Eight years on from the financial crises, the recovery in the EU timber market remains slow and fragile. There is Europe-wide economic growth and key market sectors such as construction, furniture, and flooring are expanding, but the rate of increase rarely exceeds 2% per year in any individual sector or European country and some are still flat-lining. Deflation remains a constant threat despite a €60 billion-a-month programme of quantitative easing implemented by the European Central Bank – recently extended at least until March 2017.

Slow growth, low interest rates and quantitative easing has led to persistent weakness in the value of the euro and other European currencies on international exchange markets. Political and economic problems mean that the Russian rouble and other Eastern European currencies are even weaker than the euro. This in turn is undermining demand for imports from other regions, including the tropics, into the EU and boosting the relative competitiveness of European manufacturers. The UK’s decision to exit the EU, taken in a referendum on 23 June, is another concern, both for the direct effects on the UK economy and the fallout for wider political and economic stability in Europe. Overall the outlook of tropical suppliers of wood products into the EU is not particularly encouraging.

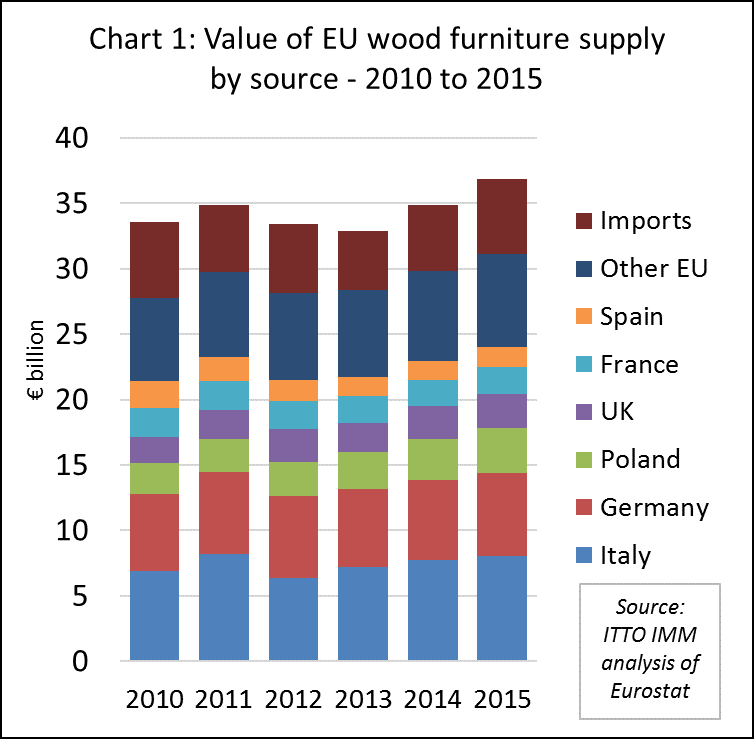

EU furniture production value increases 4.4% in 2015

Eurostat has just published the PRODCOM industrial production data for 2015 which indicates modest growth last year in the EU wood furniture sector. Domestic production of wood furniture (excluding kitchen furniture) increased 4.4% to €31.15 billion in 2015. Production increased in all the main EU manufacturing countries including Italy (+4% to €8.06 billion), Germany (+4% to €6.35 billion), Poland (+9% to €3.42 billion), the UK (+1% to €2.59 billion), France (+3% to €2.05 billion), Spain (+7% to €1.53 billion), Sweden (+2% to €1.02 billion), Lithuania (+3% to €740 million), Romania (+4% to €690 million), and Portugal (+2% to €640 million). Imports of wood furniture from outside the EU were worth €5.73 billion in 2015, 13% more than in 2014, but still only 16% of furniture supply in the EU. (Chart 1).

