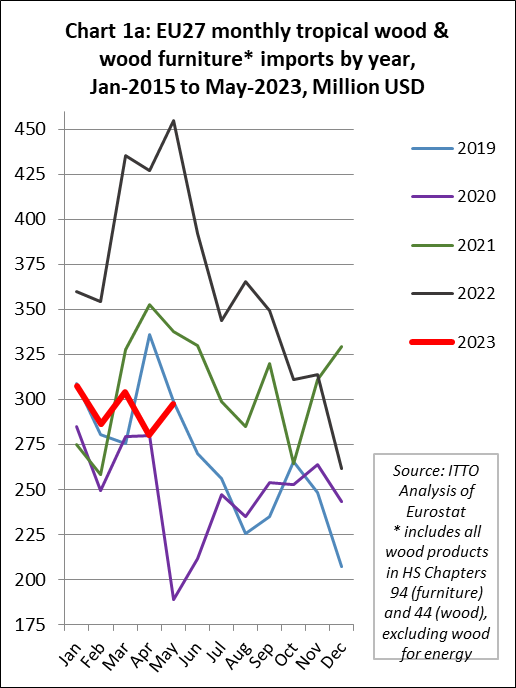

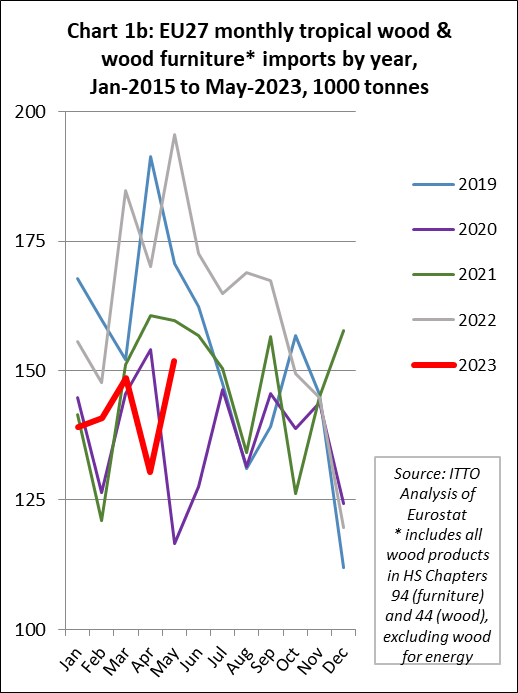

In the first five months of this year, the EU27 imported 710,800 tonnes of tropical wood and wood furniture products with a total value of USD1.48b, respectively 17% and 27% less than the same period in 2022. The sharp downturn this year is mainly indicative of the very strong start to the year in 2022. Total EU27 imports of tropical wood and wood furniture in the first five months this year were closely aligned with the long-term average between 2013 and 2019 when trade was subdued but steady. For now, therefore, trade seems to have returned to more “normal” levels after the volatility during the COVID pandemic. While imports were reasonably robust between January and March this year, particularly in dollar terms, they slowed sharply in April before picking up again in May (Charts 1a and 1b).

The “normalisation” of trade partly reflects broader conditions in the European economy in the sense that growth in the region has returned to the sluggish pace characteristic of the decade prior to the COVID pandemic. However, the underlining factors behind this slow growth are now different.

After years of very low inflation before 2020, inflation in the EU27 hit record levels in 2022 due to the combined effects of supply disruption brought on by the pandemic, the war in Ukraine and subsequent sanctions against Russia, and the large injection of government funds to stimulate economic growth. Despite a series of eight interest rate increases bringing the eurozone base rate from 0% before July 2022 to 4% in June 2023, inflation remains stubbornly high, at 5.5% far above the 2% target of the European Central Bank (ECB). High inflation is set to persist as wages are still growing much faster than productivity.

On the positive side, the Eurozone managed to get through last winter without energy shortages and the severe recession feared by many analysts. Labor markets have continued to thrive. In fact, at 6%, the Eurozone has reached a record-low unemployment rate. While this is contributing to high wage demands, it has also helped to stabilize consumer expenditure and economic sentiment has recovered despite high borrowing costs.

