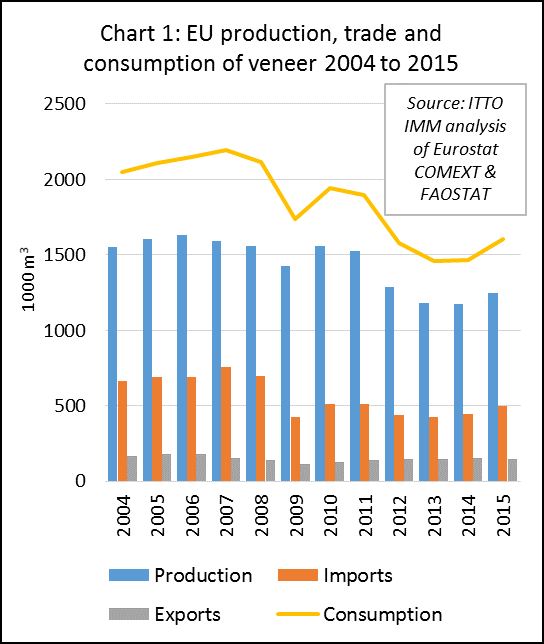

Preliminary analysis of Eurostat data indicates that the European veneer market, which was in decline between 2010 and 2014, staged a partial recovery in 2015. Total EU veneer consumption increased by 9% from 1.47 million m3 in 2014 to 1.60 million m3 in 2015. This rise was driven both by a 7% rise in domestic production, from 1.17 million m3 to 1.25 million m3, and a 12% rise in imports from 448,000 m3 to 500,000 m3 (Chart 1).

Slowly improving economic conditions in Europe have contributed to rising veneer consumption in key sectors, including veneered panels and flooring. There are also encouraging signs that veneer manufacturers may be making more progress to regain share lost to non-wood alternatives in recent years through innovations in processing to further improve resource efficiency and to develop new products. 3-D veneers are now ell established in Europe and have extended real wood veneers into applications previously dominated by plastics. As larger industrial markets for standardised veneer products have declined, there has also been a strong emphasis on more flexible servicing of smaller customer specific requests.

European oak in short supply

Nevertheless, anecdotal reports suggest 2015 was another challenging year for the European veneer sector. Throughout 2015 and continuing into 2016, European veneer mills were suffering from shortages of veneer grade oak logs. This was particularly the case for manufacturers of mass-produced veneers for veneered panels and furniture. Various factors contributed including intense competition in oak log procurement from barrel manufacturers and buyers in Asia and the relative weakness of the euro in 2015 which encouraged more focus on European oak, increasing the costs of imported logs while also making European oak more attractive to mills outside Europe.

Another significant development in 2015 was passage of a law in Ukraine on 9 April 2015 which imposed an export ban on unprocessed timber for 10 years effective from 1 November 2015 for all species (with the exception of pine banned from 1 January 2017). While the law only became effective later in the year, it seems to have had an immediate impact to reduce EU imports of hardwood logs, particularly oak, from Ukraine. EU imports of Ukrainian oak logs were only 29,000 m3 in 2015, down from 82,000 m3 the previous year and figures closer to 200,000 m3 prior to the economic crises.

While there was pressure on European oak supplies in 2015, the same cannot be said for other European hardwood species. Under-utilisation of beech remains a significant problem in Europe, while markets for other more specialised species have come under intense pressure from substitute materials. For example, large furniture manufacturers will only use ash veneers if they remain cost-competitive compared to artificial heavily structured surfaces.

EU exports of veneer have also came under pressure, declining 4% from 155,000 m3 in 2014 to 149,000 m3 in 2015, particularly due to a downturn in sales to Turkey, Morocco, Russia, and China. Recent market reports suggest this trend has continued into 2016

