Expectations of the impact of the Covid-19 pandemic on the European plywood sector turned out generally to have been worse than the reality.

Nevertheless, overall trading levels in the first half of 2020 are reported sharply down. Some fear business may not return to pre-crisis levels until a vaccine is found for the virus and there is concern among importers over the longer term repercussions of the crisis for European national economies, particularly for employment, with predictions that Brexit may add to market stresses.

EU and UK plywood importers and distributors took a range of steps to comply with social distancing and other official health guidelines through the lockdown – and it’s reported that most of the sector did keep trading.

“We divided the workforce into teams, working several days on, several off, both in order to meet distancing rules and so that, if anyone fell sick, we’d have a back-up,” said a director of one leading EU importer.

Another company said its strategies differed across the national markets it services. “In France at the height of the pandemic and lockdown, we were down at one point to around to around 10-15% of normal activity, so reined in operations accordingly. In the UK only our main directors came in, while everyone else worked from home, but in the Netherlands, Belgium and Germany we pretty much continued as normal,” they said.

A major UK importer distributor said they had furloughed just six people out of a workforce of 90. “Our offices were big enough to maintain distancing rules and we adapted in other ways,” they said.

“For instance, delivery drivers stayed in vehicles to minimise contact and we went even more paperless, sending delivery and order notes to tablets and smartphones. It’s really demonstrated the value of new technology and digitization, with staff and supplier meetings online and sales communicating with customers remotely, all with no appreciable adverse impacts on business. We’ll probably stick with some of these approaches post pandemic.”

The fall in turnover in the first six months of 2020 varied according to importers’ product mix and national markets, with estimates ranging from 15% to 35%. However, some had expected a bigger contraction.

“Sales falling by between fifth and a third obviously is bad news, but mid-March into April, when the health crisis was at its peak and the media full of dire predictions, we discussed contingences for a more serious situation,” said one company.

A multi-national importer/distributor reported the French market through April into May down 75%, the UK 65% and Belgium 35%, but business in the Netherlands and Germany was significantly less affected. “The Germans and Dutch lockdowns either weren’t as severe, or businesses coped better,” they said. “The result was that most customers were able to carry on near normally.”

One company said its sales in these two countries had enabled it to maintain first half construction sector business overall at 90-95% of 2019 levels. “We actually saw surprisingly few site closures generally and also the building sector had benefited from a mild winter, so ongoing projects hadn’t been interrupted or building starts delayed due to bad weather. As a result, the sector went into the pandemic period at strong levels of activity. Demand from customers in infrastructure also held up well. Projects were possibly brought forward by contractors to take advantage of lower traffic levels and by local and central government also to help maintain economic activity.”

Merchants and small to medium sized distributors were the mainstay of another importers’ business from March through June, particularly those servicing smaller builders and private customers.

“Some bigger distribution chain customers and larger construction contractors we service curtailed operations, but traditional merchants were busy, as were builders working on smaller projects, repair and refurbishment, plus the DIY sector. Consumers clearly took advantage of lockdown to do home improvements,” said an importer/distributor.

UK importers painted a similar picture, with DIY trade holding up particularly well. One had also seen strong demand from retail and hospitality for plywood and OSB to board up locked down premises.

UK construction activity varied from site to site, some closing, others continuing, operating to health guidelines. Most interruption was reported in Scotland where the sector was hit by the strictest lockdown rules.

In common with most continental counterparts, a UK company said their worst affected areas were packaging, shop fitting, the exhibition sector and hospitality refurbishment.

“Some shops have used it to refurb, but the sector generally didn’t go into lockdown in a strong position, due in particular to online retail growth, so didn’t have the resources,” said the importer.

“We’ve also seen a sharp downturn in anything to do with manufacturing. That includes sales to the automotive sector, boat building and particularly furniture production.”

Another continental importer described the packaging business as a ‘disaster area’ – down at least 50%. “It’s dependent on transport of goods which, of course, was severely curtailed,” they said.

Major interruption in Chinese plywood supply into Europe

On supply, some interruption was reported out of Indonesia and Malaysia due to lockdown; some factories reported to have closed for several weeks, others reducing output. But the major issue was with Chinese product. The combined effects of Chinese New Year and pandemic saw shipments virtually dry up. The impact was partially softened by lower demand in Europe, but companies still report coming close to selling out.

“We’d stocked up as usual ahead of New Year. But rather than the usual two to three weeks hiatus in supply, for us this year it was seven to eight, mid-January to the end of March,” said an importer.

“Basically, we cleared our stocks and most customers were sold out, particularly on film-faced and other construction and industrial product. Even now, whatever’s coming in from China is presold and immediately going out again.”

Through May, Chinese and South East Asian supply was reported to have recovered, and combined with slight weakening of the yuan, the consequence, said an importer, is that there is now more “flexibility on price”. “It’s generally not substantial, although there are some suppliers hungrier for business than others and open to offers,” they said.