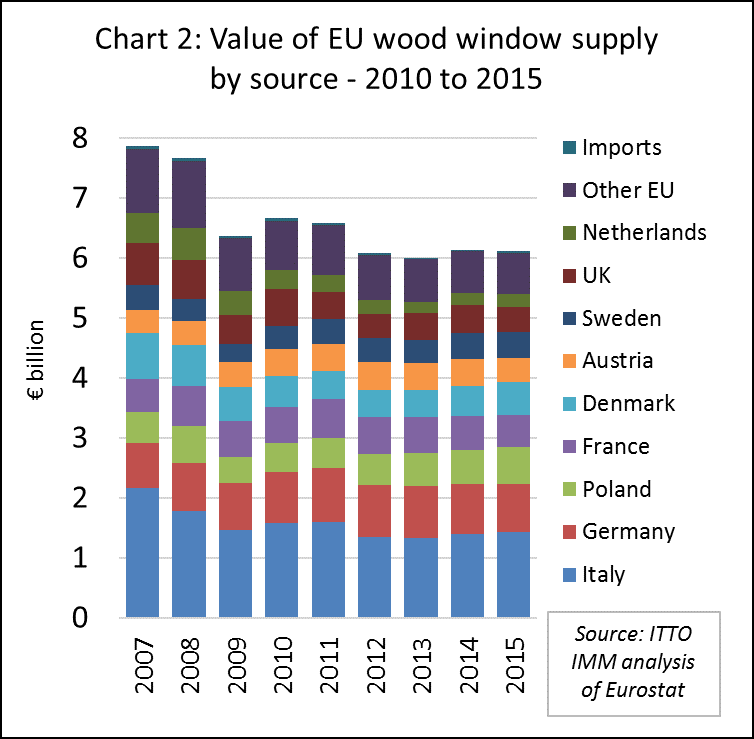

Sluggish growth in European window production

The total value of wood windows supplied to the EU increased only 1.2% to €6.11 billion in 2015. There was rising production in Italy (+2% to €1.42 billion), Poland (+8% to €620 million), Denmark (+9% to €550 million) and the Netherlands (+2% to €210 million). Imports of wood windows from outside the EU also increased by 41% to €30 million but still represented a very small share of overall supply. These gains were offset by falling production in Germany (-4% to €810 million, France (-5% to €530 million), Austria (-9% to €410 million) and the UK (-13% to €410 million). Wood window production in Sweden remained stable at €440 million in 2015. (Chart 2).