EU veneer imports strengthen in 2014 and 2015

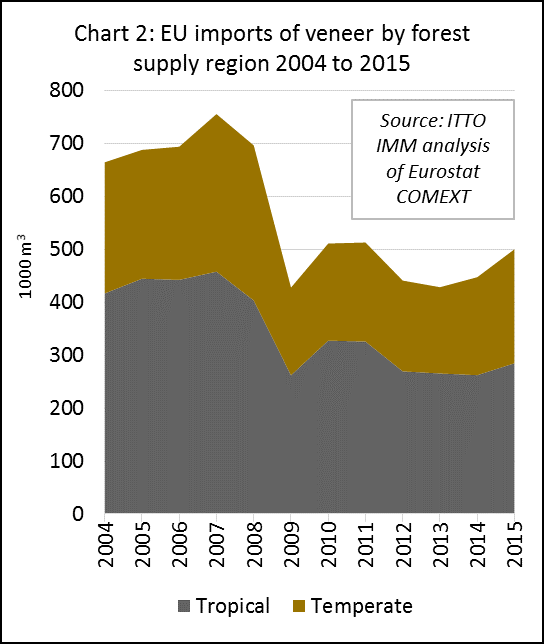

Chart 2 shows the long-term trend in imports of all veneer into the EU from outside the region between 2004 and 2015. It highlights the large drop in imports during the financial crises in 2009. After a partial recovery in 2010 and 2011, imports weakened in 2012 and 2013 but then rebounded again in 2014 and 2015.

EU imports of veneer from tropical countries increased 9% from 263,000 m3 in 2014 to 287,000 m3 in 2015. Tropical countries accounted for 57% of all EU imports of veneer in 2015, down from 59% the previous year and 64% in 2010. EU imports of veneer from temperate countries increased 16% from 185,000 m3 in 2014 to 215,000 m3 in 2015. The most noticeable trend in EU temperate hardwood veneer imports during the last five years has been a rise in volume and share from Ukraine, Russia and Serbia. The rise in Ukraine’s share accelerated in 2015, likely related to the restrictions on log exports from that country.

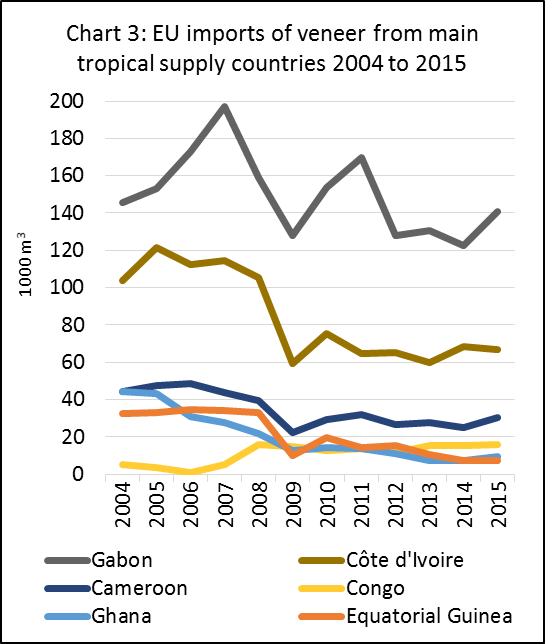

Recent trends in EU imports of tropical hardwood veneer are strongly influenced by events in the plywood industry (Chart 3). The short-lived recovery in EU tropical veneer imports in 2010 and 2011 was primarily due to rising exports of rotary okoume veneers from Gabon to supply the European (mainly French) plywood manufacturing sector after Gabon imposed a total log export ban in May 2010.

The uptick in EU imports of tropical veneer in 2015 was mainly due to imports from Gabon, which increased 15% to 141,000 m3, with much of the volume destined for France. Demand for okoumé plywood picked up in Europe in 2015 due primarily to recovery in the Netherlands building industry and slow improvement in the French market. The French company Rougier which produces okoumé veneers and plywood in France and Gabon, booked a 9.8% increase in revenues in its European business during 2015. Rougier reports an improved economic climate in Europe in 2015, a trend which continued into the first quarter of 2016.

In addition to Gabon, EU imports of tropical veneer also increased during 2015 from Cameroon (+21% to 30,200 m3), Congo (+2% to 15,700 m3), and Ghana (+26% to 9,400 m3). However imports from Côte d’Ivoire declined 2% to 66,800 m3.

