The latest European import data suggests that the dramatic fall in EU tropical hardwood imports which began at the start of 2008, continued into the second quarter of 2009. Between January and June this year, European imports of tropical hardwood logs, sawn lumber, veneer and plywood were down 41%, 45%, 39% and 46% respectively compared to the same period in 2008. European import volumes of these commodities in 2009 are a small fraction of those prevailing only two years earlier in 2007. While it is easy to explain falling import volumes as a cyclical response to the global economic downturn, such has been the depth of the decline that serious issues are raised about the extent to which it might drive long-term structural changes in the European wood industry that may be generally detrimental to future prospects for tropical hardwood.

Import downturn continues into the second quarter

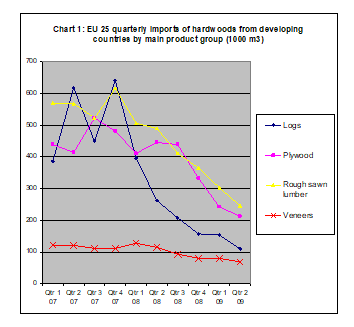

Chart 1 indicates that total EU-25 imports from developing countries of hardwood logs, plywood, rough sawn lumber and veneers suffered further falls in the April-June period of this year. The fall in tropical hardwood log imports has been particularly dramatic. Total EU-25 imports of this commodity reached only 109,000 m3 during the three month period, a figure which compares to over 600,000 m3 during the second quarter of 2007.

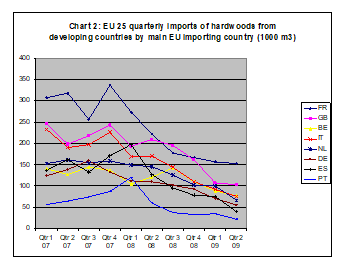

Chart 2 shows that the continuing decline in tropical hardwood imports during the second quarter of 2009 affected all the major EU markets. While the data hints that the market decline may be bottoming out in France, and the UK, imports into both the Netherlands and Spain experienced further significant downturns in the April-June period.

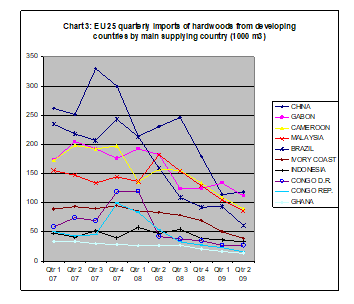

Chart 3 suggests that all the major tropical hardwood supplying countries to the EU with the exception of China experienced a decline in sales to the EU during the second quarter of 2009. Imports from China (mainly plywood) showed marginal gains during the second quarter compared to the first quarter, although the volumes involved remained well below those of the previous year.

