The latest Eurostat trade data shows that the EU’s wood furniture industry, having lost a little ground to imports in 2017, is struggling to increase sales outside the EU as the global trade slows. However, the sector is once again reinforcing its dominance in the home market this year.

As reported by ITTO MIS in July (Volume 22, Number 13), the EU wood furniture sector recorded only slow growth in 2017. The value of EU wood furniture production was €40.3 billion in 2017, no change from the previous year. Total imports from outside the region increased 9% to €6.29 billion.

In 2017, EU wood furniture imports increased 7% from the tropics, to €1.75 billion, and 3% from China, to €3.18 billion. However, most of the gains were made by other non-EU temperate countries, such as Ukraine, Bosnia and Serbia. Total imports from these countries increased 28% to €1.36 billion.

EU consumption of wood furniture was €37.6 billion in 2017, a gain of 2% compared to 2016. Despite the rise in imports in 2017 the share of domestic manufacturers in total EU furniture supply declined only slightly last year. In 2017, domestic manufacturers accounted for 86.7% of the total value of wood furniture supplied into the EU market, down from 87.5% in 2016.

EU wood furniture production data is published only annually, so it is too early to assess how consumption is developing in 2018. However, EU monthly data on internal and external trade provides insights into the changing share of the various wood furniture supply countries to the EU, alongside changes in internal distribution patterns in 2018 which may have long term implications.

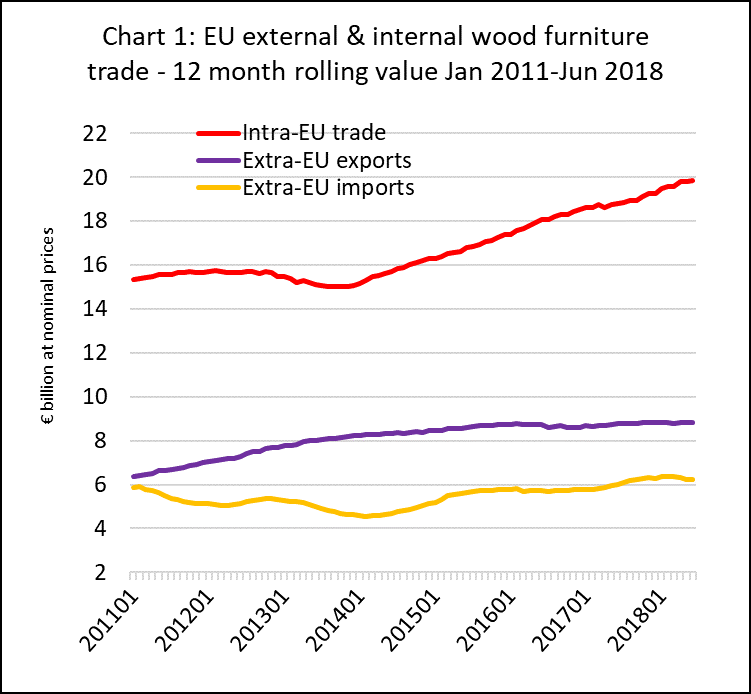

Eurostat trade data reveals that internal EU trade in wood furniture, which increased 4% to €19.2 billion in 2017, increased a further 6% in the first half of 2018. Meanwhile the pace of EU wood furniture exports to non-EU countries, which were flat at €8.7 billion in 2016 and 2017, have continued at the same rate in the first half of 2018. Wood furniture imports into the EU from outside the region were rising in the second half of 2017, but began to dip in the first half of this year (Chart 1)