However, economic conditions vary widely between sectors and countries in the EU27. Construction is one of the worst performing sectors. The HCOB Eurozone Construction PMI declined to 44.2 in June, well below the 50-mark which is the threshold for stable conditions and down from the previous month’s 44.6. This was the most significant reduction in overall construction activity since December 2022. It also marks the 14th consecutive month of output decline, primarily driven by a sharp contraction in residential construction. Commercial work and civil engineering projects also continued to decline.

The Construction PMI report also showed that the inflow of new business in June this year experienced the steepest drop since the end of 2022, and the rate of job cuts accelerated to its fastest pace since May 2020. Moreover, eurozone construction companies witnessed a significant decline in purchasing activity, reaching its lowest level in over three years. Overall, businesses maintained a pessimistic outlook for the next 12 months, citing tight financial conditions, limited investment, and economic uncertainty as contributing factors.

In other sectors in the EU27, consistent with the global picture, service industries are doing better than manufacturers. Last month the PMI for the industrial sector in the eurozone continued to contract as manufacturers are suffering from weak orders and abating international demand. In contrast, the PMI for the services sector was in solidly expansionary territory, even tending to accelerate.

These divergent trends are highlighted in the latest forecasts for European economic growth. For example, in July Citigroup cut its 2023 economic growth forecast for the euro area, citing pressures from a high interest rate environment as the ECB has signalled further hikes.

“We still expect monetary tightening to trigger a recession (in the eurozone) in H2 2024 and forecast 0.9% real GDP growth in 2024,” said Citigroup economists in a note dated 4 July. Citigroup now expect the eurozone’s real GDP to grow 0.8% this year, down 0.3 percentage points from their previous forecast.

The downgraded forecast was largely due to Germany where Citigroup now predict only 0.2% growth this year, down from their earlier prediction of 1.0% after the country’s first-quarter GDP was revised down. However, Citigroup raised Italy’s GDP growth forecast to 1.3% from 0.4% previously, citing normalisation of tourism inflows and contact-intensive activities, and the effects of fiscal stimulus.

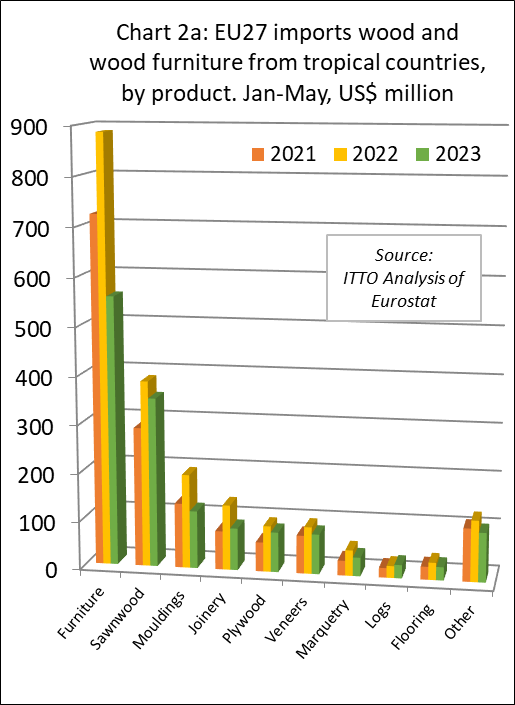

Particularly large fall in EU import value of secondary and tertiary tropical products

There was a year-on-year decline in EU27 import value for all tropical wood product groups except logs between January and May this year (Chart 2a). Overall, the decline in import value was more severe for secondary and tertiary processed products than for primary processed products. During the five-month period, there were large declines in EU27 import value for: wood furniture from tropical countries (-37% to USD557m); tropical mouldings/decking (-39% to USD119m); tropical joinery products (-35% to USD87m); tropical marquetry (-27% to USD39m); and tropical flooring (-23% to USD28m). More moderate declines were recorded for EU27 imports of tropical sawnwood (-9% to USD350m), tropical-hardwood-faced plywood (-13% to USD83m); and tropical veneer (-15% to USD83m). EU27 import value of tropical logs increased 12% to USD28m during the five-month period.

