding doors as consumers demand greater space and light within living areas. Another factor is the demand for lower maintenance and greater strength in light weight frames for high energy efficiency double and triple glazed units.

However, in 2018, the growth in consumption of steel and aluminium appears to have stalled. Wood even regained a little share, rising from 28% to 29%, at the expense of plastic for which share fell from 28% to 27%.

The Eurostat data has limitations and the suggestion that wood may be regaining some market share is contradicted, at least in the window sector, by other more detailed studies (see report below on the Interconnection study).

A specific constraint of the PRODCOM data is that it does not distinguish products made wholly in wood or metals from those that are composites of both materials. The development of wood-aluminium composite window frames has been a key growth area in the EU in recent years. These products combine the strength and efficiency of aluminium with the thermal insulation and aesthetic properties of wood.

Stasis in EU market for wooden doors

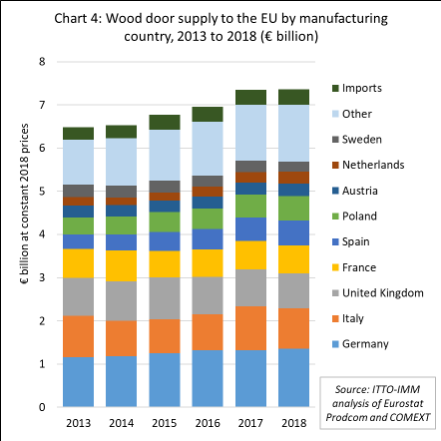

Eurostat PRODCOM data shows that the total value of wood doors supplied to the EU increased just 0.1% to €7.36 billion in 2018. Most new wood door installations in the EU comprise domestically manufactured products. The EU’s domestic production was static at €7.0 billion in 2018 (Chart 4).

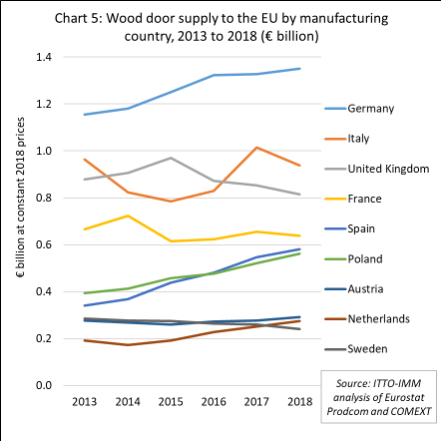

There was significant variation in the performance of the wood door sector in EU countries in 2018. Production in Germany, the largest wood door manufacturing country, increased 1.9% to €1.35 billion during the year. Production in the UK fell back a further 4.5% to €810 million in 2018 after declining 2% the previous year, the volatility being partly due to Brexit and partly to changes in the EUR-GBP exchange rate.

Door production in Italy has also been volatile, declining 7.5% to €940 million in 2018 after a 22% increase the previous year. Production in France fell 2.5% to €640 million after a 5% rise in 2017. Production in Sweden fell nearly 8% to €240 million. Elsewhere there were solid gains during 2018, with door production rising 6% to €580 million in Spain, 7.4% to €560 million in Poland, 5% to €290 million in Austria and 9% to €280 million in the Netherlands (Chart 5).

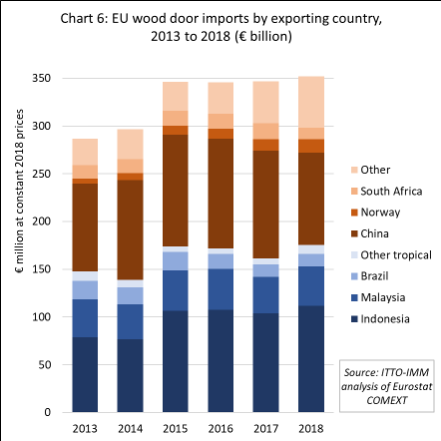

Wood door imports into the EU increased by 1.5% to €352 million in 2018 (Chart 6). Imports accounted for 4.8% of the total euro value of wood door supply to the EU in 2018, the same proportion as the previous year.