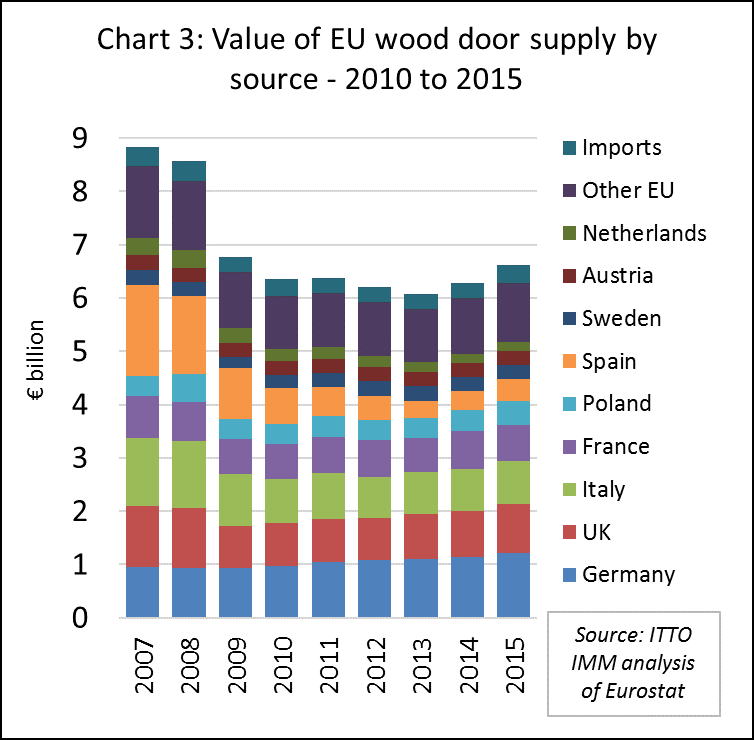

More robust growth in the EU wood door sector

Growth in the EU wood door sector was more robust than in the window sector in 2015. The total value of wood doors supplied to the EU increased 7% to €6.62 billion in 2015. There was rising production in Germany (+6% to €1.21 billion), UK (+7% to €930 million), Poland (+11% to €440 million), Spain (+19% to €420 million) and the Netherlands (+5% to €180 million). Imports of wood doors from outside the EU increased by 17% to €33 million. These gains were offset by falling production in France (-2% to €690 million, Sweden (-1% to €260 million), and Austria (-3% to €250 million). Wood door production in Italy remained stable at €800 million in 2015. (Chart 3).

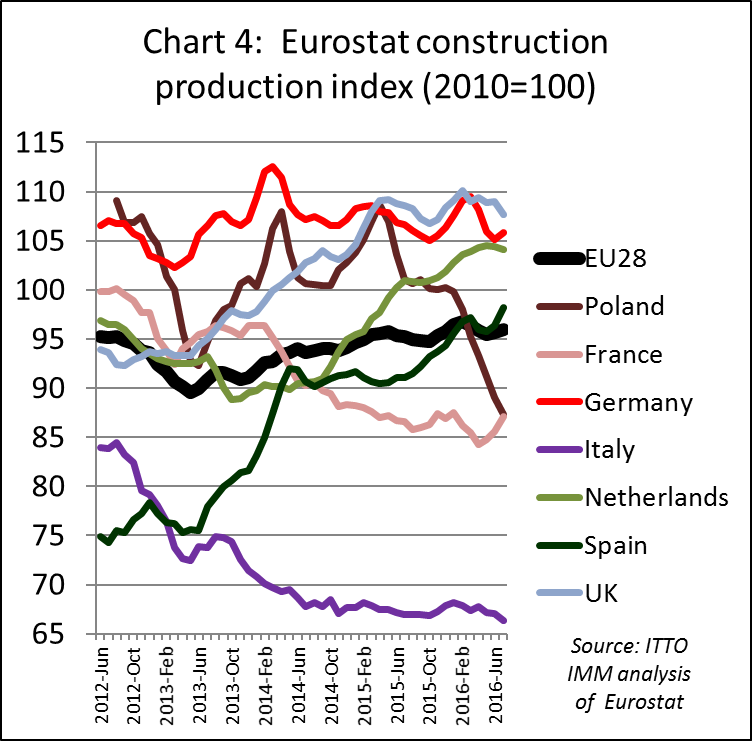

EU construction dips again in 2016

Rising furniture and joinery production in the EU during 2015 mirrors the slow recovery in construction activity during the year. The Eurostat Construction Production Index for EU member states shows that construction activity rose sharply at the end of last year, with notable upturns in Germany, the UK, Spain, the Netherlands and France. However, activity across the EU dipped again this year. Activity in Poland has slowed very dramatically during 2016. The total value of EU construction in July 2016 was still 5% lower than in 2010 and 20% down on 2008. The Italian market remains particularly weak (Chart 4).

Market implications of Indonesia’s FLEGT licenses

Earlier this month, ITTO reported that Indonesia is due to issue the first FLEGT licenses in November and observed that the Indonesian government and industry are looking to these licenses to deliver significant market advantages (ITTO TTM Report 1–15 September 2016). There are reasons for optimism, FLEGT Licensing gives a green lane through the EUTR due diligence procedures, the economic advantages of developing a single unified system for all exporters, and the greater confidence such a system offers to both buyers and investors.

These are all benefits which will give Indonesian timber a competitive edge in the EU market in the months ahead. However, prospects for Indonesian timber, and indeed any timber supplier into the EU market, are not only dependent on their ability to provide legality licenses. The first question for international buyers both in the EU and elsewhere is not whether or not they have a FLEGT license or other assurance of legality or sustainability, but rather are they able to offer products which are good quality, on time and at a reasonable price.