Double digit growth in French and Italian tropical veneer imports

Imports of tropical veneer into France and Italy, now the largest EU markets for tropical veneer, both registered double-digit growth in 2015, rising 15% to 116,258 m3 and 19% to 67,626 m3, respectively. There were also significant increases in imports by Greece (+29% to 16,494 m3) and Romania (+37% to 14,860 m3). Of the five largest EU markets for tropical veneer, Spain (-14% to 36,608m3) was the only to report declining imports in 2015. However imports also declined into Germany (-17% to 14299 m3) and Belgium (-44% to 7107 m3) during the period.

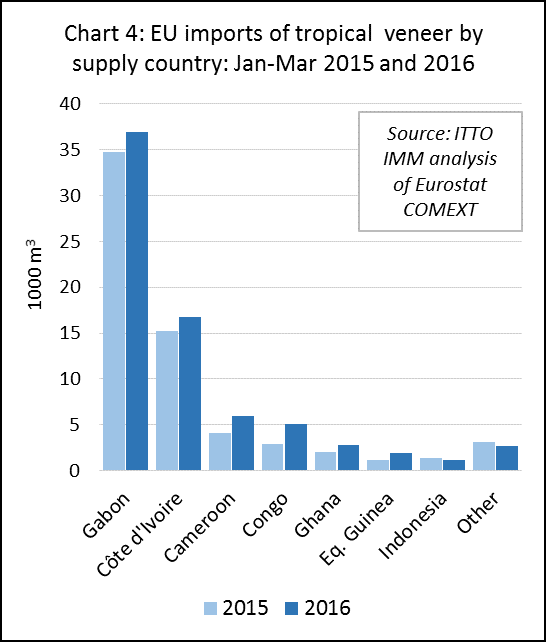

The positive trend in EU imports of veneer from tropical countries continued into 2016 (Chart 4). Imports were 73,300 m3 in the first quarter, up 14% compared to the same period in 2015. Imports increased from all the main supply countries during the period including Gabon (+6% to 36,900 m3), Côte d’Ivoire (+11% to 16,800 m3), Cameroon (+45% to 5,900 m3), Congo (+72% to 5,100 m3) and Ghana (+42% to 2,800).

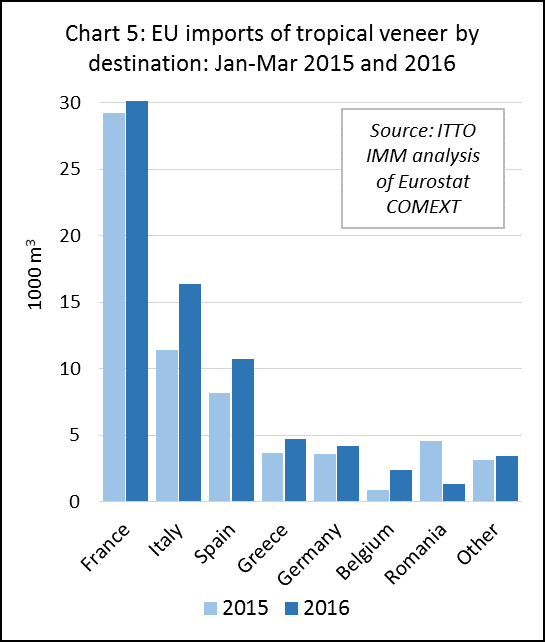

All the largest EU markets for tropical veneer have been importing more this year (Chart 5). During the first quarter of 2015 compared to the same period in 2014, imports increased into France (+3% to 30,100 m3), Italy (+44% to 16,400 m3), Spain (+31% to 10,700 m3), Greece (+30% to 4,700 m3), Germany (+17% to 4,200 m3), and Belgium (+175% to 2,400 m3). These gains offset a 70% decline in imports by Romania to only 1,400 m3.

STTC Conference on tropical timber purchasing policies, Rotterdam, 23 June 2016

The title of the European Sustainable Tropical Timber Coalition (STTC) conference on June 23 is ‘Real Impact Through Timber Purchasing Policies. The free-entry, one-day event in Rotterdam tackles sustainable timber purchasing policy implementation and building market demand for sustainably sourced tropical wood products. It is organized by Probos, with supporters including STTC principal partner the ETTF, the City of Rotterdam, Dutch Infrastructure and Environment ministry and local government sustainability body ICLEI.