Tropical countries took a larger share of the EU market for wooden doors in 2018, largely at the expense of China. Total EU imports from the tropics were €175 million in 2018, 8.6% up on the previous year and enough to offset a 6% decline in 2017. In 2018, wooden door imports from Indonesia increased 7.8% to €112 million, while imports from Malaysia were up 7.1% to €41 million. Imports from Brazil increased 1.7% to €13 million. EU imports of wooden doors from China, still the largest single external supplier, fell 2% to €111 million in 2017.

The European wood door industry is now dominated by products manufactured using engineered timber driven by requirements to comply with higher energy efficiency standards and efforts to provide customers with more stable products and long-life time guarantees.

Another key trend is towards composite doors with a steel-reinforced uPVC outer frame with an inner frame combining hardwood and other insulation material. These new products are designed to combine strength, security, durability, high energy efficiency, with a strong aesthetic.

There may be a place for tropical hardwoods in the design of these products with manufacturers looking to combine high quality, consistent performance, regular availability, and good environmental credentials with a competitive price.

EU market for wood windows fell 1.6% in 2018

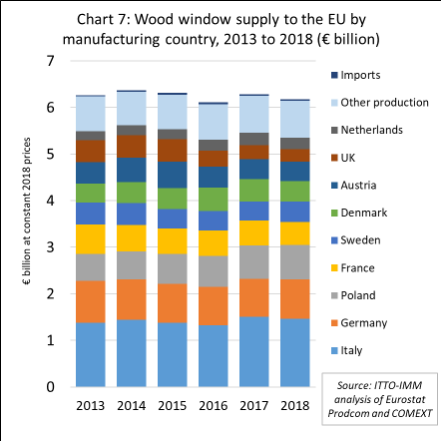

The total value of wood windows supplied to the EU fell 1.6% to €6.18 billion in 2018 following a 2.8% increase the previous year (Chart 7). EU consumption of wood windows in 2018 was €6.14 billion, the second lowest level recorded in the last twenty years (when adjusted for inflation), only just exceeding the record low of €6.07 in 2016.

Supply of wood windows to the EU is overwhelmingly dominated by domestic production which fell 1.7% to €6.14 billion in 2018. Imports from outside the EU accounted for only 0.6% of total EU wood window supply in 2018, a slight gain compared to 0.6% in 2017.

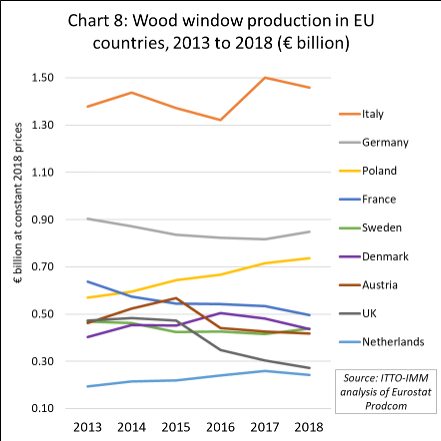

Italy has maintained its position as the largest wood window manufacturer in the EU, although production fell 2.7% to €1.46 billion in 2018. Production in Germany increased 4% in 2018, to €850 billion, rebounding after a 0.9% decline the previous year. Production in Sweden also rebounded in 2018, up 5.4% to €440 million, after declining 2.4% the previous year. Production in Poland continued to rise in 2018, by 2.9% to €740 billion.

However, wood window production declined in most other leading EU producer countries in 2018 including France (-7.2% to €500 million), Denmark (-9.2% to €440 million), Austria (-2.2% to €420 million), UK (-10.8% to €270 million), and the Netherlands (-5.9% to €240 million) (Chart 8).

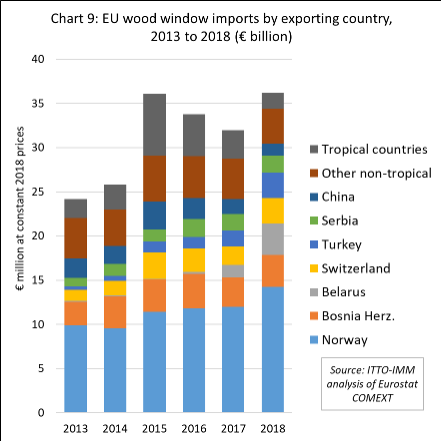

EU imports of wood windows from outside the EU increased by 13.1% in 2018 to €36 million, recovering ground lost in the previous two years (Chart 9). Imports increased 19% to €14 million from Norway, 8% to €4 million from Bosnia Herzegovina, and 154% from Belarus, to €4 million.