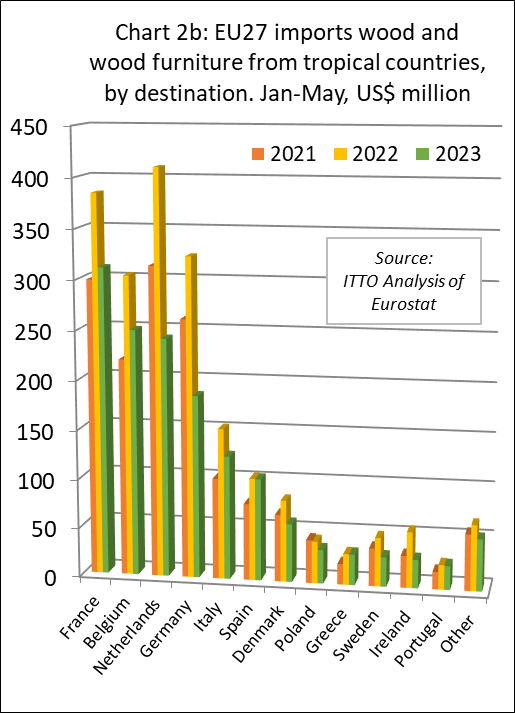

In terms of EU destinations, import value of tropical wood and wood furniture in the first five months this year was down year-on-year in all the main markets. The decline was relatively small in Spain (-0.5% to USD103m), Greece (-0.6% to USD31m), and Portugal (-3% to USD24m). Elsewhere, import value fell 19% in France to USD311m, 18% in Belgium to USD249m, 41% in the Netherlands to USD242m, 43% in Germany to USD185m, 18% in Italy to USD125m, 29% in Denmark to USD59m, 19% in Poland to USD34 million, 40% in Sweden to USD30 million, and 49% to USD29m in Ireland. (Chart 2b).

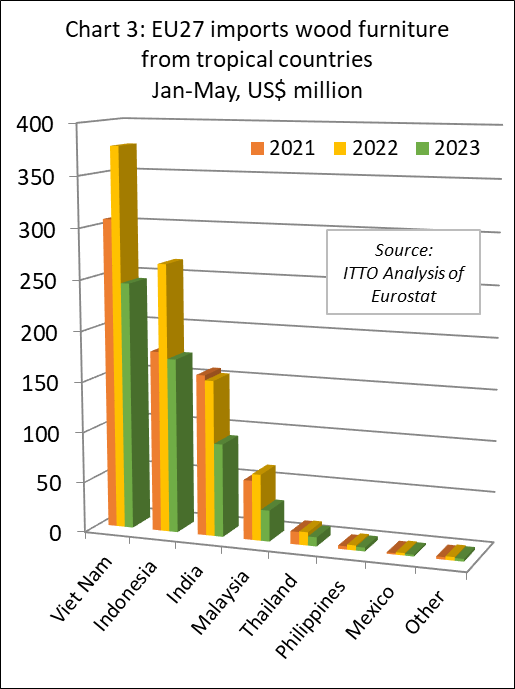

EU27 wood furniture imports from tropical countries down 30% in the first quarter

In the first five months of 2023, the EU27 imported 122,900 tonnes of wood furniture from tropical countries with a total value of USD557m, down 32% and 37% respectively compared to the same period in 2022. Import value decreased 35% to USD244m from Vietnam, 35% to USD173m from Indonesia, 40% to USD92m from India, 53% to USD31m from Malaysia, and 31% to USD9m from Thailand. EU27 wood furniture imports from all other tropical countries were negligible during the five-month period (Chart 3).

