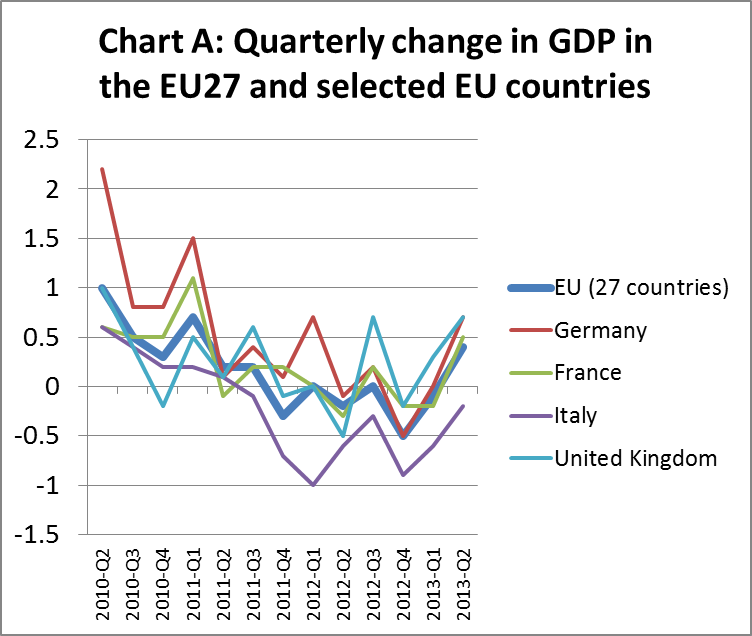

There are early signs that the EU may be at last emerging from recession. The 27 countries’ combined gross domestic product grew 0.4 per cent in the second quarter compared to the previous three-month period, when it shrank 0.1 per cent, according to Eurostat (Chart A). A rise in household spending underpinned the economic momentum in many countries. There are also signs of increased business optimism and higher manufacturing output.

During the second quarter of 2013, there was robust GDP growth in Germany (+0.7%), the UK (+0.7%) and France (+0.5%). Although GDP continued to shrink in Italy (-0.2%) and Spain (-0.1%), the rate of decline was much slower than during previous quarter.

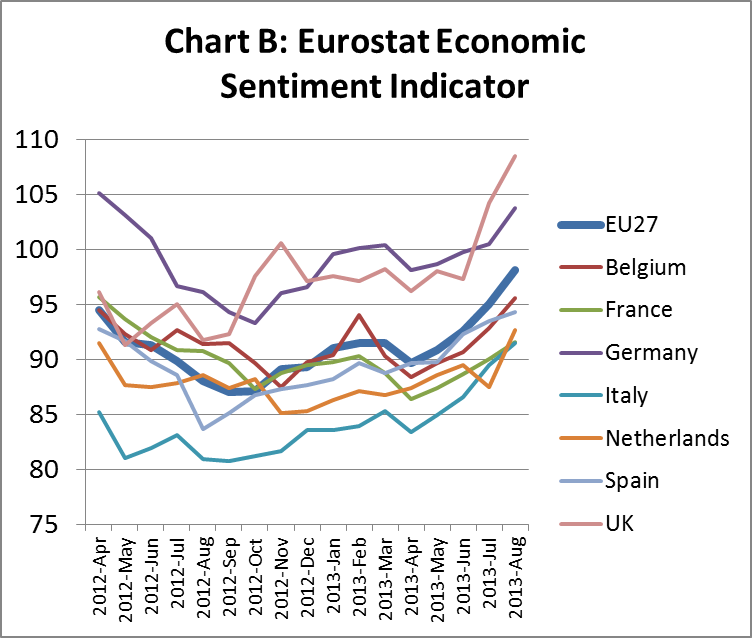

The rise in GDP was mirrored in a significant improvement in the Eurostat Economic Sentiment Indicator between April and August 2013 (Chart B). This indicator, which draws on a regular monthly survey of perceptions and expectations in five sectors (industry, services, retail trade, construction and consumers) improved across a wide range of EU countries.

While economic conditions are improving, several factors are likely to limit the pace of recovery. Particularly notable amongst these are the high level of consumer and government debt and the weakness of the labour market. Europe’s unemployment rate remains stubbornly high at 12.1%. In some countries hardest-hit by Europe’s debt crisis, such as Greece and Spain, more than one in four people don’t have a job. Analysts say more dynamic growth will be needed to spur investment and job creation there.