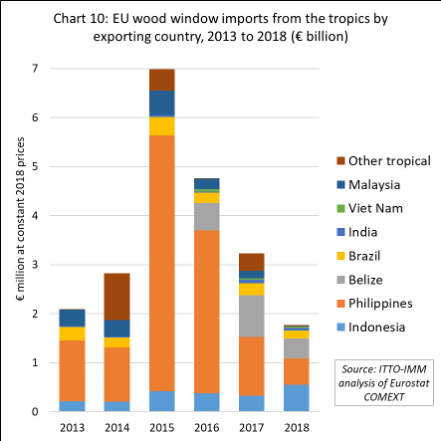

Only a very limited, and declining, quantity of wood windows is imported into the EU from tropical countries. After a spike in imports of €7 million in 2015, mainly from the Philippines, imports from tropical countries fell continuously to only at €1.8 million in 2018 (Chart 10). Most EU wood window imports from tropical countries are destined for France and Belgium.

Tropical wood in the European wood window market

While tropical countries are not significantly engaged in the EU market for finished windows, this sector is of interest as a source of demand for tropical wood material. From this perspective, a notable trend in the EU window sector – as in the door sector – is towards use of engineered wood in place of solid timber. This is particularly true of larger manufacturers producing fully-factory finished units that buy engineered timber by the container load.

Increased use of engineered wood is closely associated with efforts by window manufacturers to meet rising technical and environmental standards, provide customers with long lifetime performance guarantees and recover market share from other materials.

Increased focus on energy efficiency means that triple-glazed insulating window units with very low U-factors are now more common than double-glazed units in Europe. These units demand thicker, more stable and durable profiles that in practice can only be delivered at scale using engineered wood products or by combining wood with aluminium and steel in composite products.

The quality and engineering of wood windows has undergone a revolution in the EU in recent years so that manufacturers are now able to deliver products with many of the benefits previously reserved only for the best quality tropical hardwood frames using softwoods and temperate hardwoods.

Factory-finished timber windows are given a specialist spray-coated paint finish for even and durable coverage which might only need redoing once a decade. The lifespan of factory-finished engineered softwood frames is now claimed to be about 60 years, while thermally or chemically modified temperate woods can achieve around 80 years.

Nevertheless, smaller independent joiners producing bespoke products in low volumes still tend to rely on solid timber purchased from importers and merchants to manufacture window frames. Tropical woods such as meranti, sapele and iroko continue to supply a high-end niche in this market sector, competing directly and often successfully with oak, Siberian larch, and western red cedar.

Total window sales increase 2% in Western Europe 2018

Sales in the window market in Western Europe increased by 2.0% in terms of value last year. Sales in the industry increased by 1.5% in terms of quantity. A similar development is expected for 2019, as shown by Interconnection Consulting in a study presented at the First Vienna Window Congress in June 2019.

The great uncertainty surrounding Brexit caused a 2.1% sales decrease in the window industry in the UK and Ireland area. By contrast, the window market in southern Europe (Italy, Spain, Portugal) will continue to recover and will be Europe’s main growth area with sales expected to increase 6.8% in 2019.

The largest markets, France and Benelux and the German-speaking DACH region, however, will continue to achieve moderate growth rates of 1.6% and 1.9% in 2019, respectively. In these countries, the main factor curbing growth is restrained housing construction.

The Scandinavian countries are also suffering from the poor development of residential construction and the window market is this region is expected to decline 1.5% in 2019 with a particularly large slowdown in Sweden.

Overall, Interconnection estimate that sales of windows in western Europe will increase from €18.4 billion in 2018 to €19.9 billion by 2022, with Italy, Spain and Portugal making a major contribution to growth both in the new construction sector and in the renovation segment.