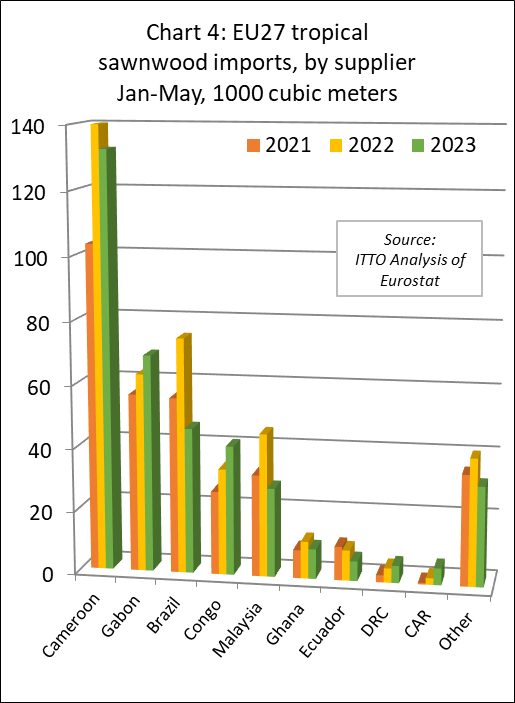

EU27 imports of tropical sawnwood down 12% this year

The EU27 imported 374,000 cubic meters of tropical sawnwood in the first five months of 2023, 12% less than the same period in 2022. Imports increased from Gabon (+10% to 68,900 cubic meters), Congo (+22% to 41,100 cubic meters), DRC (+21% to 5,500 cubic meters) and CAR (+154% to 5,300 cubic meters). However, these gains were offset by large declines in imports from Cameroon (-5% to 132,400 cubic meters), Brazil (-38% to 46,200 cubic meters), Malaysia (-38% to 28,200 cubic meters), Ghana (-19% to 9,500 cubic meters) and Ecuador (-35% to 6,300 cubic meters) (Chart 4).

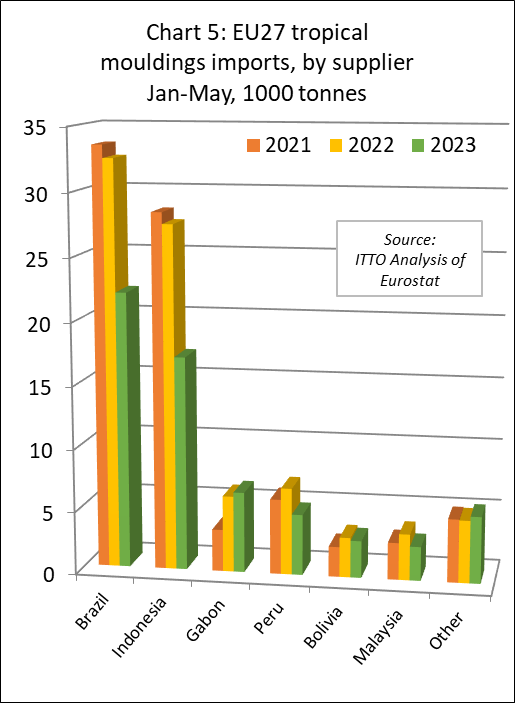

The EU27 imported 61,300 tonnes of mouldings/decking in the first five months of 2023, 27% less than the same period last year. Imports from the two largest supply countries fell sharply; declining 32% to 22,000 tonnes from Brazil, and down 38% to 17,000 tonnes from Indonesia. There was also a sharp fall in imports from Peru (-30% to 4,800 tonnes), Bolivia (-7% to 3,000 tonnes), and Malaysia (-26% to 2,700 tonnes). Imports from Gabon increased by 6% to 6,400 tonnes (Chart 5).