Still, even meagre growth in Europe provides a boon to the global economy. The EU, which now totals 28 nations following Croatia’s accession in July, has a population of some 500 million, and its annual gross domestic product stands at around $17.3 trillion — both more than the U.S., which has GDP of $16.6 trillion for 315 million people.

EU construction sector flat overall but positive signs in UK and Germany

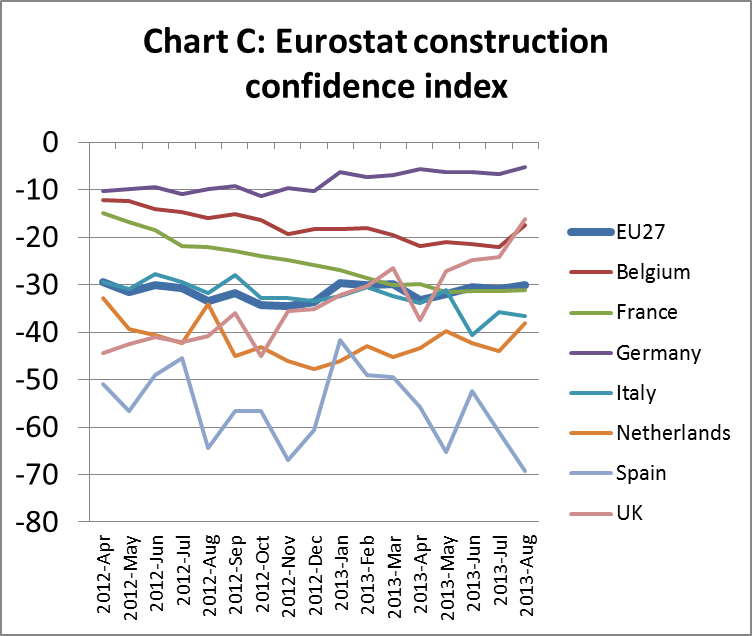

Short-term prospects for the European wood industry continue to be dampened by the slow pace of recovery in the construction sector. The Eurozone Construction Confidence Index (Chart C) has remained flat at a low level of around -30 since the beginning of 2013. This means that construction companies across the EU continue to have declining order books and low employment expectations in the coming months. However, construction confidence has remained comparatively high in Germany and improved rapidly in the UK in recent months.

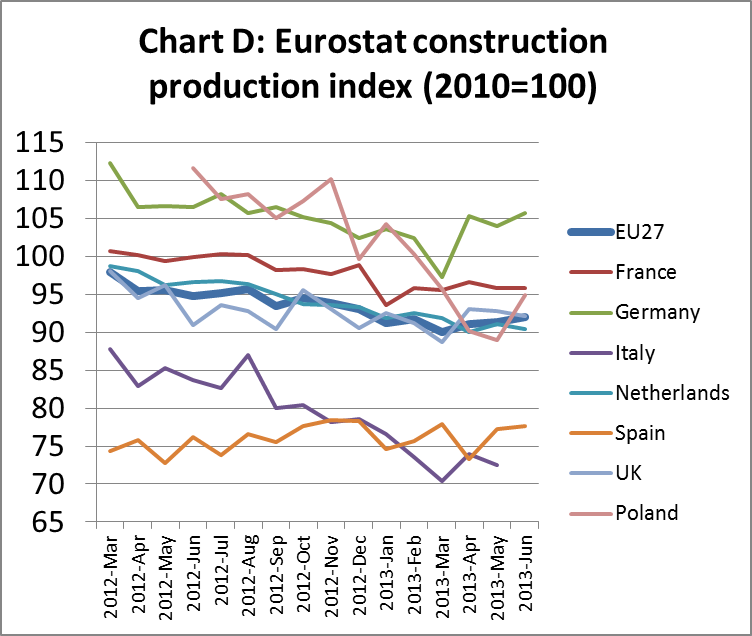

The Eurostat Construction Production Index (Chart D), which measures the seasonally adjusted production level, increased slowly but consistently between March 2013 and June 2013. This was due primarily to a strong rebound in German construction in the summer months after a dip last winter.

