On 4 May, the European Commission (EC) published a comprehensive independent evaluation of the EU FLEGT Action Plan. The Plan encompasses the wide range of EU policy measures introduced over the last decade to support good forest governance and remove illegal wood from trade. Key amongst these are the EU Timber Regulation (EUTR) and the Voluntary Partnership Agreements (VPAs) now being implemented by six tropical countries and negotiated by another nine countries. The report assesses progress since the Plan’s publication in 2003 and makes recommendations for future action.

The report’s central conclusions are positive: the EU FLEGT Action Plan is assessed to be a relevant and innovative response to the challenge of illegal logging and to have improved forest governance in all target countries. The report says the EU FLEGT Action Plan has been effective in terms of raising awareness of the problem of illegal logging at all levels, contributing to improved forest governance globally and particularly in partner producer countries, and has helped reduce demand for illegal timber in the EU.

The report’s recommendations imply that the Plan is heading in the right direction and not needing a major overhaul. “Main pillars and action areas should be retained, but FLEGT support to producing countries should be delivered in a more demand-driven and flexible manner, while bottlenecks affecting VPAs should be addressed and the private sector more involved”.

The report suggests that “the direct FLEGT objective of decreased EU imports of illegal wood is being achieved”. This observation is based largely on the results of interviews and perception surveys undertaken by the consultants both in the EU and producer countries over the last two years rather than any direct evidence from changes in trade flows. Assessments of trade flows have yet to reveal any significant step change in trade that can readily attributed to measures such as the EUTR and VPAs which are central to the FLEGT Action Plan.

Lack of progress on trade aspects of FLEGT

The report highlights that while the Action Plan is contributing broadly to its specific objectives, it’s effectiveness across action areas varies widely. It notes that progress on trade aspects of the plan has been a particular area of weakness and that there is a need for greater focus on VPA and EUTR implementation and private sector engagement.

The report suggests that the VPA process has yet to deliver on the Action Plan objective of increasing market confidence for timber from participating countries. In fact interviews in VPA countries as part of the evaluation indicated that many observers feel that the EU market is now less confident than before about tropical timber.

To a large extent this failure to increase market confidence is tied up with the lengthy time between signing a VPA and delivery of FLEGT licensed timber. The report is blunt in its assessment of efforts to develop Timber Legality Assurance Systems (TLAS) noting that “generally speaking, the TLAS projects have met with little success”. According to the report, out of 200 responses to the Public Survey, less than 5% consider the TLAS to be a major achievement of the FLEGT Action Plan.

Furthermore, responses to the VPA-country survey undertaken by the consultants indicate that countries implementing a VPA still consider the TLAS to be a challenge. The reasons vary from country to country: in Cameroon, Congo and CAR the Wood Tracking Systems (WTS) development and acquisition projects have so far been difficult to manage and expensive; in Vietnam, there have been disagreements between the partners on approaches to TLAS development, including the scope of verification; in Malaysia the need for capacity building to run the TLAS has been underestimated.

Moreover, VPA countries find it hard to accept the lack of recognition of their efforts to enhance their broader governance framework (in the absence of FLEGT licenses they are treated like any non-VPA country). This has led several countries (Vietnam, and Congo) to propose a phased application of the TLAS, while in Cameroon such is being suggested by stakeholders.

FLEGT licensing in Ghana and Indonesia close to operational

More positively, the report suggests there is general recognition that VPA negotiation and implementation, strongly supported by EFI, the EC and EU Member States, have helped to sharpen the legality definition, and this has been valuable, even if no functioning TLAS has been produced. The VPA Survey revealed that three VPA implementing countries acknowledge the positive effect of the legality definition process on the development of the TLAS. And despite the challenges, two countries – Ghana and Indonesia – now have systems very close to operational.

Another observation is that the Action Plan’s contribution to the objective of sustainable forest management is unclear and needs to be made more explicit. According to the report, available data suggest that the TLAS under development are not necessarily enhancing more sustainable forest management (SFM) or SFM certification, and that this is not envisaged by many stakeholders in VPA countries.

There’s also a concern that FLEGT needs to focus more on domestic timber markets and support for the actors operating in them. This is seen as critical to the broader FLEGT objective of contributing to poverty reduction.

Slow EUTR implementation weakens incentives

Considering the EU demand side, the report echoes many of the conclusions of the EU review of the EU Timber Regulation published earlier this year. The report suggests there is a widespread perception that EUTR has been implemented slowly and unevenly and that this is decreasing incentives for VPA countries to commit to finalising FLEGT licensing systems.