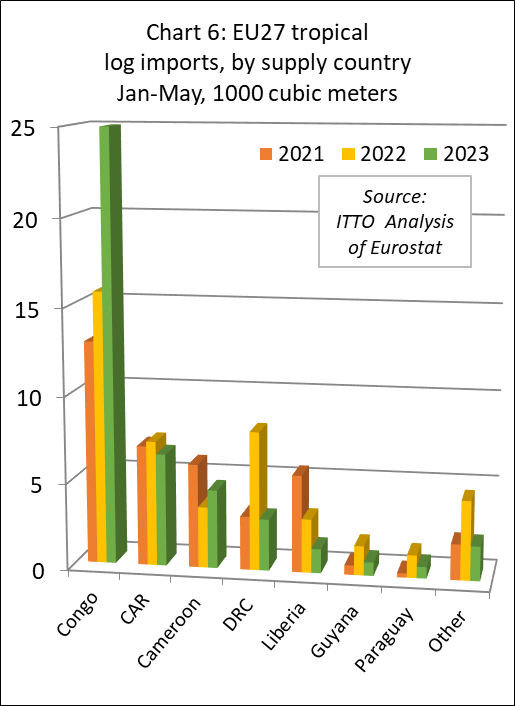

In the first five months of 2023, the EU27 imported 43,800 cubic meters of tropical logs, 3% less than the same period in 2022. The most significant trend during the period was a sharp 58% rise in EU27 log imports from Congo to 25,000 cubic meters. This surge in European arrivals – which was concentrated in the first quarter of this year – probably reflects a last-minute effort to ship logs in advance of the log export ban imposed by the Republic of Congo from 1st January 2023. EU27 imports of logs also increased sharply from Cameroon (which may be derived from neighbouring Congo or Central African Republic) in the first five months this year, rising 29% year-on-year to 4,500 cubic meters. EU27 imports of tropical logs from all other supply countries declined during the period including Central African Republic (-10% to 6,500 cubic meters), Democratic Republic of Congo (-63% to 3,000 cubic meters), Liberia (-55% to 1,400 cubic meters), Guyana (-55% to 750 cubic meters) and Paraguay (-49% to 500 cubic meters) (Chart 6).

Downturn in EU27 imports of tropical veneer but plywood more stable

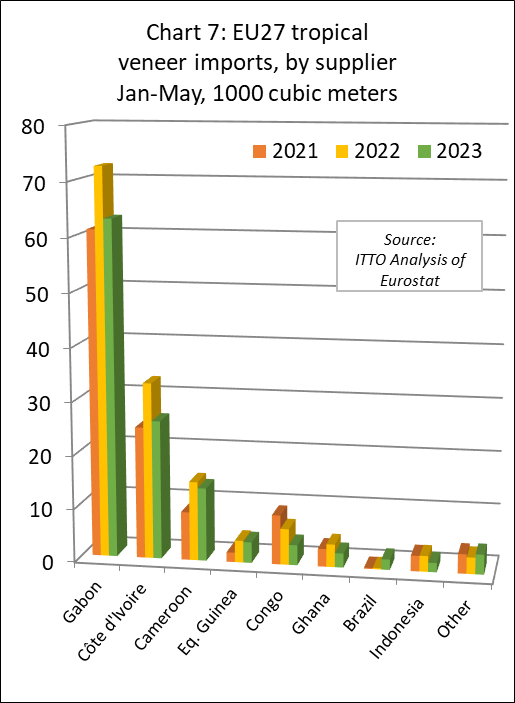

In the first five months of 2023, the EU27 imported 63,000 cubic meters of tropical veneer, down 13% compared to the same period last year. Imports of tropical veneer from Gabon, by far the largest supplier to the EU27, decreased 13% to 63,000 cubic meters after rising sharply last year. EU27 veneer imports in the first five months of this year also declined from Côte d’Ivoire (-21% to 26,000 cubic meters), Cameroon (-8% to 13,700 cubic meters), Congo (-44% to 3,800 cubic meters), Equatorial Guinea (-5% to 3,900 cubic meters), Ghana (-38% to 2,600 cubic meters), and Indonesia (-41% to 1,700 cubic meters). However, hardwood veneer imports from Brazil increased sharply from negligible levels last year to 1,900 cubic in the first five months this year. (Chart 7).

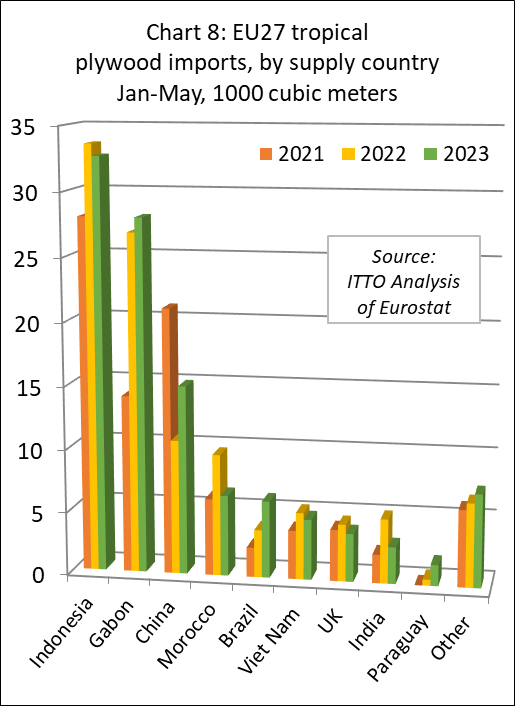

In the first five months of 2023, EU27 tropical plywood import increased 2% to 108,700 cubic meters. Imports from Indonesia, at 32,600 cubic meters, were down 3% compared to the same period last year. Imports also fell from Morocco (-34% to 6,400 cubic meters), Vietnam (-10% to 4,800 cubic meters), and India (-43% to 2,900 cubic meters). However, imports increased from Gabon (+4% to 28,000 cubic meters), China (+41% to 15,000 cubic meters), and Brazil (+61% to 6,100 cubic meters) (Chart 8).