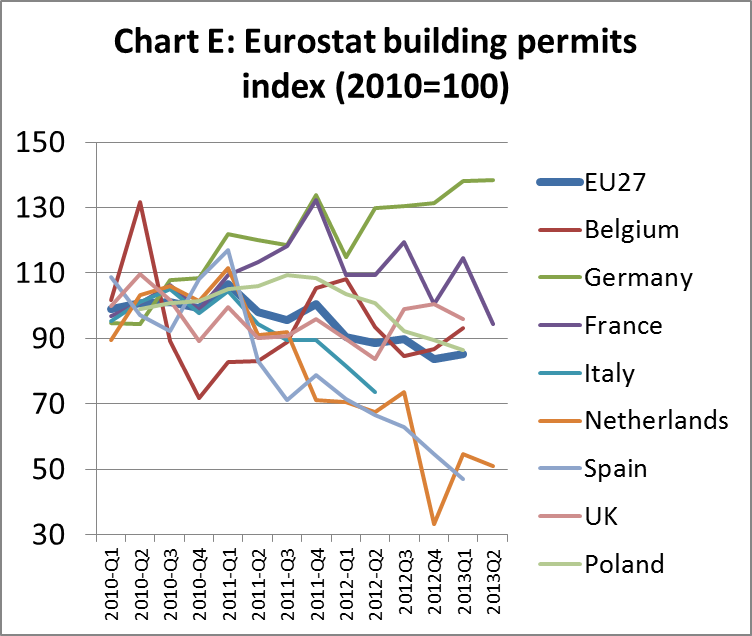

The Eurostat Building Permits Index (Chart E), which provides a forward indicator of likely future construction activity, suggests good prospects in Germany but flat or declining prospects elsewhere in the EU. Building permits are currently at around 85% of the 2010 level across the EU as a whole. However permits issued in Germany this year are nearly 40% up on the level prevailing in 2010. In France and the UK, building permits are at a similar level to 2010. However permit levels have continued to fall sharply in a few countries this year, notably Netherlands and Spain.

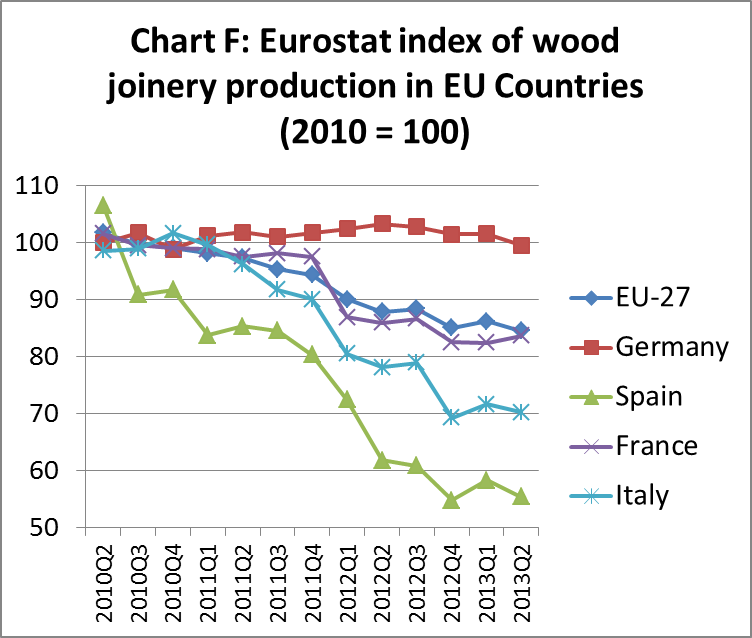

The Eurostat Index of Wood Joinery Production (which covers all joinery products except flooring) indicates that joinery activity across the EU in 2013 has remained flat at around 85% of the level prevailing in 2010 (Chart F). Joinery production in Germany has remained stable at around the same level for the last 3 years. However production declined sharply in Spain, France and Italy between 2010 and 2012 before levelling out at a low level this year.

UK joinery manufacturers optimistic but sales volumes are yet to rise

The latest British Woodworking Federation (BWF) quarterly survey of joinery companies in the UK suggests that the sector remains optimistic about an increase in sales volumes for the remainder of 2013, despite slightly disappointing results during the second quarter of the year.

On balance, respondents to the survey reported slightly lower sales in the second quarter of 2013 compared to the first quarter despite improving weather conditions. Order books are also low with only 7% of companies reporting orders for future work extending beyond 3 months.

Nevertheless, respondents were confident that sales volumes would improve, with a balance of 19% predicting an increase in the third quarter of 2013. A majority of respondents said that they had been using less than 70% of their production capacity for the past year. However, most expected a significant increase in production in the second half of 2013.