Poland’s increasing role in EU wood furniture supply

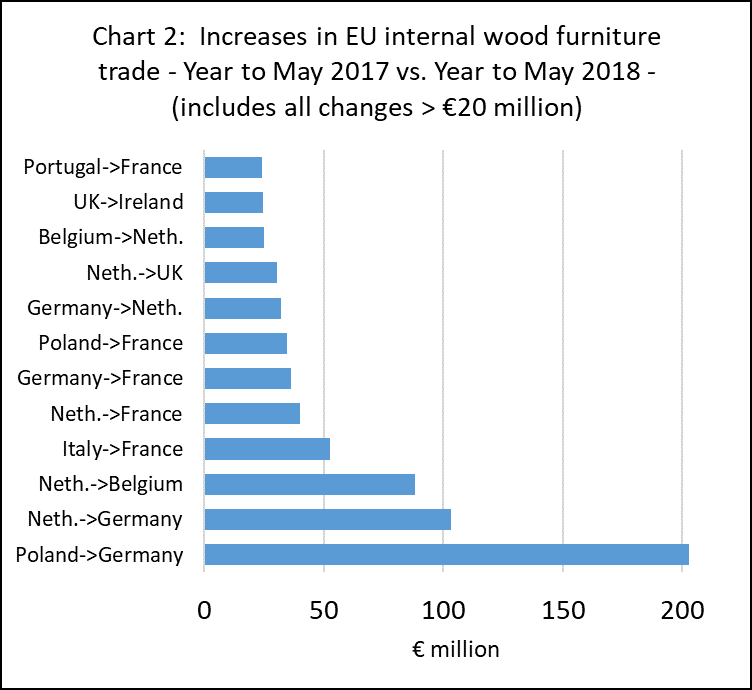

Closer analysis of EU internal trade flows suggests that the Polish wood furniture industry, which is expanding partly at the expense of manufacturing in western European countries, particularly Germany, is playing an important role to drive the on-going rise in internal EU trade. By far the largest increase in internal EU wood furniture trade flows in the last two years was in exports from Poland to Germany (Chart 2).

In recent years, Poland has quickly emerged as the world’s sixth largest furniture producer and fourth largest furniture exporter. This has been achieved by exploiting the combination of the EU’s common market in goods, proximity to Germany and other large western European markets, and low labour costs. Hourly labour rates average only around €9 in Poland compared to €27 for the EU as a whole and €34 in Germany.

Germany is Poland’s largest furniture export market with a share of around 30% of total trade, followed by UK, Czech Republic, France and the Netherlands.

In the wood furniture sector, Poland has benefitted from the relatively large forest resource in Eastern Europe, although availability of oak, by far the most popular species, has been a limiting factor in recent years.

Another limiting factor is that Polish brands are not yet well known in export markets and overseas sales are largely controlled by large retail chains that dominate fashion and design trends.

At present, there are over 27,000 Polish companies involved in furniture manufacturing, although only 407 large and medium-sized enterprises account for three quarters of production. Poland is the second largest supplier of furniture to Ikea after China. The Swedish giant operates a dozen factories in the country and is the largest company in the furniture industry in Poland.

Nevertheless, the Polish furniture industry is also characterised by many companies with domestic capital which are becoming leading players in the Central and Eastern European market. Efforts are also being made by these companies to increase production and sales of own-brand product.

Netherlands rising importance in EU-wide furniture distribution

In addition to the rising influence of Poland in EU wood furniture supply, Chart 2 indicates that there has been significant growth in wood furniture exports by Netherlands to neighbouring EU countries since 2016. Wood furniture supply in the Netherlands is fed by imports from outside the EU, and by domestic wood furniture manufacturing, both of which have been rising in the last 2 years.

This suggests that the Netherlands in playing an increasing role in the wood furniture sector, as in other wood sectors, in the distribution of products to other EU countries. It is likely driven by two factors.

First moves to consolidate the retail sector in the EU which has been accompanied, to some extent, by greater centralisation of retailers’ procurement operations. This has led to greater focus on imports through the large ports in Benelux countries.

Second, the EU Timber Regulation (EUTR) may be reinforcing this trend towards concentration of the procurement function. Smaller importers have become more inclined to buy from other larger EU importers, or only from EU-based manufacturers, to avoid the requirement to implement due diligence systems.

If this latter factor is important, then it should present an opportunity for Indonesian products which, due to FLEGT licensing, are the only non-EU wood furniture products that may be placed on the EU market without any further due diligence.