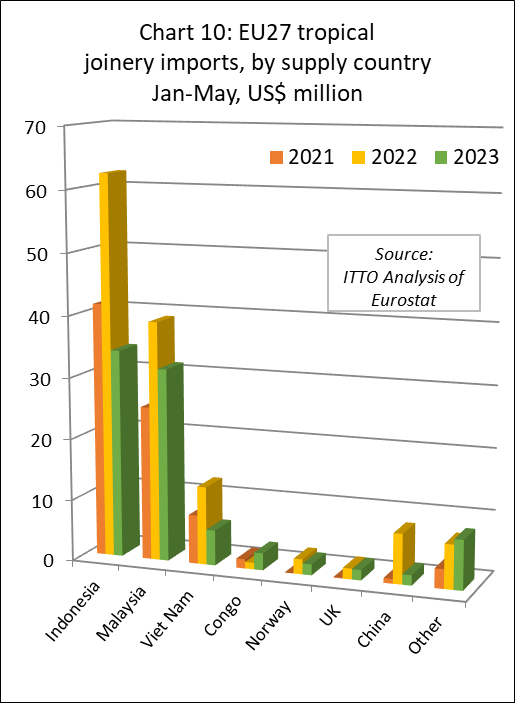

Sharp slowdown in EU27 imports of joinery products

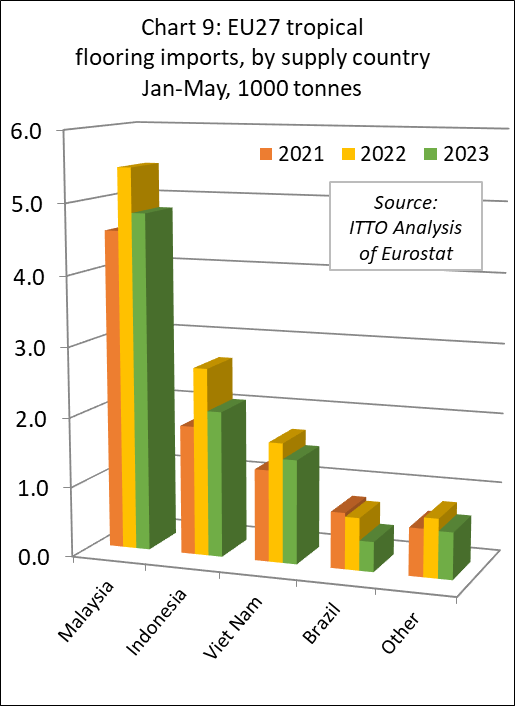

In the first five months of 2023, the EU27 imported 9,500 tonnes of tropical wood flooring, down 17% compared to the same period last year. The consistent rise in EU27 wood flooring imports from Malaysia, that began in 2020, has stalled this year. Imports of 4,800 tonnes from Malaysia in the first five months of 2023 were 12% less than the same period in 2022. Imports also fell from Indonesia (-22% to 2,100 tonnes), Vietnam (-13% to 1,500 tonnes), and Brazil (-43% to 425 tonnes) (Chart 9).

The value of EU27 imports of other joinery products from tropical countries – which mainly comprise laminated window scantlings, kitchen tops and wood doors – declined 35% to USD87m in the first five months of 2023. Despite much lower prices than the same time last year, imports are low this year as many importers already have sufficient stock to meet current slow consumption levels. In the first five months this year compared to the same period in 2022, imports were down 46% to USD34m million from Indonesia, down 19% to USD31m from Malaysia, down 55% to USD6m from Vietnam, and down 80% to less than USD2m from China.

In a potentially significant longer-term development, given efforts in the country to shift up the value chain as log exports are banned, EU imports of laminated joinery products from Congo were valued at USD2.8m in the first five months of this year, nearly double than during the same period last year (Chart 10).