BWF conclude that “anecdotal evidence and industry predictions suggest that we could be looking at better fortunes for joinery manufacturers in the third quarter, as the housing recovery, a general uplift in construction work and fair weather are all likely to boost activity. But the second quarter results serve as a reminder that growth for the joinery sector continues to be slow if at all, and it shouldn’t be taken for granted in what remains an exceptionally competitive marketplace.”

New report indicates long term decline in European construction

A newly released report suggests only poor prospects for long-term growth of construction activity in Western Europe. The “Global Construction 2025” report by research firms Global Construction Perspectives and Oxford Economics predicts that the region’s construction market will be 5% smaller in 2025 than in 2007. This is due to a combination of declining real wages and unemployment having a negative impact on housebuilding, as well as high levels of public debt meaning there will be little funding available for infrastructure investment. The report forecasts that output growth will struggle to reach 2% in any year between now and 2025.

However, the news is better for the UK. This is due to a pressing need for new homes and renewed infrastructure and also the apparent willingness of Chinese and Middle Eastern sovereign wealth funds to invest in UK infrastructure and real estate. The report forecasts that UK construction output will grow at 2.1% a year on average up to 2025. The report concludes that by the end of the forecast period the size of the UK market will rival that of Germany’s, with output of $315bn and $342bn respectively.

There are also better prospects in Eastern Europe. The population of Eastern Europe is expected to decline by 0.2% a year over the forecast period. However the report says that strong economic growth should lead to increased construction demand. It expects construction output in Eastern Europe to grow on average by 4.6% a year over the next 12 years, marginally higher than the global average.

However, there are marked differences between Eastern European countries. The best performers, Turkey and Russia, are predicted to see average annual growth exceeding 5%. Russia is expected to move from being the ninth largest construction market in the world in 2012 to the sixth by 2025. Growth in Turkey is forecast to be, if anything, higher than in Russia, with rapid urbanisation and the need to replace and upgrade the country’s housing stock driving growth.

EU wood door consumption stable at a low level

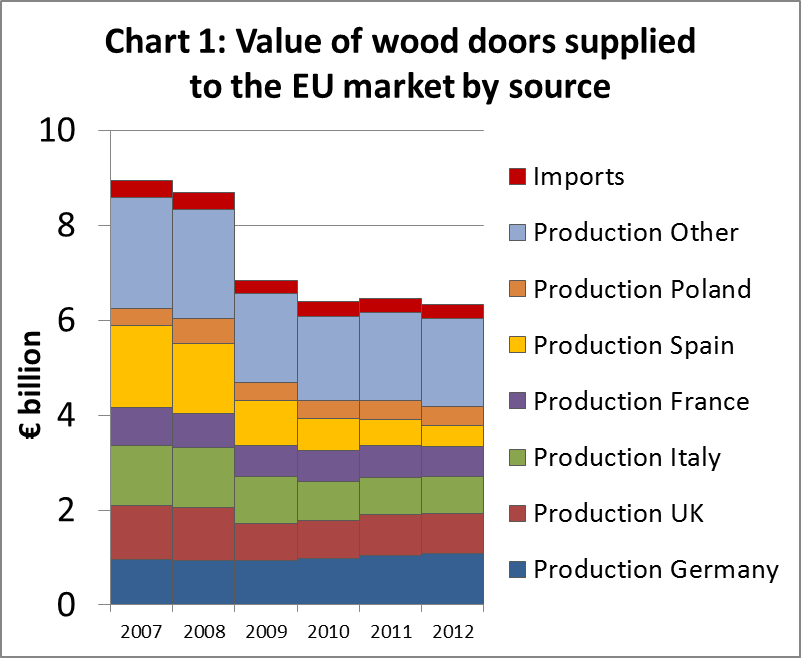

Data newly released by Eurostat shows that production of wooden doors across the EU in 2012 was valued at €6.04 billion, 2% less than the previous year (Chart 1). A 2.7% increase in German production to €1.08 in 2012 was insufficient to offset declining production elsewhere. Production value in Spain fell 21% to €437 million in 2012, only a quarter of the value of 2007 prior to the economic crises. During 2012 there was also a 4.4% decrease in French production to €640 million, and 1.4% decrease in Italian production to €780 million. Production value in the UK remained stable at €850 million in 2012.