Despite the supply issues, bar moderate weakening in Chinese product more recently, importers report South East Asian prices overall stable over the last few months, with just “minor adjustments”.

Brazilian elliottis and Russian birch, however, have been on a downward trajectory, the former quoted falling 20 to 25% over the first half of 2020, the latter 10%.

“Combined with the weakening of the Brazilian real, which, despite slight recent recovery early June was still 25% to 30% lower than at Christmas, this left European importers who bought January and February, when prices were actually increasing, with expensive stocks they’ve had to discount,” said one company. “There are signs prices have bottomed out, but, with the pandemic worsening in Brazil and their domestic market contracting, you never know.”

Russian price cutting was described as an “over reaction to market conditions”. “[Russian] suppliers have had problems. First, they had a mild winter and log shortages, then came the pandemic and contraction of the building interiors market, which is significant for them,” said an importer.

“But Russian suppliers seemed to get into a race for the bottom. Whether they’ve reached it yet is unclear. These are big companies which may have room for more cuts. As with elliottis, it’s meant write offs and particularly bigger stock-holding importers losing a lot of money.”

European plywood imports down 16% in first four months of 2020

According to analysis of latest UK Government and Eurostat statistics, total plywood imports by the EU27+UK (excluding internal trade) dropped by 15.6% to 1.58 million m3 from January through April this year compared to the same four months last year. This follows a dip of 5.3% to 4.4 million m3 for the full year in 2019.

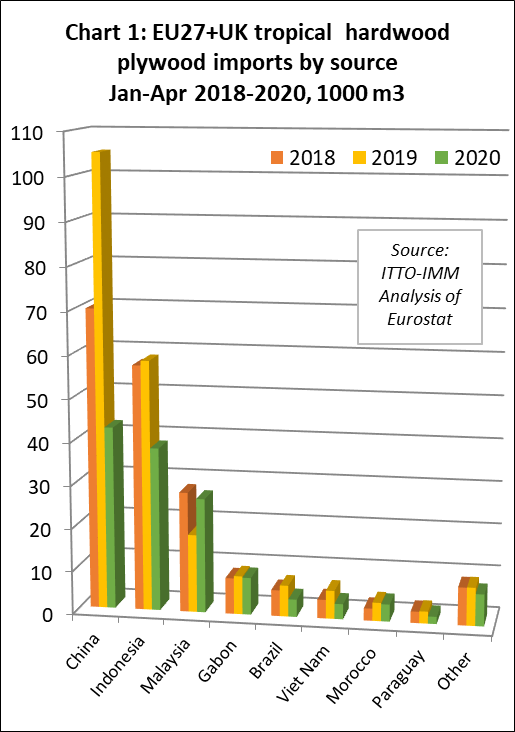

EU27+UK tropical hardwood plywood imports, including both direct from the tropics and from non-tropical countries, were 137,000 m3 between January and April this year, 38% less than the same period in 2019.

EU27+UK tropical hardwood plywood imports from China from January through April were 59.5% lower at 43,000 m3. Imports of tropical hardwood plywood also declined sharply from Indonesia (down 34.6% at 38,000 m3), Gabon (down 3.3% at 9,000 m3), Brazil (down 43.9% at 4,000 m3) and Viet Nam (down 45.8% at 4,000 m3). However imports from Malaysia were up 47.1% at 27,000 m3 (Chart 1).

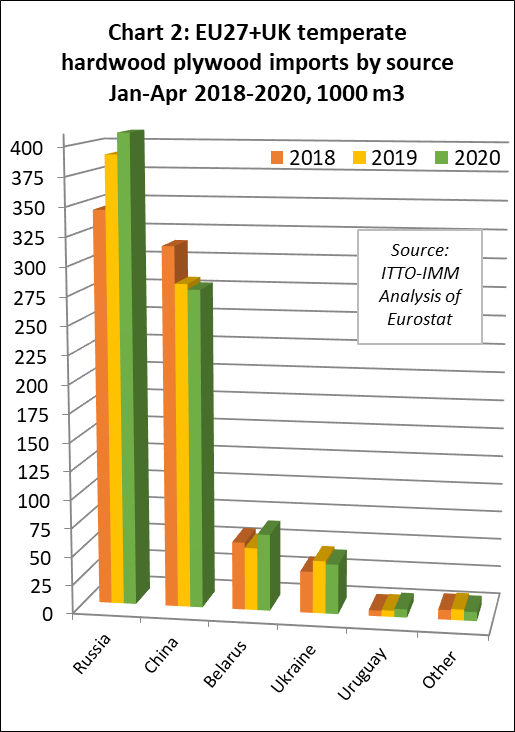

In contrast to tropical hardwood plywood, EU27+UK imports of temperate hardwood plywood were up 3.1% at 815,000 m3 in the first four months of 2020. Imports of this commodity from Russia were 4.8% ahead at 410,000 m3, from Belarus up 22.7% at 67,000 m3, and Uruguay up 31.9% at 7,000 m3. However, imports of temperate hardwood plywood from China were down 1.7% at 278,000 m3 and from Ukraine down 5.6% at 44,000 m3 (Chart 2).