However, so far other factors are not leading to a significant increase in Indonesian wood furniture trade with the EU – such as very long lead times in supply from Indonesia and the country’s tight focus on marketing of only a relatively limited range of mainly exterior, often teak, products in the EU, without regularly reviewing the products to ensure they align with changing fashion trends.

Fall in EU wood furniture imports from China and the tropics in 2018

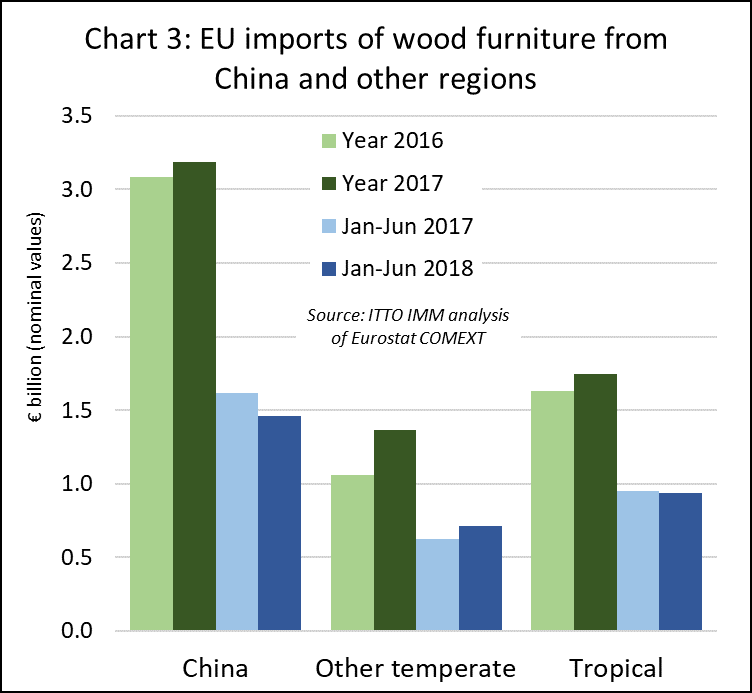

After making gains last year, EU wood furniture imports from tropical countries and China fell in the first 6 months of 2018. EU imports from tropical countries decreased 2% to €940 million, while imports from China fell nearly 10% to €1.46 billion (Chart 3).

In recent years China’s competitiveness in the EU wood furniture market has been impeded as prices have risen on the back of growing domestic demand and new laws for pollution control pollution in China. EU furniture importers also continue to question the variable quality of product imported from China and some have struggled to obtain the legality assurances required for EUTR conformance when dealing with complex wood supply chains in China.

Meanwhile EU imports of wood furniture have continued to rise from other temperate countries, mainly bordering the EU. EU imports from these countries increased 14% to €720 million in the first 6 months of 2018, building on a 28% gain recorded the previous year. The biggest gains are being made by Ukraine, Bosnia and Serbia.