In 2012, imports of wooden doors from outside the EU were valued at €283 billion, 2.3% less than the previous year. Imports accounted for 4.5% of total supply of wooden doors to the EU market in 2012, the same proportion as the previous year.

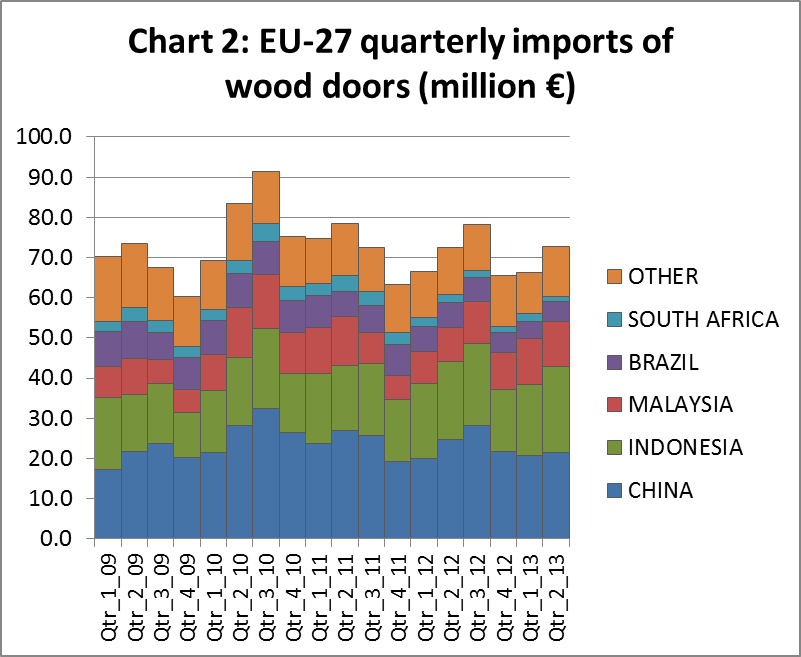

Chart 2 shows recent quarterly trends in the value of EU wooden door imports by supply country. While subject to seasonal variation, import levels have been reasonably consistent averaging around €70 million per quarter since the start of 2011. China is the largest single supplier accounting for 30% of all import value during the first six months of 2013, down from 32% during the same period of 2012. The share of imports from Indonesia was 29% in the first six months of 2013, up from 27% during the same period last year. In 2013, imports from China have been destined primarily for the UK (42%), Romania (18%) and France (17%).

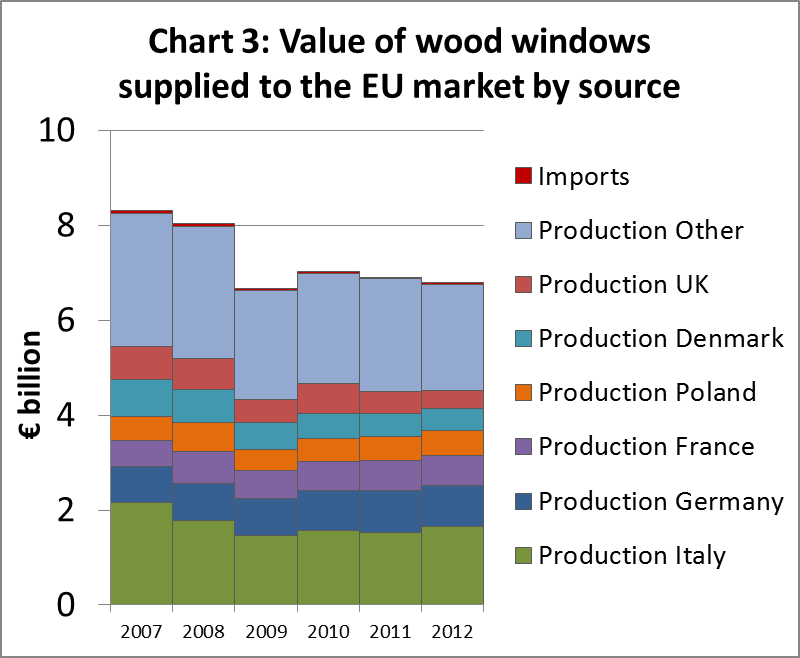

Wood window imports slide to negligible levels

According to Eurostat, production value of wood windows in Europe was €6.76 billion in 2012, 1.6% less than the previous year. Despite the economic downturn, Eurostat report a 9% rise in Italian production of wood windows in 2012 to €1.65. This rise offset falling production value in Germany (-1.6% to €870 million), France (-2.0% to €630 million), Denmark (-3.2% to €470 million), and the UK (-17% to €380 million). Production value in Poland was €510 million , the same as the previous year.