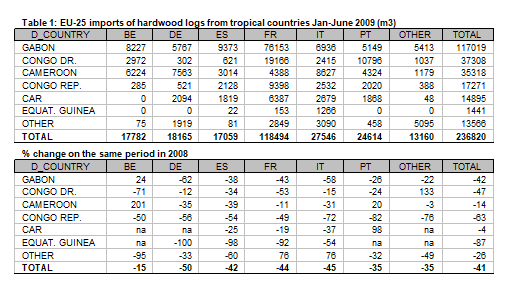

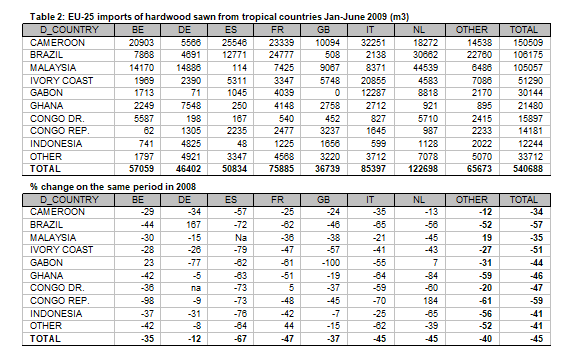

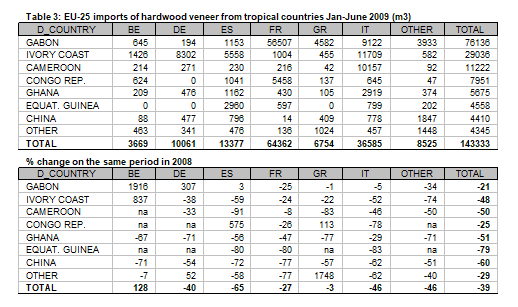

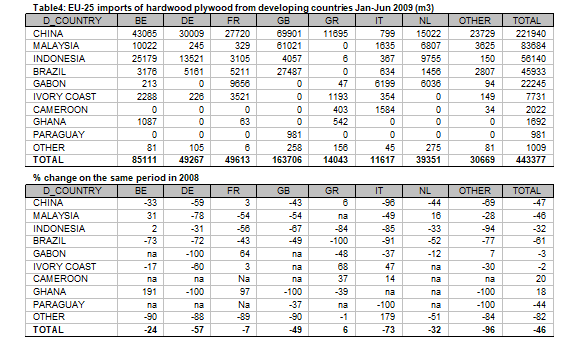

Tables 1 through to 4 provide more detail of cumulative EU tropical hardwood imports by both major tropical supply and receiving EU country during the first half of 2009 compared to the same period in 2008. Highlights include:

· A 44% decline in imports of tropical hardwood logs into France, the main EU market for this commodity, with French imports from Gabon, the largest supplier falling a massive 43%.

· A 67% decrease in Spanish imports of tropical sawn lumber, with imports from all the major tropical supply countries down by well over 50%.

· Of all significant European importers of tropical hardwood, only Greece seems to have escaped the turmoil. Greek imports of tropical veneers were down only 3%. Greek imports of hardwood plywood from developing countries actually increased during the period (although most of this came from China). Greek imports of tropical sawn lumber (not shown on the charts) also nearly reached 2008 levels (11,370 m3) at 11,180 m3.

· UK imports of hardwood plywood from developing countries during January to June 2009 were only half those of the same period the previous year.

· Of all significant tropical hardwood plywood suppliers to the EU, only Gabon managed to maintain levels close to those of 2008 this year. Given the huge fall in French log imports from Gabon, this is clearly indicative of a continuing shift in manufacturing location for okoume plywood from France to the African country.

Evidence of structural changes

Some significant structural changes in the European wood importing industry, which began several years ago, seem now to be deepening in response to the recession. For example, dependence on just-in-time ordering of tropical hardwood goods from large corporations with concentration yards in the Benelux countries, has increased. As a result, these companies are becoming increasingly critical to the long term future of tropical wood in the EU. Uncertainty and lack of availability of credit is also encouraging a move away from any speculative purchases, and encouraging a shift to products and suppliers which are regarded as lower risk, usually to the detriment of tropical wood.

In this environment, there are some signs that the relative power of larger better capitalised importing companies and merchants is increasing at the expense of smaller companies. The larger companies are more likely to demand environmental certification and to impose other technical requirements on their suppliers. This in turn is also encouraging a general shift to low risk products from an environmental point of view. This is well illustrated by the recent announcement of Lathams Limited, a major UK panel products importer, that it is now sourcing “tropical hardwood replacement” plywood manufactured from plantation-grown eucalyptus in Uruguay. This is a worrying sign that some importers are using the fact of their actively avoiding tropical hardwood to improve image.

It is also worth highlighting that while imports of tropical hardwood have declined dramatically this year, sales and production of some important competing materials are actually rising – again because they are perceived to be lower risk, both in terms of environmental and technical performance and their ready availability at reasonably stable (although not necessarily particularly low) prices. For example, in their latest issue, the German trade journal EUWID reports that German wood plastic composite (WPC) manufacturers are continuing to invest in new capacity. WPCs are becoming an increasingly important competitor for tropical hardwoods, particularly in the decking sector but also for cladding, construction mouldings, and garden furniture. EUWID reckon that total European WPC capacity now extends to roughly 120,000 tonnes, while European imports of WPCs from North America (with capacity now closer to 1 million tonnes) are also increasing.

In a similar vein, the UK’s TTJ recently reported that UK sales of thermally-treated and acetylised softwood products have been rising this year despite the recession. These products also target tropical hardwood market niches, such as window frames, decking, cladding, bridges, and other external applications.

The combination of these changes on the demand side, and the supply side problems emerging from widespread shutdowns and closures in tropical countries during the recession, suggests tropical wood suppliers may face a major challenge to rebound from the current downturn in the European market even as economic conditions begin to improve. Certainly, it will require much larger investments in marketing, particularly to the architectural and design profession, product development, and certification, than has previously been applied by the tropical hardwood industry. But financing such activities may be particularly difficult after such a prolonged slump.

If the tropical wood industry is to stop the rot, it has no option but to find more effective ways of working together to implement a coherent market access strategy. There may be some scope to use the EU’s FLEGT VPA programme as a platform for such a strategy in Europe.

NB. All trade data is derived from Forest Industries Intelligence Industries analysis of Eurostat and Customs data supplied by BTS Ltd

PDF of this article:

Copyright ITTO 2009 – All rights reserved