Wood-metal composite windows gain ground in western Europe

According to Interconnection, western European sales of windows with wood content should hit €5.38 billion in 2019, including €2.62 billion of wood-only products and €2.86 billion of wood-metal composite products. Window market share of wood-only products currently stands at 14.0% while the share of wood-metal composites stands at 15.3%.

Sales of wood-only windows in western Europe are forecast to decline 1.2% per year between 2018 and 2022. However, this decline is expected to be offset by 2.6% annual growth in sales of wood-metal composite windows.

In 2019, metal windows have the largest share of the western European window market, with 36.8%. Sales of metal windows in this market are forecast to reach €6.8 billion this year and annual growth of 3.2% is expected until 2022. Consistently high growth rates for this material are expected due to relatively low costs of maintenance and the optical appeal of aluminium.

PVC currently accounts for €5.40 billion (29.4%) of window sales in the western European market. PVC window sales are expected to grow by 1.7% per annum until 2022, mainly driven by rising demand in southern Europe. An additional €680 million (3.7%) of window sales comprise PVC-aluminium composite product. Sales of this product are expected to increase 3.7% annually until 2022.

Environmental requirements drive window demand for renovation

Interconnection report that the residential construction sector is the most important market for windows in western Europe, accounting for 66.3% of sales. Total sales in this sector are expected to grow 1.4% per year until 2022 with most of the increase driven by renovation which continues to perform well due to increased environmental requirements.

The European window industry is undergoing a major structural change due to increased internationalization. Companies from Eastern Europe, particularly in Poland, Slovakia and Romania, are gradually increasing share of western European markets. Nearly 30% of windows installed in Germany each year are manufactured outside the country. Exports account for 56% of sales by Polish windows manufacturers.

Eastern European window market faces stagnation

Meanwhile, according to Interconnection Consulting, the crisis in the construction industry in Russia and Ukraine is dampening growth prospects in the Eastern European window market. Sales in the CEE group of Central and Eastern European countries (as defined by OECD) in 2019 will amount to only 33.1 million units, only 0.6% more than the previous year and well below the 2014 level of 40.9 million units.

A large proportion of sales in this region are in Russia and Ukraine which together account for 17.6 million units. Interconnection expects total sales in the two countries to fall 1.2% in 2019 and no recovery is expected until 2022.

The biggest growth market for windows in the Eastern European region in the past 10 years has been in the Baltic countries, driven by a huge boom in construction, both residential and non-residential. Window sales in the Baltic countries increased nearly 8% in 2018. Nevertheless, the pace of growth will slow in the coming years. Annual average of growth of 1.4% is now expected until 2022.

The Visegrad countries (Poland, the Czech Republic, Slovakia) recorded 4.2% growth in window sales in 2018. However, the annual growth rate is expected to fall to 1.4% until 2022 as a result of slowing construction sector activity.

Growth in the Balkan countries is expected to remain consistent at an average annual rate of 2.7% until 2022. The region of Hungary-Romania-Bulgaria-Greece recorded a decline in new construction in 2018, but this is offset by strong growth in the renovation sector. Here, window sales are expected to grow by 2.3% until 2022.

Residential construction currently accounts for two thirds of all window sales in Eastern Europe, but this sector is now stagnant and future growth is expected to be concentrated in non-residential construction.

While triple glazing is the preferred window type in the Baltic States, Russia and Ukraine (accounting for around 66% of all new installations), double glazing dominates in the Visegrad countries (66%) in the Balkans (74%), and in Hungary-Romania-Bulgaria-Greece (80%).

PVC dominant window type in Eastern Europe

According to Interconnection Consulting, PVC is the leading material used for window frames in Eastern Europe, with annual sales of €2.48 billion expected to grow at 3% per year until 2022. Metal windows are the second most popular window type with annual sales of €1.03 billion euros growing annually at a rate of 5.2%. Metals are particularly dominant in the non-residential construction sector. There is also expected to be rapid growth in sales of wood-aluminium windows in Eastern Europe, at an annual rate of 7.6% until 2022.

PDF of this article:

Copyright ITTO 2020 – All rights reserved