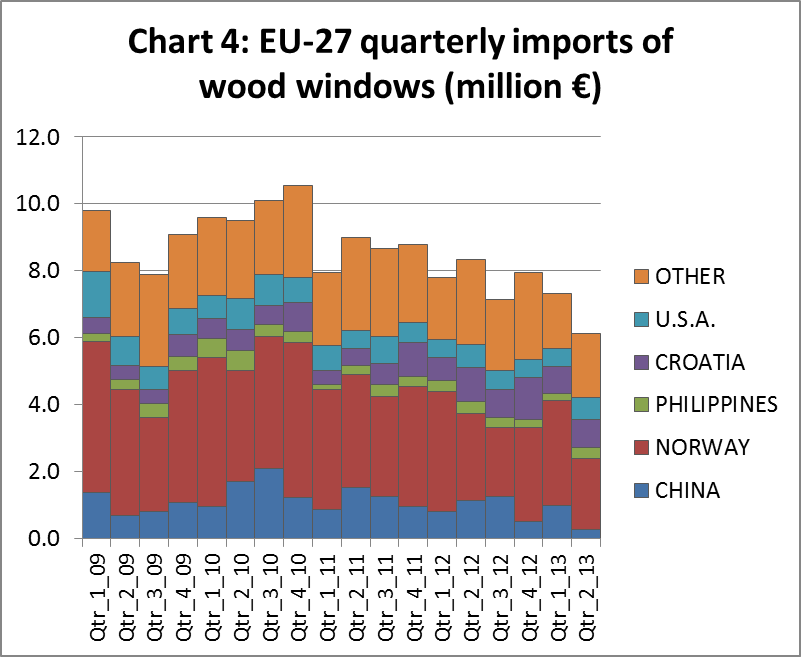

Domestic manufacturers are overwhelmingly dominant in the European windows sector. Imports have not been competitive in a market requiring regular supply of consistent product at short notice to a highly fragmented building sector in accordance with demanding national quality and efficiency standards. Imports of wood windows into the EU were valued at only €31 million in 2012, 9% less than the previous year, and only 0.5% of total supply. Norway is the largest non-EU supplier of wood windows into the region, benefiting from geographic proximity (Chart 4).

EU imports of wood windows from China have been falling over the last 2 years and were valued at only €1.3 million in the first six months of 2013, down from €2 million in the same period of 2012. Wood window imports from China are destined mainly for France, Belgium and Poland.

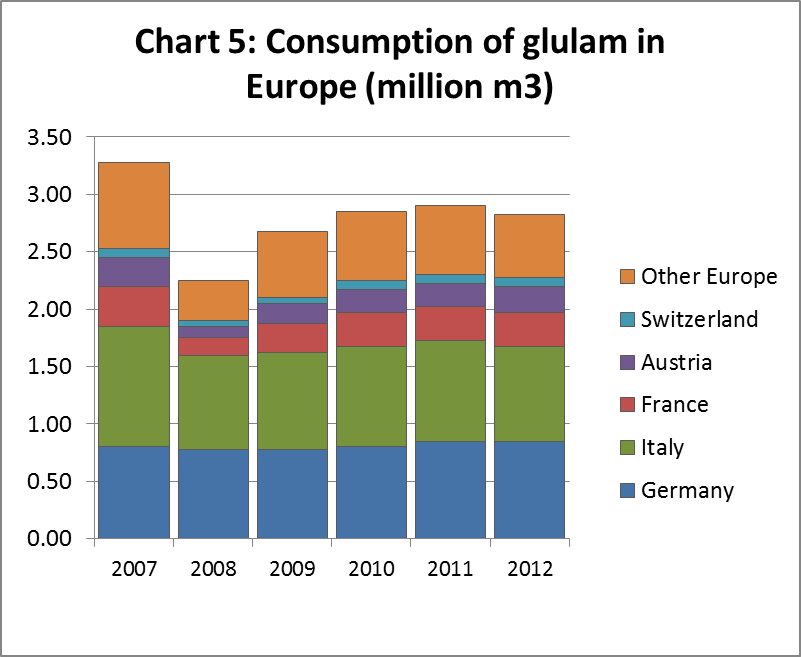

Competition intensifies in the glulam sector

Data from the UNECE Timber Committee indicates that European glulam consumption fell 2.6% to 2.83 million m3 in 2012 (Chart 5). Germany and Austria have traditionally been the largest markets for glulam, while Italy and France showed rapid growth in consumption prior to 2007. Consumption of glulam in other European countries is still low despite significant growth potential.