The report notes that “while advances have been made [on EUTR implementation], there have been major differences between front-runner [EU] countries and slow followers. This has resulted in unfair competition between Member States, inconsistent market requirements for the private sector in producer countries and a risk that VPAs would lose their value and the EC some of its credibility”.

The report goes on to suggest that the capacity of most EUTR authorities is considered rather limited, in terms of staff numbers, budgets and training. In important timber-importing countries, such as the Netherlands and Belgium, only three and half a full-time equivalent staff, respectively, has been assigned to EUTR enforcement.

It’s noted that while big EU companies started developing due diligence (DD) systems at an early stage – which had sometimes resulted in a significant reduction in their number of suppliers – and were ready to exercise DD when the EUTR came into force, the vast majority of companies across the EU applied a “wait and see” mentality. Unless there is effective implementation, control and prosecution on the one hand, and sufficient and clear guidance on the other, especially the SMEs seem unlikely to change their practice.

EUTR beginning to change trade practices

Nevertheless, the report suggests that EUTR is beginning to change trade practices in those countries where implementation is more advanced. Specific changes identified include: increased awareness on risk of illegal timber; increased import of certified timber and a push to certification in some producer countries; positive influence on legislation in producer countries; and some benefits emerging for legal producers due to exclusion of low priced illegal timber from the market.

To some extent these benefits are offset by negative changes including an increased cost and administrative burden on operators, the withdrawal of SMEs in producer countries from export markets, and confusion and concerns in producer countries due to the lack of harmonized implementation across EU countries.

The findings and recommendations of the report will now guide the EC in improving the efficiency, effectiveness and value-for-money of work undertaken to further implement the Action Plan. The report will also guide the EC in assessing policies to address the broader drivers of deforestation, and in linking action under FLEGT to the international climate change and Sustainable Development Goals agendas. Further details including a complete copy of the reported is available at: http://www.euflegt.efi.int/eu-flegt-evaluation

Tropical plywood share falls to all time low in EU

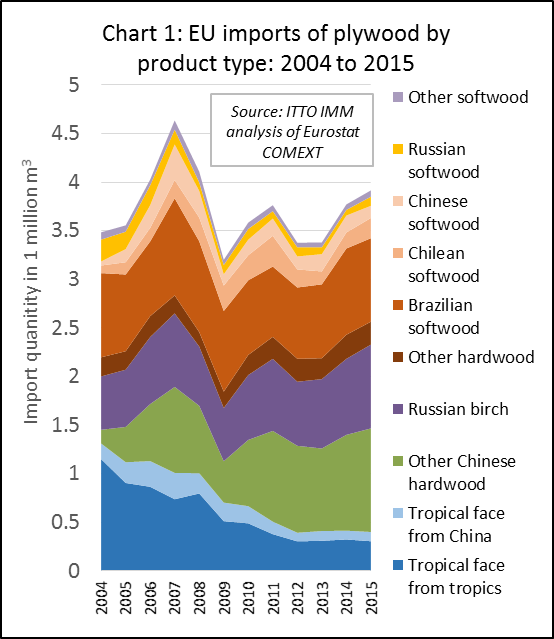

Latest EU import data shows that tropical plywood has continued to lose share in the EU plywood market during the last two years. While EU imports of plywood from all sources increased sharply between 2013 and 2015, from 3.38 million m3 to 3.92 million m3, a level not seen since before the financial crises, imports from the tropics have remained stubbornly low (Chart 1).

After increasing 4% to 324,000 m3 in 2014, EU imports of plywood from tropical countries fell back 6% to 305,000 m3 in 2015. The share of tropical countries in EU plywood imports fell from 9.2% in 2013 to only 7.8% in 2015, the lowest level for at least the last 20 years, and probably much longer. The share of imports of tropical hardwood faced plywood from China also fell in the last two years, from 3.0% in 2013 to 2.4% in 2015.

Tropical hardwood faced plywood has lost share mainly to Chinese plywood faced with temperate hardwood (including poplar, eucalyptus and birch), and to Russian birch plywood. EU imports of temperate hardwood plywood from China increased from 986,000 m3 in 2014 to 1.07 million m3 in 2015 and share of imports increased from 26.1% to 27.2%. Over the same period, EU imports of Russian birch plywood increased from 782,000 m3 to 863,000 m3 and share increased from 20.7% to 22.0%.