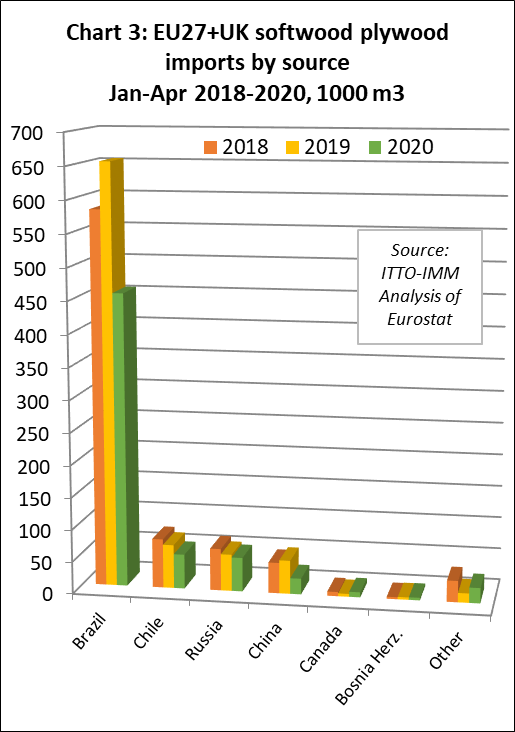

EU27+UK imports of softwood plywood declined 27.1% to 623,000 m3 in the first four months of 2020. Imports from Brazil were 30.3% lower at 456,000 m3, from Chile down 20.9% at 54,000 m3, Russia down 7.5% at 53,000 m3 and China down 52.7% at 25,000 m3, while those from Canada rose 77.5% to 8,000 m3 (Chart 3).

Uncertain outlook for European plywood market

As for the outlook for the European plywood sector, importers said it remained a difficult call. “There are so many variables,” said one company. “There’s anxiety about a second spike in Covid-19 in Europe, and we’ve already seen renewed outbreaks and subsequent localized lockdowns in Germany.

“There’s been consumer confidence and market recovery from mid-May through to June, for instance France was heading back towards 80% of 2019 levels for us and the UK has also seen marked improvement, and we see the position continuing to improve through the summer, but it won’t take many more such instances for that to be threatened. There’s talk too of the risk of company failures and accelerating job losses as government pandemic business support programmes are wound down, with unemployment forecast to be a major drag on the European economy. Then there’s the worry of the course of the disease elsewhere in the world.”

Prospects in construction are also causing concern. “I think we’ll see an upturn in activity as those projects that were delayed come back on stream, with more work done than normal through July and August,” said an importer-distributor.

“But, as these projects complete, are we going to see new ones starting? Some governments are pump priming the sector, with Germany and the UK, for instance, promising multi-billion infrastructure spending. But not everyone is going to have that kind of resource.”

These concerns are borne out by latest forecasts from Euroconstruct. It predicts that its 19 member countries in 2020 will see an overall contraction in construction turnover to €1.5 trillion, the lowest figure since 2015. In Germany the fall will be just 2.4%, but in the UK and Ireland could be as severe as 33% and 38% respectively. While building output will start recovering in 2021, Euroconstruct predicts that in 2022 it will still only be back to 2018 levels. Euroconstruct adds that there are also downside risks to its forecast, the most significant being the coronavirus and its containment.

Adding to importers’ challenges, they also report greater difficulty in meeting EUTR due diligence requirements due to a combination of having furloughed their own personnel, and suppliers’ offices also being short-staffed, so processing documentation more slowly. “And EU competent authorities are making no allowances,” said one company.

Another reported that the Belgian competent authority is also scrutinizing FLEGT-licensed cargoes more closely. “Whether it’s to do with Indonesia’s proposed then abandoned move to drop the obligation on companies to provide legality assurance on timber exports is unclear,” they said. “But it seems excessive.”

A UK importer voiced the sector’s consensus about the immediate future. “Business continues to pick up and we’re being positive, but it’s going to be challenging. We think our new norm will be about 15-20% below 2019 business levels; where we were doing £10 million a month, we’ll now be on £8-8.5 million,” they said. “We hope to be proved wrong, but at the moment we can’t see that changing significantly until a Covid-19 vaccine is out there.

“Then there’s the downside risk posed to us and the rest of Europe by Brexit. The pandemic has taken months out of negotiations and the risk of the UK exiting the EU without a trade deal is reported as very real. On top of the health crisis, that could be tough to cope with. Our hope is that they extend the transition period so they can come to a deal and we only have one crisis to manage.”

PDF of this article:

Copyright ITTO 2020 – All rights reserved