Various indices of international competitiveness suggest that Indonesian exporters face significant challenges on these wider market issues. For example, in 2015, the World Bank ranked Indonesia at 109th on the “Ease of Doing Business” (EDB), significantly lower than Indonesia’s direct competitors in the timber sector such as Malaysia (18th), Thailand (49th), China (84th) and Vietnam (90th). The UNCTAD Line Shipping Connectivity Index shows that the logistics of shipping to world markets are significantly more challenging in Indonesia than in other South East Asian countries.

In practice these indices imply that Indonesian products tend to be more expensive and to be subject to longer delivery times than competing products from elsewhere. At a High Level Market Dialogue held in Jakarta in November 2015, the Chairman of the Indonesian Furniture and Craft Association AMKRI commented that some furniture manufacturers are moving away from Indonesia to Vietnam on grounds of red tape and cost and that prices for equivalent furniture manufactured in Indonesia may be 15% to 20% higher than in Vietnam.

The wider macro-economic background in Europe also presents challenges to Indonesian wood products. Indonesian exporters have to contend with the relative weakness of the euro, slow pace of recovery from the financial crises, the dominant position of domestic and Chinese manufacturers, and the strong fashion for temperate woods and wider market prejudices against tropical timbers.

But it would be wrong to overemphasise the downside. Growth in the EU may be slow, but it is significant given the sheer size and wealth of the European economy. Despite barriers to Indonesia’s competitiveness in the EU, Indonesia is now the largest single supplier of tropical timber products into the EU by a significant margin. In the 12 months to end June 2016, the EU imported €1.01 billion of timber products from Indonesia, including €490 million of wood products (HS 44), €310 million of wood furniture (HS 94) and €213 million of paper (HS 48). This compares to €799 million from Vietnam (second largest supplier – nearly all furniture) and €533 million from Malaysia. Indonesia accounted for nearly a quarter of all EU timber product imports from tropical countries in the twelve month period.

Indonesia’s competitive position in various sectors

In practice the competitive position of Indonesian timber products in the EU varies widely between sectors. In some sectors for niche tropical wood products, Indonesia is already the leading supplier and FLEGT licenses will provide an opportunity to extend this lead. Indonesia is the largest external supplier of “continuously shaped” wood (HS code 4409) which includes both decking products and interior decorative products like moulded skirting and beading. EU imports of this commodity from Indonesia increased 3% from 88000 m3 in 2014 to 91000 m3 in 2015 and Indonesia’s share of total imports (tropical and temperate) in both years was around 26%.

Indonesia is also the largest tropical supplier of wood flooring to the EU. Although still low by historical standards, EU imports from Indonesia increased 4% to 1.59 million m2 in 2015. This is only a very small share of the overall EU market, which consumes over 100 million m2 of wood flooring every year and which imported 29 million m2 in 2015. However, the FLEGT license should help rebuild the niche market for tropical wood floors, which still offer strong benefits – including a unique look and good durability – but have gone out of fashion in the EU in recent years.

It’s notable that China, by far the EU’s largest single external supplier of wood floors, suffered a set-back in the EU market last year, with EU imports of Chinese wood flooring falling 7.4% to 17.5 million m2, the lowest level since 2005. Whether this might signal new opportunities for competing external suppliers like Indonesia, or is a sign of consumers turning more to domestic products, is hard to say at this stage.

Plywood is a market sector where FLEGT licenses might play an important role to boost demand for Indonesian product. EU imports of plywood from all sources increased sharply between 2013 and 2015, from 3.38 million m3 to 3.92 million m3, a level not seen since before the financial crises. However, imports from Indonesia and other tropical countries have remained stubbornly low in recent years. After increasing 3% to 308,000 m3 in 2014, EU imports of plywood from tropical countries fell back 6% to 291,000 m3 in 2015. The share of tropical countries in EU plywood imports fell from 9.2% in 2013 to only 7.8% in 2015, the lowest level for at least the last 20 years, and probably much longer. Imports from Indonesia fell 5% from 117,000 m3 in 2014 to 112,000 m3 in 2015. However, Indonesia became the largest single tropical supplier of plywood to the EU last year as imports from Malaysia fell 11% from 121,000 m3 in 2014 to 107,000 m3 in 2015.