Further gains by Russia and China in the EU market in the last two years are likely due to the combined effects of the weak Russian rouble, declining value of the Chinese yuan and falling domestic demand in China, and rising availability of plantation wood from China. Weakness of the euro against the dollar during 2015 will also have reduced sales of South East Asian plywood in the EU.

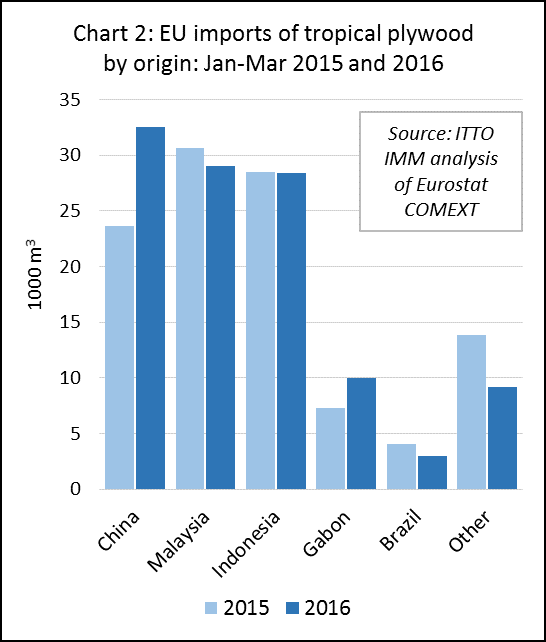

Early indications are that the share of tropical countries in EU plywood supply has continued to erode during 2016. EU imports of plywood faced with tropical hardwood were up 3.7% in the first three months of 2016 compared to the same period last year. However this was largely due to a 38% rise in EU imports of tropical hardwood plywood from China, from 23,700 m3 in the first quarter of 2015 to 32,600 m3 during the same period in 2016. So far this year, China has been the EU’s largest supplier of tropical hardwood plywood (Chart 2).

Imports from Malaysia were down 5.4% at 29,000 m3 in the first quarter of 2016 and imports from Indonesia remained static at 28,400 m3. Of significant suppliers in the tropics, only Gabon registered an increase in exports to the EU in the first three months of 2016, with a gain of 37% to 10,000 m3 compared to the same period in 2015. The latter is a trend worth watching as perhaps signalling the first sign of growth in the EU market for African okoume plywood after many years of recession.

The gain in EU imports of plywood from Gabon in 2016 has been concentrated in Italy and the Netherlands, with a much smaller gain in France where trade in this product is still very limited.

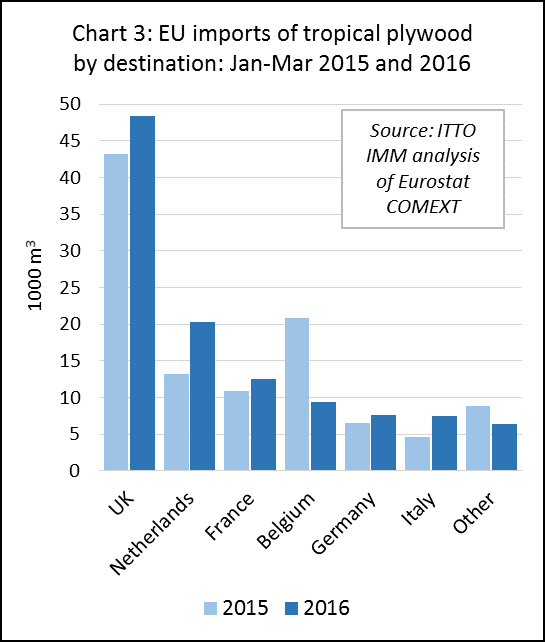

The increase in EU imports of tropical hardwood faced plywood from China this year has been concentrated mainly in the UK and Netherlands (Chart 3). This is notable from the perspective of EUTR and forest certification, since importers and EUTR authorities in both countries are renowned for their relatively rigorous efforts to ensure wood is risk-free from an illegal logging perspective. It implies that a significant proportion of this material is faced with FSC or PEFC certified tropical hardwood, or at least that Chinese manufacturers are now successfully reassuring customers of the legality of their tropical veneer supplies by other means.

Another notable trend in the first quarter of 2016 was the low level of import of tropical hardwood plywood into Belgium, at 9,400 m3, less than half the same period in 2015. Belgian imports of plywood from Indonesia have been much slower in 2016 than in 2015, although the fall in Belgium has been offset by rising Indonesian exports to the UK, Netherlands, Italy and Germany in 2016.

PDF of this article:

Copyright ITTO 2020 – All rights reserved