The downturn in EU consumption in 2012 was mainly due to declining construction and other economic problems in Italy. For 2012 Italy’s glulam consumption is estimated at 830,000 m3, down 5.7% compared to 2011. Consumption in Austria increased 12% to 230,000 m3 in 2012, while consumption was stable in Germany (850,000 m3) and France (300,000 m3).

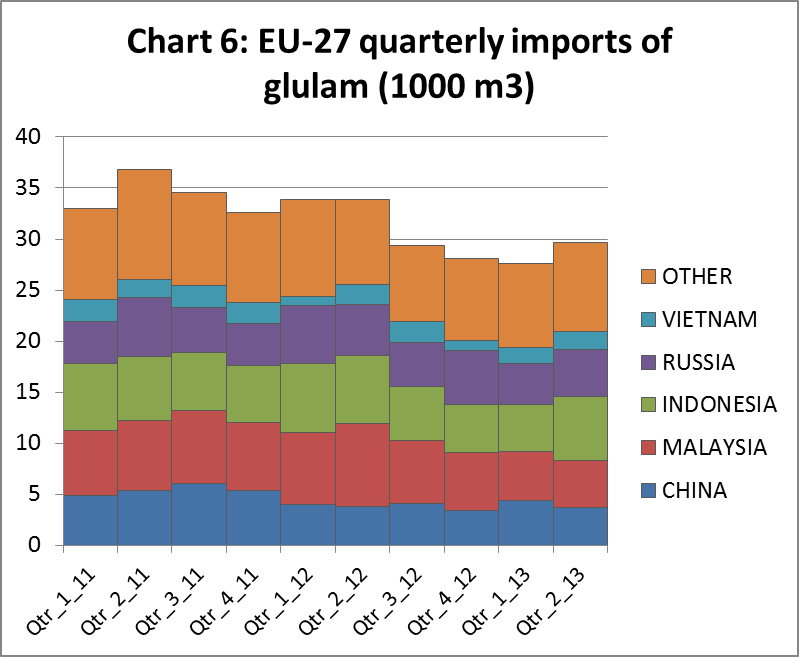

In 2012, 125,000 m3 of glulam was imported into the EU, 8% less than the previous year. In 2012 imports accounted for 4.4% of total consumption, down from 4.7% in 2011. Glulam imports have continued to decline this year. In the first 6 months of 2013, imports were 57,300 m3, 15% less than the same period in 2012 (Chart 6). The leading external suppliers of glulam to the EU are Malaysia, Indonesia and Russia, followed by China. In the first 6 months of 2013 compared to the same period in 2012, EU imports declined from Malaysia (-38% to 9400 m3), Indonesia (-18% to 11000 m3) and Russia (-20% to 8600 m3). However imports from China increased by 3% to 8000 m3, mainly due to rising sales in the UK.

The European glulam market is currently suffering from saturation. Also, several other engineered wood products are now competing with glulam in Europe, such as laminated veneer lumber (LVL), which is gain importance in northern Europe. Competition from LVL may intensify this year as Pollmeier in Germany is expected to begin production of LVL from beech, starting with 150,000 m3 of production capacity.

European glulam manufacturers have been increasing their efforts to expand markets outside the EU, notably in Japan and the Middle East. The main focus is on big projects and eco-buildings, including government buildings, retail developments and sports and recreation centres. A big part of the market development strategy focuses on European glulam producers’ ability to provide a “one-stop shop” integrating design, manufacture, and installation.

Commenting on their Middle Eastern marketing operation one large European manufacturer comments: “we are reducing out-sourcing and developing our own capacity to manufacture steel connectors and undertake hybrid buildings, combining wood with other materials, as well as projects using solid timber frame and cross-laminated timber. Our design office can also provide all structural calculations and drawings. Essentially we help clients realise their concepts in our wood products”.

PDF of this article:

Copyright ITTO 2020 – All rights reserved