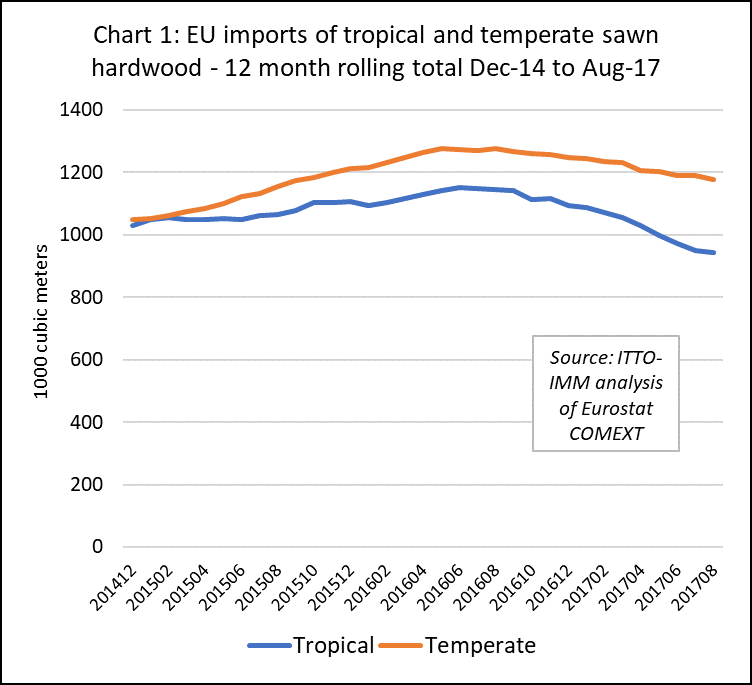

The latest trade data shows that EU imports of sawn tropical hardwood have continued to slide this year, despite on-going economic recovery in the region. The decline is not restricted to tropical products. EU imports of sawn temperate hardwood have also declined in 2017, although at a slower rate than for tropical hardwood.

Chart 1, which reports 12-month rolling data to remove short-term variability and emphasise long term trends, shows that EU imports of both tropical and temperate sawn hardwood declined after reaching a peak in the middle of last year. For sawn tropical hardwood, the 12-month rolling total import fell from 1.15 million m3 to 0.95 million m3 between June 2016 and August 2017.

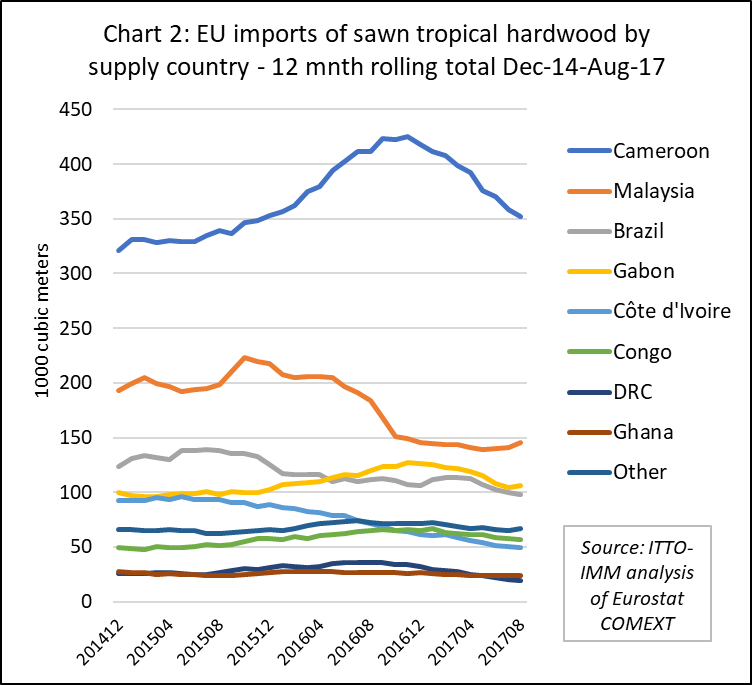

After a brief surge in the second half of last year, EU imports from Cameroon, the largest EU supplier, slowed dramatically in 2017. There has also been a sharp fall in imports from Malaysia, and a slower decline from Brazil, Gabon, Cote d’Ivoire, Congo, DRC, and Ghana. (Chart 2).

