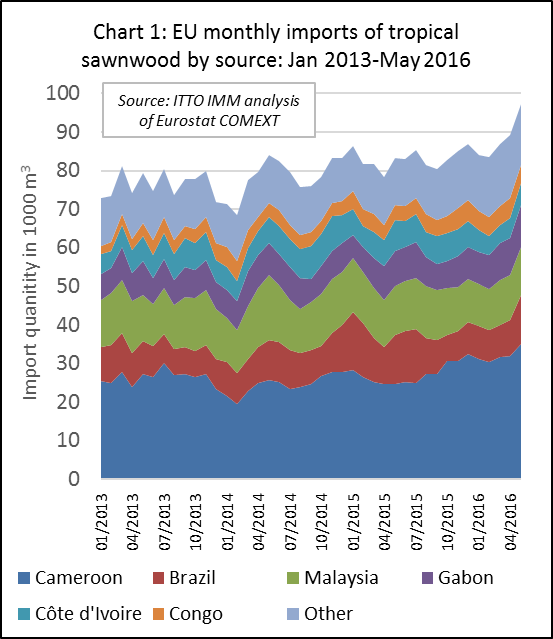

EU imports of tropical sawnwood have continued to recover slowly in 2016 from the depths of recession in early 2013. There was a particularly significant surge in trade in the second quarter of this year, notably from Cameroon. (Chart 1).

EU imports of tropical sawnwood in the first five months of 2016 were 460,000 m3, 11% more than the same period in 2015. There were significant gains in imports from a wide range of countries including Cameroon (+31% to 166,400 m3), Gabon (+20% to 50,200 m3), Congo (+21 to 24,300 m3), DRC (+28% to 13,200 m3), Indonesia (+40% to 11,800 m3), Ghana (+15% to 10,900 m3) and Suriname (+56% to 10,000 m3). These gains offset a decline in imports from Malaysia (-8% to 59,900 m3) and Brazil (-16% to 53,600 m3). (Chart 2).

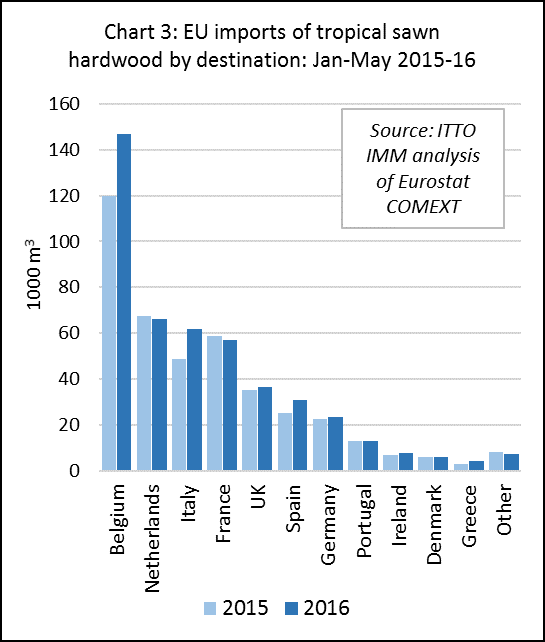

The rise in EU imports of tropical sawnwood in the first five months of 2016 was concentrated in Belgium (+22% to 147,000 m3), Italy (+27% to 61,800 m3) and Spain (+24% to 31,000 m3). Imports into other leading destinations, including Netherlands, France, UK, Germany and Portugal, were very similar to the level in 2015. (Chart 3).

The increasing concentration of EU imports of tropical sawnwood into Belgium, which accounted for 32% of the total in the first five months of 2016 – compared to only 26% for the year in 2014 – is striking. Companies in Belgium seem to be playing an ever larger role in distributing tropical sawnwood into other parts of the EU – a trend that may be partly driven by EUTR as it discourages smaller EU operators to buy direct and to rely on larger companies with greater resources available to implement bureaucratic due diligence procedures.

A rising share of the tropical timber imported into Italy also seems now to be sold into other parts of the EU as the country’s domestic market remains very weak. Some larger Italian importers are known to be distributing tropical hardwoods into northern parts of the EU.

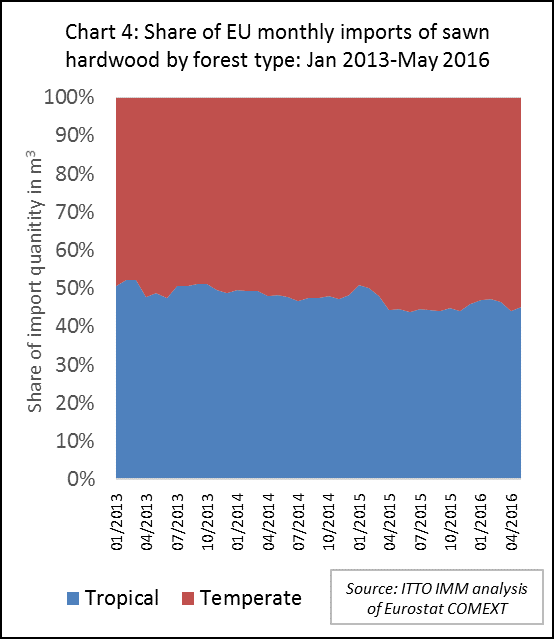

While EU imports of tropical sawnwood have been rising this year, trade in temperate sawn hardwood has risen more rapidly so that the share of tropical wood has continued to slide (Chart 4).