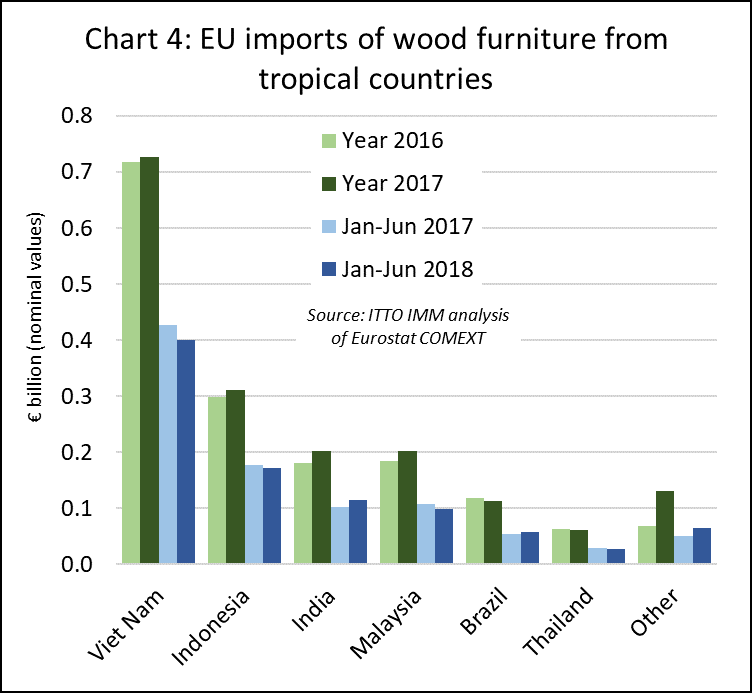

The main South East Asian supply countries have all followed a similar trajectory in the EU wood furniture market in the last 18 months. A rise in EU imports last year was followed by a decline in the first six months of 2018.

After increasing 1% to €730 million in 2017, EU imports from Viet Nam fell 6% to €400 million in the first six months of 2018. Imports from Indonesia increased 4% to €311 million in 2017 but fell back 4% to €171 million in the first six months of 2018. Imports from Malaysia increased 10% to €203 million in 2017 and were 8% down at €99 million in the first 6 months of 2018.

In contrast, EU wood furniture imports from India have continued to rise, up 12% to €103 million in the first six months of 2018 after a 12% increase to €202 million for whole of 2017. Imports from Brazil bounced back in the first half of 2018, rising 4% to €57 million, after declining 5% to €112 million for the whole year 2017 (Chart 4).

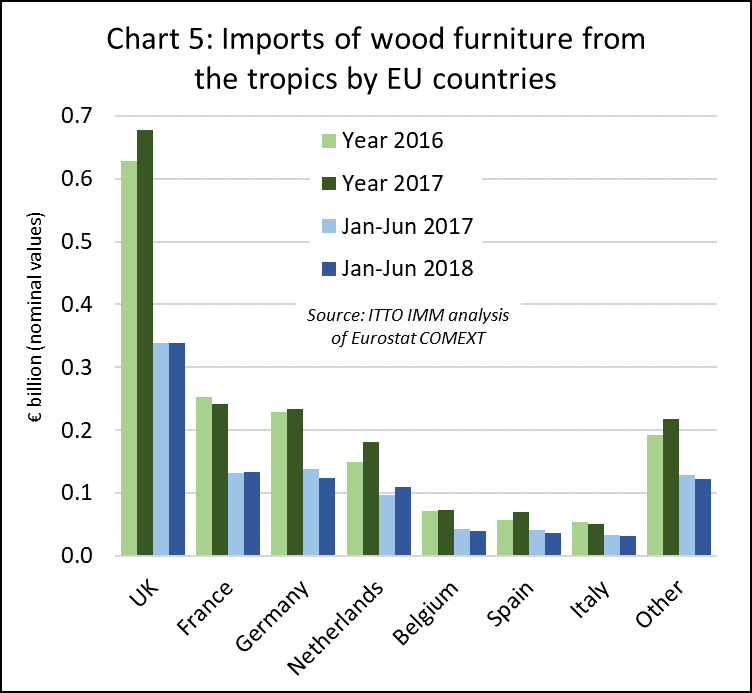

There were also shifts in the destinations for wood furniture imported into the EU from tropical countries in the first half of 2018. Imports in the UK, the largest market, were €339 million between January and June 2018, unchanged from the same period in 2017.

However, in the first half of 2018 there was a sharp fall in imports of wood furniture from the tropics by Germany (-11% to €123 million), Belgium (-8% to €39 million), Spain (-12% to €37 million), and Italy (-4% to €31 million). These losses were partly offset by rising imports in France (+1% to €134 million) and Netherlands (+12% to €109 million) (Chart 5).

The large rise in Netherlands imports of wood furniture from tropical countries in the first half of 2018 may be related to the wider trend, mentioned earlier, to centralise procurement functions within the EU, contributing to a greater share of wood furniture trade passing through Dutch ports.

PDF of this article:

Copyright ITTO 2020 – All rights reserved