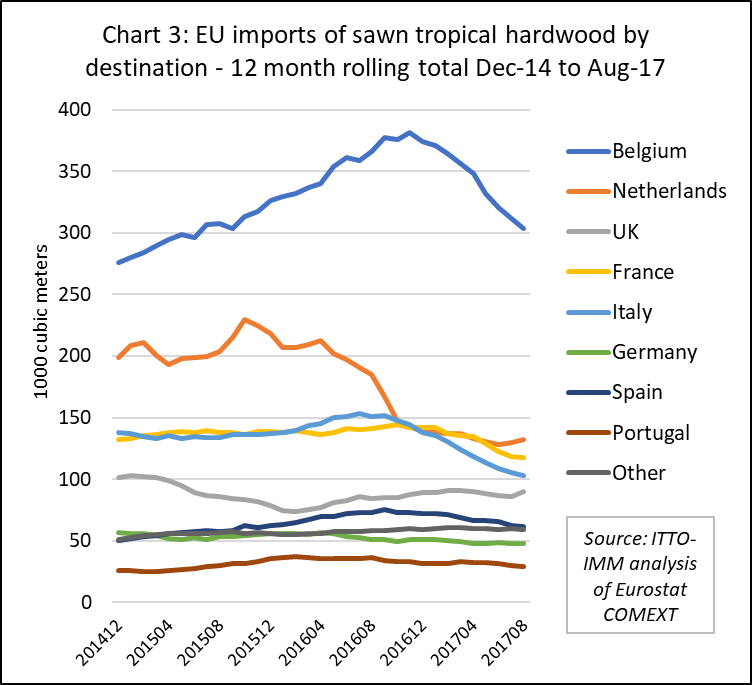

Most tropical sawnwood is now imported into the EU by way of large distributors in Belgium and the Netherlands. This is due to partly to the large volume of green (undried) lumber imported from Africa which is kilned at facilities close to the ports in both countries, and partly to EUTR which has discouraged many smaller importers from dealing direct with tropical suppliers.

The central role of re-exports from Belgium and the Netherlands makes it more difficult to determine from trade statistics exactly where this year’s slowdown in EU tropical wood consumption is concentrated. However, the decline seems to be widespread across the continent. There was a very dramatic fall in imports into both transit countries, as well as into France and Italy. Imports into Germany and Spain, which are now relatively limited, have slowed this year, while imports into the UK and Portugal have been flat. (Chart 3).

The decline in EU imports of sawn tropical hardwood is particularly disappointing at a time when economic conditions in the EU seem to be improving. The latest annualised GDP numbers show the eurozone is growing at 2.3%, faster than the U.S. where growth is 2.2%. Eurozone unemployment has fallen to the lowest level since 2009, while manufacturing output in the region is up 3.2% on last year.

To some extent weak imports into the EU during 2017 are supply related. Exporters of sawn hardwood in all regions have benefitted this year from steady demand from China at a time when supply of favoured species have been constrained. Buyers in other Asian markets and the Middle East are also now more active. Restrictions on log exports in several countries is also boosting global demand for sawnwood.

European importers are therefore having to secure supplies in competition with other buyers, many of which are willing to pay better prices. The demands of the EUTR, which has led EU importers to focus their buying on a much narrower range of tropical suppliers, also encourages supply to be diverted to other markets.

Lingering economic uncertainties in the EU

However, continuing weaknesses in the European economy are also likely to be contributing to slow tropical imports this year. While the headline GDP figures have improved, the economic crisis has left deep scars in the EU and many wounds are yet to fully heal.

Despite the rapid pace of job creation, eurozone unemployment remains high (9.1%) and eurozone economies need to expand faster to generate steeper falls in unemployment. High rates of unemployment are not only an indication that the economy is operating at well below full capacity, but also act as a constant drag on consumption.

In France, the economy is expanding at an annualised rate of 1.7%, fuelled by confidence in French president Emmanuel Macron and his reform agenda, but growth continues to lag the eurozone average. Germany’s economy remains solid, but Germans are increasingly worried about inequality and low-wage jobs. Italy’s economy is doing better, but it is starting from a low base and worries remain over its heavily indebted banks.