The first session features keynote speakers on how procurement can shape and grow European sustainably sourced tropical timber sales and this can drive spread of sustainable forest management in supplier countries. Afternoon breakout discussion workshops will look at ‘Timber Procurement Policies in Practice’. Topics for private sector delegates will include the STTC’s activities and future development, barriers to sustainable tropical timber becoming mainstream, tackling price differential between certified and non-certified timber, product substitution and image.

Public sector themes include developing public sector participation and public-private partnerships in the STTC and specifying sustainably sourced timber in contracts. Speakers include EU Green Public Procurement Policy Officer Robert Kaukewitsch, Stéphane Glannaz and Peter Gijsen of STTC participants Precious Woods and BAM, policy analyst Duncan Brack, Maja Valstar of the Dutch Environment Ministry Léon Dijk, Environmental Coordinator for Rotterdam, Netherlands Timber Trade Association Managing Director Paul van den Heuvel, ETTF Secretary General André de Boer and Lidia Capparelli of Italian national procurement agency CONSIP. Also participating are Le Commerce du Bois Managing Director Eric Boilley, AEIM General Secretary Alberto Romero and GD Holz Head of Foreign Trade Nils Olaf Petersen.

Register at www.europeansttc.com. For more contact Joyce Penninkhof, tel. +31 (0) 317-466557 or email joyce.penninkhof@probos.nl

Italy sets minimum requirement for certified or recycled timber in public procurement

According to a report by the STTC, Italy’s timber sector is identifying positives in the country’s new law ruling that at least 50% of wood products procured by government for public projects are certified legal and sustainable, or recycled. The regulation was passed at the end of 2015 and came into effect earlier this year. Its full title is ‘Environmental Provision to promote green economic measures and contain excessive use of natural resources’.

“It stipulates that all public sector bodies ensure that at least half of tenders for timber and wood products by value meet a range of environmental criteria,” said Stefano Dezzutto, Chief Executive of timber sector federation Fedecomlegno. “And it applies to local as well as central government.”

He added that the new ruling currently covers office and outdoor furniture, construction materials, windows and doors and said Fedecomlegno consulted on the drafting process. “We contributed actively to drawing up the ‘minimum environmental criteria’ for each kind of product,” he said.

The law states that the minimum 50% of wood and wood-based goods must comprise re-used or recovered timber, or include a minimum 70% of material sourced from sustainably managed forest. Proof of origin can include FSC or PEFC certification, these schemes’ recycled wood certificates, or an equivalent, which has to be independent third party verified and ISO-approved.

Fedecomlegno sees the new regulation boosting overall Italian demand for certified sustainable timber, especially wood-based panels used in furniture.

It has also communicated the details to its members so they can be prepared.

“And it’s felt that the topic will be addressed further by legislators in the near future,” said Mr Dezzutto. “Some have forecast that the government procurement threshold on certified legal and sustainable timber will be increased to 100%.”

SMEs target of NEPCon due diligence training

According to a report by ETTF, a new pan-EU training programme aims to make EU Timber Regulation (EUTR) due diligence part of the ‘standard way of doing’ business for small to medium sized enterprises (SMEs). The EU-funded initiative, ‘Increasing awareness and capacity to support effective implementation of the EUTR’, is being organised by not-for-profit international sustainability organisation NEPCon, with support from the Global Timber Forum.

The training courses, led by NEPCon experts, are free for and tarket timber sector SMEs. Delegates will also receive due diligence tools to take away, plus new risk assessment information for 40 supplier countries globally, accounting for 90% of Europe’s timber imports. This data is also available to EUTR Competent Authorities and Monitoring Organisations.

NEPCon says the training aims to make due diligence ‘an integral element in a company’s administrative systems – even a business opportunity’. It is also undertaking a survey of to further assess EUTR businesses’ compliance needs (see http://www.surveygizmo.com/s3/2817275/Legal-timber-in-the-EU).

“Due diligence is, at heart, good business practice,” said NEPCon. The project’s ultimate aim is consistent implementation of the EUTR by EU SMEs. The courses will be run in Belgium, Denmark, Estonia, Germany, Holland, Latvia, Lithuania, Poland, Portugal, Romania, Slovakia and Spain.

PDF of this article:

Copyright ITTO 2020 – All rights reserved