In recent years, tropical hardwood faced plywood has lost share in the EU mainly to Chinese plywood faced with temperate hardwood (including poplar, eucalyptus and birch), and to Russian birch plywood. The plywood sector has been a strong focus for EUTR enforcement activities to date and, given difficulties of establishing traceability and relatively high illegality risk of some competing suppliers, Indonesia FLEGT license should significantly boost competitiveness in this sector.

Uphill struggle to increase share of EU furniture market

Indonesia faces more of an uphill struggle to increase market share in the furniture sector. This is particularly critical given the sheer size of the market and the potential it offers to add value to the wood resource. However, it’s also a sector where the technical advantages of tropical wood are less relevant – at least in the interior furniture market which dominates sales – than wider competitiveness issues such as labour costs, red tape, logistics, processing efficiency, innovation, and marketing.

Indonesia faces considerable competition in this sector, not least from the EU’s domestic furniture manufacturers which are hugely dominant, accounting for 84% of all furniture supplied to the EU in 2015. One clear sign of the rising global competitiveness of EU’s domestic manufacturers, boosted by the weak euro, is the region’s rising trade surplus in wood furniture. While EU countries imported wood furniture worth €5.78 billion from outside the EU in 2015, EU exports of wood furniture rose to €8.73 billion in 2015, up only 3.5% from 2014 but 51% more than in 2009.

EU imports of Indonesian wood furniture increased by 7% to €316 million in 2015, which is encouraging but less dramatic than from other countries. EU imports of wood furniture from Vietnam increased 21.6% to €725 million in 2015. This follows 19% growth the previous year and is a clear demonstration of Vietnam’s rising competitiveness in global furniture manufacturing. Despite Vietnam’s rise, more than half of all EU wood furniture imports, €3.15 billion, came from China in 2015, with deliveries rising 12.1%. In 2015, EU imports also increased rapidly from Malaysia (+12% to €191 million), Turkey (+21% to €183 million) and India (+23% to €162 million).

Mixed prospects for FLEGT licensed timber products

In short, there are reasons to believe that FLEGT licensing will help improve competitiveness and could provide a fairly immediate boost to trade in those sectors where Indonesia has already established a strong market position and where EUTR regulatory activity has been focused – such as decking, plywood and wood flooring. However, significant gains in market share over the long term, particularly in high value sectors like furniture, will only be achieved if FLEGT licensing is combined with policies to improve the international competitiveness of Indonesian wood manufacturers across a wider range of issues.

The good news is that the FLEGT process has some potential to enhance this process through the role it plays to increase industry co-operation, improve dialogue and information exchange with customers and suppliers, raise the overall image of Indonesian products and potentially encourage investment by reducing actual and perceived business risk.

Indonesian supply of wood products to the EU must also be set within the context of the wider market opportunities available to Indonesian manufacturers. The influential “Global Construction 2030” report by Oxford Economics published in 2015 forecast that Indonesia will rise to become the world’s fourth largest construction market by 2030. The value of Indonesian construction is predicted to rise from around $250 billion in 2015 to nearly $700 billion in only 15 years, moving up from its current position as the 11th largest market to overtake Japan. The same report suggests that European construction will also grow, but only slowly from around $1800 billion in 2015 to $2250 billion in 2030, little more than the total value of the European market in 2007 before the crash ($2200 billion).

Therefore, the key challenge, and opportunity, for the SVLK system on which FLEGT licensing is based may ultimately lie in the role it plays to promote efficient delivery of legal and sustainable timber products into the domestic market and to promote new investment in forest, technical and human resources to supply that market.

PDF of this article:

Copyright ITTO 2020 – All rights reserved