Spain was bouncing back well from the crisis, but the recent secession bid by the wealthy north-eastern region of Catalonia has created new uncertainty. The Spanish government currently forecasts the eurozone’s fourth-largest economy to grow 3% this year, but the standoff with Catalonia over its independence ambitions has prompted Madrid to slash growth projections for next year.

Uncertainty also continues to surround prospects for the UK economy. In the immediate aftermath of last year’s referendum decision to leave the EU, the economy initially proved resilient. However, weakness in the value of the pound is now feeding through into high inflation which recently spiked to almost 3 per cent, squeezing real wages.

The slow pace of Brexit negotiations, and the lack of any clear vision of the UK’s future relationship with the EU after March 2019 when the country is due to leave the trading bloc, seems now to be undermining business investment, which in turn is leading to declining productivity. The continuing uncertainty prompted the International Monetary Fund to cut its forecast for UK economic growth in 2017 from 2% to 1.7%. For now, the forecast for 2018 remains unchanged at 1.5 per cent.

ATIBT launches tropical timber branding initiative

A new tropical timber branding initiative is being launched by the ATIBT (International Tropical Timber Technical Association) focused on encouraging ‘qualitative and participatory’ consumption that is ‘respectful of mankind and the environment’.

The promotional campaign will focus on the brand ‘Fair & Precious’, which will be available for use by companies which “affirm their adherence to strict environmental standards and allocate significant budgets to ensure compliance as verified by audits conducted by independent bodies”.

These, at least initially, will be ATIBT’s core African tropical timber producer members, and their customers among timber processors, traders and distributors in Europe and around the world.

It’s hoped that businesses that will use and promote the brand will include public and private sector tropical timber procurers, specifiers, retailers and end-users large and small.

As well as the importance of sustainable procurement and the environment, a strong focus of the campaign will also be on social and corporate responsibility.

“Fair & Precious companies will participate in solidarity-based economic and social growth that is conducive to the well-being of people living in [tropical timber] production areas, providing them services such as education, health care and housing,” states the ATIBT.

“The brand will be administered from France, where ATIBT is based, but it is intended to be a European and even global promotional initiative,” said ATIBT Marketing Programme Coordinator Christine Le Paire. “Besides companies in African countries and France, our members include Dutch, German, Spanish, Italian, English, and American companies.”

Fair & Precious will be officially launched on November 8 by ATIBT President Robert Hunink at Paris’s Garden of Tropical Agriculture in Nogent-sur-Marne. For more: www.fair-and-precious.org.

ATIBT is promoting ‘Fair & Precious’ alongside another new website www.mytropicaltimber.org described as a launching pad for the sector designed to deliver broad messaging on tropical timber to a wide market audience and give descriptions and applications of a broad range of species, plus supplier listings.

STTC calls for greater focus on marketing and promotion

The Sustainable Tropical Timber Coalition (STTC) conference held in Aarhus, Denmark, in September highlighted that work by European governments, trade and NGOs to encourage certification in tropical producing countries must be linked to concerted efforts to increase certified tropical timber market demand.

The conference focused on promotion and marketing of tropical timber in the EU under the headline theme “sustainably sourced tropical timber: selling a positive story”.

To tackle the topic, speakers came not only from across the EU timber sector, but also from NGOs and marketing agencies, with a keynote delivered by brands expert and marketeer Nigel Hollis, Executive Vice President of international consultancy Kantar Millward Brown.

A view shared by speakers and the international audience of over 100, was that, besides its environmental story, key to marketing sustainable tropical timber was to present exemplars of its use. These could demonstrate its durability, aesthetics, technical performance and overall sustainability in use, with construction and design professionals among principal targets. Mr Hollis effectively summed this up with his comment ‘great [marketing] content is more than a great advertisement’.

The conference itself did this by including a tour of tropical timber applications and installations across the host city. These ranged from decking and seating in newly pedestrianised zones, to interior uses in Aarhus’s Aros modern art gallery and the striking Kulbroen (Coalbridge).

The latter is a derelict concrete coal conveyor in the reviving harbour area, set to be restored as a public walkway using FSC tropical timber decking in an STTC-backed FSC Denmark project. Conference delegates climbed to the demonstration platform where various species are being tested on outdoor perfomance.