In the first 5 months of 2016, EU imports of sawn hardwood increased sharply from Ukraine (+25% to 170,100 m3), the USA (+10% to 146,300 m3) and Russia (+16% to 56,552 m3). This is a reflection of the strong and increasing dependence on oak in the European hardwood sector and is also due to policy and exchange rate effects. In the last two years, the euro has strengthened by 50% against the Ukrainian hryvnia and by 40% against the Russian rouble. The Ukraine also banned log exports from November 2015, encouraging a switch to trade in sawnwood.

STTC Conference focuses on public procurement policy

The theme of the European Sustainable Tropical Timber Coalition (STTC) Conference held in Rotterdam in June and co-organised by the Dutch Ministry of Infrastructure and Environment (MIE) was “Real impact through timber purchasing policies”. As such it was less concerned with generic marketing efforts to expand the European market for tropical timber than with incentivizing sustainable forest management in supplier countries by “creating market demand for certified responsibly sourced tropical timber”.

The STTC, which launched in 2013, was founded and is funded by Dutch government-backed IDH, the Sustainable Trade Initiative. STTC now has 80 members and rising; including timber traders, federations, end-users, specifiers, retailers, local and national government bodies, certification organisations and NGOs. The primary objective of STTC is to boost certified timber’s European tropical market share to 50% over 2013 levels by 2020.

Among the STTC’s latest developments is a €2 million funding programme, managed by the European Timber Trade Federation (ETTF), to support businesses, federations and local authorities implementing sustainable timber procurement policies. It is also increasing communications activities, with the Rotterdam Conference among the outcomes.

The Conference attracted nearly 100 people from across the STTC membership, plus delegates from associated areas. Opening speaker Hannie Vlug, MIE Sustainability Director, highlighted the impact government and private sector procurement policies could have together. “Governments can lead by example and use procurement policy as leverage, incentivizing companies to bring sustainable products to market,” she said. The Netherlands’ procurement system, she added, had contributed to a rise in certified timber market share in the country from 13.4% in 2005 to 74% in 2013.

IDH Programme Director Hans Stout described his organisation’s role to support tropical forest certification, but stressed that a viable market for the resulting timber was equally critical. “That’s why the STTC is focused on stimulating demand Europe-wide,” he said.

Robert Kaukewitsch, Green Public Procurement Officer at the European Commission, spoke of the role of the EU to ‘create an enabling environment’ for industry and governments to establish timber procurement policies, including allowing environmental criteria in tender procedures. He noted that a key EU concern at present is to ensure that these policies will give appropriate recognition to FLEGT licensed timber when it becomes available.

Robert Kaukewitsch also reported that the EU has established common green public procurement criteria for over 20 priority products and services, of which those for furniture, office buildings, and wall panels are most relevant to tropical timber. These criteria are applied in procurement by the European Commission and EC funded projects and may be voluntarily adopted by member state governments.

At present the EC requirement is that all timber content must be legally sourced and is therefore no more demanding than the existing regulatory requirement in EUTR. Discussions are on-going on possible development of criteria for sourcing “sustainable timber” but this work is slow due to lack of an EU-wide definition of sustainable timber and the difficulty of verification where there are technical obstacles to certification, for example in the smallholder sector.

Researcher and Chatham House Associate Duncan Brack put the role of public sector procurement into broader market perspective. “In most developed countries, government buying accounts for 10-12% of GDP, but its impact on wider business procurement can increase that to 20-40%,” he said.

Brack also noted that the number of government timber procurement policies has risen from eight ten years ago to 33 today, including 22 in EU. Of these policies: five are “comprehensive criteria-based” (Belgium, Denmark, Luxembourg, Netherlands, UK); sixteen are “simpler scheme/document-based” (Australia, Austria, China, Finland, France, Germany, Italy, Japan, Latvia, Lithuania, Mexico, New Zealand, Norway, Spain, Sweden, Switzerland); six rely entirely on the EU guidelines for green public procurement policies (Bulgaria, Cyprus, Czech Republic, Estonia, Malta, Slovenia); and six are still under development (Chile, Colombia, Croatia, Ghana, Indonesia, Ireland).

Brack observed that a major challenge in developing green public procurement policies is to make it easy for government buyers to ensure products meet criteria. Most criteria are generally satisfied through certification schemes, although some recognise a wider range of evidence, including FLEGT licenses when available.

Stephane Glannaz, Chief Commercial Officer of tropical supplier and STTC participant Precious Woods, said that to encourage implementation of sustainable timber procurement policies, in turn, the tropical timber sector must highlight the wider values of sustainable forest management. In particular that included linkage with climate change mitigation.

A presentation on the Netherlands’ Green Deal, the country’s public/private sector alliance to further boost certified sustainable timber’s market share procurement policies, was given by Maja Valstar, MIE Sustainable Timber Advisor, and Paul van den Heuvel, Managing Director of the Netherlands Timber Trade Association. Core to its success, said Mr van den Heuvel, was clear messaging on the sustainable timber market’s role in forest maintenance. “We put it simply,” he said. “Use it or lose it.”

Peter Gijsen, Corporate Social Responsibility Manager of global construction giant Royal BAM Group, said his sector was increasingly focused on sustainable materials procurement as it reached the limits in improving environmental performance through building energy efficiency.

Concluding the Conference, ETTF Secretary General André de Boer said there were early signs that efforts to strengthen the sustainable tropical timber market in Europe are having an effect. “But more needs to be done to make it mainstream,” he said. “So we urge more companies and organisations to join the STTC.”

PDF of this article:

Copyright ITTO 2020 – Al rights reserved