Aarhus City Architect Stephen Willacy underlined the potential of such projects by highlighting the latent appetite of the modern construction sector to build sustainably with wood. He described the significant role timber-based housing was set to play in Aarhus as it grew from a city of 325,000 people to 450,000 by 2050.

Among the sales and marketing-related projects which the STTC has supported, Iván Bermejo Barbier of Copade presented the joint marketing project the sustainable development NGO had undertaken with the Spanish arm of home improvement retail giant Leroy Merlin. This included creating a database of the company’s tropical timber suppliers and supporting those still uncertified towards achieving certification.

Leroy Merlin staff were trained in certification issues and new in-store point of sale material and a website advert on sustainable tropical timber were developed. The project partners also held meetings with public procurement officers in Madrid and elsewhere to deliver sustainable tropical timber messaging.

Alberto Romero of Spanish timber trade federation AEIM described its ambitious marketing led plan for the next three years. The goal is to increase Spain’s percentage of verified legally sourced tropical imports from 86% to 95% of the total, and sustainably sourced from 4% to 12%.

Delegates at the STTC conference were also invited to join three half hour presentations from a choice of twelve on themes ranging from using sustainable development goals in timber sales, to positioning FLEGT when selling timber, marketing lesser known species and the importance of market intelligence in boosting sustainably sourced timber demand.

The Value and Impact Analysis Initiative (VIA), which is led by the ISEAL Alliance (IA), in partnership with Kingfisher, IKEA and Tetra Pak, also shared independent research-backed marketing messages that businesses can now use in their efforts to communicate the sustainability benefits of certified tropical timber.

In his keynote, Mr Hollis underlined the importance in marketing any product of building a strong and coherent identity. “The vast bulk of buying decisions are influenced by brands,” he said. “They are ultimately determined by emotions and ideas already in your head, but what a strong brand does is short cut the decision-making process through building trust and confidence.”

It was also important the industry has confidence and pride in its identity and was not afraid to be unique, pioneering and to challenge market perceptions. “It’s been shown that meaningfully different brands grow fastest,” said Mr Hollis.

Following his presentation, he used exercises to guide delegates, divided into groups, through the process of developing a potential marketing approach and identity for sustainable tropical timber. Besides sustainability, climate change and saving the forest, promotional themes also emerged from the ‘teams’ around ‘pride’, ‘protection’ and ‘beauty’.

The Conference closed with a call from IDH for ideas for the future development of the STTC since its funding programme in its current form finishes at the end of 2018. A poll of delegates showed nearly all favouring STTC’s continuation and put communication at the top of its priorities.

Nienke Sleurink of IDH said they will continue to be involved in STTC and provide some support, perhaps as a secretariat, but their future role will be more in an enabling capacity. The most likely option for the STTC going forward seems to be a membership structure, but funding needs to be found for a coordinator. IDH would like to hear from the industry on how and in what form the STTC should continue. To contribute your ideas email sleurink@idhtrade.org.

Dutch certification mark to link FSC and PEFC

Independent Netherlands timber research institute Stichting Hout Research (SHR) has unveiled a new business certification mark, guaranteeing to their customers all their timber is 100% sourced from sustainably managed forest, regardless of sustainability certification scheme.

The STIP (Sustainable Timber In Product) scheme has been approved by the Dutch Timber Procurement Assessment Committee, TPAC. SHR Director Oscar van Doorn said it also aligns with the objective of supporters of the Netherlands’ multi-sector-backed Green Deal and new Wood Covenant to remove logistical barriers to use of sustainable timber.

“It’s a breakthrough,” he said. “Removing uncertainties about mixing woods with different chain of custody (CoC) certificates and facilitating achievement of the broad-based goal that 100% of timber is from responsibly managed forestry.”

The STIP is not itself a CoC, he explained, but a business mark, confirming that a business only sells timber from sustainable sources, for example FSC or PEFC forests.

“It entails fewer administrative and logistical obligations and less paperwork for woodworking companies and their customers,” said Mr Van Doorn.

He explained that to become a STIP company, a business submits to exhaustive evaluation by experts from an accredited certification body to ensure all their timber is sourced from responsibly and sustainably managed forest. Once approved, they are periodically audited to ensure maintenance of STIP standards.

PDF of this article:

Copyright ITTO 2020 – All rights reserved